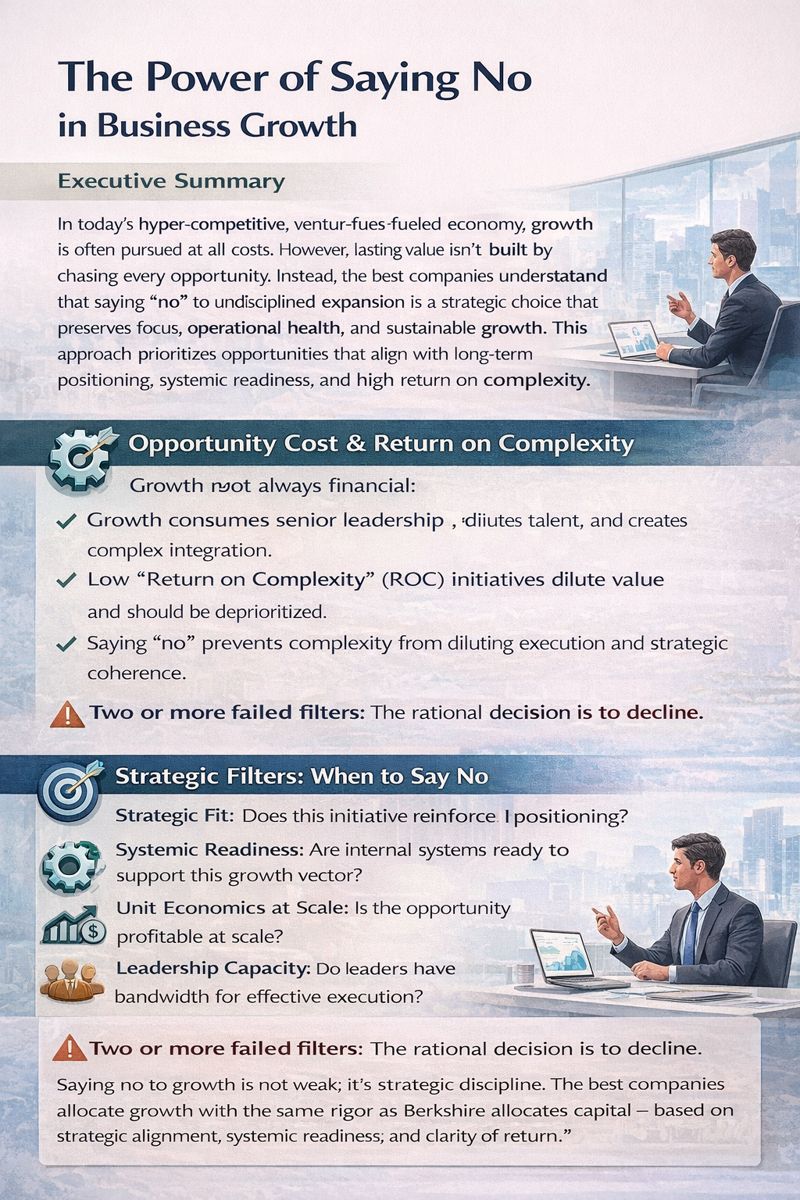

Executive Summary

In today’s hyper-competitive, venture-fueled economy, few things generate boardroom anxiety like the possibility of leaving growth on the table. Revenue is often equated with relevance and market share with inevitability. For executives, the pressure to pursue every opportunity including entering new markets, launching adjacent products, or acquiring new customer segments can be intense. Throughout my twenty-five years leading finance across cybersecurity, SaaS, manufacturing, logistics, and gaming, I have learned that this environment, where fear of missing out masquerades as strategy, makes no the hardest word in the boardroom vocabulary. Yet the most sophisticated companies and the most durable have learned that growth is not always good and more is not always better. Saying no to growth is not a concession. It is a choice to play a longer, more deliberate game. It reflects maturity that recognizes the difference between growth that fuels value creation and growth that masks systemic fatigue.

The Myth of Infinite Growth

There is a persistent myth in business that market opportunity should be pursued to its outermost boundary. But opportunity, like bandwidth, is finite. Every growth decision consumes capital, talent, focus, and operational bandwidth. Chasing all of them at once creates entropy, not expansion.

Even among well-capitalized firms, growth comes at a cost. Consider Amazon’s early years: for all its legendary expansion, it famously declined to chase certain retail verticals for decades. Apple, despite having more capital than many governments, has resisted diversifying into services that do not match its core design and privacy ethos. Strategy in these firms was not about what they could do but what they chose not to do.

