Executive Summary

There is a certain romance in starting from zero. It sounds clean. It sounds disciplined. It suggests rigor. And for decades, zero-based budgeting, ZBB as it is known in finance circles, has held a near-mythical status among cost-conscious organizations. Its logic is seductively simple: instead of assuming every line item from last year will reappear in the next, ask every department to justify every dollar, from the ground up. Start with nothing, prove everything. The idea is admirable. But in most companies, it has not aged well. Throughout my twenty-five years leading finance across cybersecurity, SaaS, manufacturing, logistics, and gaming, I have learned that in the traditional playbook, ZBB becomes a spreadsheet war. Managers scramble to defend their headcount. Every software license becomes a courtroom debate. The process takes months, frays nerves, and often leaves behind a pile of one-time cuts rather than a lasting culture of value. It does not have to be this way. What agile organizations need is not a return to old-school austerity but a reimagining of what ZBB can mean. Not as a blunt instrument of cost control but as a framework for intentionality, for clarity, for choices.

Why Traditional ZBB Fails in Modern Organizations

Let us start with why the original ZBB model often fails in modern settings. First, it is too episodic. The process kicks off once a year, usually with spreadsheets cascading from finance to department heads. It becomes a rear-view exercise: justify what you did last year, line by line. What gets lost is the why. Why are we in this market? Why this pricing strategy? Why this channel? ZBB becomes forensic accounting rather than strategic inquiry.

Second, traditional ZBB is often divorced from outcomes. The scrutiny falls on inputs including travel expenses, software tools, and office leases, but does not connect those inputs to the impact. You might save $200,000 by cutting back on engineering tools but lose $2 million in velocity and morale. Old ZBB is penny-wise and pound-blind. It optimizes budget lines, not business results.

Third, it is weaponized. When costs need to come down, leadership announces a ZBB initiative. Suddenly, every manager is in defense mode. The tone shifts from what should we invest in to what can we survive without. That shift suffocates innovation. And worse, it creates shadow budgets where people hoard resources for fear they will not get them back.

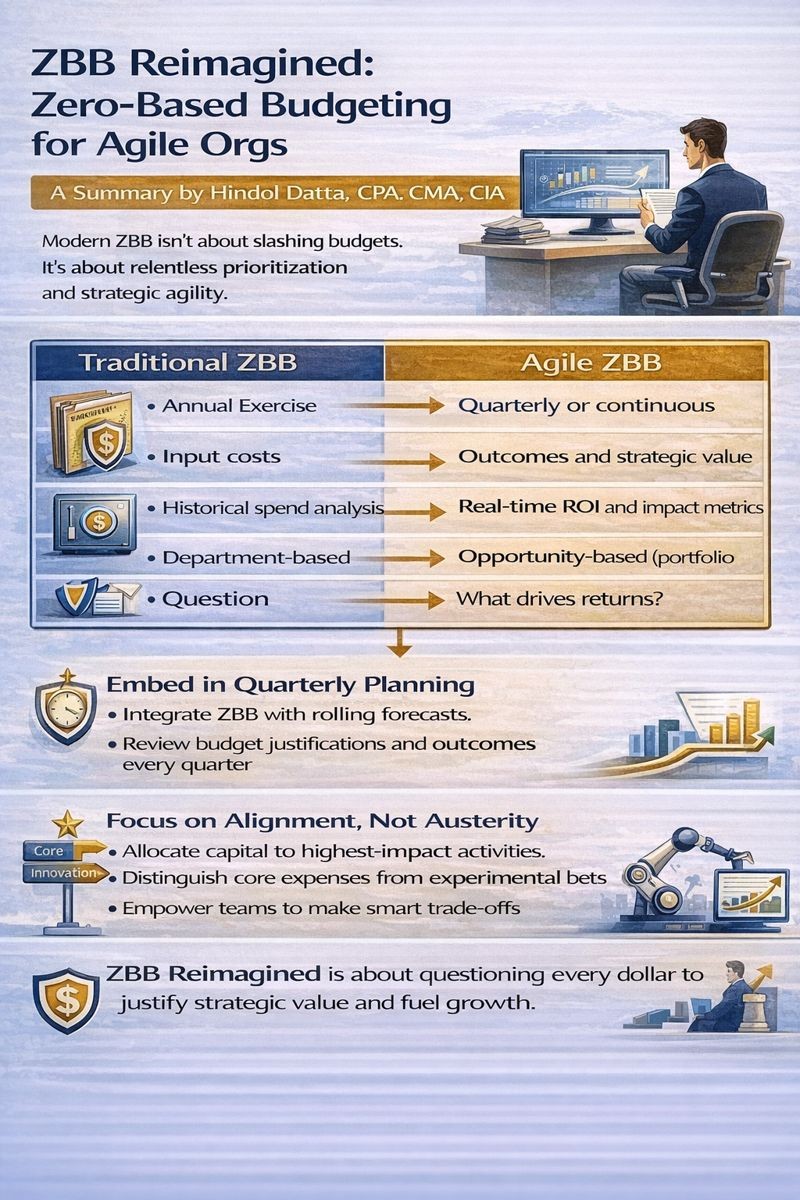

Traditional ZBB versus Agile ZBB

| Dimension | Traditional ZBB | Agile ZBB |

| Frequency | Annual exercise | Quarterly or continuous |

| Focus | Input costs (travel, tools, headcount) | Outcomes and strategic value |

| Tone | Defensive justification | Strategic inquiry |

| Data | Historical spend analysis | Real-time ROI and impact metrics |

| Allocation | Department-based | Opportunity-based (portfolio thinking) |

| Integration | Standalone cost exercise | Embedded in rolling forecasts |

| Primary Question | What can we cut? | What can we justify? |

When I reduced monthly burn from $800,000 to $200,000 at an email marketing SaaS company, we used ZBB principles but with an agile mindset. Rather than uniform cuts, we asked each function to identify their highest-impact activities and their lowest-return spend. We eliminated redundant systems, consolidated vendors, and stopped low-performing marketing channels. But we protected core engineering capacity and customer success because those functions directly drove retention and expansion. The result was sustainable efficiency, not just temporary austerity.

