Executive Summary

In the early days of any company, simplicity is a given. There are few customers, a small team, and a singular mission. Everyone knows what is being built, who it is for, and why it matters. But as growth accelerates, especially the kind of heady, investor-fueled growth celebrated in pitch decks and boardrooms, something more insidious begins to creep in: complexity. Having scaled organizations from nine million to one hundred eighty million dollars in revenue across sectors from software as a service to logistics to professional services, I witnessed how complexity that looks like sophistication, more stock-keeping units, more markets, more teams, more tools, can morph into high-friction when it outpaces the company’s ability to make sense of it. If coherence does not scale alongside ambition, what was once high-performance becomes organizational entropy. This article explores how complexity without coherence silently kills execution in high-growth companies and what leaders must do to build clarity at scale.

What Is Complexity Without Coherence?

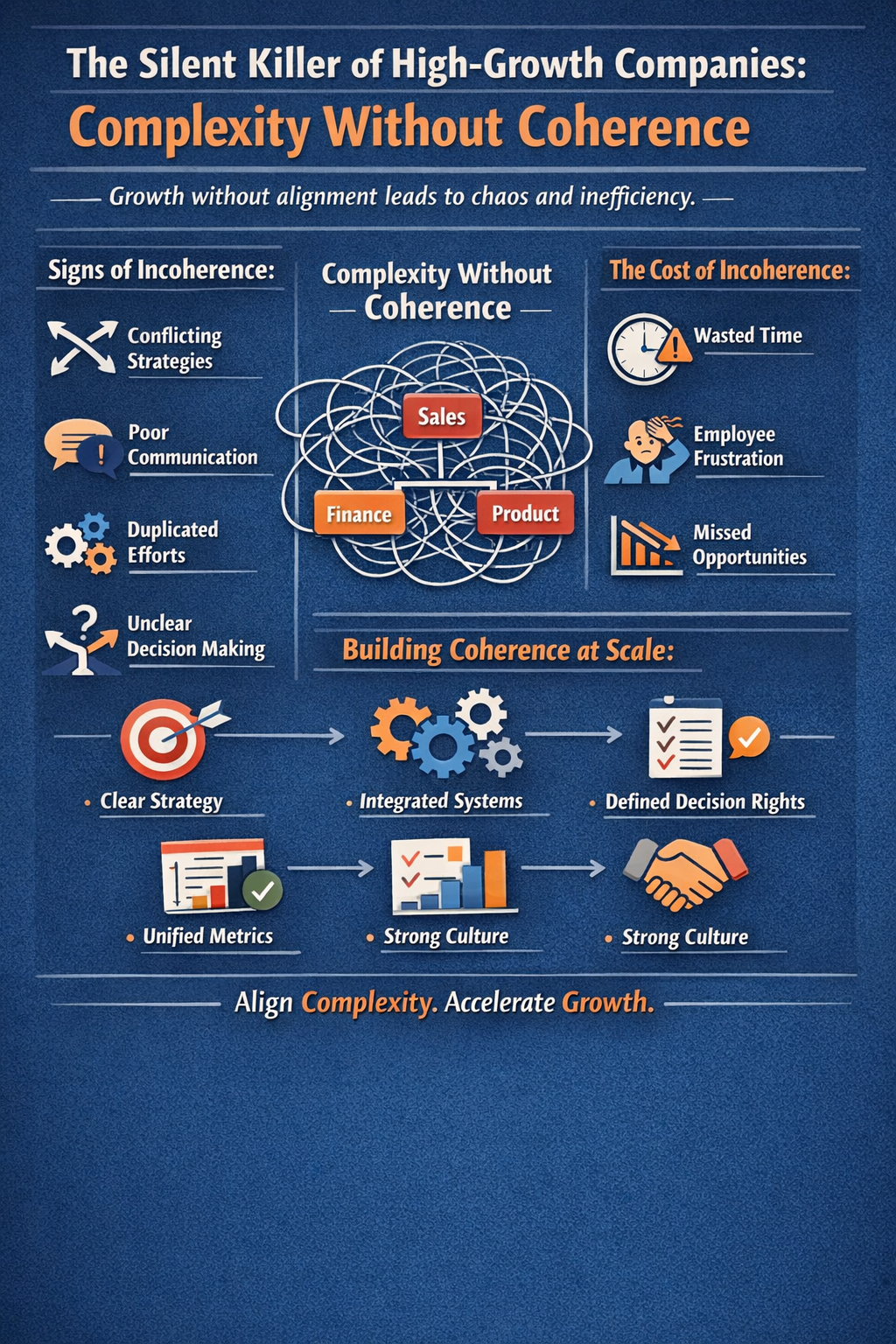

Complexity is inevitable in a growing organization. It is not the enemy. But it must be matched by a proportional increase in coherence, the shared understanding of what matters, how things work, and why decisions are made. Coherence is the connective tissue between moving parts. When complexity outpaces coherence, departments solve the same problem in parallel, unaware of each other. Metrics conflict across functions, with sales optimizing for growth, finance for margin, and product for engagement. Systems require duplicative inputs or manual workarounds. Strategy documents contradict each other or go unread. Talent is hired faster than it can be aligned.