The best companies allocate growth the way Berkshire Hathaway allocates capital: with an eye toward return on invested attention. That same philosophy applies to modern strategic planning.

Opportunity Cost and Return on Complexity

The cost of growth is not always financial. It is often organizational. Growth initiatives, especially those in new domains, consume senior leadership time, dilute talent concentration, fragment technical resources, and require complex integration with existing systems.

For example, entering a new geography may promise a 15 percent lift in topline revenue. But if it consumes 30 percent of the company’s executive focus, doubles compliance complexity, and delays core product innovation, is it still accretive? These are not theoretical trade-offs. They are the real costs of complexity.

Companies must think in terms of Return on Complexity: how much value does a growth initiative generate per unit of added complexity? Low ROC initiatives should be deprioritized or avoided entirely, no matter how shiny the topline projection. Strategic maturity is the ability to say no to what looks good on paper but erodes coherence in practice.

When I managed global finance for a $120 million logistics organization, the executive team faced pressure to expand into e-commerce fulfillment services. The revenue projection was attractive, a potential $30 million increase. But our analysis showed it would require entirely new technology infrastructure, different operating margins, regulatory compliance in multiple states, and 40 percent of leadership attention for 18 months. The ROC calculation revealed that every dollar of new revenue would add $1.50 of complexity while delaying our core B2B expansion by a year. We declined the opportunity. Eighteen months later, our focused B2B expansion delivered $25 million in higher-margin revenue with half the operational overhead.

Strategic Filters: When to Say No

To build discipline into decision-making, companies can establish filters that determine when growth is strategic versus reactive. These filters provide a rubric for when no is not only acceptable but necessary:

- Strategic Fit – Does this initiative reinforce the company’s long-term positioning? A foray into a new market may be financially tempting but strategically incoherent.

- Systemic Readiness – Do internal systems, culture, and processes support this growth vector? If infrastructure will be overwhelmed, growth becomes self-defeating.

- Unit Economics at Scale – Does this opportunity become more profitable with scale, or does complexity grow faster than contribution margin?

- Leadership Capacity – Does the current leadership bandwidth support effective execution, or will this require compromising other priorities?

- Time to Clarity – How long will it take to determine if this initiative is succeeding? Low-feedback, long-lag bets drain attention without near-term course correction.

If an opportunity fails two or more of these filters, the rational decision, however unpopular, is to decline.

The Psychology of FOMO and Executive Overreach

Saying no is not just an analytical challenge. It is a psychological one. Founders and CEOs are often wired for optimism. Boards push for relevance. Markets punish perceived inertia. This creates an environment where the mere existence of opportunity feels like a mandate to pursue it.

But succumbing to FOMO can lead to what psychologists call overchoice, a state where too many options reduce the quality of decision-making. In business, overchoice leads to a portfolio of half-executed initiatives, overstretched teams, and diminishing returns.

The best leaders create internal permission structures for restraint. They publicly praise deliberate decisions to focus. They tie incentives not just to outcomes but to strategic alignment. And they model that declining a shiny opportunity is not weakness. It is wisdom.

The Economics of Focus

There is a direct correlation between strategic focus and operational leverage. Companies that focus on fewer, higher-quality initiatives generate better marginal economics. They iterate faster, compound learnings, and create flywheels that turn focus into defensibility.

Focus is not about austerity. It is about maximizing the conversion rate of growth into value. It asks: what are the three things we can do with excellence rather than the ten things we can do with mediocrity?

When I secured $40 million in Series B funding and an $8 million credit line, investors pressured us to simultaneously expand into three new program areas. Instead, we focused capital on perfecting one core program model, achieving best-in-class outcomes that became the foundation for sustainable expansion. This discipline enabled us to scale efficiently rather than fragment resources across unproven initiatives.

My certifications as a CPA, CMA, and CIA emphasize financial discipline and strategic resource allocation. But what separates companies that grow durably from those that grow desperately is not analytical rigor alone. It is the courage to decline opportunities that do not pass strategic filters, the wisdom to calculate return on complexity rather than just return on investment, and the leadership conviction to model that saying no to the wrong growth is saying yes to sustainable value creation.

Conclusion

In a market addicted to momentum, saying no is a radical act. But it is one that separates durable businesses from ephemeral ones. Growth is not strategy. It is a byproduct of strategy. And when that strategy is anchored in coherence, readiness, and clarity, the organization earns the right to grow sustainably. The strategic no is not about avoiding risk. It is about avoiding regret. Because in the end, the companies that endure are not those that chase every opportunity. They are the ones that choose the right ones.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.