Reimagining ZBB for Agile Organizations

So how do we reimagine ZBB for agile organizations? We begin with intent. The goal of modern ZBB is not to cut. It is to clarify. It is to ensure that every dollar serves a purpose. That every investment has a story. That we do not do things just because we did them last year. In this light, ZBB becomes less a cost exercise and more a strategy tool.

Instead of running ZBB once a year, we embed its principles into quarterly planning. We integrate it with rolling forecasts. Rather than asking every team to build a budget from zero, we ask them to build from first principles. What outcomes are you driving? What is the minimum you need to do that well? What experiments are worth funding? What can be paused?

This is not about top-down control. In fact, it works best when it is bottoms-up. Teams closest to the work know what matters. ZBB in agile organizations gives them the structure to question assumptions. It asks product teams what features move the needle. It asks marketing which campaigns actually convert. It asks HR are we over-engineering culture.

When I built enterprise KPI frameworks using MicroStrategy, Domo, and Power BI tracking bookings, utilization, backlog, annual recurring revenue, pipeline health, customer margin, and retention, we embedded ZBB thinking into quarterly planning. Each quarter, teams reviewed their spend against outcomes. Marketing could see which channels drove qualified pipeline at what cost. Product could see which features drove retention versus which sat unused. This visibility enabled teams to make intelligent trade-offs rather than defend static budgets.

Data-Driven Decision Making

This approach thrives when powered by data. In legacy ZBB, decisions were made with limited visibility. Today, we have dashboards, attribution models, and real-time metrics. A modern ZBB model says do not tell me what you spent, show me what you got. How did this campaign affect customer acquisition cost? How did this tool improve engineering velocity? How did this team reduce cycle time?

The CFO’s role here is to turn finance into a facilitative partner. To ask tough questions, yes, but in the spirit of growth. To help teams connect cost to value. To shine a light on blind spots, not just slash from the shadows. This is ZBB as a lens, not a knife. Technology is key. With today’s planning platforms, finance can model scenarios, track return on investment, and empower managers to reallocate budgets in real time. ZBB does not have to be a mountain of spreadsheets. It can live in systems. It can evolve monthly. It can trigger alerts when variances drift. It can empower decision-makers to own their numbers, not just defend them.

When I managed global finance for a $120 million logistics organization, we applied ZBB principles to operational expenses quarterly. We analyzed cost per shipment, cost per delivery route, and cost per customer service interaction. This granular visibility revealed opportunities to consolidate routes, optimize warehouse layouts, and automate manual processes. The approach reduced logistics cost per unit by 22 percent while actually improving service levels because we invested savings in high-impact improvements.

Culture and Portfolio Thinking

And the culture matters too. If ZBB is associated with layoffs and austerity, it will breed resistance. But if it is positioned as a way to do more with purpose, it becomes liberating. Teams that know they can justify new spend if it drives results do not fear cuts. They focus on impact. They stop playing budget games. They start making trade-offs. And that is when agility happens.

The modern version of ZBB also plays well with portfolio thinking. In many organizations, there are mature businesses that need stability and emerging bets that need experimentation. ZBB allows you to calibrate differently. In the core, you look for waste. In the edge, you look for acceleration. You allocate capital not by department but by opportunity.

Boards increasingly expect this kind of thinking. They want to know not just where the money goes but why it is there. In high-growth companies, they ask are we scaling too fast. In mature companies, they ask where is the next source of leverage. ZBB, when practiced wisely, gives the CFO a story to tell, not just numbers to report.

When I secured $40 million in Series B funding and an $8 million credit line at a nonprofit organization, our ZBB-informed budget demonstrated disciplined capital allocation. We showed investors how we evaluated every program using cost per outcome metrics, how we reallocated from lower-impact to higher-impact initiatives, and how we maintained financial flexibility to respond to changing conditions. This approach built investor confidence that capital would be deployed efficiently.

And yes, ZBB still saves money. But it does so intelligently. It reveals duplication. It highlights legacy spend that no longer supports strategy. It encourages substitution, maybe that $100,000 tool can be replaced by a $30,000 open-source alternative. But the goal is not austerity. The goal is alignment.

Let me be clear: this is hard work. It requires changing planning cycles. It requires cross-functional trust. It requires systems, data, and leadership. But the payoff is significant. Companies that embed modern ZBB principles see faster decision-making, more empowered teams, and higher return on spend. They move capital like chess pieces, not concrete slabs. And most importantly, they build resilience. In a volatile world, the ability to reallocate resources quickly, without panic or politics, is the ultimate advantage.

Conclusion

So yes, zero-based budgeting is alive. But not in the form that dominated the 1980s. It has grown up. It has gone agile. It no longer asks what can we cut. It asks what can we justify. And in that question lies the future of smart finance. Because in the end, every dollar has a job to do. And every job should be worth doing.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.