Executive Summary

Artificial intelligence is fundamentally transforming financial controls from static compliance frameworks into dynamic, learning systems that anticipate rather than merely detect risk. Drawing from three decades of operational CFO experience across industries, this article examines how AI introduces a third dimension to traditional controls: anticipation that warns organizations before systems veer off track rather than catching mistakes after occurrence. The shift from rule-based to probabilistic controls requires new governance frameworks addressing opacity, accountability, and bias while maintaining the trustworthiness that defines effective control systems. Success demands treating AI as tiered partner rather than autonomous decision-maker, establishing model explainability protocols, and training teams to interpret machine-generated signals alongside traditional metrics. CFOs must evolve from designing static rules to curating dynamic signals, from approving thresholds to setting guardrails, and from asking what went wrong to understanding what the agent learned. The greatest opportunity lies not in automation alone but in building controls that surface inefficiencies, suggest better workflows, and distribute trust from individuals to architectures while retaining human judgment for context-laden decisions that define real-world finance.

The Quiet Revolution in Financial Controls

Internal controls once evoked the soft rustle of binders, the smell of dry-erase markers on audit room walls, and the ritual gravity with which CFOs would solemnly pronounce that controls are in place. It was a phrase meant to instill comfort, but behind it lay a complicated reality. We did not truly know whether controls were in place. We only knew they had not failed yet.

Controls were static structures including segregation of duties, approval thresholds, and reconciliations. They were human systems dependent on consistency and vigilance, two qualities that in any high-growth company are often in short supply. Having spent three decades as an operational CFO across industries, I have watched these systems buckle under the weight of scale and speed. It was not that people were failing. It was that processes had not evolved.

Then came the algorithms. Artificial intelligence entered the world of financial controls not with dramatic announcements but with quiet suggestions. A flagged transaction here, an unexpected expense there. At first, it felt like a helpful assistant. But slowly, it became clear: this was not an assistant but a new nervous system. One that learns.

From Detection to Anticipation

At a fintech company I advised, we integrated an AI tool into the procurement process. No grand unveiling, just a pilot. Within a month, it began surfacing invoice anomalies including a supplier charging twenty-two percent above historical norms and contract terms that did not match what was negotiated. We had not told it to look for these things. It had inferred them from behavioral patterns.

But the revelation was not just in the precision. It was in the timing. This AI was not catching mistakes after the fact. It was catching them in flight. That changes everything.

