Executive Summary

If a startup’s journey can be likened to an expedition up Everest, then its operating model is the climbing gear: vital, adaptable, and often revised. In the early stages, founders rely on grit and flexibility. But as companies ascend and attempt to scale, they face a stark truth: yesterday’s systems are rarely fit for tomorrow’s challenges. Having scaled organizations from nine million to one hundred eighty million dollars in revenue and advised companies from pre-revenue startups through growth stages, I learned that your operating model must evolve consciously and structurally every twelve months if your company is to scale, thrive, and remain relevant. This is not speculative opinion. It is a necessity borne out by economic theory, pattern recognition, operational reality, and the statistical arc of business mortality. According to McKinsey research, only one in two hundred startups make it to one hundred million dollars in revenue, and even fewer become sustainably profitable. The cliff is not due to product failure alone. It is largely an operational failure to adapt at the right moment. This article explores why systematic operating model evolution is essential for startup success and how to implement a disciplined review cycle.

The Law of Exponential Complexity

Startups begin with a high signal-to-noise ratio. A few people, one product, and a common purpose. Communication is fluid, decision-making is swift, and adjustments are frequent. But as the team grows from ten to fifty to two hundred, each node adds complexity. The formula for potential communication paths in a group, n multiplied by n minus one divided by two, reveals that at ten employees there are forty-five unique interactions. At fifty, that number explodes to one thousand two hundred twenty-five.

This is not just theory. Each of those paths represents a potential decision delay, misalignment, or redundancy. Without an intentional redesign of how information flows, how priorities are set, and how accountability is structured, the weight of complexity crushes velocity. An operating model that worked flawlessly in year one becomes a liability in year three.

During my time implementing enterprise resource planning systems including NetSuite and Oracle Financials across organizations at different scales, I witnessed how systems designed for twenty employees broke at fifty, and structures that worked at fifty created bottlenecks at two hundred. The operating model must evolve to actively simplify while the organization expands.

The Four Seasons of Growth

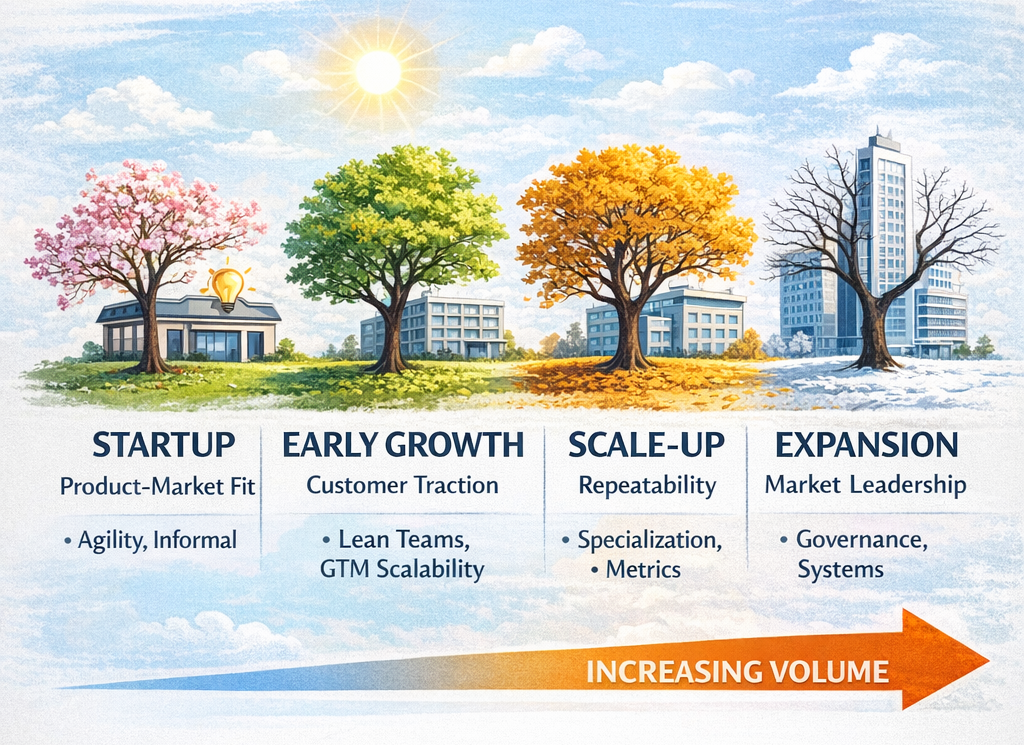

Companies grow in phases, each requiring different operating assumptions:

