Executive Summary

In the space where founders and boards intersect, tension is inevitable. Founders breathe purpose, urgency, and risk appetite. Boards offer perspective, prudence, and process. The CFO stands at the pivot, responsible for translating ambition into disciplined execution. Throughout my twenty-five years leading finance across cybersecurity, SaaS, manufacturing, logistics, and gaming, I have learned that when differences surface, the CFO must reframe the discussion in a way that respects conviction without sacrificing accountability. The challenge is not to take sides. It is to transform disagreement into structured dialogue, anchored in shared mission, supported by transparent evidence, and delivered with credibility. This begins with recognizing the types of disagreement that arise. Some are philosophical, a founder prioritizing moonshot ahead of margins. Others are operational but fueled by strategic misalignment: prioritizing breakthrough product versus scaling profitable channels. Cure follows diagnosis. And the first task for any CFO is to name the disagreement clearly. Without this clarity, debate drifts to defensiveness. Stakeholders talk past each other. Trust frays. Vision becomes fuzzy.

Naming the Disagreement

Consider a tech company where the founder insisted on accelerating product development at all cost. The board emphasized path to profitability. Performance lagged. Execution stalled. The CFO recognized the root: a framing mismatch. It was not a dispute about runway. It was a narrative gap. So they reframed the argument: this is not shortcuts versus scale, it is about building optionality while preserving runway. That shift allowed both sides to see the path, to agree not on speed or safety but on calibrated velocity backed by financial guardrails.

When I secured $40 million in Series B funding and an $8 million credit line at a nonprofit organization, we faced similar founder-board tensions around growth velocity versus financial sustainability. The founder wanted aggressive program expansion. The board wanted operational reserves and margin protection. Rather than forcing a binary choice, I reframed the discussion around staged growth with defined financial thresholds. We established quarterly checkpoints measuring program impact, cost per beneficiary, and reserve ratios. This reframing transformed a positional standoff into a shared experiment with clear success criteria.

Three Core Reframing Tools

To reframe effectively, CFOs deploy three tools: strategic anchoring, scenario modeling, and language discipline.

Tool 1: Strategic Anchoring

Strategic anchoring is the first. It requires relinking the disagreement to the agreed mission. Was the company founded to disrupt the industry? To deliver sustainable growth? To preserve cultural DNA? Whatever the promise, it must be made visible. Anchoring the dialogue in shared purpose creates a north star. It reduces positional arguments. It invites aligned unpacking. CFOs often discover that founders and boards share more common ground than they imagine, especially when reminded why the business began.

Tool 2: Scenario Modeling

Scenario modeling is the second tool. Conflicts about direction often mask fear of consequences. Build too fast and capital depletes. Hold too long and competition overtakes. Scenario models surface the spectrum. They show upside, downside, and stress cases. They quantify optionality. They surface trade-offs in capital, talent, and timing. When CFOs pack these into visual frameworks, boards and founders can discuss strategy with data, not instinct. And that yields both insight and empathy.

When I managed global finance for a $120 million logistics organization, we faced disagreement between the founder-CEO who wanted to pursue international expansion and board members concerned about domestic market consolidation. I built a three-scenario model showing capital requirements, revenue trajectories, and margin impacts for aggressive international expansion, moderate international testing, and domestic consolidation. Each scenario included break-even timelines, competitive positioning, and capital efficiency metrics. This modeling shifted the conversation from opinion to evidence-based strategic choice.

Tool 3: Language Discipline

Modeling alone does not solve perception bias. That is where language discipline matters. Founders bring emotion. Boards bring caution. The CFO must moderate the tone. They shift I feel to we see, you must to what if. They translate we need to hurry into projected versus required runway, and we need to grow into market capture scenarios. This calibrated diction converts personalization into professionalism, clearing the path for rational alignment.

