Executive Summary

The hardest call a CFO makes is not when to cut costs. It is when to raise capital. Because timing a raise is not a math problem. It is a narrative problem. It asks whether the story the company tells aligns with the appetite of the market, the conviction of the board, and the rhythm of the business. Throughout my twenty-five years leading finance across cybersecurity, SaaS, manufacturing, logistics, and gaming, I have learned that too early and you sell your future at a discount, too late and you sell your credibility. The difference is often measured not in quarters but in days. Cash does not run out overnight. It erodes. Slowly at first, then fast. But erosion is deceptive. A company can feel financially strong while structurally fragile. This is especially true in growth companies where headline revenue masks burn rate. The mistake many CFOs make is equating runway with time. But runway is not time. It is options. And once options narrow, leverage disappears.

The Strategic Imperative: Raise Before Need Becomes Visible

The most strategic CFOs understand this fundamental truth: they do not raise when they need to, they raise before the need can be seen. This is not about conservative forecasting. It is about understanding market psychology. Investors do not fund survival. They fund growth. And growth requires clarity, not desperation.

That clarity begins with capital mapping. Not just how much money the company needs but what each raise must accomplish. Is this round to scale a product, enter a market, reach breakeven, or position for mergers and acquisitions? Each answer changes the narrative. Each answer determines the investor profile. Timing becomes the function of milestones, not of months.

Capital Mapping Framework

To map capital properly, CFOs must model not only financials but inflection points. What happens if sales cycles lengthen? What if CAC increases 10 percent? What if churn rises? These are not tail risks. They are realistic perturbations that test the integrity of the plan. The goal is not to build a scenario where you survive. It is to build one where you can still choose.

When I secured $40 million in Series B funding and an $8 million credit line at a nonprofit organization, we built comprehensive capital planning models that mapped every dollar to specific milestones: program expansion into three new markets, technology platform rebuild, leadership team buildout, and working capital reserves. We modeled three scenarios with different growth rates and burn assumptions, showing the board that even in the conservative case we maintained 18 months of runway post-raise with clear path to sustainability. This scenario discipline enabled us to raise from a position of strength rather than necessity.

