Executive Summary

Strategy is, in its purest form, a statement of confidence in the future. It is a declaration of belief, sometimes grounded, sometimes aspirational, about where the world is going and how an enterprise should move with or against its currents. And yet, the act of building strategy is increasingly fraught, not because we lack vision but because the world itself has become less obliging. We live and plan in an era when discontinuity is the rule, not the exception, and in this new terrain, the old rituals of forecasting, budgeting, and linear projections feel not just inadequate but almost performative. It is in this climate, part anxiety, part acceleration, that scenario analytics has emerged as a new form of strategic literacy. Not as a substitute for conviction but as a scaffold for its complexity. Scenario thinking is no longer about mapping best, worst, and base cases. It is about embracing structural ambiguity. It is about answering a different kind of question, one that begins not with “what is most likely to happen” but with “what could happen, and what would we do then.”

From Linear Thinking to Structural Ambiguity

In my early years in finance, we were trained to look backward. Past performance was the raw material of decision-making. Everything could be extrapolated, smoothed, trended. The models obeyed the logic of yesterday.

But today, threats and opportunities emerge instantaneously. A pandemic closes supply chains overnight. Regulators rewrite rules on the fly. Customers pivot, competitors appear from unexpected quarters.

Throughout thirty years leading finance organizations across SaaS, digital marketing, gaming, and logistics, I have witnessed how linear thinking blinds us to inflection points and dulls response time. At a digital marketing organization that scaled from nine million to one hundred eighty million in revenue, traditional forecasting models failed to capture market discontinuities.

Scenario analytics invites us to think in branches and forks. There are multiple ways the future could unfold, and we must be ready to live in several of them at once. We need to design for optionality, to create a strategy that flexes without breaking.

The Practice of Scenario Thinking

Scenario analytics is grounded and practical. The work begins with questions:

- What if our largest customer disappears?

- What if energy costs double?

- What if AI commoditizes our advantage?

- What if our talent base moves faster than our operating model?

- What if regulatory frameworks shift fundamentally?

Each what-if becomes the seed of a scenario, and from it grows operational implications. We are forced to ask: what would we stop doing? What would we double down on? What assumptions would unravel? What decisions would suddenly become urgent?

Scenario thinking is a return to first principles. It demands that we unearth assumptions buried in our models, surface our mental shortcuts, and examine the scaffolding on which our plans rest.

At organizations where I led FP&A and board reporting, implementing scenario planning frameworks exposed not only risk but dependency. We saw where our business leaned too heavily on fragile inputs and where we had invested conviction in mirages.