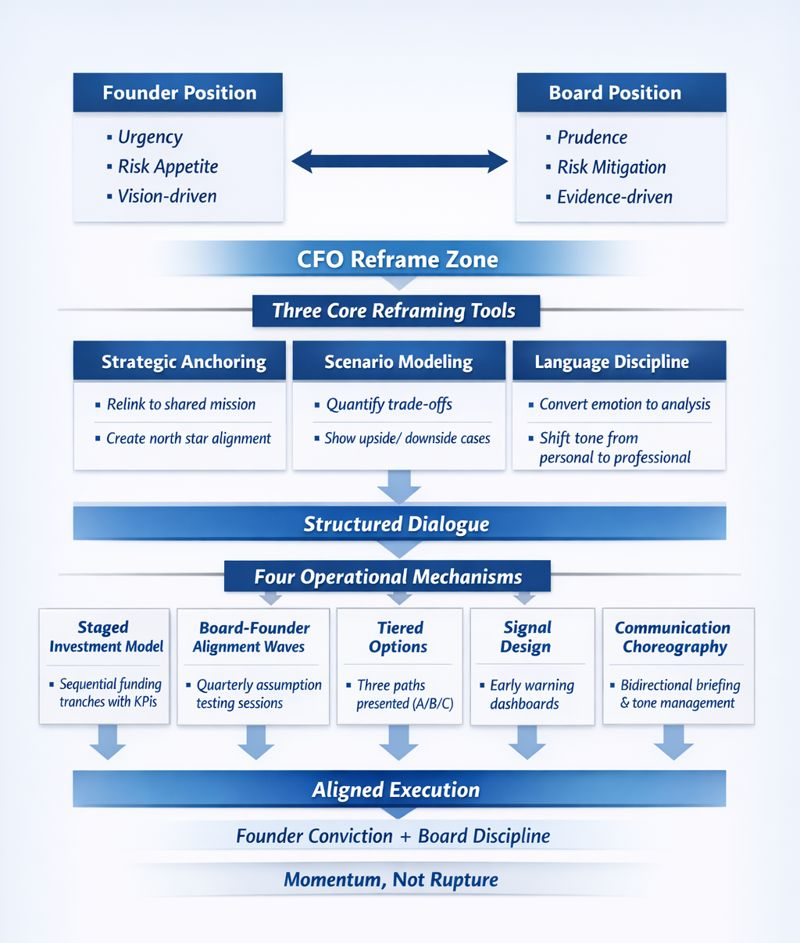

CFO Reframing Framework

This framework illustrates the complete CFO reframing process. At the top, founder and board positions create tension between urgency and prudence. The CFO operates in the reframe zone, deploying three core tools (strategic anchoring, scenario modeling, language discipline) to create structured dialogue. This flows into four operational mechanisms (staged investment model, board-founder alignment waves, tiered options, signal design, communication choreography) that transform disagreement into aligned execution where founder conviction and board discipline drive momentum together.

Four Operational Mechanisms

To move from disagreement to alignment, the CFO must operationalize the reframe. That begins not with resolution but with structure, structures that enable shared understanding, protect decisions from ego, and allow data to guide progress.

Mechanism 1: Staged Investment Model

This approach breaks a founder’s vision into sequential funding tranches, each conditioned on agreed performance metrics. The CFO defines thresholds: user growth, gross margin inflection, customer churn control, capital efficiency. These metrics are debated and then locked. If they are hit, capital continues. If not, reevaluation is triggered. This model reframes the founder’s ask from a bet to an experiment. It signals trust while preserving control.

In one growth-stage healthtech firm, the founder advocated a $30 million expansion into adjacent markets. The board balked. The CFO countered with a $5 million pilot into two geographies. Success metrics were set. At each milestone including customer activation, channel efficiency, and sales velocity, the plan unlocked more capital. Six months later, the board approved the full roll-out, not because of persuasion but because the model had created accountability. The argument had shifted from do we trust the founder to are the signals working.

