Executive Summary

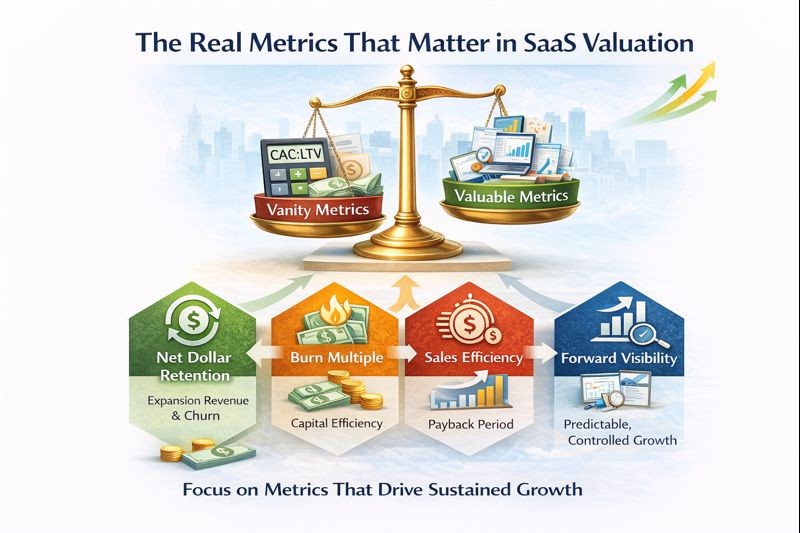

Some metrics are so often repeated in board decks and pitch meetings that they become gospel. Customer acquisition cost to lifetime value ratio, for example, has reached a kind of cult status in SaaS circles. Every founder can recite it. Every investor expects to see it. And every dashboard flashes it with confidence. But if you have ever been in the room during a real valuation discussion, whether on the buy side or in the middle of a financing round, you know something different. That ratio, while useful, is far from the full story. Throughout my twenty-five years leading finance across cybersecurity, SaaS, manufacturing, logistics, and gaming, I have learned that valuation in SaaS is not an exercise in formula. It is a synthesis of expectation, predictability, and leverage. The most insightful investors do not care about customer acquisition cost to lifetime value in a vacuum. They want to know if the business compounds, if the model is both scalable and defensible, and if there is durability embedded in retention.

Beyond CAC:LTV – The Context Problem

Let us begin with a simple truth: customer acquisition cost to lifetime value is a directional indicator, not a valuation driver. It helps you understand the efficiency of customer acquisition relative to monetization over time. But it is built on assumptions that vary wildly. What is the time horizon for lifetime value? What churn rate is baked into the denominator? Is customer acquisition cost measured by blended cost or marketing-only? Is lifetime value calculated on gross margin or net revenue? A good ratio can hide bad retention. It can also overstate monetization in a small sample of high-paying customers. And when every startup learns to optimize it by tweaking definitions, the signal gets lost in the noise.

When I rebuilt GAAP and IFRS financials for a high-growth SaaS company and designed cohort analysis frameworks, we discovered that our headline customer acquisition cost to lifetime value ratio looked healthy but masked significant variation by customer segment. Enterprise customers had attractive economics. Small business customers churned quickly. Without cohort-level analysis, we would have missed that our growth was built on an unsustainable foundation.

Net Dollar Retention: The Valuation Anchor

What does matter, consistently, is net dollar retention. This metric cleanly, quietly tells the story of whether your product grows with your customer. It reflects expansion, upsell, cross-sell, and yes, churn. But more than that, it reflects embeddedness. High net dollar retention tells investors that your revenue base is not just stable, it is compounding. It means your existing customers are delivering more value over time, often with no additional acquisition cost. That predictability is a valuation anchor. It lowers perceived risk. It increases pricing power. And in companies with strong net dollar retention, growth capital is cheaper because future cash flows look more reliable.

When I secured $40 million in Series B funding and an $8 million credit line at a nonprofit organization, investors focused intensely on our retention and expansion metrics. They wanted to understand not just whether donors returned but whether their giving increased over time. That expansion behavior signaled program effectiveness and created confidence in our ability to scale impact sustainably.

