Executive Summary

I have seen many founders learn about insurance the hard way. Not because they lacked intelligence or discipline, but because they assumed that insurance is a product you buy when a specific risk becomes obvious. Like smoke alarms or backup generators, they considered insurance a just-in-time tool. That mindset, while common, is dangerous. And it reveals a deeper misunderstanding: most startup leaders view insurance as a transactional necessity rather than a strategic asset. They see it as a fixed cost, not a form of dynamic protection. The difference between buying insurance before the fire and after one breaks out is more than just pricing. It is a matter of leverage, process, and control. Insurers assess risk based on both timing and narrative. A company that purchases coverage after a scare, or worse, after an actual event, walks into the negotiation with diminished leverage. Underwriters become wary. Policy exclusions multiply. Premiums rise. Claims get scrutinized with microscopic skepticism. Throughout my experience overseeing finance and strategy across organizations from BeyondID to managing global finance for a $120 million organization at Lifestyle Solutions, I have learned to act preemptively in that liminal space where risk is not yet realized but already latent. Buying insurance while the house is still standing is not just good judgment. It is financial foresight.

The Asymmetry Between Price and Value

Most founders think in terms of burn rate, CAC, LTV, and ARR. These metrics offer clarity and drive behavior. But insurance operates differently. Its payoff is not linear. It sits quietly on the P&L, indistinct from vendor spend or IT support. Until it is not. Then, in a single moment, a lawsuit, a breach, an employee action, it transforms into the most important asset on the books. This asymmetry makes insurance feel optional. But that optionality is deceptive.

The Insurance Value Paradox:

| Perception Stage | How Founders View Insurance | Actual Strategic Value |

| Pre-Incident | Fixed cost reducing runway | Leverage preservation tool |

| During Underwriting | Bureaucratic hurdle | Opportunity to shape terms and demonstrate maturity |

| Policy Active Period | Dormant line item | Protection enabling bold execution |

| Incident Occurs | Critical lifeline | Capital preservation mechanism |

| Claim Resolution | Transactional interaction | Indicator of operational resilience |

| Post-Incident | Necessary evil with higher premiums | Foundation for investor confidence |

One of the earliest lessons I learned in risk management came during a merger integration. The acquirer had delayed adding errors and omissions coverage until the legal team flagged it post-closing. They scrambled to secure it while onboarding new enterprise clients. The result was a policy with significant exclusions tied to the integration timeline. Months later, a customer dispute emerged. The claim fell into a gray zone, technically post-policy but originating from pre-policy operations. The insurer contested coverage. The company paid out of pocket. In theory, they had coverage. In practice, they had coverage with an asterisk.

This example reinforced a fundamental truth: timing defines not just price but utility. Early coverage buys not just lower premiums but broader terms, simpler underwriting, and fewer conditions. Founders who secure coverage while operations are stable, before contracts get complex, before customer volume spikes, before regulatory audits begin, gain more than protection. They gain terms that actually hold up under stress.

Systems Thinking and the Lag of Recognition

Startups operate in systems defined by feedback loops, time delays, and compounding uncertainty. Insurance fits neatly into that landscape. The problem is, too many leaders treat it as a discrete decision. They ignore the time lag between exposure and effect. They forget that recognition is a lagging indicator. By the time a founder realizes the company needs cyber coverage, the most insurable event has already occurred. By the time an employee makes a claim, the lack of employment practices liability insurance coverage turns into a liability, not a line item.

I view insurance through a systems lens. It is not a hedge against known risk. It is a mechanism that absorbs the volatility you cannot see yet but will likely face. Like most systemic interventions, its value emerges not in isolation but in how it interacts with everything else: contracts, policies, culture, and cash flow.

Essential startup insurance categories:

I once instituted a risk refresh cycle tied to roadmap planning. Each quarter, we asked: What are we shipping? What is the exposure? What is the coverage? One quarter, the roadmap included a data-intensive feature integrating a third-party analytics API. That triggered a discussion about liability in the event of a breach. The company had standard cyber coverage, but it did not extend to vendor-induced failure. That conversation led to a revised policy, secured before anything went wrong. We never needed to invoke it. But had we waited, we would have lacked coverage precisely when it mattered.

