Executive Summary

In the corporate vocabulary of value creation, few words have worn as many masks and borne as much unrecognized weight as procurement. For decades, the function has been framed as a cost sentinel, an operational service line whose metrics of success were measured largely in terms of negotiated discounts or cost containment. But such a framing is not only antiquated, it is strategically inefficient. When procurement is relegated to a tactical afterthought, companies overlook a rich reservoir of insights, leverage, and innovation that lies dormant within their supplier ecosystems. Having led procurement optimization, negotiated master service agreements ranging from three hundred thousand to over twenty million dollars, managed supply chain analytics for a one hundred twenty million dollar logistics enterprise, and implemented production and inventory management systems across multiple organizations, I have seen how the procurement function, when properly empowered, can emerge not as a ledger entry but as a forward-deployed arm of enterprise strategy. That transformation begins with a shift in mindset: treating procurement not as a center of cost but as a center of value. This article explores how to reframe procurement from transactional execution to strategic value creation, and how CFOs can operationalize spend management that drives not just savings but resilience, innovation, and competitive advantage.

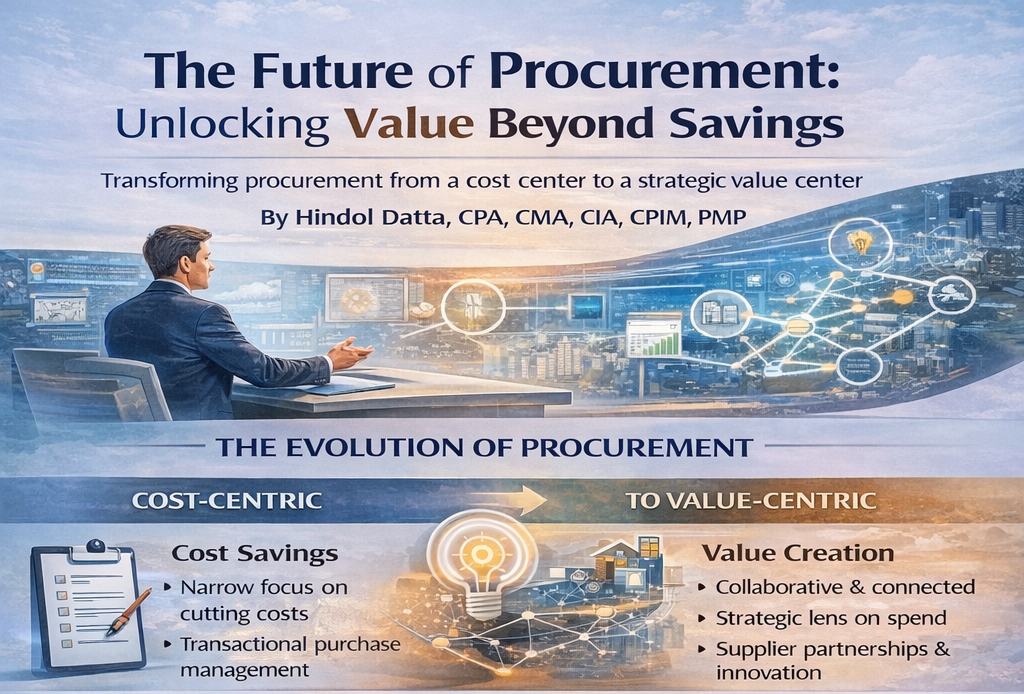

Reframing Procurement: From Cost Center to Value Center

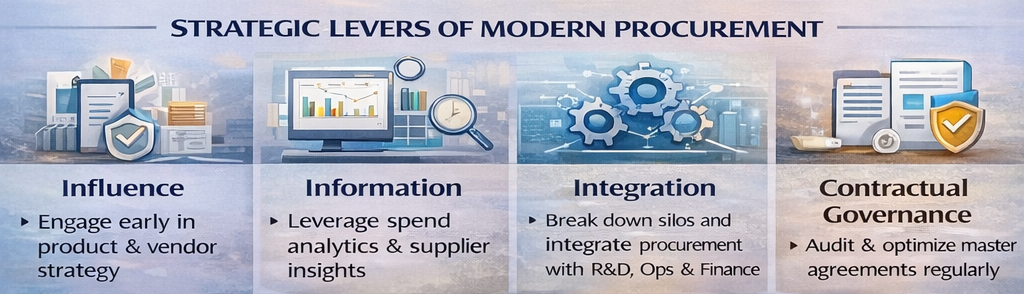

The re-architecture of procurement starts by rebalancing three essential levers: influence, information, and integration. Influence is earned when procurement is brought into the design room, not just the negotiation room. This requires early-stage involvement in product roadmaps, vendor identification, and even customer-driven requirements. Information is gained not only from spend analytics but from structured feedback loops with the supplier base, unlocking signals that go beyond pricing: resilience, co-development potential, environmental and social governance risk, and innovation velocity. Integration is realized when procurement is embedded not in silos but as connective tissue across research and development, operations, finance, and compliance.

During my time managing supply chain analytics and logistics operations for a one hundred twenty million dollar wholesale and logistics enterprise, I witnessed this transformation firsthand. We reduced logistics cost per unit by twenty-two percent not through simple cost-cutting but by treating procurement as a strategic function. We analyzed routing patterns, consolidated shipments based on predictive demand modeling, negotiated volume-based pricing with carriers, and optimized warehouse placement. This required procurement to work closely with operations on demand forecasting, with finance on working capital implications, and with sales on customer delivery requirements. The savings came from integration, not isolation.