- Startup (Product-Market Fit): Agile, informal, founder-centric model

- Early Growth (Customer Traction): Lean teams with tight loops and scalable go-to-market

- Scale-up (Repeatability): Functional specialization and rigorous metrics

- Expansion (Market Leadership): Cross-functional governance and sophisticated systems

At each transition, the company must answer: what must we centralize versus decentralize? What metrics now matter? Who owns what? A model that optimizes for speed in year one may require guardrails in year two. And in year three, you may need hierarchy, yes that dreaded word among startups, to maintain coherence. Attempting to scale without rethinking the model is akin to flying a Cessna into a hurricane. Many try. Most crash.

My certifications spanning production and inventory management and project management provide frameworks for understanding how operational complexity scales. In manufacturing, production systems designed for job shop operations fail when volume increases and process manufacturing becomes necessary. The same principle applies to organizational design. What works at low volume breaks at high volume unless consciously redesigned.

From Hustle to System: Institutionalizing What Works

Founders often resist operating models because they evoke bureaucracy. But bureaucracy is not the issue. Entropy is. As the organization grows, systems prevent chaos. A well-crafted operating model:

- Defines governance by clarifying who decides what, when, and how

- Aligns incentives by linking strategy, execution, and rewards

- Enables measurement by providing real-time feedback on what matters

Let us take a practical example. In the early days, a product manager might report directly to the chief executive officer and also collaborate closely with sales. But once you have multiple product lines and a sales organization with regional profit and loss statements, that old model breaks. Now you need product operations. You need roadmap arbitration based on capacity planning, not charisma. The lesson is to institutionalize what worked ad hoc by architecting it into systems.

Having designed business intelligence architectures using MicroStrategy and Domo and built key performance indicator frameworks across organizations, I learned that measurement systems must evolve with organizational complexity. Early-stage metrics focus on product engagement and customer acquisition. Growth-stage metrics add cohort economics and retention. Scale-stage metrics emphasize efficiency ratios and capital deployment return. Each phase requires different dashboards, different rhythms, and different accountability structures.

Why Every Twelve Months? The Velocity Argument

Why not every twenty-four months or every six? The twelve-month cadence is grounded in several interlocking reasons:

- Business cycles: Most companies set targets, budget resources, and align compensation yearly. The operating model must match that cadence or risk misalignment.

- Cultural absorption: People need time to digest one operating shift before another is introduced. Twelve months is the Goldilocks zone.

- Market feedback: Every year brings fresh signals from the market, investors, customers, and competitors. If your operating model does not evolve in step, you lose your edge.

- Compounding effect: Like interest on capital, small changes in systems when made annually compound dramatically. Optimize decision velocity by ten percent annually, and in five years you have doubled it.

