Executive Summary

There comes a moment in the life of a business when survival hinges on a decision hidden behind a spreadsheet: whether to seek rescue funding. It is one of those inflection points that arrives in a whisper, a delayed payment, a tightening credit line, a pause in sentiment. Leadership then must ask not merely whether it can raise capital but whether it should. For this is not just a financial decision but a question of identity and resilience. Every bridge built reshapes the bridge-builder, alters both autonomy and narrative. A bridge loan by definition is intended to carry an enterprise from one state to the next, perhaps past a seasonal revenue trough or to the point of refinancing. But without clarity it becomes a bridge to nowhere. Throughout thirty years managing growth capital raises and treasury operations, I have witnessed how bridge funding decisions reveal more about organizational character and strategic discipline than the capital itself.

The Nature of Bridge Capital

A bridge loan is temporary financing intended to carry an enterprise from one state to the next. A bridge with no defined shore simply delays reckoning, allowing the same structural problems to gather increased momentum. When funds arrive without purpose, they create a fog rather than illumination.

At organizations where I managed treasury operations and working capital optimization, we learned that rescue funding without structural reform merely postpones inevitable decisions rather than enabling sustainable recovery.

Strategic Framework for Bridge Loan Decisions

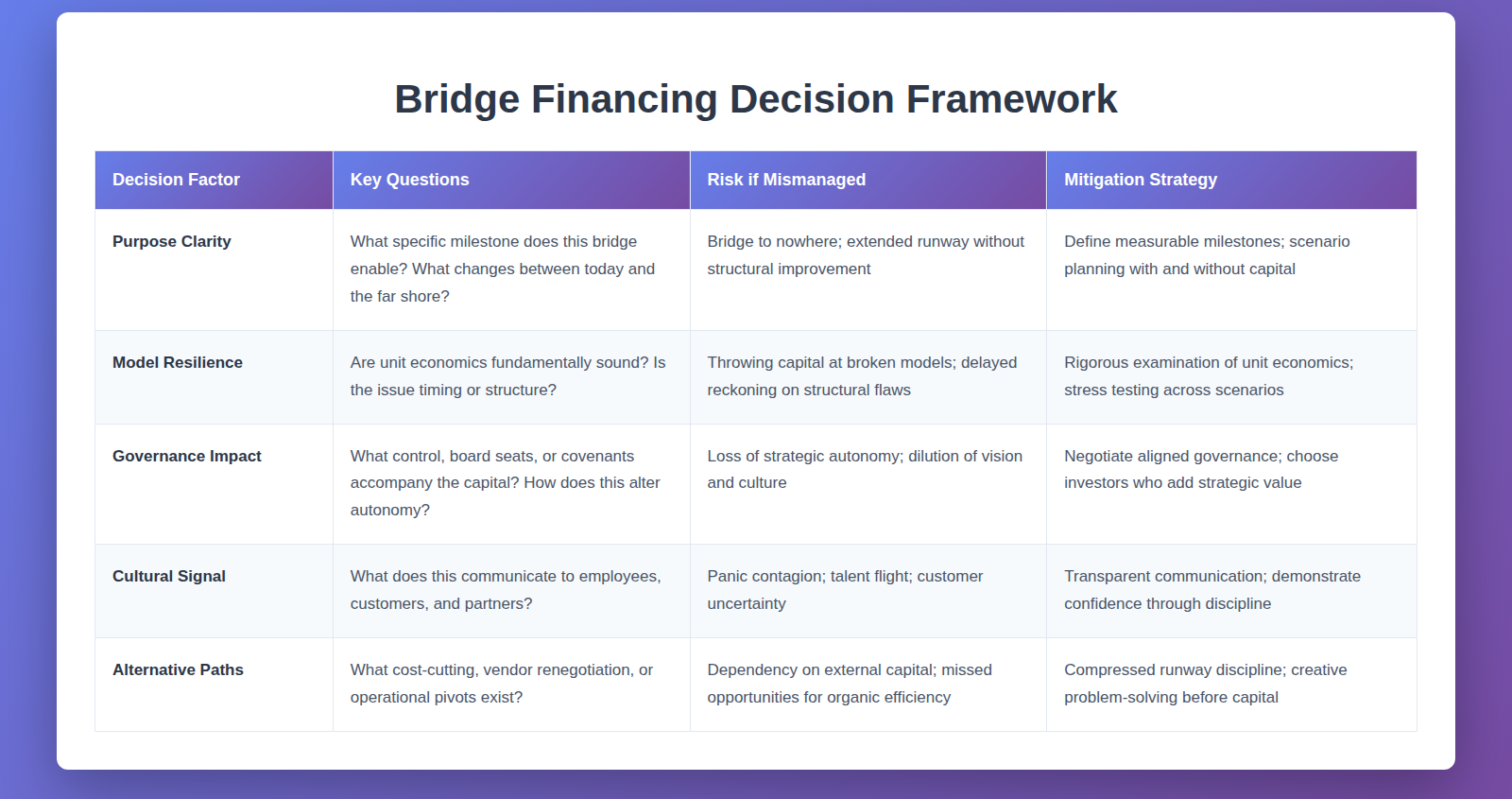

The following framework outlines key considerations when evaluating bridge financing:

