Executive Summary

In the high-stakes environment of mergers and acquisitions, Quality of Earnings reports function as the buyer’s truth serum. A financial due diligence tool that deconstructs reported profits and reconstructs them with objectivity and rigor, the QoE study offers buyers a cleaner, normalized, and sustainable view of the economic earning power of a target business. Across participation in multiple M&A transactions ranging from tech platforms to industrial services, QoE reports have played a decisive role in shaping final purchase price, negotiating working capital adjustments, structuring earn-outs, and identifying deal-killing red flags. A well-executed QoE report often leads to EBITDA adjustments ranging from 5 to 25 percent, significantly impacting valuation. The traditional P&L statement is not a lie but a version of truth filtered through layers of accounting judgments, accruals, deferrals, and non-recurring adjustments. A QoE study slices through those layers, pointing not just to where the business has been but where it is likely to go, and whether the map matches the terrain.

What Is a Quality of Earnings Study

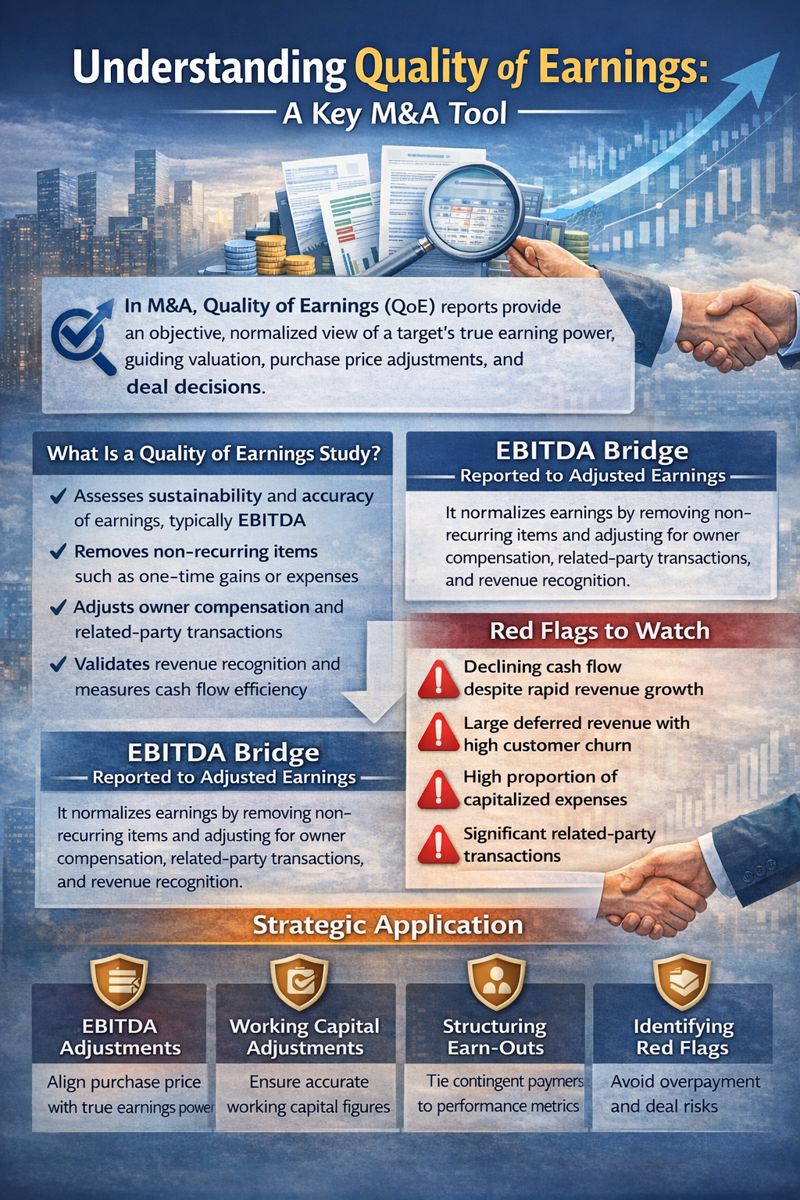

The core objective of a QoE study is to assess the sustainability, accuracy, and repeatability of a target company’s earnings, typically EBITDA. Its true value lies deeper than surface-level validation. A robust QoE report, usually conducted by a Big Four firm or a reputable transaction advisory group, goes far beyond a financial audit. It normalizes earnings by removing non-recurring items, adjusts for owner compensation and related-party transactions, validates revenue recognition practices, and measures cash conversion efficiency.

In transactions I have participated in, ranging from thirty-five million to three hundred fifty million dollars, the level of preparedness and diligence around earnings quality has always made a visible difference. Buyers respond to clarity. Valuations hold when diligence confirms what was promised. A QoE study is where that confirmation happens.

How Quality of Earnings Is Calculated

While mechanics vary by industry, the following step-by-step framework captures the general flow. Starting with the seller’s income statement over two to three years plus trailing twelve months, the process moves through four stages of adjustment before arriving at a final normalized figure.