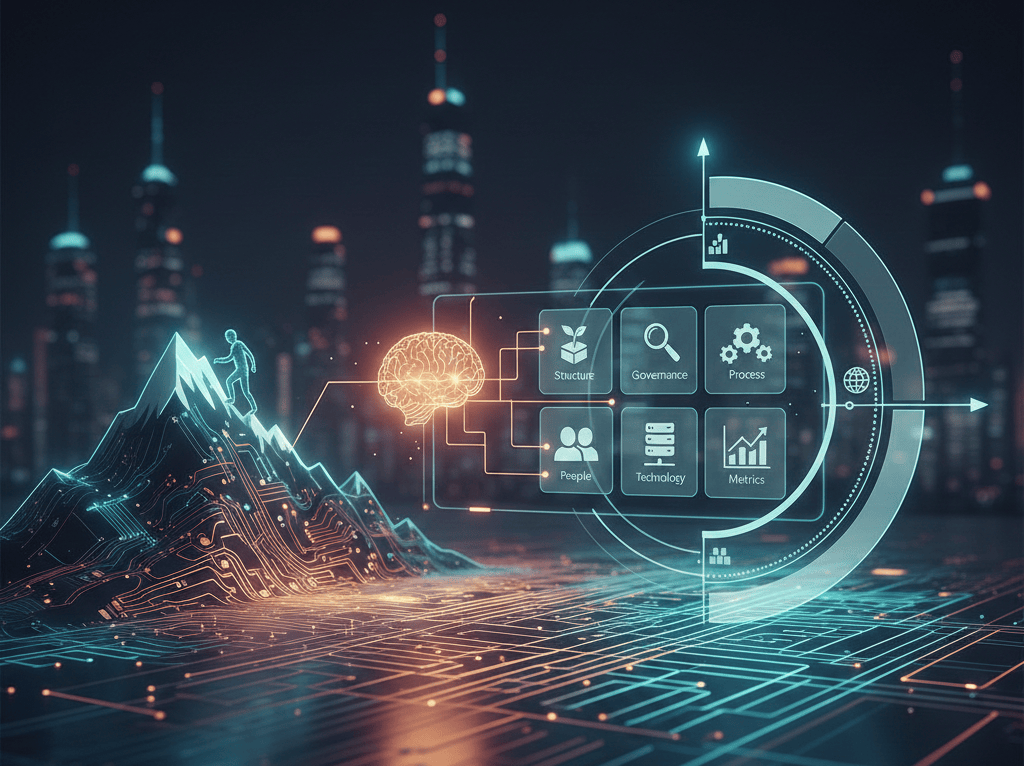

The Operating Model Canvas

To guide this evolution, use a simplified operating model canvas, a strategic tool that captures six dimensions that must evolve together:

Structure: How are teams organized? What is centralized versus decentralized?

Governance: Who decides what? What is the escalation path for conflicts and exceptions?

Process: What are the key workflows? How do they scale with volume and complexity?

People: Do roles align to strategy? How do we manage talent development and succession?

Technology: What systems support this stage? Where are the gaps and integration needs?

Metrics: Are we measuring what matters now versus what mattered before?

Reviewing and recalibrating these dimensions annually ensures that the foundation evolves with the building. The alternative is often misalignment where strategy runs ahead of execution, or worse, vice versa. My background as a Certified Internal Auditor emphasizes the importance of control frameworks that evolve with organizational complexity. Static controls designed for simple operations create bottlenecks in complex environments. Dynamic controls that adapt to changing risk profiles enable both growth and governance.

The Cost of Inertia

Aging operating models extract a hidden tax:

- Confuse new hires who cannot understand unnecessarily complex processes

- Slow decisions by creating unclear accountability

- Demoralize high performers who see bureaucracy without purpose

- Inflate costs by maintaining redundant structures

- Signal stagnation in a landscape where capital efficiency is paramount

According to Bessemer Venture Partners research, top quartile software as a service companies show Rule of Forty compliance with fewer than three hundred employees per one hundred million dollars in annual recurring revenue. Those that do not often have twice the headcount with half the profitability, trapped in models that no longer fit their stage.

During my time managing financial planning and analysis for organizations across growth stages, I witnessed how operational bloat compounds faster than revenue. When we improved month-end close from seventeen days to under six days through process redesign and system automation, we did not just save time. We reduced headcount requirements, improved decision velocity, and freed capacity for strategic analysis. The same principle applies at the organizational level. Streamlined operating models enable faster decisions, lower costs, and better outcomes.

