Executive Summary

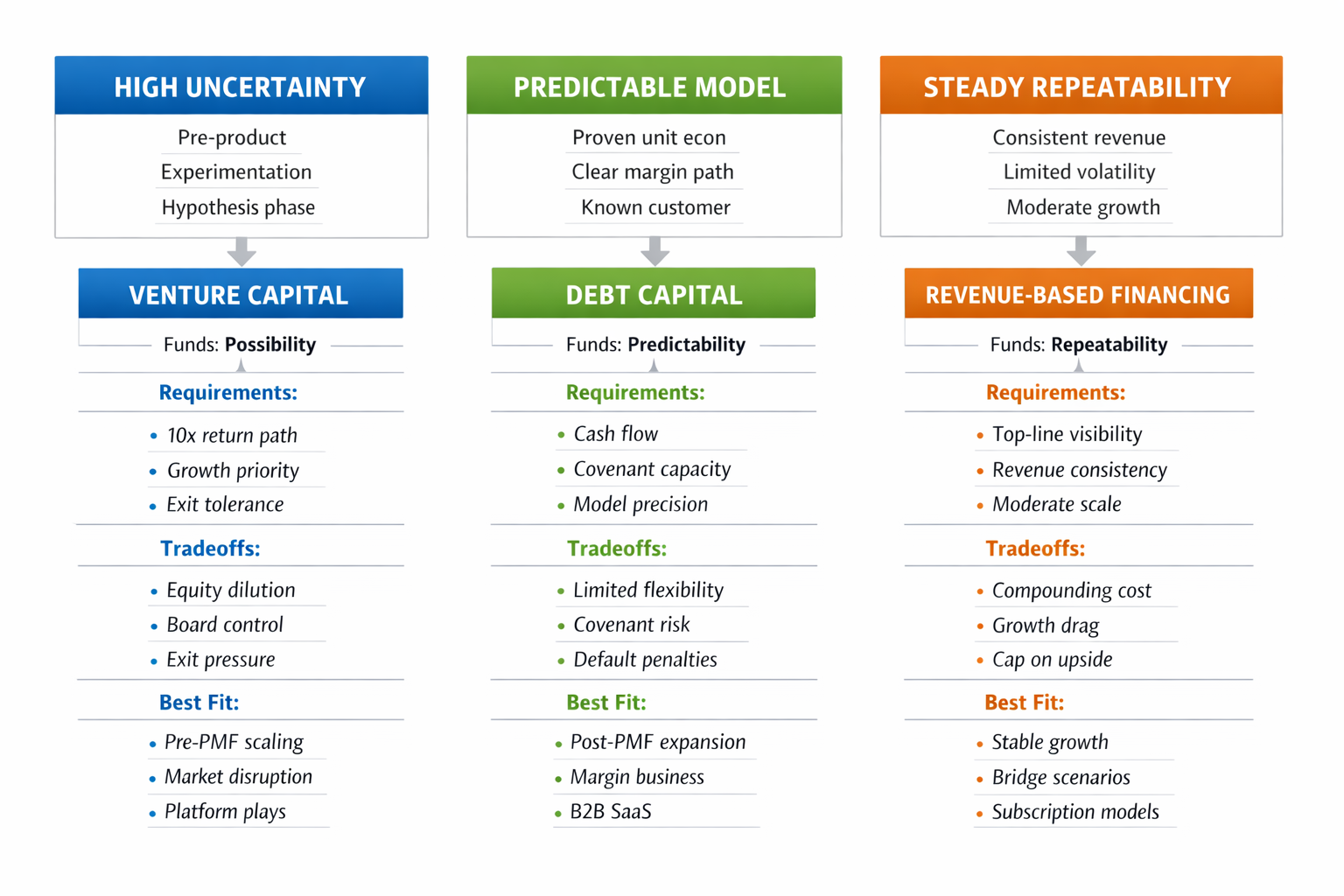

Every business wants to grow. Few pause to ask how their personality grows best. There is a rhythm to growth and there is a temperament to capital. Yet in the early throes of ambition, many companies grab whatever cash is closest including venture capital, a bank line, or a revenue-based facility. Throughout my twenty-five years leading finance across cybersecurity, SaaS, manufacturing, logistics, and gaming, I have learned that companies look at cost, not compatibility. And then they pay for it later in decision friction, board tension, or misaligned growth expectations. There is a reason capital comes in so many forms. It is not just about stage. It is about structure. Venture capital funds possibility. Debt funds predictability. Revenue-based financing funds repeatability. Each has its own temperament. Each asks something different of the company.