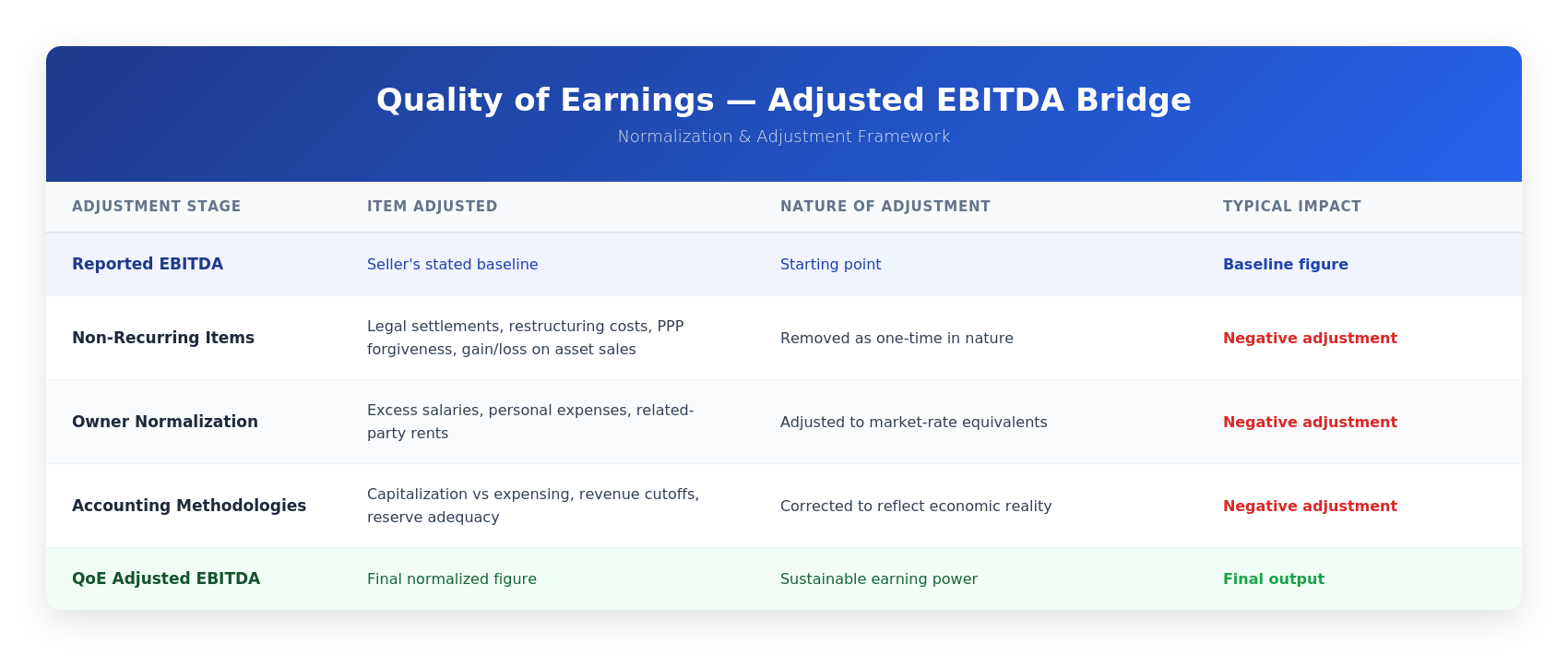

EBITDA Bridge: Reported to Adjusted

This bridge illustrates how reported EBITDA progressively moves through stages of normalization. Each adjustment reflects a layer where accounting judgments or one-time events have distorted the true earning power of the business. The final adjusted figure is what a buyer can reasonably expect to sustain going forward.

Risk Identification and Strategic Application

Red Flags to Watch

Buyers should remain particularly alert to signals that suggest earnings may not reflect economic reality. In one transaction involving a consumer goods company, a QoE flagged that 38 percent of net income came from favorable foreign tax credits unlikely to recur post-close. This led to a six million dollar reduction in purchase price. In another case involving a SaaS platform with an enterprise value of 380 million dollars, the QoE reduced reported EBITDA from 34 million to 29.5 million by removing non-recurring legal settlements, misclassified capitalized development costs, and under-accrued bonuses. The result was a 50 million dollar reduction in purchase price at a 10x multiple.

The most consequential red flags include rapid revenue growth paired with declining cash flow, which often signals aggressive revenue recognition. Large deferred revenue balances combined with high churn suggest customer dissatisfaction or unearned revenue. Expenses capitalized at more than 10 percent of operating expenditure indicate inflated EBITDA through accounting manipulation. High related-party transactions signal risk of future dis-synergies post-close.

Using QoE Findings Strategically

Quality of Earnings is not just a defensive exercise. It is strategic. A well-positioned buyer uses QoE findings to structure contingent payments through earn-outs, adjust working capital targets, determine the appropriate debt versus equity financing split based on actual cash flow, and negotiate indemnities and escrow amounts. It also supports valuation modeling in leveraged buyout transactions where debt service capacity is critical, in roll-ups where synergy verification matters, and in cross-border deals where accounting harmonization is required.

