Executive Summary

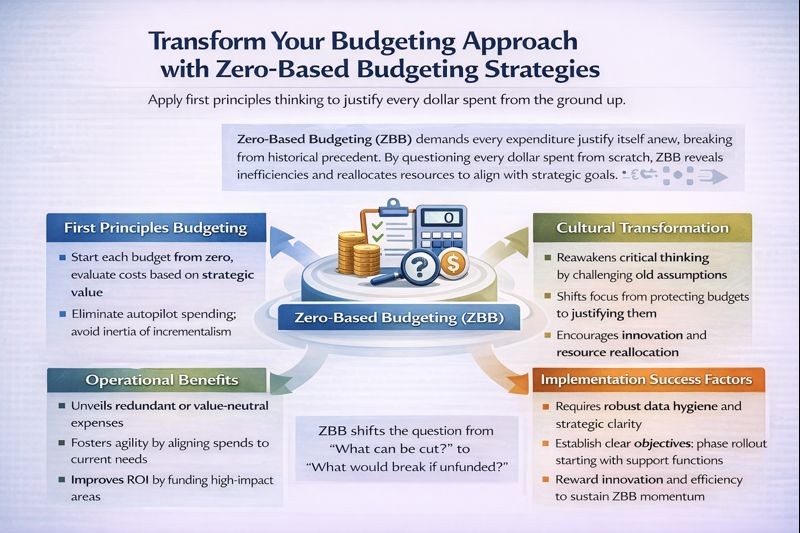

Budgeting is often mistaken for a clerical exercise connecting last year to the next with minor adjustments. Many corporations adopt methods not out of conviction but habit. Zero-Based Budgeting requires every line item to earn its keep irrespective of historical precedent, reawakening first principles thinking. Every dollar spent must be justified anew as if starting from scratch. This rigor exposes redundancy and laziness. A multinational consumer goods firm using a plus-five-percent heuristic for decades revealed through ZBA that nearly 18 percent of corporate overhead was duplicative or value-neutral. The deeper implication is cultural. Incrementalism assumes stasis, but the modern enterprise operates amid discontinuities rendering the past an unreliable guide. ZBA shifts the burden of proof: why should we fund this, and what would break if we did not? When practiced with discipline, ZBA becomes less about cutting costs and more about reallocating resources, the capital allocator’s equivalent of a factory reset.

The Case for First Principles Budgeting

Budgeting is often mistaken for a clerical exercise connecting last year to the next with minor adjustments for inflation or growth. A typical budget review involves department heads arriving with spreadsheets pre-populated with last year’s numbers, nudging them based on sentiment rather than scrutiny. The ritual is comfortable, familiar, and dangerously misleading.

Zero-Based Budgeting requires every line item to earn its keep irrespective of historical precedent. This is not merely a budgeting technique but a rethinking apparatus. Having managed financial planning while implementing systems and reducing monthly burn from $800K to $200K through disciplined resource allocation, I have witnessed how every dollar spent must be justified anew as if the enterprise were starting from scratch.

Consider a multinational consumer goods firm that used a plus-five-percent heuristic for decades. In expansion years, this led to overbuilt bureaucracies. In lean years, it delivered nominal cuts preserving inefficiency. Eventually, board mandate drove transformation. Functions were compelled to submit budgets from zero base, defending each activity against strategic objectives. Redundant roles were consolidated, pet projects euthanized, and technology spends recalibrated. The finance team noted nearly 18 percent of overhead was duplicative or value-neutral. More importantly, the shift reactivated institutional introspection.