Much of the success of this reorientation depends on tools, but tools without philosophy are rarely transformative. A modern procurement stack is incomplete without scenario-based planning, total cost of ownership modeling, and continuous vendor scorecards. Yet the real differentiator lies in how these tools are used to inform conversations upstream, before the contract, before the build, before the spend. My certification in production and inventory management provides the operational perspective that procurement cannot be separated from demand planning, inventory optimization, and production scheduling. These functions must work in concert.

The Critical Importance of Contractual Governance

A key inflection point in elevating procurement came during one particularly complex professional services engagement where a long-standing master service agreement, assumed to be active, had lapsed. The realization forced a rapid but focused course correction. Working cross-functionally with legal and operations, we crafted an amendment framework not only to revalidate terms but to modernize clauses that were misaligned with the current risk environment. That episode cemented a discipline I now carry forward: procurement governance must include a master service agreement audit mechanism. An expired master agreement is not merely a legal technicality. It is a strategic vulnerability. Ensuring contractual hygiene is an operational imperative that undergirds all future value extraction.

My background as a Certified Internal Auditor informs this perspective. Just as we audit financial processes for control effectiveness, we must audit procurement processes for contractual validity, risk exposure, and alignment with current business needs. During my time implementing Sarbanes-Oxley controls and managing internal audit functions, I learned that governance frameworks prevent small issues from becoming major problems. The same principle applies to procurement. Regular contract reviews, vendor performance assessments, and compliance audits create the foundation for strategic value creation.

Moreover, in supply-heavy industries such as logistics or shipping, where contracts often extend over years and millions of dollars, procurement’s role extends far beyond price. These environments demand step-wise optimization: supplier segmentation, rebate structures, foreign exchange exposure clauses, and throughput-based pricing bands. What is not in the contract is as dangerous as what is ambiguously worded within it. Having negotiated complex agreements across multiple sectors and geographies, I learned that contract precision determines long-term value capture.

Strategic Spend Management: From Budgets to Insights

To elevate procurement from transactional to strategic, one must begin with a more intelligent relationship to spend itself. Spend is not just an output of operations. It is a predictive signal. It reveals dependencies, exposes concentration risks, and reflects shifts in demand behavior long before revenue lines catch up. Therefore, spend must be managed not just through budgets but through insights.