From the seller’s perspective, a clean and transparent QoE prepared before going to market can strengthen the credibility of the deal and protect valuation. In one instance, a seller-prepared QoE added twelve million dollars to the final deal price simply because buyer confidence was elevated from the outset. The seller had reclassified personal and owner expenses clearly, been transparent about non-recurring events, and provided a walk-forward bridge from GAAP to adjusted EBITDA.

Navigating QoE: Buyer and Seller Playbooks

The Buyer’s Priorities

The buyer should conduct QoE before signing or secure a post-LOI break clause. Specialist advisors should be hired rather than relying solely on auditors. Seller-adjusted EBITDA should never be accepted at face value. Cash-to-EBITDA reconciliation must not be skipped.

The Seller’s Credibility Game

The seller should prepare a sell-side QoE report before going to market. Personal and owner expenses should be reclassified clearly. Transparency about non-recurring events is essential. Growth costs should not be treated as one-time expenses. Customer churn or margin compression must not be concealed.

Conclusion

A Quality of Earnings study is the economic compass in the M&A terrain. It offers not just a snapshot of where earnings have been but a credible projection of where they are likely to go. More than once, a QoE has been the reason a deal was re-negotiated, delayed, or walked away from. And in several cases, it has given conviction to pay a premium, knowing the earnings were real, sustainable, and cash-convertible. For the CFO navigating a transaction, whether as buyer or seller, the QoE is not optional. It is the foundation upon which every other negotiation rests.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.