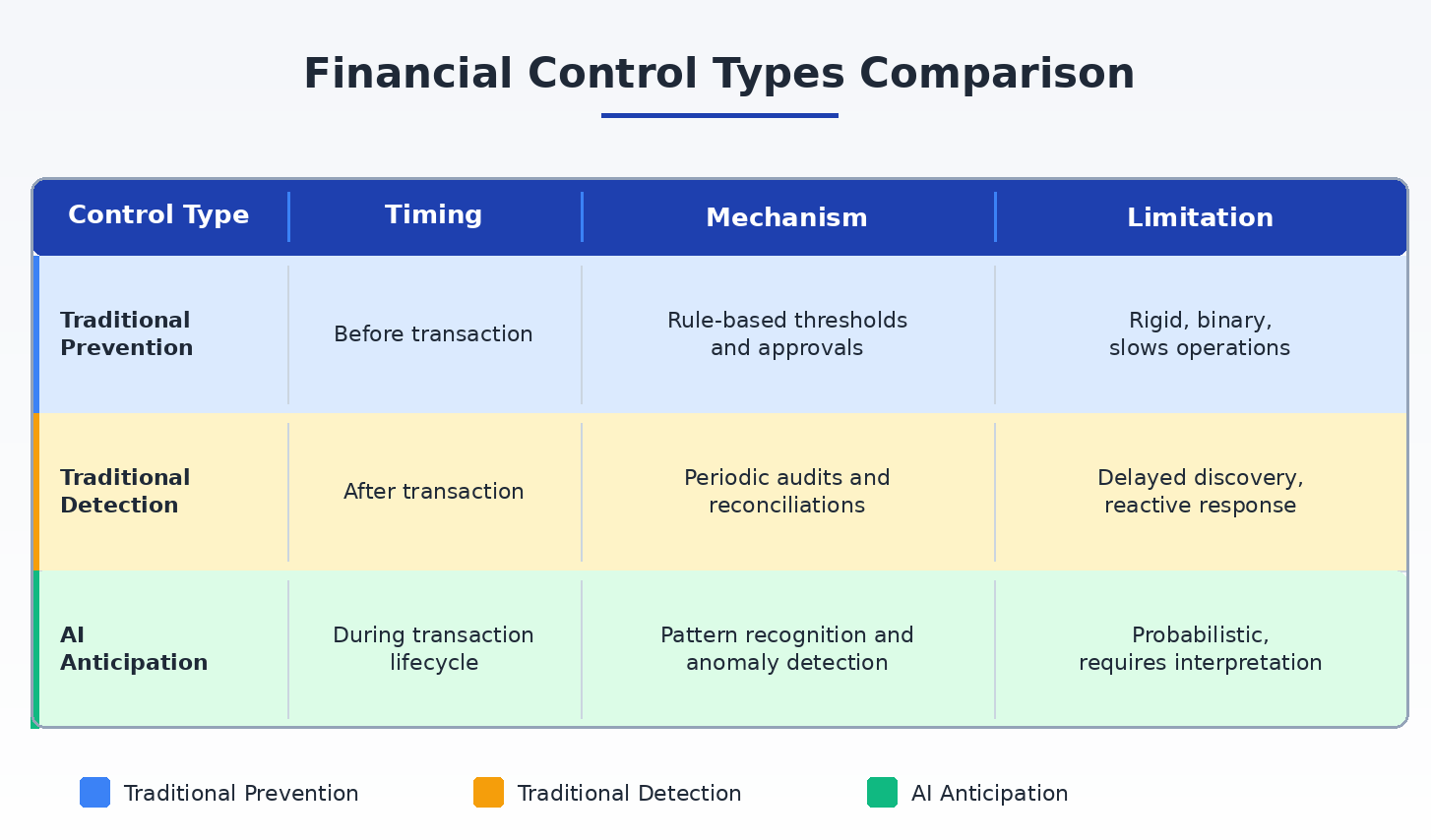

Controls have always walked a line between prevention and permission. Too strict, and you throttle the business. Too loose, and you invite risk. But AI introduces a third dimension: anticipation. It does not merely stop bad behavior. It warns before the system veers off track.

Three Dimensions of Financial Controls

I have seen AI tools flag employees booking hotels during non-travel periods not because they broke a rule but because their behavior deviated from learned patterns. I have seen neural networks track spending velocity and trigger soft budget locks before we needed financial triage. These systems are not rule followers. They are risk interpreters.

The Cultural Shift: From Binary to Probabilistic

Traditional controls are grounded in compliance. They are backward-looking and comfortingly binary: pass or fail, within threshold or outside it. But AI does not speak in binaries. It speaks in likelihoods and shades. For a generation of finance professionals trained to think in ledgers, this probabilistic whisper requires a new kind of listening.

There is, of course, a cost. When you begin trusting machines to interpret financial signals, you must also ask: Who audits the algorithm? How do we know it is not biased, overfitting, or simply wrong? In one company, an AI control flagged a high-risk transaction tied to our largest client. The model was right, but we overrode it for commercial reasons. That override sparked a deeper question: where do human instincts belong in a system that no longer waits for them?

This is not just a technical question but a philosophical one. Controls were once about reducing human error. AI now asks us to reconsider the definition of error itself.