Three Capital Temperaments

Venture Capital: Funding Possibility

Venture is the most seductive form of capital. It is fast. It is loud. It is aspirational. It wants growth first, everything else second. Venture wants to believe in the inevitability of a 10x return. That belief demands a certain kind of company: one that can scale before it stabilizes, one that can survive volatility in service of velocity, one that can live in story as much as in numbers.

But venture is not benign. It comes with partners who expect a path, even if it bends. It reshapes governance. It tilts incentives toward exits. It compresses timelines. Companies that mistake venture for safety misunderstand the deal. Venture is a bet and the company is the table. If the business misses milestones, it does not get more time. It gets replaced.

Debt: Funding Predictability

Debt is different. Debt is cold. Predictable. Rational. It asks for service, not story. A company must show cash flow or at least proximity to it. Banks and debt funds want to know how the company will pay them back with interest, on time, no drama. For companies building steady-state machines, this is often a perfect match: SaaS companies with retention, e-commerce with margins, marketplaces with cadence.

But debt punishes unpredictability. Miss a covenant and terms tighten. Miss two and control shifts. The CFO becomes the negotiator-in-chief. Everything gets modeled, then remapped. The board gets nervous. The team gets distracted. Debt rewards precision. It is a fit for those who know their model, not those still searching.

When I secured an $8 million credit line alongside Series B equity at a nonprofit organization, we structured debt specifically for working capital and bridge timing between receivables and payables. The predictability of our revenue model with multi-year foundation commitments enabled favorable covenant terms. We maintained 18-month runway visibility that gave lenders confidence while preserving operational flexibility. This debt structure provided growth capital without additional equity dilution.

Revenue-Based Financing: Funding Repeatability

Then there is revenue-based financing. The shapeshifter of capital. It takes a slice of top-line in exchange for flexibility. It does not demand control. It does not require equity. It looks easy and sometimes it is. For businesses with predictable revenue but limited margin, it can feel like found money. It adjusts with performance. It does not punish ambition.

But revenue-based financing has its own gravity. It works best in flat curves: steady sales, moderate growth. It becomes costly in breakout scenarios. A company growing 20 percent per quarter sees its capital cost compound. There is no equity but there is drag. It is a useful tool when well-timed. It is a leash when misused.

Capital Temperament Matching Framework

This framework illustrates how to match capital type to business characteristics. High uncertainty businesses in experimentation phase require venture capital funding possibility with tolerance for dilution and board control. Predictable model businesses with proven unit economics fit debt capital funding predictability requiring covenant capacity and model precision. Steady repeatability businesses with consistent revenue match revenue-based financing funding repeatability with revenue visibility and moderate scale expectations.

Choosing Compatible Capital

So how does a company choose? The answer lies in self-awareness. What kind of business are you building? What is the rhythm of your model? Do you spike or coast? Is your margin fixed or floating? What is your tolerance for oversight? What is your tolerance for dilution?

Founders often answer these questions with optimism. CFOs must answer them with realism. The best capital strategy is not what gets the highest valuation. It is what keeps the company in motion with the fewest constraints. It is what matches model to money.

A high-churn SaaS company should not raise debt. A pre-product consumer brand should not chase venture. A fast-spiking, short-lifecycle product should think twice before giving away top-line. Each of these pairings creates strain. Not because the capital is wrong. Because the fit is.

Term Sheets: Contracts with Consequences

A term sheet is a promise. But it is also a price. Most companies treat it as an achievement. But to a CFO, a term sheet is something else entirely. It is a contract with consequences. Because while capital feels liberating in the moment, it often arrives with strings long enough to wrap around the business and shape every decision that follows.

The cost of venture capital is not paid in interest. It is paid in optionality. Companies that miss growth targets face new terms, new controls, sometimes new leadership. Debt speaks in different terms: interest rates, covenants, default triggers. Revenue-based financing feels gentler but the tradeoff is compounding. The better the business does, the more expensive certain forms of capital become.

My certifications as a CPA, CMA, and CIA provide technical foundation for capital structure analysis. But what separates effective capital strategy from reactive fundraising is not financial modeling sophistication alone. It is the self-awareness to understand business temperament, the discipline to match capital to model rather than chasing headlines, and the foresight to see term sheet consequences five years forward under both best-case and worst-case scenarios.

Conclusion

Companies are organisms. They metabolize capital differently. What fuels one will choke another. The CFO’s job is not to chase headlines. It is to diagnose structure. To know what kind of growth the business can sustain and what kind of capital accelerates or impairs that growth. There is no ideal capital. Only compatible capital. The difference is the distance between momentum and regret.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.