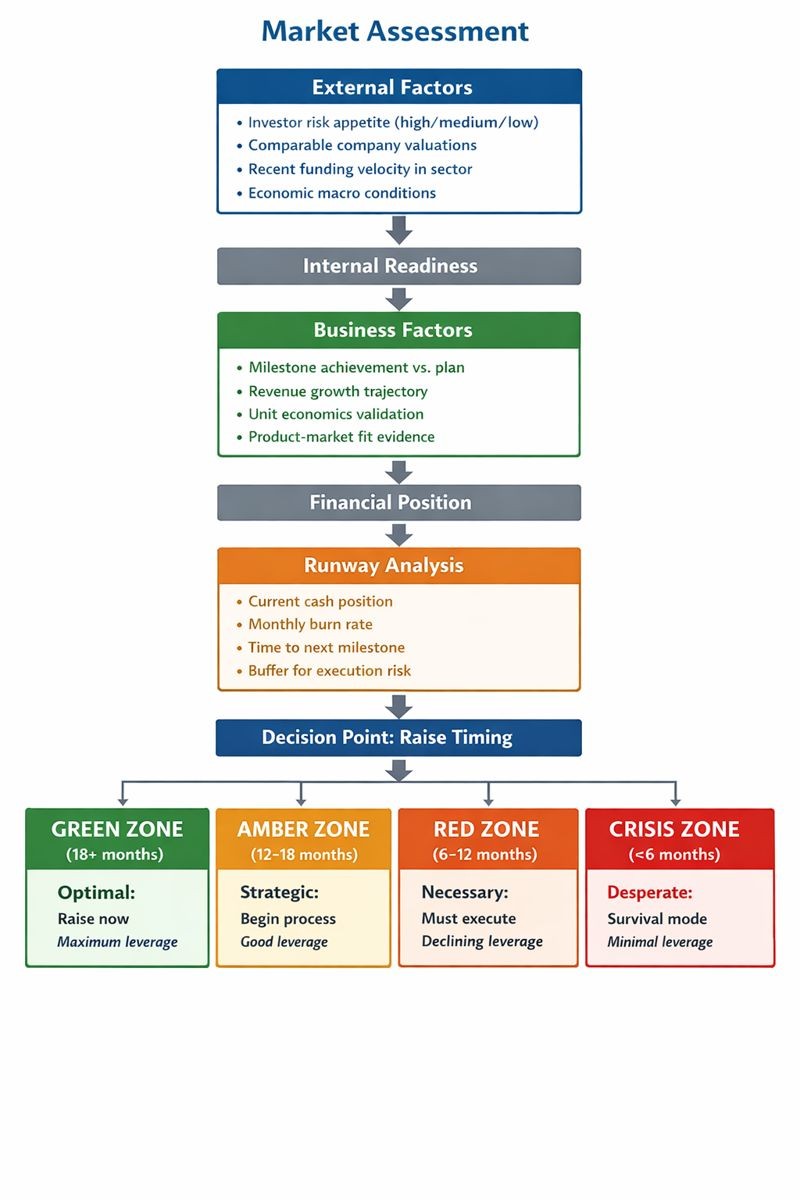

Capital Raise Timing Decision Framework

This framework illustrates the capital raise timing decision process. External market assessment examines investor appetite and sector conditions. Internal readiness evaluates business milestone achievement and financial position. The runway analysis determines timing zones: Green Zone (18+ months) offers optimal timing with maximum leverage, Amber Zone (12-18 months) provides strategic timing with good leverage, Red Zone (6-12 months) signals necessary timing with declining leverage, and Crisis Zone (under 6 months) forces desperate survival mode with minimal leverage. The best CFOs raise in the Green Zone before need becomes visible.

Market Windows and External Timing Factors

Market windows matter. Capital is not a constant. Markets swing open and shut with little warning. Valuations expand and compress. Risk appetite flares and fades. Smart CFOs track this pulse. They maintain relationships with investors long before they raise. They monitor comps, analyze recent rounds, and decode term sheet shifts. Because when the window opens, readiness is not optional.

But internal alignment is just as critical. Boards often want maximum valuation. Founders want minimal dilution. Neither instinct aligns with timing discipline. The CFO must arbitrate this tension. With data. With history. With patience. Sometimes the best raise is the one done quietly, at a discount to peak but at a premium to the next. That requires courage. And it requires board education.

The discipline extends to communication. A premature raise framed as strategic expansion is credible. A last-minute raise framed as bridge is not. Investors read tone as much as terms. If the story feels reactive, they question execution. If it feels opportunistic, they lean in. Timing shapes tone. Tone shapes trust.

Structure Is Substance: Beyond the Amount

The moment a CFO decides to raise capital, the question shifts from when to how. Because in capital strategy, structure is substance. The terms of the deal speak louder than the amount. And while timing buys leverage, structure determines outcome. It defines who sits at the table, who holds the pen, and who sets the next horizon.

Valuation and Instrument Selection

Valuation is where most CFOs start. It is also where many go astray. Chasing the highest number often means accepting the harshest terms including participating preferred, ratchets, and oversized anti-dilution. Terms that win headlines but steal control. Smart CFOs know valuation is a function of alignment. A great valuation with misaligned investors leads to conflict. A disciplined valuation with strategic capital leads to velocity.

Valuation must reflect not just market comps but milestone traction. Investors fund trajectory, not potential. If a company has product-market fit, they price it. If it has repeatable sales motion, they reward it. If it is still hypothesis-driven, they hedge. The CFO’s job is to build a story that converts metrics into momentum. That story must be defensible in diligence with cohort data, churn analysis, cost curves, and roadmap clarity.

Then comes the instrument. Equity is the default but not always the answer. Convertibles, SAFEs, venture debt, each carries implications. Convertibles delay valuation but concentrate risk later. Debt preserves ownership but amplifies pressure. SAFEs simplify structure but complicate cap tables. The right instrument matches stage with risk appetite and ambition with discipline.

Investor Mix and Syndicate Strategy

The investor mix is equally strategic. Capital is not neutral. It brings perspective, preference, and pace. Some investors support product cycles. Others drive sales expansion. Some bring brand. Others bring governance muscle. The CFO must curate this mix. Syndicate strategy is not who is available. It is who aligns. Who complements. Who sustains.

This is where board alignment becomes vital. Founders often resist dilution. Boards often over-index on valuation. The CFO must translate structure into strategic language. A clean deal at $150 million is often better than a hair-trigger $200 million that triggers downside scenarios. The best CFOs show dilution paths under multiple futures including exit at 5x, 10x, and 20x. They model dilution not as loss but as leverage.