The Information Theory of Underwriting

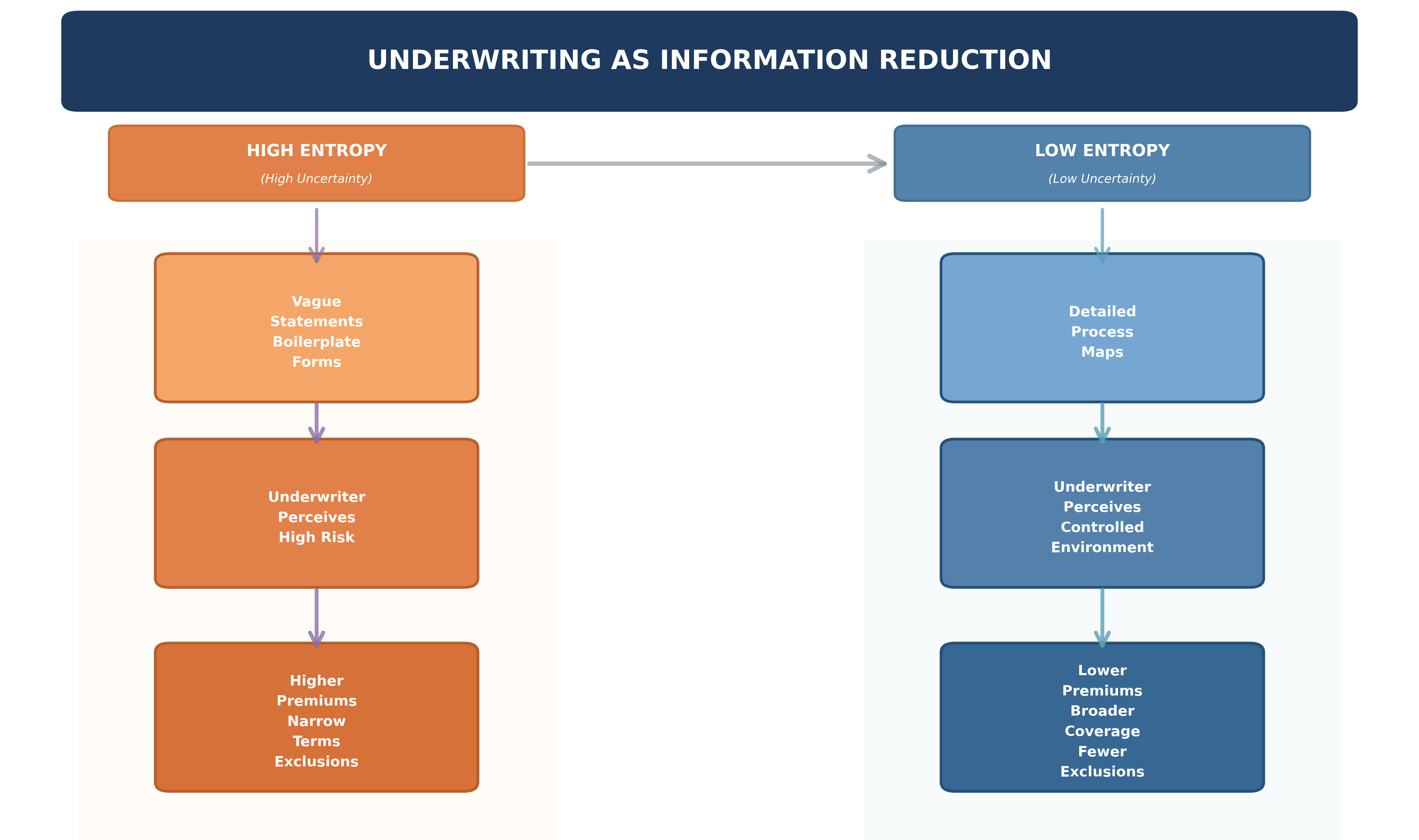

Over the years, I have grown fascinated by how insurers process information. Underwriting, at its core, operates like a form of probabilistic reasoning. It relies not only on data but on how that data is framed and presented. From the outside, this can feel opaque. But founders who understand information theory quickly grasp what is really happening. Insurers evaluate entropy, how much uncertainty exists in your operation, and how well your communication reduces it.

