Executive Summary

In the financial architecture of a modern enterprise, few decisions bear more consequence than how revenue is contracted. The world of fixed-fee engagements is being eclipsed by shared-risk frameworks including performance-based SLAs, gain-sharing mechanisms, and penalty clauses that enable CFOs to turn contracts from rigid commitments into dynamic instruments of alignment. The move toward risk-sharing stems from realizing that in a volatile world, static pricing fails to reflect service delivery reality. Traditional contracts assume scope, inputs, and outcomes are knowable at inception, but assumptions underpinning forecasts are now routinely invalidated within months. Well-structured risk-sharing contracts balance predictability with adaptability, creating symbiotic feedback loops between client objectives and provider behavior. However, risk-sharing requires greater precision, demanding clear baselines, correct measurement of causality, and shared understanding of success through data design, scenario analytics, and economic corridors defining acceptable variation.

The Strategic Case for Risk-Sharing Frameworks

In the financial architecture of a modern enterprise, few decisions bear more consequence than how revenue is contracted. The world of fixed-fee engagements is being eclipsed by shared-risk frameworks that enable CFOs to turn contracts from rigid commitments into dynamic instruments of alignment and resilience.

Having managed finance operations and vendor relationships while overseeing procurement and performance management frameworks, I have witnessed how the move toward risk-sharing stems from realizing that static pricing arrangements fail to reflect service delivery reality. Traditional contracts assume scope, inputs, and outcomes are knowable at inception. Whether due to supply chain disruptions, labor volatility, or fluctuating demand, assumptions underpinning forecasts are routinely invalidated within months. The CFO role evolves from compliance steward to architect of economic balance.

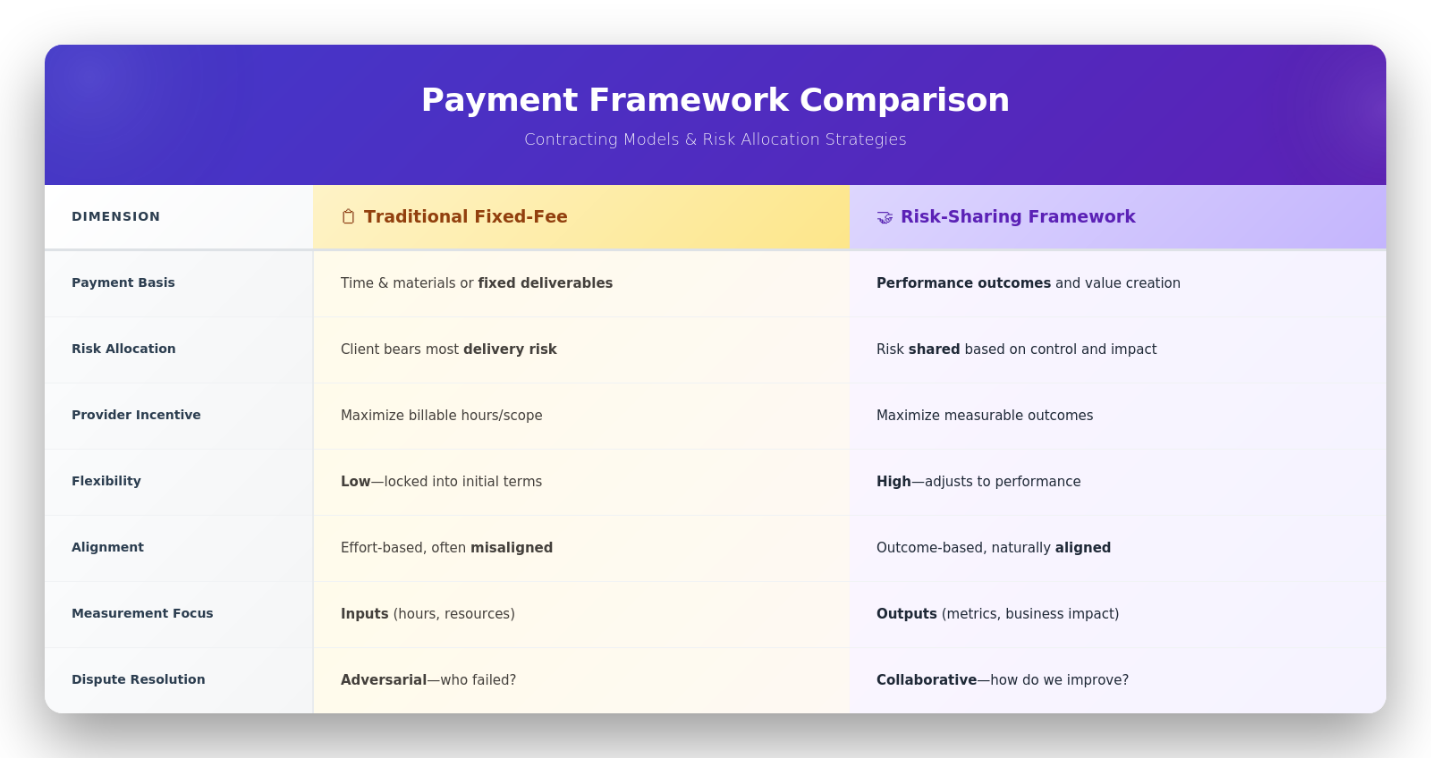

Contract Model Comparison

Performance-Based SLAs: From Cost Centers to Partners

A well-structured risk-sharing contract begins with mutual clarity on value. At their best, these are strategic instruments balancing predictability with adaptability. Performance-based SLAs pay service providers based on achievement of defined outcomes rather than delivery of inputs. When implemented well, these agreements become symbiotic, creating continuous feedback loops between client objectives and provider behavior.