The CFO as Architect of Intelligent Trust

The CFO’s role is evolving from gatekeeper of compliance to architect of intelligent trust. In boardrooms, I now speak less about checklists and more about learning systems. I report not just on exceptions caught but on exceptions predicted. I show how our models evolve, how our blind spots shrink, and how our confidence grows.

What is remarkable is how much more strategic this makes financial controls. They are no longer the province of auditors and accountants alone. AI-infused controls touch operations, procurement, sales, and HR. They surface inefficiencies, suggest better workflows, and nudge behavior. They do not just say no. They ask, are you sure?

In one Series D company, an AI-driven review of refund patterns revealed a subtle trend in customer behavior that had nothing to do with fraud and everything to do with a flawed returns policy. A finance tool had just improved the customer experience.

When the Controls Start to Think: Generative and Agentic AI

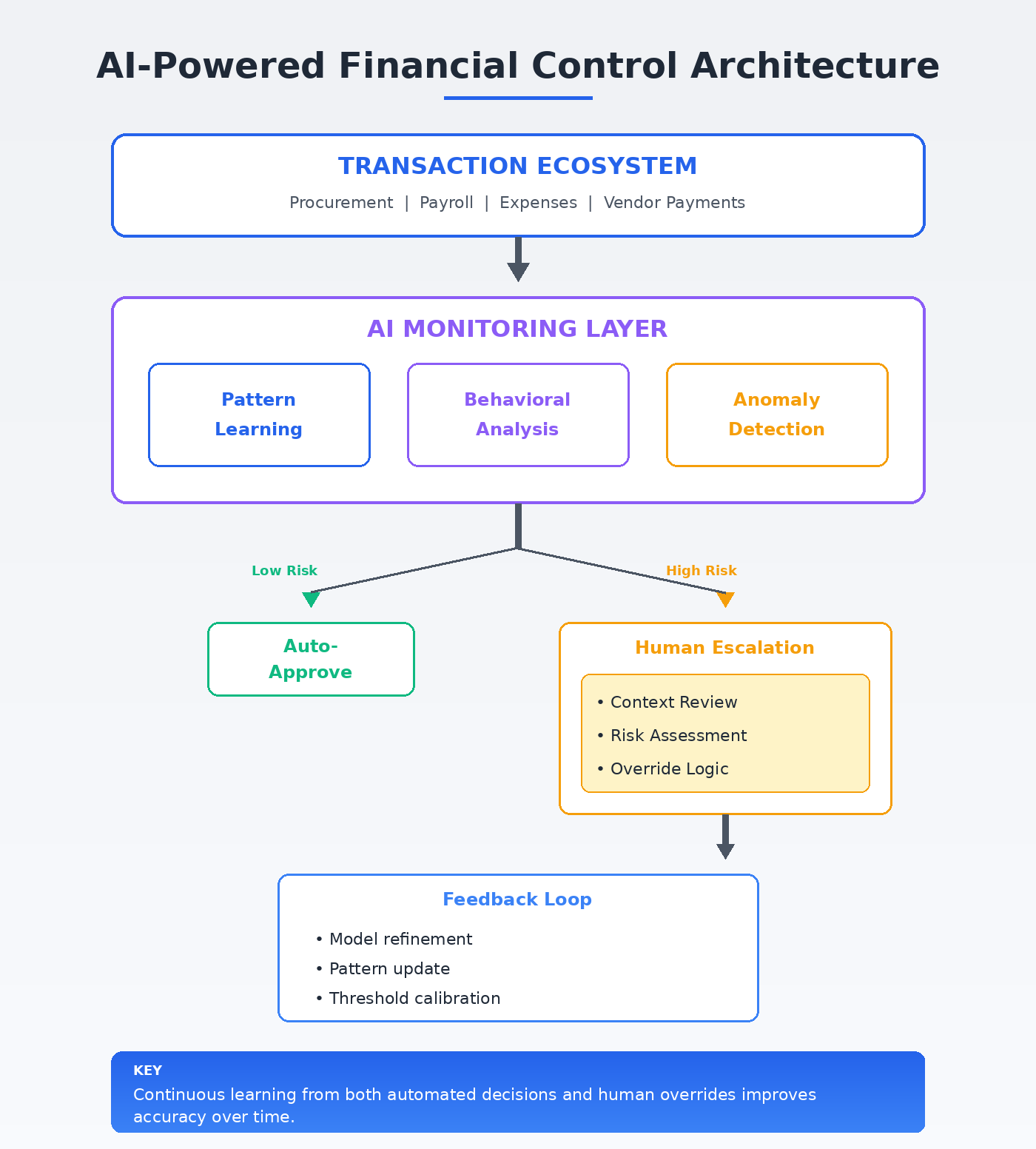

Where generative models mimic, synthesize, and generate new content from emails to summaries to code, agentic systems go further. They observe, decide, and act. A Gen AI tool might write a policy. An Agent AI system might enforce it, monitor compliance, and revise it all without waiting for a human prompt.

The Promise of Intelligent Controls

Speed and Real-Time Response Traditional controls create bottlenecks through manual reviews, periodic audits, and exception queues. AI collapses that latency. Instead of waiting for quarter close to identify fraud, algorithms detect unusual vendor billing patterns within hours. Instead of relying on sample testing, AI scans entire populations of transactions, flagging edge cases with uncanny accuracy.

Contextual Intelligence Unlike rule-based systems looking for specific violations such as expenses above certain thresholds, AI models learn from behavior. They recognize that a four hundred fifty dollar hotel charge is perfectly normal for one employee and suspicious for another. They adjust sensitivity based on patterns, not hard-coded rules. This makes controls not just stricter but smarter.