This is why underwriters respond differently to two companies with identical risk profiles. One submits polished financials, detailed process maps, and a clear explanation of its risk controls. The other sends boilerplate forms and vague statements. The former reduces uncertainty. The latter magnifies it. The result? Lower premiums and better terms for the former. This is not a game. It is an inference process.

I have helped multiple teams prepare for underwriting reviews. I advise them to narrate their maturity. If you have onboarding scripts, show them. If you train staff on compliance, document it. If you monitor uptime, describe your response process. These signals matter. They do not merely check boxes. They shape how the insurer models risk and whether they feel comfortable committing capital.

Founders who treat underwriting as a negotiation win twice. First, they receive better terms. Second, they demonstrate competence, which spills over into investor confidence. Every time I have framed insurance preparation as part of capital planning, investors have responded positively. It shows discipline. And discipline earns trust.

Building Insurance into Capital Strategy

Over time, I have come to treat insurance not as an expense to minimize but as a strategic input into capital allocation. Just as founders model runway by projecting spend on headcount, growth, and infrastructure, they should do the same with downside coverage. That approach changes how one thinks about the cost of insurance. It stops being a question of how much does this policy cost and becomes how much would a comparable mitigation cost if something goes wrong.

I have seen founders painstakingly guard dilution, raising $15 million with tight valuations and even tighter equity grants, only to lose $1.5 million from an uninsured legal dispute that a $35,000 policy would have covered. That is not just an operational loss. It is an erosion of capital strategy. When viewed that way, insurance preserves optionality. It protects cash so that when market conditions turn or cycles shift, the company remains in control.

I often advise finance leaders to show insurance allocations in capital stack presentations. Doing so reframes the dialogue. It shows the board that leadership anticipates, not just raises. It also telegraphs a level of financial maturity that most early-stage operators overlook. The implicit message becomes: we know risk exists, and we have chosen to neutralize it proactively rather than react defensively.

Renewal as Strategic Trigger

One of the more misunderstood aspects of startup insurance is the annual renewal cycle. Most teams treat it like software procurement: tick the boxes, pay the bill, move on. That mindset wastes opportunity. Renewal should act as a strategic trigger, a moment to review risk exposure, business model evolution, and vendor shifts. It is also a moment when founders hold more leverage than they think.

Underwriters pay close attention to how companies behave between policies. Did the company grow but maintain controls? Did it experience incidents and respond well? Did it invest in compliance? These signals shape pricing. But they also shape flexibility. If renewal becomes a negotiation and not just a renewal, founders can push for better terms: higher sub-limits, narrower exclusions, more favorable definitions.

I have worked with firms that tied renewals to quarterly retrospectives. Every time the company crossed a threshold such as $10 million in ARR, 50 employees, or international expansion, it triggered an insurance review. We did not always adjust coverage, but we used those points to reassess assumptions. That process became not just about coverage. It became a tool for discipline. Over time, the company did not just manage risk. It made insurance part of how it planned for uncertainty.

Preparing for the Day You Need to File

Perhaps the most emotionally disorienting part of insurance is filing a claim. No founder wants to imagine it. But that reluctance becomes a liability. The worst time to learn how a policy works is the day after an incident. The best time is months earlier, during policy review and onboarding. That distinction often separates companies that recover quickly from those that spiral into distraction and miscommunication.

In my experience, every startup should rehearse claims protocols:

- Who calls the broker?

- Who notifies legal?

- How do you preserve evidence?

- Who coordinates external response vendors?