A global enterprise software firm restructured professional services using tiered SLAs. Instead of paying for labor hours, clients paid based on implementation success milestones including user onboarding rates, system uptime, and satisfaction scores. Contracts included bonus incentives for early delivery and penalties for delays. What emerged catalyzed collaboration. Delivery teams worked cross-functionally to anticipate issues, customers provided clearer requirements earlier, and both sides benefited from increased speed-to-value.

Gain-sharing agreements echo this dynamic. Service providers are compensated not solely for effort but for value generated. If a logistics partner reduces freight costs below baseline, they share in savings. If a digital partner boosts ecommerce conversions, a percentage of uplift flows back to them. These models reward ingenuity and introduce powerful incentive alignment: the provider’s gain is directly tied to customer success. In an era of blurred boundaries between enterprise functions and external vendors, this alignment is essential.

The Discipline of Data and Calibration

Risk-sharing is not abdication of control. It requires CFOs to exert greater foresight and precision. Structuring effective models demands clear articulation of baselines, correct measurement of causality, and shared understanding of success. Too often, contracts conflate correlation with causation. The answer lies in better data design through dashboards tracking leading indicators, measurement models adjusting for macro-variables, and scenarios reflecting not just what happened but why.

Scenario analytics becomes indispensable. Contracts must include economic corridors, bands defining acceptable variation in cost, performance, and delivery timeframes. These corridors tie to business context. During supply chain disruption, performance SLAs could flex without triggering penalties. During stable operation, expectations could tighten. CFOs move from blunt-force penalties to calibrated accountability.

The deeper insight is philosophical. Risk-sharing frameworks move away from the false binary of control versus trust. They recognize that accountability is not about punishment but clarity. By defining success metrics upfront and embedding economic consequences responding to performance variation, CFOs foster transparent partnership. They replace hope with mechanism, creating contractual structures that are robust and adaptive.

Operationalizing Fairness: Key Implementation Principles

While theory may seem elegant, implementation is demanding. The key lies in calibration, ensuring each mechanism is anchored in fairness and practicality.

Data Fidelity as Foundation: CFOs must work with operating leaders to build a contractual truth baseline, a shared empirical understanding of how the current system performs absent intervention. Without it, gain-sharing mechanisms become arbitrary and performance SLAs can distort behavior. Every contract must be underpinned by a minimum viable data model that is granular enough to detect signal from noise but simple enough to scale.

Modular Contract Architecture: Contracts should not be monoliths but ecosystems. Different service components have different risk profiles. Fixed fees may suit commodity infrastructure while gain-sharing may suit transformation projects. By disaggregating contracts into modules, each with its own risk-reward equation, CFOs create a portfolio of contractual positions rather than a single bet, allowing dynamic renegotiation as business evolves.

Graduated Penalty Structures: The best penalty clauses are not punitive but corrective. They set clear, bounded consequences for failure triggered only after transparent failure of agreed processes. A three-tier structure allows course-correction:

- Warning tier: Performance alerts and collaborative problem-solving

- Financial holdback: Partial payment retention pending remediation

- Termination rights: Reserved for sustained, unremedied failure

This ensures vendors remain committed and collaborative rather than defensive and litigious.

Internal Alignment: Contracts are embedded in organizational incentive matrices. If internal stakeholders are not measured on the same metrics underpinning external contracts, misalignment ensues. A vendor may be incentivized to cut costs while internal managers focus on speed. CFOs must ensure internal scorecards mirror external SLAs. Only then does risk-sharing logic permeate beyond legal language into operational action.

Quarterly Recalibration: Risk-sharing contracts must evolve with business. Quarterly reviews should be embedded contractually, with both sides bringing updated forecasts, risk assessments, and performance data. These create recalibration cadence, allowing changes in scope, pricing, or expectations based on fresh information. They also reduce surprises, which in contract management are often governance failure proxies.

Shared Transparency: A contract is only as effective as its interpretability. CFOs must invest in tools and dashboards democratizing visibility. Both internal teams and external partners should access the same data sources with role-based views protecting confidentiality. This shared visibility fosters joint problem-solving, transforming the contract from compliance artifact into living document, a playbook for performance.

Conclusion

As a practitioner straddling finance, operations, and systems thinking, I view risk-sharing contracts not as volatility hedges but as strategic fulcrums. They embody financial stewardship discipline and partnership ethos. They force both sides to return to first principles: what value are we creating, what risks are we assuming, and what outcomes are we optimizing for? They are the financial equivalent of constitutional design, a durable yet adaptable framework balancing liberty with responsibility. Ultimately, the rise of risk-sharing is not a fad but a necessity. In a world of increasing interdependence and accelerating change, no organization can afford to bear all risk or reap all reward alone. By designing contracts that mirror this reality, CFOs can build not just better agreements but better businesses, creating economic architectures that are fair, accountable, and resilient.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.