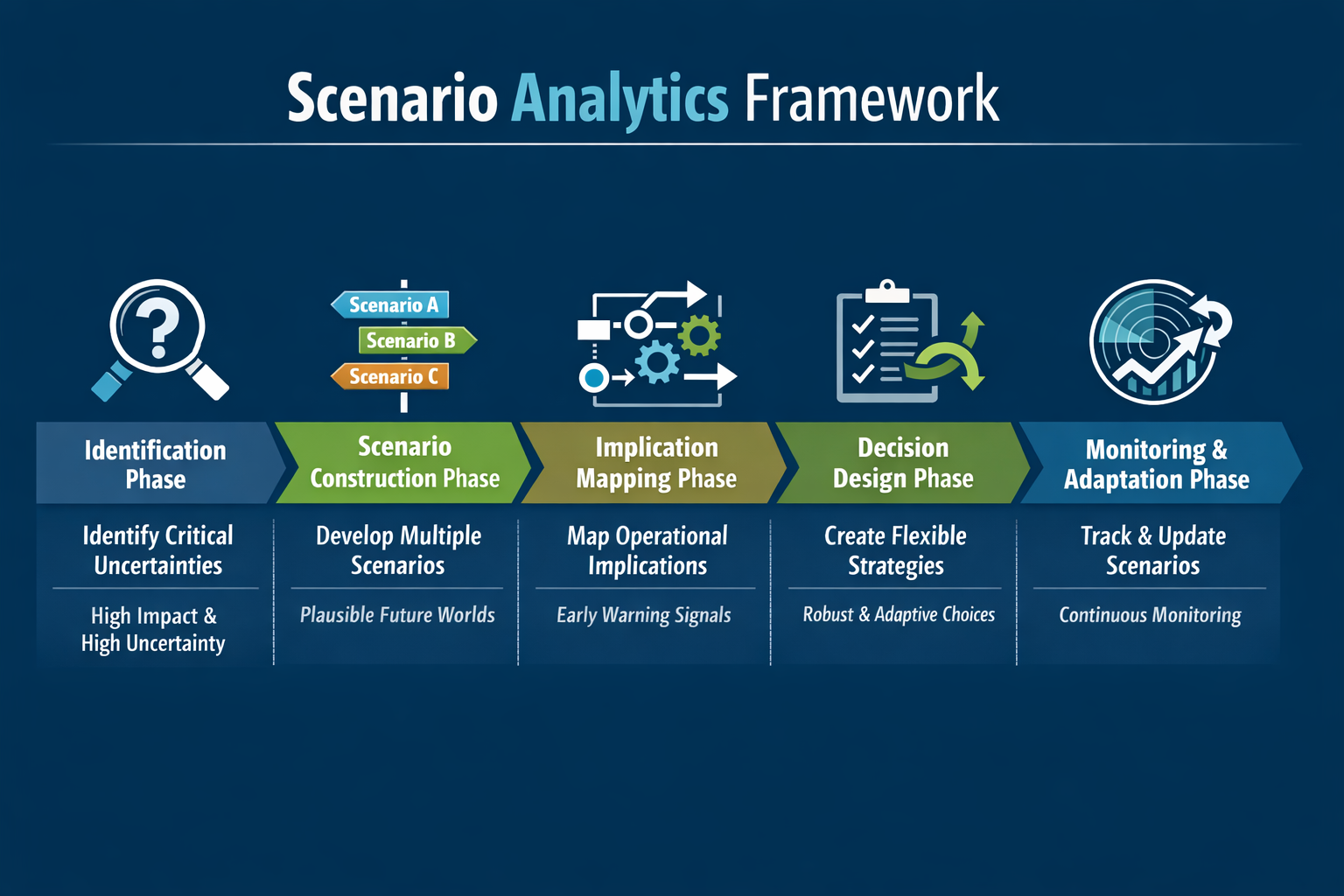

Scenario Analytics Framework

The following framework outlines how scenario analytics transforms strategic planning:

- Identification Phase: Identify critical uncertainties with high impact and high uncertainty. At one education nonprofit where I secured forty million in Series B funding, identifying donor concentration risk and regulatory uncertainty proved essential for strategic planning.

- Scenario Construction Phase: Build three to five plausible future scenarios spanning the range of possibilities. Name them to make them memorable and actionable. At a gaming enterprise where I led global financial planning, we constructed scenarios around platform shifts and competitive dynamics that informed multi-year investment decisions.

- Implication Mapping Phase: For each scenario, map specific operational implications across functions. Identify early warning signals that indicate which scenario is materializing. At a logistics organization managing one hundred twenty million in revenue, mapping supply chain disruption scenarios enabled proactive vendor diversification.

- Decision Design Phase: Identify decisions that are robust across multiple scenarios versus those that are scenario-dependent. Build flexibility mechanisms including option value in capital allocation and reversible commitments.

- Monitoring and Adaptation Phase: Establish ongoing monitoring of scenario indicators. Update scenarios quarterly based on emerging information.

The Tools Have Improved

Scenario analytics has evolved from a whiteboard exercise to a rigorous discipline, enabled by data science, probabilistic modeling, and enterprise systems. But the technology is not the point. The real power lies in the mindset it cultivates.

Scenario analytics changes the way leaders think. It trains us to hold multiple hypotheses at once, to evaluate decisions across time horizons, to ask not just “what is the plan” but “what are the conditions under which this plan survives.”

When implemented seriously, it reshapes governance. It forces executives to argue not just for outcomes but for flexibility. It shifts conversations from reactive to anticipatory.

From Clarity to Range

As a CFO, I used to pride myself on clarity, on tightening the aperture of possibility to a single number. But clarity is not the same as certainty. And in a volatile world, it can be a kind of hubris.

Today, I value range. I value preparedness. I value the discipline of saying: we do not know exactly what will happen, but we know what we will do if it does. That is not equivocation. It is responsibility. It is what separates firms that flinch in crisis from those that act with conviction.

In scenario thinking, we replace the question “what is the plan” with “what is our agility.” And this shift has profound consequences for how capital is allocated, how talent is deployed, and how resilience is built.

The Value of Improbable Scenarios

Some scenarios are improbable. That is not a reason to ignore them. The value of a scenario is not in its likelihood but in its impact. A low-probability event with catastrophic consequences deserves more attention than a high-probability one with minor effects.

The cost of preparedness is often trivial compared to the cost of unpreparedness. And the act of preparing, even if the scenario does not materialize, strengthens the organization. It builds muscles of rapid decision-making and exposes outdated assumptions.

At one SaaS organization operating across US and EU entities, we modeled regulatory divergence scenarios that seemed improbable at the time. When GDPR implementation accelerated, we had already designed compliance frameworks that competitors scrambled to implement under deadline pressure.

Democratizing Strategy

Scenario analytics, when used responsibly, democratizes strategy. It invites more voices into the room. The analyst who sees a risk that leadership has ignored. The product lead who imagines a pivot others dismissed. The frontline operator who knows the system’s true vulnerabilities.

In a world of rigid planning, these insights are often lost. In scenario thinking, they become essential. It creates a culture where uncertainty is not a weakness but a shared field of inquiry.

This demands time, imagination, and rigor. But it is also liberating. It breaks the spell of false precision. It restores the humility that complex systems require. And in its place, it offers something better than certainty. It offers readiness.

Conclusion

For me, scenario analytics is no longer a tool but a habit of mind. It is how I think about everything from capital planning to risk management to organizational design. I do not fear uncertainty as I once did. I expect it. I welcome it. Because I know that while I cannot predict the future, I can prepare for it. And in that preparation lies the difference between navigating volatility and being undone by it.

There is no perfect plan. There is only a process of strategic calibration, an ongoing effort to adjust, to learn, to decide. Scenario analytics is how we keep that process honest. How we move through uncertainty with eyes open. How we build organizations that are not brittle but resilient, not reactive but poised. The future will continue to surprise us. That much is guaranteed. But how we respond, that is still within our control.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.