How to Operationalize the Twelve-Month Reset

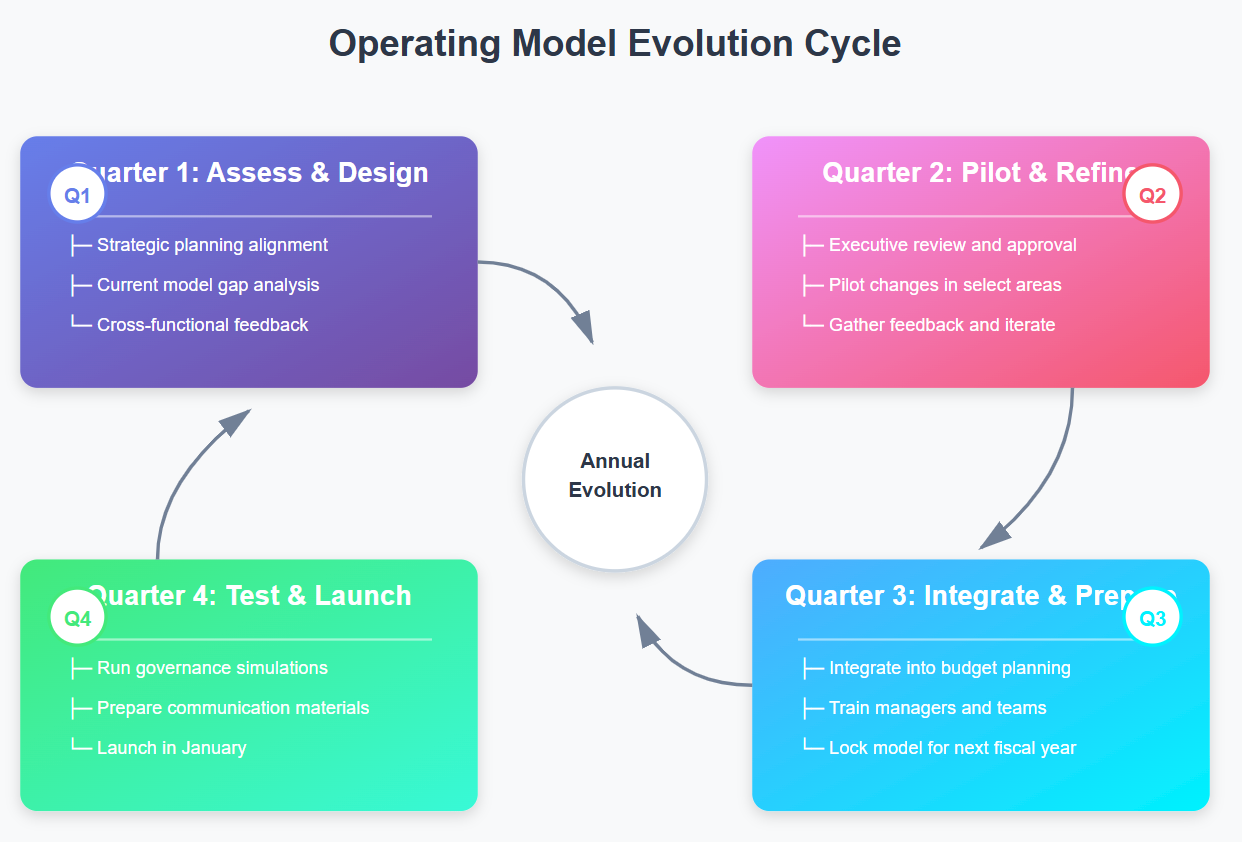

For practical implementation, establish a twelve-month operating model review cycle. In January and February, finalize strategic planning and conduct gap analysis of the current model. In March and April, gather cross-functional feedback and draft the new operating model version. In May and June, review with the executive team and pilot model changes in select areas. In July and August, refine based on pilot results and communicate broadly while training managers on new structures.

In September and October, integrate changes into budget planning and lock the model into the fiscal year plan. In November and December, run simulations to test governance mechanisms and prepare for January launch. This cycle ensures that your organizational model does not lag behind your strategic ambition. It also sends a powerful cultural signal: we evolve intentionally, not reactively.

Having led organizations through multiple planning cycles and strategic transformations, I learned that change management determines implementation success as much as strategic design. The best operating models fail without proper communication, training, and reinforcement. Conversely, imperfect models succeed when leaders commit to making them work.

Operating Model Evolution Cycle

Conclusion: Be the Architect, Not the Archaeologist

Every successful company is, at some level, a systems company. To scale, you must be the architect of your company’s operating future, not an archaeologist digging up decisions made when the world was simpler. Based on thirty years of financial leadership across diverse sectors and situations, I can attest that operating models are not carved in stone. They are coded in cycles. And the companies that win are those that rewrite that code every twelve months with courage, clarity, and conviction. Your operating model is your climbing gear. Inspect it regularly, upgrade it systematically, and replace it before it fails.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.