Execution Excellence: From Preparation to Close

Raising capital is not a PowerPoint event. It is a full-contact execution sprint. By the time a CFO gets to pitch mode, the deal is already 70 percent decided in the minds of the investors, in the trajectory of the company, and in the story shaped by the preparation. Execution is the test not of strategy but of discipline. And in markets that move with velocity, discipline is the only edge that holds.

When I managed capital raises at organizations preparing for growth funding, we maintained investor-ready data rooms continuously, not just when actively fundraising. This included monthly updated financial packages with variance commentary, quarterly cohort analyses showing retention and expansion patterns, and rolling 409A valuations. When market windows opened unexpectedly, we could engage investors within days rather than weeks, preserving momentum and maximizing leverage.

The Negotiation Process

The negotiation itself is choreography. It is not adversarial. It is a test of readiness. Investors ask the same questions: How defensible is your moat? How efficient is your growth? How disciplined is your roadmap? But how the CFO answers reveals tone. Confidence without arrogance. Flexibility without weakness. Conviction without denial. These cues shape terms as much as metrics do.

Diligence is a mirror. The company that prepares well signals excellence. That means data rooms are current. KPIs are consistent. Legal is tight. Metrics align with narrative. Surprises are contextualized, not hidden. The CFO must own the process. They are not a passenger. They are the driver. The tempo, the flow, the response cadence all shape investor belief.

Post-Raise Integration: When Capital Becomes Capability

A capital raise is not the finish line. It is the starting bell of the next stage. The moment the funds hit the balance sheet, expectations change. Stakeholders ask what you will do, when you will do it, and how you will prove it worked. Capital invites scrutiny. And that scrutiny becomes the proving ground for CFOs who intend not just to finance growth but to govern it.

Intentional Capital Deployment

The first principle after a raise is intentionality. Money is not strategy. It is fuel. And unless it is tied to specific outcomes, it evaporates into operational haze. CFOs must anchor the use of funds to measurable initiatives including headcount expansion, market entry, product acceleration, or infrastructure fortification. These priorities must be visible, time-boxed, and owned.

Capital allocation must now operate with surgical focus. Growth for its own sake tempts many post-raise companies. Burn increases. Margins narrow. Discipline fades. But capital is not an excuse to loosen standards. It is the opportunity to upgrade them. The CFO must install financial rigor that scales with ambition including departmental budgets, milestone-based disbursements, and variance tracking.

Continuous Stakeholder Communication

Communication becomes more critical than ever. Investors who just participated in a raise expect updates, not spin. The CFO must own the investor narrative, not just quarterly but continuously. This includes formal reporting but also informal signaling through emails, analyst calls, and executive access. The message is not just what was achieved but what was learned. Investors want transparency, not perfection.

This discipline extends to internal stakeholders. Teams need to see the connection between the capital raised and the mission ahead. Compensation plans, hiring strategy, and system upgrades all must align with the use-of-proceeds story. Morale is buoyed by clarity. The CFO must be present, not just in boardrooms but in team meetings, explaining how strategy and capital now walk in lockstep.

Strategic Patience and Anti-Dilution Mindset

One of the most overlooked dimensions post-raise is strategic patience. Not everything must accelerate. The temptation to overspend, overhire, and overpromise is high, especially when valuation has set the expectation of hypergrowth. But timing remains critical. Capital must be metered to ambition. CFOs must act as friction against overreach. Sometimes the best use of capital is to wait, to test, to pilot, to refine before scaling.

Anti-dilution is not just a term sheet clause. It is a mindset. Every post-raise decision must protect against unnecessary equity leakage in the next round. That means hitting KPIs that raise valuation. That means defending margin. That means showing operating leverage. CFOs who treat capital as leverage, not lifeline, prevent dilution by earning better terms next time.

My certifications as a CPA, CMA, and CIA provide technical foundation for capital structure and financial planning. But what separates effective capital raise execution from transactional fundraising is not financial modeling sophistication alone. It is the strategic judgment to raise before need becomes visible, the discipline to structure deals for alignment rather than headlines, the execution rigor to prepare continuously rather than reactively, and the stewardship mindset to deploy capital intentionally while preserving optionality for the next stage.

Conclusion

Raising money is not the hardest part. Using it wisely is. And the CFO who masters that task does more than finance a company. They make it durable. In capital strategy, timing buys leverage, structure determines outcome, execution builds credibility, and stewardship compounds value. The CFOs who understand this do not just survive capital markets. They shape them.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.