Covenants and Constraints as Navigational Aids

Covenant terms are not punitive clauses but navigational aids. Without them, rescue funding becomes unmoored. The covenant serves as ballast and rudder, guiding purpose and incentives with boundary.

At a digital marketing organization that scaled from nine million to one hundred eighty million in revenue, we structured covenants that aligned investor interests with operational milestones rather than creating adversarial oversight.

Autonomy and Identity

Accepting rescue capital is not an administrative footnote but a foundational choice. It changes the boardroom dynamics, reassigns power, and can subtly shift culture. Autonomy is the engine of purpose. I have seen firms choose discipline over dilution, electing to tighten costs and negotiate rather than dilute shares or board influence. They preserved identity and agency and retained narrative coherence.

Model Strength Over Momentum

Rescue capital must follow a rigorous examination of model resilience. In fintech and payments, user acquisition often hides deeper unit-economics issues. More cash may extend runway but cannot alter fundamental structural flaws.

At a gaming enterprise where I led global financial planning, we consistently evaluated whether growth initiatives improved unit economics or merely masked underlying structural challenges.

Governance as a Catalyst

When rescue funding brings not only money but insight, accountability, and industry connections, it becomes transformational. Investors from regulatory and infrastructure sectors can open doors, legitimize startups, and align with existing governance, creating value beyond the capital itself.

Psychology and Morale

Funding decisions signal tone to teams. Chase capital hastily, and panic spreads. Choose restraint, and you project confidence and autonomy.

Key signaling considerations:

- Transparent communication about the decision process demonstrates leadership confidence

- Restraint in capital pursuit encourages creative problem-solving and internal innovation

- Disciplined capital allocation reinforces cultural values around efficiency and accountability

The Discipline of Compressed Runway

Declining rescue capital demands small-scale pivoting: freezing headcount, pushing for client renewals, tightening cash flow, and streamlining operations.

At a professional services organization where I reduced month-end close from seventeen days to under six days, we demonstrated that operational discipline often unlocks hidden runway without external capital.

Scenario Planning as Decision Foundation

Case Study: Fintech Payment Platform Turnaround

An unbranded fintech payment processor had built its initial revenues by subsidizing merchants. Growth soared, but margins and cash flow crumbled. A bridge capital offer would have extended runway three times, but leadership did not see this as salvation.

They conducted stress tests revealing that growth without profitability would burn through cash in sixty days. The bridge would create a one hundred eighty-day runway but would not fix margins.

The team chose constraint-driven change over capital reliance. Within four months they stabilized gross margins and eventually closed a conventional investment round at significantly better terms without dilution or external control.

Case Study: Regulatory Technology Platform

A mid-sized regulatory technology platform encountered delays in its software integration across regional banks. An investor offered a modest bridge loan with a convertible note and a board seat.

The team conducted a rapid forty-eight-hour scenario analysis comparing execution timelines and client onboarding markers. The analysis revealed that funding would smooth the path and support strategic retail bank launches.

They structured milestones for deployment and appointed an ex-compliance officer to the board. The injection provided six months of runway and instilled confidence in clients. When integration was successful, the company closed a full financing round on favorable terms.

Strategic Choice as Character Revelation

Rescue funding decisions reveal character. Pursue it with purpose and execution becomes sharper. Decline it with discipline and creativity becomes currency. Walk across the bridge with intent and future capital arrives as support rather than distraction.

The alternative is building a bridge with no plan or crossing with dead capital. That is no bridge at all but an illusion.

Conclusion

A bridge loan is a tool, not a cure, not a statement of failure, but a choice in strategy and identity. When wielded with clarity, oversight, aligned purpose, and preserved autonomy, it can create upward trajectory. When accepted without discipline or plan, it becomes a costly illusion. Thoughtful bridge builders emerge not only solvent but stronger. Those who chase capital to delay hard conversations often find themselves adrift when the lights flicker again. Capital may buy time, but character builds endurance.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.