Scalability Across Complexity As companies expand across geographies, currencies, and compliance regimes, traditional control frameworks struggle to keep up. AI monitors thousands of payment streams, vendor profiles, and policy documents simultaneously, adapting to local context without requiring armies of controllers.

The Perils: Opacity, Accountability, and Bias

For every elegant edge AI sharpens, it introduces new kinds of risk that CFOs must actively manage.

Critical Risk Dimensions

Opacity and Explainability Traditional controls are transparent by design. Approvals, thresholds, and escalation paths are visible. With AI, reasoning becomes probabilistic. A transaction is flagged not because it violated a known rule but because it deviated from a model’s trained expectation. For finance professionals used to deterministic logic, this is deeply unsettling. When the system says this does not look right, it is often hard to explain why.

Accountability Gaps When a human controller misses a red flag, we know who is responsible. But when an AI-driven control misfires, approving something it should have blocked or blocking something strategic, who takes the blame? The model’s designer? The user? The CFO? This ambiguity becomes especially thorny in high-stakes environments like SOX compliance, tax audits, or material misstatements in financial reporting.

Embedded Bias AI learns from historical data, and historical data often contains the biases of the systems that created it. If a company’s procurement controls have historically treated new vendors with suspicion and large incumbents with deference, an AI trained on that data may replicate that bias, subtly privileging the past over innovation or entrenching systemic blind spots.

Autonomous Overreach Agentic AI that not only detects but acts introduces new governance dilemmas. In one company I worked with, an AI system automatically paused a large vendor payment after detecting an unrecognized invoice format. The issue? The vendor was critical to product delivery, and the delay set back shipments by a week. The model was technically correct. The override was human. But the damage was already done.

