Executive Summary

Every board faces an inflection point: the moment when renewal becomes not only advisable but essential. Boards mature, strategies evolve, and external landscapes shift. What once was an advantage including long-standing knowledge, industry tenure, and institutional memory can calcify into inertia. Throughout my twenty-five years leading finance across cybersecurity, SaaS, manufacturing, logistics, and gaming, I have learned that the hardest work in governance is not building the board but refreshing it: with discernment, fairness, and resilience. It is where strategy meets people. Board renewal requires both hard discipline and soft touch. Recruitment brings rigor: creating purpose-driven role descriptions, defining capability gaps, and executing a search process that balances immediate need with long-term vision. Retirement demands courage: recognizing when service diminishes value, managing transitions with respect, and communicating change in ways that preserve relationships and reputation. Both are acts of stewardship.

The Duality of Recruitment and Retirement

The duality of recruitment and retirement raises questions of posture. How do boards ensure they do not pine for pristine balance sheets at the cost of fresh insight? How do they avoid tokenism or reputation-based renewal? How do they tell a long-serving director they have done their time without diminishing their contribution? These are not just procedural questions. They are cultural and strategic.

Recruitment: Purpose-Driven Board Building

Begin with Clarity of Purpose

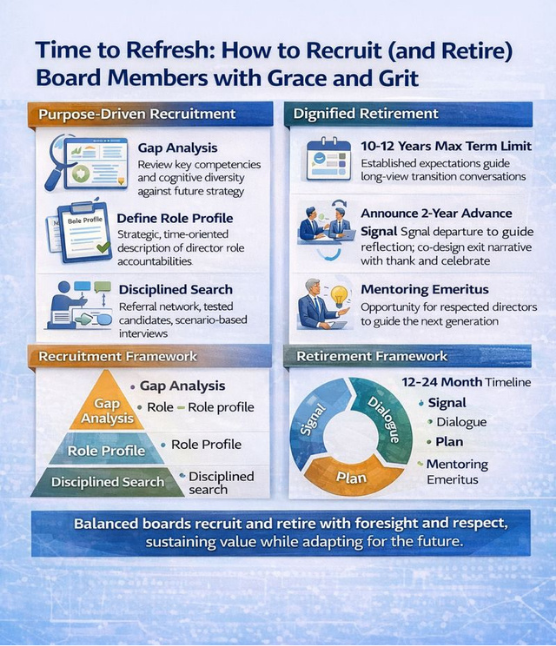

Recruitment begins with clarity of purpose. Renewal should never be reactive. It should arise from an explicit assessment of board composition against future strategy. What capabilities will drive the next stage? Is digital fluency more critical than domain experience? Is sustainability expertise now mission-critical? These questions must drive the role profile including its accountabilities, time horizon, and influence.

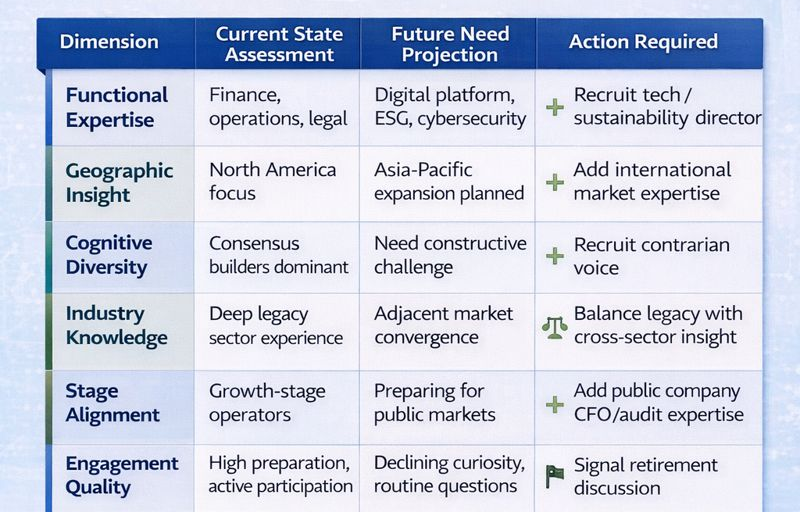

Boards that recruit well conduct a robust gap analysis. They diagnose not only skill sets but also cognitive diversity: operational leaders versus financial strategists, local experts versus global connectors, contrarians versus integrators. The strongest profiles emerge from real debate: where performance ambitions meet pressurized realities. And then the role is written not as a ceremonial seat but as a strategic lever.

When I led board reporting at a gaming enterprise where I oversaw $100 million in acquisitions and post-merger integration, we conducted a board composition review that identified gaps in digital platform expertise and international market experience. Rather than recruiting based on credentials alone, we created role profiles that specified the strategic questions new directors needed to ask: how do we monetize cross-platform engagement, what regulatory risks exist in our target Asian markets, how should we structure partnerships versus acquisitions. This purpose-driven approach resulted in board members who immediately contributed to strategic decisions rather than requiring years to find their voice.