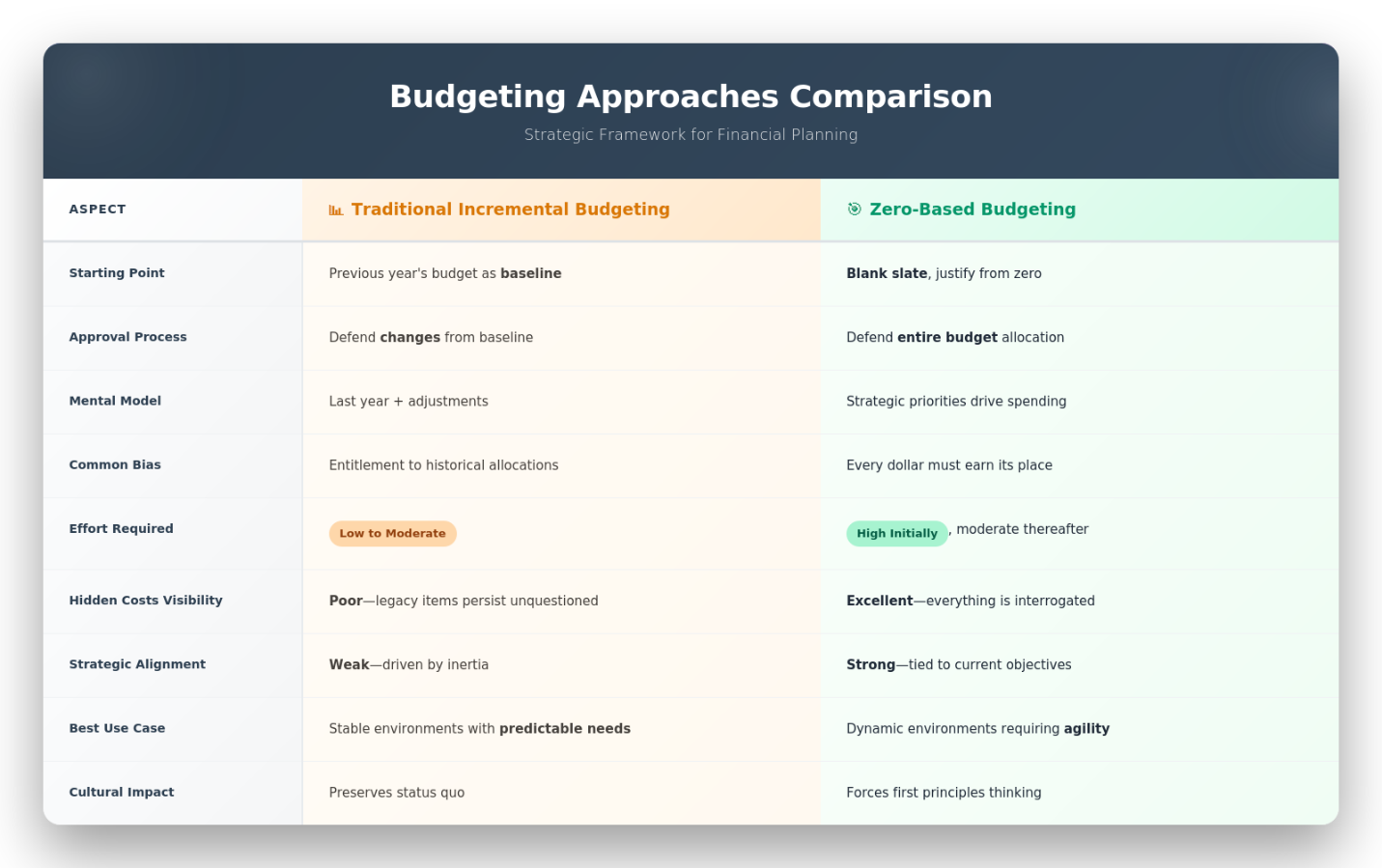

Traditional vs. Zero-Based Budgeting

The Cultural Transformation

The deeper implication is cultural. Incrementalism, while seductive, assumes stasis. It presupposes that yesterday’s solutions are a fit for tomorrow’s problems. But the modern enterprise operates in a world of discontinuities where geopolitical tension, technological disruption, and demographic inversion render the past an unreliable guide. ZBA offers not just a new method but a new mindset. It shifts the burden of proof from the critic to the claimant: why should we fund this, and what would break if we did not?

That is not to say ZBA is without pitfalls. It can veer into paralysis if not managed judiciously. The burden of proving every cost from scratch can sap time and morale if done indiscriminately. What distinguishes success from failure is not the austerity of the method but the clarity of its implementation. When practiced with discipline and a clear strategic north star, ZBA becomes less about cutting costs and more about reallocating resources. It is, in essence, the capital allocator’s equivalent of a factory reset.

Operationalizing ZBA: A Practical Framework

A mid-sized software services firm grappling with margin compression embarked on a ZBA exercise. Historically, budgeting resembled autopilot: each department received a baseline tied to previous year with adjustments for headcount and technology. When ZBA was introduced, leadership framed it as fiduciary discipline. Each unit built budgets from ground up, aligning requests to strategic goals.

Marketing discovered nearly 40 percent of digital spend generated negligible conversion rates, while customer referral programs yielded 3x the ROI. Spend flowed from vanity campaigns toward performance-tied initiatives. IT revealed legacy software licenses receiving funding despite 5 percent utilization. The $4 million in redundant licensing redirected toward cloud modernization improved developer productivity by 12 percent. HR questioned training assumptions, piloting in-house peer-led modules that reduced costs by 60 percent while increasing satisfaction scores.

ZBA forced a shift from entitlement to accountability. Departments viewed themselves as investments competing for capital. The CFO positioned this as shared re-justification. Weekly working sessions replaced budget defense meetings. Assumptions were interrogated, not attacked. The emphasis was getting it right.

Employees were told ZBA was rebasing, not haircut. Rather than start with what they had and subtract, they started with needs and built upward. This surfaced innovation: automation initiatives with twelve-month paybacks became investable under ZBA though unaffordable under the old model.

Critical Success Factors

ZBA requires strong data hygiene, clarity of strategic intent, and executive patience. The first cycle is most painful, upending years of accretive budgeting. But like pruning, initial discomfort is followed by healthier growth. The real win is not just dollars saved but intellectual discipline restored. When I managed zero-based budgeting exercises reducing operational expenses by 18 percent without impacting revenue capabilities, the transformation was cultural, creating permanent shift toward evidence-based resource allocation.

Key implementation principles: Frame ZBA as strategic realignment, not austerity. Establish clear strategic objectives first. Provide robust data infrastructure for evidence-based budgets. Use phased rollout starting with non-customer-facing functions. Create working sessions, not defense meetings. Reward innovation and efficiency. Plan for multi-cycle implementation where subsequent cycles become progressively more efficient.

In times of exuberance, ZBA may seem austere. But its value lies in counter-cyclical stabilization. When downturns come, organizations that institutionalized ZBA are not scrambling for arbitrary cuts. They have a map of what matters. They know where fat and muscle lie.

Conclusion

Zero-Based Budgeting represents a fundamental shift from incremental thinking to first principles resource allocation. When implemented with clear strategic direction, it transforms budgeting from ceremonial exercise into strategic capability. Organizations that master ZBA continuously realign resources to strategic priorities, building organizational muscle for evidence-based decision-making. In an era of discontinuous change, the discipline of justifying every dollar anew is not austerity but wisdom, ensuring capital flows to its highest and best use rather than to the loudest voice or longest tenure.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.