Governance Framework for AI-Powered Controls

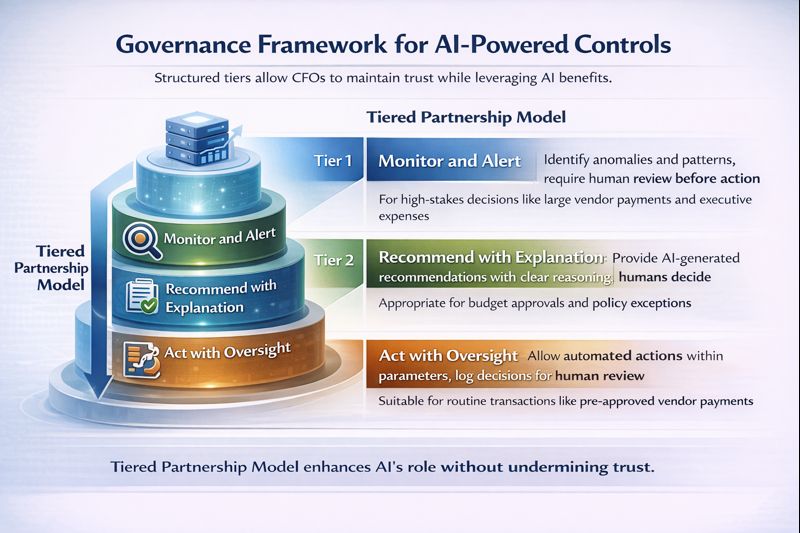

The challenge for CFOs is not to resist this evolution but to govern it effectively through structured frameworks that maintain trustworthiness while capturing AI benefits.

Tiered Partnership Model

Essential Governance Protocols

- Model Explainability Standards: Establish requirements for AI systems to articulate reasoning behind flags and recommendations in business language finance teams understand.

- False Positive and Negative Review: Regularly analyze both types of errors not just for technical tuning but for ethical risk and business impact assessment.

- Bias Auditing: Conduct periodic reviews of AI decision patterns across vendor types, employee levels, and transaction categories to identify and correct systemic biases.

- Human Override Documentation: Require clear documentation when humans override AI recommendations, creating feedback loops that improve model accuracy while preserving institutional knowledge.

- Escalation Thresholds: Define clear criteria for when AI must defer to human judgment based on transaction materiality, strategic importance, or contextual complexity.

The Path Forward: Reimagining Financial Controls

AI is not the enemy of controls but a force demanding we reimagine them. We must learn to partner with machines that learn, to teach systems that teach themselves, and to retain our judgment even as we build systems designed to mimic it.

Strategic Imperatives for CFOs

Evolve Role Definition Shift from designing static rules to curating dynamic signals, from approving thresholds to setting guardrails, and from asking what went wrong to understanding what the agent learned. Controls will no longer be engineered but trained, and the vocabulary of internal audit will expand from policies and tests to prompts, weights, and model drift.

Build Hybrid Teams Develop finance professionals who can interpret probabilistic signals alongside deterministic metrics. The future controller combines traditional accounting rigor with data science literacy and ethical reasoning about AI deployment.

Maintain Trust Through Transparency The greatest strength of a control system is not its intelligence but its trustworthiness. Trust is not built through automation but through understanding, transparency, and accountability. AI systems must be designed to explain themselves in ways that build rather than erode confidence.

Embrace Continuous Learning At its best, this new breed of intelligent control does not just protect the enterprise but teaches it. It surfaces biases, identifies systemic inefficiencies, and reveals where human judgment, once thought infallible, quietly falters. The controls themselves become sources of organizational learning rather than mere compliance checkpoints.

Conclusion

The transformation of financial controls through AI represents not just technological advancement but fundamental reimagining of how organizations build and maintain trust in financial operations. The shift from static, rule-based frameworks to dynamic, learning systems introduces both tremendous opportunity and significant governance challenges. Success requires CFOs to become architects of intelligent trust, establishing frameworks that leverage AI’s speed, contextual intelligence, and scalability while maintaining human oversight for decisions requiring business context, ethical judgment, and strategic consideration. The future belongs not to organizations that automate controls completely but to those that build hybrid systems where machine precision enhances rather than replaces human wisdom. In the quiet spaces between forecast and ledger, approval and payment, AI-powered questions may prove the most valuable control of all, provided we retain the judgment to answer them wisely.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.