Execute Disciplined Search

Next comes the search. Boards that distinguish purpose from perfunctory deploy disciplined search processes. They seek referrals, engage peer networks, and consider both traditional and non-traditional sources. They interview with intensity. They test candidates on judgment, resilience, and alignment. They do not limit energy to the nomination committee. Key directors join not for ceremony but for probe.

The most effective boards ask scenario-based questions: you are on a board and the CEO proposes a transformational deal, the CFO hesitates, how do you proceed? Or you have just joined a board with misaligned culture and underwhelming metrics, what is your first move? Responses are analyzed not for polish but for thinking. Boards want directors who act with clarity and humility under pressure.

Successful recruitment signals courage. It says not only you are welcome but we believe this adds value. It also sends an external message to investors, employees, and clients that renewal is not chaos but intention. It is a posture of stewardship.

Board Renewal Matrix Framework

Retirement: Managing Transitions with Dignity

Establish Ruled Tenure

Graceful retirement starts with ruled tenure. The board must be clear: tenure is not an entitlement. It reflects stewardship. The best succession plans include ambitious and earnest turnover, enough to renew perspective but not so much as to lose memory. Tenure policies such as 10 or 12 year maximum or rolling term limits work when applied thoughtfully.

Even with limits in place, sunsets require management. The decision should be prompted by board evaluation, not breach. Directors know the rule. They do not need surprise. Invite conversations early: two years in advance, suggest renewal mindset; one year in advance, explore stepping into a mentoring or emeritus role. By the time the tenure expires, they leave with agency and dignity, not forced disembarkation.

Three-Phase Transition Model

The strongest boards deploy a three-phase transition model:

Signal: The board renewal matrix reveals potential rotation, and the chair discusses future expectations. This happens 18 to 24 months before anticipated departure.

Dialogue: The director is invited to reflect and, if appropriate, co-design their exit narrative. This includes discussing timing, public messaging, and potential advisory roles.

Plan: Public recognition, role reallocation, and formal succession are coordinated. Retirement should feel earned, not enforced. Directors who leave at the right time should be thanked publicly and personally.

Communication with Care

Retirement is also timing. Boards should avoid bunching departures. Rotating too many seats in a single year strains orientation, committee focus, and collective rhythm. Adopting rolling refresh schedules cultivates both continuity and innovation.

Finally, communication must be constructed with care. Those retiring should be publicly acknowledged: celebrated for their service, recognized for their contribution, and encouraged to stay as informal advisors. Investors should hear a narrative of renewal, not disorder. Internal teams should understand the context, not fear succession as signal of weakness. And new directors should be positioned as adding value, not substituting displaced contributors.

Structural Tools for Continuous Renewal

Great boards do not wait for dysfunction to initiate renewal. They build refreshment into the operating model. Several structural tools enable this:

Board Renewal Matrix: Strategic capability map that outlines each director’s core contributions and aligns against future needs. Updated annually with board evaluation feedback.

Profile Storyboard: Narrative framework for each anticipated vacancy that defines the value proposition of the next director: what voice is missing, what judgment is needed, what questions must be asked.

Annual Self-Evaluation: Director-by-director feedback that assesses influence, value add, and curiosity, not just attendance or civility. Over time, evaluation becomes the primary signal of readiness.

Immersive Orientation: New directors paired with board mentors, scheduled for deep dives with operating executives, assigned onboarding themes. Orientation is a campaign, not an introduction.

Consider the case of a global retail board that faced strategy shift toward digital and ESG-led transformation. They used their renewal matrix to identify three underweighted dimensions: digital product fluency, emerging markets, and sustainability-linked capital metrics. Three directors were within two years of maximum tenure. The chair met each one individually, discussed the strategic evolution, and offered options. All three agreed. New profiles were created, candidate pipelines curated, and by the next annual meeting, the board was transformed deliberately, respectfully, and strategically.

My certifications as a CPA, CMA, and CIA emphasize governance and organizational effectiveness. But what separates boards that renew gracefully from those that fracture during transitions is not policy compliance. It is the courage to initiate difficult conversations early, the discipline to tie renewal to strategy rather than convenience, and the humanity to honor service while recognizing when fresh perspective will better serve the enterprise.

Conclusion

Recruitment and retirement are not opposite acts. They are part of the same discipline: sustaining board value over time. Great boards do this with grace, treating people with dignity, honoring legacy, and ensuring exits do not leave wounds. And they do it with grit, confronting underperformance, resisting the comfort of familiarity, and facing the realities of competitive pace. The board’s job is not to stay together. It is to stay relevant. That requires renewal. Done with intent. Done with care. Done without drama. That is the standard.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.