These steps sound bureaucratic. They are not. They are operational defense. One hour of preparation prevents weeks of post-incident ambiguity. I have sat through incident calls where the team scrambled to find policy language, clarify coverage scope, or locate broker contact details. That chaos is preventable. And in a claim context, avoidable delay is the enemy.

I once coached a finance leader to build a claims readiness kit. It included a checklist, escalation contacts, internal communication scripts, and a data retention protocol. That same company filed a cyber claim 18 months later. The response was seamless. The insurer paid promptly. The team returned to execution within days. That outcome was not luck. It was a result of treating insurance as part of the business operating system.

Insurance as an Investor Signal

In an age of asymmetric risks, from regulatory shifts to cybersecurity to employment litigation, investors increasingly look beyond topline growth. They seek evidence of resilience. Founders who treat insurance as an afterthought raise doubts. Founders who embed insurance into strategic planning raise trust.

I have often been asked by investors during diligence, how do they handle downside scenarios? A coherent insurance stack answers that question silently. It suggests maturity, accountability, and the ability to preserve enterprise value under stress. And in venture capital, that subtext often matters more than the slide deck. I have seen term sheets move faster when founders present their risk posture clearly. I have also seen deals stall when companies fumble basic questions about coverage and exclusions.

Moreover, coverage gaps can become liabilities during M&A or secondary transactions. Throughout my experience overseeing over $150 million in M&A transactions and post-merger integrations at organizations including Atari SA and Cryptic Studios, I witnessed how acquirers ask for representation and warranty insurance. They scrutinize prior claims and unresolved liabilities. Any gaps or ambiguities create drag on pricing, on terms, on closing speed. That drag costs time and leverage. Insurance, when properly structured, eliminates friction. It greases the path to liquidity.

Thinking Like a Credit Officer

Much of my thinking around insurance has evolved by sitting across from lenders and credit committees. Unlike venture investors, credit officers work in a world of rules, not narratives. They assess risk through ratios, covenants, and mitigants. To them, insurance is not a luxury. It is a requirement. It reduces downside volatility, stabilizes cash flow, and protects collateral. And because lenders have long memories, the behavior you model early shapes your options later.

When founders think like credit officers, they approach insurance differently. They do not just ask, is this covered? They ask, does this help stabilize our risk-adjusted liquidity profile? That framing changes how you invest in coverage. It shifts the conversation from cost to certainty. And it aligns internal risk posture with external capital expectations.

I encourage early-stage companies to build this perspective early. Even if you do not raise debt now, you might later. When that time comes, the quality of your insurance posture will already be embedded in the system. You will not need to clean up history. You will simply extend trust.

The Economics of Discipline

Founders who buy insurance after an incident pay for it twice. First, in the premiums that reflect elevated risk. Second, in the terms that narrow protection. Founders who buy insurance proactively pay for it once. And the return on that foresight compounds.

This is the hidden economics of discipline. The earlier you act, the more you preserve, not just capital but confidence. Teams execute better when they trust the company has contingencies. Boards govern better when they know the firm will not panic in crisis. Investors allocate better when they believe the floor is in place.

Throughout my professional experience, with certifications as a CPA, CMA, CIA, CPIM, and PMP, along with academic credentials including an MS and MBA, I learned this lesson repeatedly. You do not earn flexibility when things go wrong. You earn it by acting before they do. Insurance is not about fear. It is about freedom. It lets you take risk on your terms, knowing that downside no longer dictates the narrative.

Conclusion

Startups succeed by performing under pressure. But performance requires a platform. That platform is built on systems, people, and preparation. Insurance belongs in that foundation, not as an afterthought but as a design decision. It enables the company to grow boldly without fearing the unavoidable friction of reality. In the end, the house does not burn down because no one saw the risk. It burns because no one planned for it. The founders who endure are not the ones who avoid every fire. They are the ones who install protection before the smoke appears. That is why I say: do not wait for the fire. Buy insurance while the house still stands. You will sleep better, build better, and most importantly, lead better.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.