Executive Summary

Due diligence, for all its strategic importance, remains one of the most labor-intensive and judgment-heavy processes in finance and corporate development. Whether assessing a potential acquisition target, onboarding a critical vendor, or entering a new market, the early stages of diligence often feel like digital archaeology: sifting through unstructured documents, triangulating conflicting data, and generating clarity from ambiguity. In my thirty years working across M&A transactions, financing rounds, vendor risk assessments, and cross-border expansions in sectors ranging from SaaS to logistics, the same inefficiencies repeat themselves. The bottleneck is not intent but information. And that bottleneck is precisely where Generative AI agents are now becoming transformative. For growth-stage companies under resource constraints but with expanding strategic horizons, GenAI agents are emerging as a new class of co-investigators. They do not replace human judgment but accelerate it, de-risk it, and systematize its early stages. Done right, this is not automation for speed but intelligence as an advantage.

Why Traditional Diligence Is Ill-Suited for Modern Timelines

Diligence in high-growth environments is a race against time. Competitive bids emerge, capital timelines accelerate, and vendors expect responses within days. Yet the process still involves teams manually reviewing hundreds of documents, pulling KPIs into inconsistent models, or conducting late-stage red flag reviews under duress.

At one gaming enterprise where I led global controllership and oversaw one hundred million in acquisitions, our finance and legal teams spent over one hundred fifty hours parsing customer contracts and revenue schedules before the first term sheet. Half that time was spent on identification and extraction, not interpretation.

GenAI can now collapse that timeline. The right agent, trained on deal logic and industry context, can scan contracts, flag missing terms, benchmark KPIs, and summarize sector-specific risks before the deal team even meets the target.

GenAI Agents as First-Pass Investigators

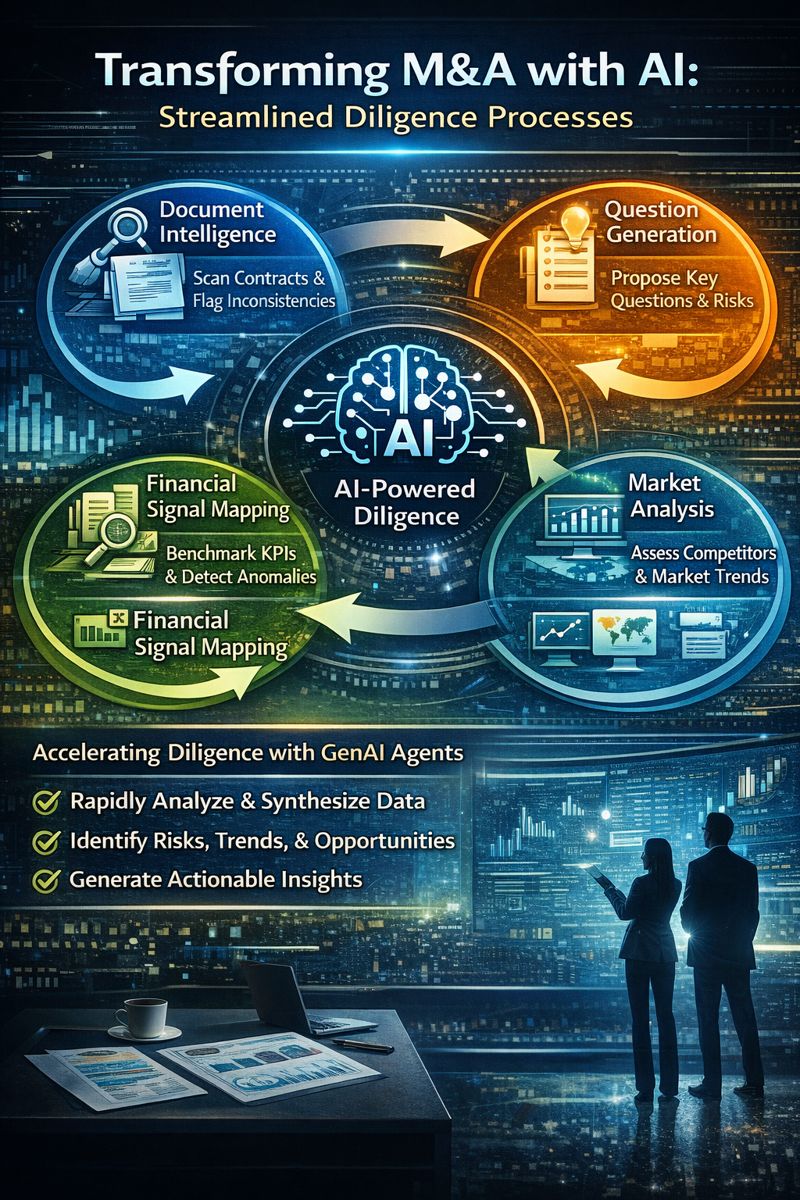

In practice, a diligence-focused GenAI agent acts as a first-pass filter across four domains:

- Document Intelligence: The agent ingests data rooms, parses NDAs, MSAs, vendor contracts, LOIs, and org charts. It highlights inconsistencies, identifies missing terms including non-competes and IP assignments, and extracts key dates, thresholds, and obligations.

- Financial Signal Mapping: The system reviews uploaded P&Ls, bank statements, cap tables, and ARR schedules. It reconciles them for consistency, flags anomalies such as flat growth alongside increased hiring, and models basic forecast scenarios.

- Market and Competitive Analysis: Drawing on external sources and embeddings of market research, the agent generates competitor landscapes, market size estimates, and SWOT-style assessments with links to source data.