Mechanism 2: Board-Founder Alignment Waves

These are quarterly sessions convened specifically to surface divergence. They are not performance reviews. They are designed to test assumptions. CFOs structure these waves around thematic questions: What do we now believe about the customer journey that we did not six months ago? How is the competition responding faster than we expected? What scenario surprised us most? Founders share hypotheses. Boards respond. The CFO moderates, documents, and recalibrates.

Over time, these sessions build muscle memory. They allow tension to release early. They reduce the risk of one-off confrontations. They create history: a visible ledger of how judgment evolved.

Mechanism 3: Tiered Options Framework

CFOs learn to replace binary proposals with tiered options. Rather than pitch a plan or a rejection, they present three paths: Plan A with founder full proposal, Plan B with adjusted scale or timeline, Plan C with board-recommended alternative. Each is quantified. Each includes risk exposure. The founder feels heard. The board sees consequence. The debate becomes navigable. The CFO facilitates, not arbitrates.

When I built enterprise KPI frameworks using MicroStrategy, Domo, and Power BI, we designed scenario dashboards that allowed founders and boards to evaluate strategic options side-by-side. Each option showed projected revenue, capital requirements, organizational capacity needs, and risk factors. This visualization enabled informed choice rather than emotional debate.

Mechanism 4: Signal Design and Thresholds

Founders and boards often talk at different tempos. The founder lives in daily volatility. The board sees quarterly snapshots. The CFO must align the signal arc. They build dashboards that reflect both cycles, operational cadence and strategic outcome. They include early warnings: customer activation drop-offs, talent flight, burn rate spikes. But they also track long-run drivers: market share, brand equity, pricing power.

CFOs also define thresholds that trigger dialogue. These are not crisis points but divergence indicators. If sales velocity slows below a rolling three-month average, an off-cycle strategy session is called. If employee churn crosses ten percent in a critical unit, the founder meets with the board talent committee. The rules are not reactive. They are proactive. Conflict becomes a monitored variable, not a breaking point.

Communication Choreography

Another aspect of reframing is communication choreography. The CFO is not just a number-teller. They are a narrative shaper. When tensions rise, timing and sequencing of communication matters. The CFO briefs board members ahead of meetings. They contextualize founder language. They de-escalate tone. When briefing the founder, they surface board concerns respectfully, without embellishment. This bidirectional preparation creates space for listening. It allows trust to seed before words are exchanged.

In one software company, the founder announced a sudden pricing change. The board feared customer backlash. The CFO reframed: let us test this among enterprise accounts, collect net promoter score deltas, and hold a mid-quarter review. The board agreed. The founder felt respected. And the pricing held. Without this sequencing, the meeting would have derailed. With it, alignment prevailed.

The final component is reputational stewardship. When disagreements surface publicly through media, investor queries, or leaks, the CFO must manage external signals. They prepare shared language for earnings calls: we are testing growth scenarios that balance market share and margin. They align messaging at conferences. They brief investor relations. Their goal is to present unity even amid internal variance. The principle is clear: disagreement is internal, alignment is external.

My certifications as a CPA, CMA, and CIA provide the technical foundation for financial analysis. But what separates effective CFO mediation from partisan advocacy is not technical skill. It is the ability to reframe disagreement from positional conflict into structured dialogue through strategic anchoring, scenario modeling, language discipline, and operational mechanisms that create conditions for shared discovery rather than forced compromise.

Conclusion

This is where great CFOs earn their stripes, not in quiet consensus but in stormy contradiction. They do not mask conflict. They frame it. They do not suppress tension. They structure it. They turn private battles into shared modeling. And they create pathways where both founder conviction and board discipline drive decisions forward, not into rupture but into rigor. Founders bring urgency. Boards bring stewardship. CFOs bring clarity. That clarity is built not in numbers but in the capacity to transform conflict into dialogue. When founders and boards disagree, it is the CFO who holds the center by reframing the argument, resetting the terms, and recovering trust. That is the job. That is the art. That is the difference between misalignment and momentum.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.