This is not a failure of ambition. It is a failure of integration. My certifications spanning accounting, management accounting, internal audit, production and inventory management, and project management provide the multidisciplinary perspective to recognize when organizational complexity exceeds governance capacity. The warning signs appear long before the crisis.

The False Comfort of Growth

The danger is that high growth can mask internal incoherence. As long as the top line is climbing, the business appears healthy. Teams are forgiven for stepping on each other’s toes. Customers tolerate friction. Margins can absorb inefficiency. But this illusion is fragile. When the market turns, competition intensifies, or capital becomes scarce, the cost of incoherence becomes visible. That is when companies realize they are not scaling. They are unraveling.

During my time leading finance for organizations that experienced rapid growth, including a digital marketing firm that scaled from nine million to one hundred eighty million dollars in revenue, I witnessed how initial success can obscure fundamental operational weaknesses. The revenue growth masked inefficient processes, duplicated efforts, and unclear accountability. When growth slowed, these structural issues became existential threats.

Signs of Incoherence

Most leaders do not notice incoherence until it is systemic. But there are early signals. Communication volume rises while clarity drops, with endless threads and unclear ownership. Different departments articulate the company’s strategy in different ways, or worse, not at all. Too many projects proliferate without clear prioritization, leaving everyone busy but nothing moving the needle. Multiple tools do similar jobs with no integration, forcing teams to copy and paste data across platforms just to stay in sync. Decision ambiguity creates situations where it is unclear who makes the call, or decisions get made then reversed. Early values get diluted as new hires onboard into silos while legacy employees feel disconnected.

These are not growing pains. They are growing threats. Having implemented enterprise resource planning systems including NetSuite and Oracle Financials, business intelligence platforms including MicroStrategy and Domo, and operational analytics tools across multiple organizations, I learned that technology fragmentation is both symptom and cause of organizational incoherence. When systems do not talk to each other, neither do teams.

The Cost of Incoherence

The direct costs of incoherence are measurable: duplicate spend, slow execution, conflicting key performance indicators. But the indirect costs are more pernicious. Employees waste cognitive energy navigating ambiguity rather than solving problems. Leadership spends time aligning internally instead of competing externally. High performers leave not because of pace but because of pointless friction. The organization cannot move fast on the right things because it is busy reacting to the wrong ones.

In high-growth companies, time is your scarcest asset. Incoherence wastes it. When I improved month-end close from seventeen days to under six days through process redesign and system automation, the breakthrough came from eliminating incoherence in data flows, reconciliation procedures, and approval workflows. The time savings translated directly into better decision velocity.

Building Coherence at Scale

How do you build coherence alongside complexity? Not through micromanagement or rigid hierarchy. Coherence is not control. It is clarity. It arises from design, discipline, and deliberate communication. First, anchor everything in strategy. Strategy should be more than a slide. It should be the lens through which all priorities are evaluated, with clear articulation of company objectives, alignment between functional goals and company goals, and a shared vocabulary for discussing trade-offs.

Second, codify decision rights. As teams grow, unclear ownership kills momentum. Use frameworks to clarify who decides, who contributes, and who executes. Make these explicit, not implicit. Third, invest in systems integration. A fragmented technology stack breeds operational incoherence. Prioritize tools that talk to each other, centralize core data, and standardize workflows where possible.

Fourth, simplify metrics. Avoid dashboard bloat. Define a few metrics that matter across the company. Ensure they roll up cleanly and do not compete. Simplicity sharpens focus. Having designed enterprise key performance indicator frameworks that tracked bookings, utilization, backlog, annual recurring revenue, pipeline health, customer margin, and retention, I learned that fewer metrics, consistently measured and universally understood, drive better decisions than dozens of metrics that compete for attention.

Fifth, create cross-functional rituals. Regular forums help teams surface friction early. These are not just meetings. They are coherence engines. Finally, guard culture deliberately. Culture is not perks or slogans. It is how decisions are made, how conflict is handled, and how success is defined. As you scale, codify your values in behavior.

The Role of Leadership

Leaders are not just strategy-setters. They are coherence builders. Their job is to translate vision into clear direction, ensure alignment between teams, remove ambiguity from decision-making, and reinforce clarity in communication. The best leaders act as internal architects. They do not just chase growth. They shape the scaffolding that supports it.

Throughout my career building finance organizations across cybersecurity, software as a service, digital marketing, gaming, logistics, manufacturing, and education sectors, I learned that the leaders who scale successfully are those who invest as much energy in organizational coherence as in market execution. They recognize that speed without clarity creates chaos, not competitive advantage.

Conclusion

Every high-growth company will face complexity. It is the price of ambition. But coherence is a choice, a discipline of clarity in the face of chaos. Companies that scale well do not avoid complexity. They organize it. The silent killer is not how much you are doing but how little it connects. Coherence is the difference between momentum and entropy, between scaling up and falling apart.

Based on thirty years of financial leadership across diverse sectors and situations, from startups to established enterprises, I can attest that the organizations that sustain high growth are those that build coherence systems as deliberately as they build products. They standardize without stifling. They integrate without centralizing. They clarify without micromanaging. In a market that rewards speed and punishes waste, coherence is not a luxury. It is a survival strategy. And like all great strategies, it starts not with more but with better.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.