Burn Multiple and Capital Efficiency

But net dollar retention on its own is still just a piece of the story. Investors want to know whether growth is efficient. That is where burn multiple comes in, a metric that emerged as gospel during the tightening of capital markets. A burn multiple of 1x means that for every dollar of net new annual recurring revenue, you are spending a dollar of burn. That might sound neutral, but in today’s environment, that is healthy. If your burn multiple is over 2x, you better be in hyper-growth or category-defining mode. Otherwise, the market will not reward you.

Even more nuanced is the question of gross margin structure. SaaS companies love to tout 80 percent margins. But that assumes consistent hosting, scalable support, and low implementation costs. In reality, many B2B SaaS companies operate closer to 65 to 70 percent once you factor in customer success and onboarding. Smart investors dig into this. They want to know what happens to margin as you scale. Are you improving? Are costs of goods sold variable or fixed? How sensitive is margin to changes in usage pricing models? Valuation does not reward theoretical margin. It rewards proven margin durability.

When I managed global finance for a $120 million logistics organization, we tracked unit economics religiously. As volume scaled, we expected margin improvement from operating leverage. But we also monitored where margin became sensitive to fuel costs, labor rates, and routing efficiency. That visibility allowed us to communicate margin trajectory credibly to stakeholders.

Sales Efficiency and Payback Period

Next is sales efficiency. Magic number, a metric that compares quarterly revenue growth to prior quarter’s sales and marketing spend, offers a shorthand for this. But like customer acquisition cost to lifetime value, it suffers from definitional inconsistency. The deeper measure is payback period, how long it takes for a customer to pay back their acquisition cost. A company with a short payback period, say under 12 months, can reinvest faster. It needs less working capital to scale. That becomes critical when capital costs rise. And in today’s markets, that kind of efficiency is rewarded with better multiples.

Another undervalued metric is product velocity. This is not always measured formally, but it is sensed by investors. How fast is your product evolving? How quickly do you ship features? How rapidly do you respond to customer feedback? This ties into engineering efficiency, research and development as a percentage of revenue, and informs how long your innovation cycle is. In SaaS, where the only real moat is often speed and user delight, product velocity becomes a proxy for resilience.

Forward Visibility and Operational Precision

But perhaps the most overlooked driver of valuation in SaaS is forward visibility. And this is not just about revenue predictability. It is about operational precision. Investors value companies that know their metrics and manage them in real time. Forecast accuracy, budget discipline, and headcount planning all show whether the team is operating with control or chasing shadows. A startup that beats plan by a little is more valuable than one that misses by a lot, even if both grow at the same rate. Because in the long game of compounding, consistency always beats volatility.

When I built enterprise KPI frameworks using MicroStrategy, Domo, and Power BI tracking bookings, utilization, backlog, annual recurring revenue, pipeline health, customer margin, and retention, the value was not just in having the data. It was in demonstrating to investors that we managed the business with precision. We could forecast accurately because we understood the drivers. We could adjust quickly because we saw trends in real time.

One reason these deeper metrics matter is that they paint a picture of control. Not just control over the numbers, but control over the business model. They tell a story of whether the team knows what levers matter and whether they can pull them in real time. This is what separates companies with frothy valuation headlines from those with real investor conviction.

And here is the part most people forget: valuation is not the same as price. Price is what you get in a term sheet. Valuation is what someone is willing to defend after diligence. Those two things can diverge quickly if your metrics are built on sand. But when your metrics tell a consistent story of growth, efficiency, and resilience, you get more than a good number. You get trust. And that trust compounds.

Conclusion

Ultimately, the best SaaS companies do not chase vanity metrics. They manage a balanced portfolio of indicators that reflect both momentum and health. They treat customer acquisition cost to lifetime value as one signal among many. They run deep on cohort analysis. They track expansion revenue like it matters. They watch margin trends like a hawk. And most of all, they use their metrics to make better decisions, not just better presentations. Because at the end of the day, valuation is not awarded. It is earned. Not in the slides you show, but in the systems you build. Not in the ratios you highlight, but in the reality they reflect. And the CFO who understands that difference will always be the one driving the narrative, not chasing it.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.