- Question Generation and Red Flags: Based on the above, the agent proposes fifteen to twenty follow-up diligence questions designed to uncover what is missing, vague, or risky. This alone can save days of prep and improve interview quality.

At one professional services organization where I built enterprise KPI frameworks and led corporate analytics, we deployed an AI co-pilot to review a potential technology vendor. In twenty-four hours, the agent flagged that a key SLA clause capped service credits in a way that shifted liability risk to us. It also found prior litigation activity involving the vendor, previously buried in public filings. That insight rebalanced the negotiation early.

From Linear Reviews to Parallel Processing

The brilliance of AI agents is not just their intelligence but their parallelism. Humans review sequentially. Agents process simultaneously. A single GenAI agent can ingest ten years of legal documents while another reviews financial trends and a third benchmarks against industry norms, all in parallel.

At a digital marketing organization that scaled from nine million to one hundred eighty million in revenue, GenAI agents enabled pre-summarization of customer contracts that would have taken weeks to become structured memos reviewed by general counsel within days.

At one education nonprofit where I secured forty million in Series B funding, the due diligence process required meticulous review of program agreements and donor restrictions. GenAI agents processed hundreds of historical agreements in parallel, identifying restriction clauses that informed our fundraising structure.

Reducing Risk by Expanding Surface Area

GenAI agents do not just save time but expand the surface area of diligence. Human teams are often forced to triage: review ten percent of documents, prioritize top customers, spot-check margins. AI agents can afford to be exhaustive, processing every document, term, and metric. This allows teams to spot low-probability but high-impact risks.

In a nonprofit merger I supported, an AI diligence agent identified language in a decade-old donor agreement that restricted use of endowment funds under new organizational structures. The clause triggered legal review and prevented reputational risk post-close.

Risk in diligence is not just what you miss but what you never knew to look for. AI changes that.

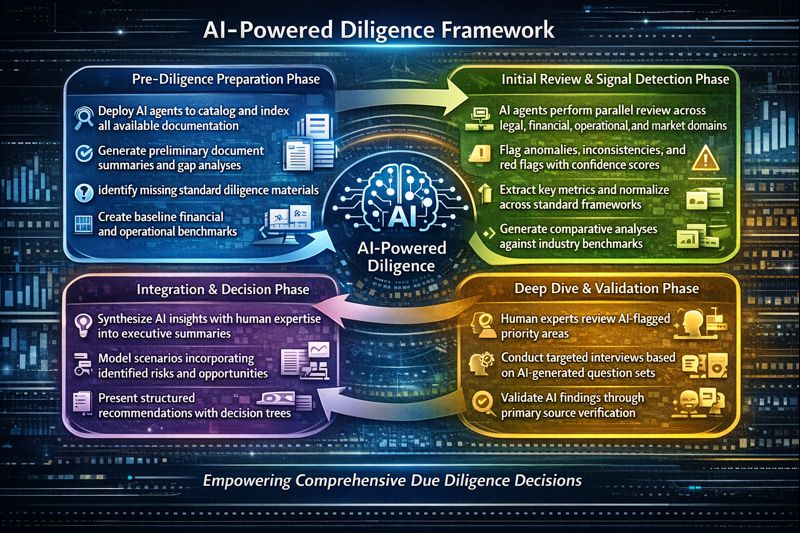

AI-Powered Diligence Framework

The following framework outlines how GenAI agents integrate into the diligence workflow:

- Pre-Diligence Preparation Phase

- Initial Review and Signal Detection Phase

- Deep Dive and Validation Phase

- Integration and Decision Phase

Accountability, Not Autopilot

Despite their power, GenAI agents must be used with care. They hallucinate. They may misinterpret industry-specific language. They lack context unless trained carefully.

Every AI-assisted diligence process must include:

- Human-in-the-loop validation: No GenAI output should go to a board or investor without human review and sign-off.

- Prompt governance: Define standard prompts that ensure completeness and risk-weighting in output generation.

- Traceability logs: Every insight must be linked back to the source document or data point.

- Disclosure discipline: If AI was used to generate memos for external use, disclose that fact.

CFOs and general counsel must not treat AI as infallible. The model proposes. The human signs off. That balance ensures both speed and scrutiny.

A New Model for Investment Committees and Boards

Imagine the next time you bring a deal review to the investment committee. Instead of a static deck, you present an AI-generated executive memo summarizing key risks and upside potential. A clause-level analysis of contracts with flags on renewal and liability risks. Scenario simulations showing cash flow under different integration timelines. Suggested questions tailored to that target’s industry and operational profile.

This is not the future. It is now emerging in progressive deal teams across venture, private equity, and strategic M&A.

Implications for Founders and CFOs

If you are a founder preparing for M&A, fundraising, or major vendor partnerships:

- Begin building structured documentation now including data rooms, clean contracts, and audit trails.

- Use GenAI as a prep assistant to generate likely questions and anticipate counterparty asks.

- Equip your CFO and legal team with AI co-investigator tools to enhance their insight.

- Treat diligence not as a transaction but as a signal of how your company manages intelligence.

Your investors will notice.

Conclusion

AI will not remove the need for judgment, negotiation, or ethical consideration in diligence. But it will remove excuses. Excuses about time, about not seeing critical details, or about information being buried in appendices. The future of diligence is fast, structured, and smart. GenAI agents are not shortcuts but scaffolding for better questions, better preparation, and better decisions. In the age of AI-assisted diligence, insight is no longer a function of effort but a function of design. The best co-investigators never sleep, never tire, and never stop learning. They simply wait for human judgment to channel their capabilities toward strategic advantage.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.