At the core of strategic spend management lies the discipline of categorization. Segmenting spend into direct, indirect, strategic, tail, and emergent clusters allows for differentiated strategies. While direct spend may benefit from long-term hedges or volume aggregation, tail spend often masks inefficiencies that can be automated or rationalized. Strategic categories, those tied to revenue generation or innovation, require deeper vendor engagement, co-creation models, and risk-sharing structures.

One particularly effective model is the dynamic spend quadrant, which evaluates suppliers across two axes: impact on business continuity and potential for value innovation. High-continuity, high-innovation suppliers are not to be squeezed. They are to be cultivated. Conversely, low-impact suppliers can be rotated, automated, or competitively tested with frequency. Procurement teams often default to blanket negotiations without this kind of segmentation, eroding supplier goodwill where it matters most and missing cost-saving opportunities where leverage is strongest.

During my time implementing business intelligence systems including MicroStrategy and Domo for operational analytics, I learned that spend visibility must translate into actionable insights. We built dashboards tracking spend by category, vendor, department, and project. But the real value came from analyzing patterns: which vendors consistently delivered on time, which categories experienced price volatility, which departments had procurement discipline, and which had maverick spend. This intelligence informed procurement strategy, vendor selection, and contract negotiations.

Technology as Enabler, Not Savior

Technology is a key enabler but not a savior. Source-to-pay platforms, contract lifecycle management systems, and artificial intelligence-assisted risk scanning must be calibrated to the company’s strategic operating model. A platform is only as valuable as the governance around it. Spend visibility without accountability yields dashboards, not decisions. I have seen well-intended technology investments fail to move the needle because the procurement team lacked decision rights or cultural permission to challenge stakeholders or reallocate vendors. This is why procurement maturity is not measured by software features but by influence within the company.

My project management certification and experience leading implementations across organizations taught me that technology adoption requires change management, training, stakeholder alignment, and continuous improvement. When we implemented enterprise resource planning systems including NetSuite and Oracle Financials with integrated procurement modules, the technical implementation was straightforward. The organizational change was challenging. Departments that previously managed their own vendor relationships resisted centralized procurement. The breakthrough came when we demonstrated value: faster vendor onboarding, better payment terms, consolidated volume discounts, and reduced maverick spend.

Yet the greatest bottleneck to procurement transformation is often the budget owner. In most companies, functional leaders hold their own profit and loss statements and view procurement as an interloper rather than a partner. The solution is neither top-down enforcement nor bottom-up education but a transparent operating model that links procurement key performance indicators with business outcomes. Win rates on supplier innovation. Time to onboard. Percentage of spend under active contract. Rebate capture. Each of these can be tied to line-of-business success metrics. Procurement cannot evolve if it is not seen as a performance function.

Procurement and Working Capital Optimization

Another often overlooked strategy is aligning procurement with finance on working capital goals. Payment terms, prepayment clauses, and invoicing cadence can be powerful tools to improve free cash flow, yet they are rarely optimized holistically. Procurement can and should lead the charge on balancing vendor health with corporate liquidity, especially in markets where small suppliers are exposed to economic shocks or inflationary waves.

Having managed treasury operations, working capital optimization, and cash management across organizations, I learned that procurement decisions directly impact days payable outstanding, which affects cash conversion cycle and liquidity. Extending payment terms from thirty to sixty days can materially improve working capital, but may strain supplier relationships or increase prices. The optimal approach balances these trade-offs through negotiated structures: early payment discounts, dynamic discounting programs, or tiered payment schedules based on order volume.

When I secured an eight million dollar credit line for a nonprofit organization and managed working capital for a one hundred twenty million dollar logistics enterprise, procurement strategy was integral to cash flow planning. We modeled how changes in payment terms, inventory levels, and supplier relationships would impact cash requirements. This integration between procurement and treasury is essential for strategic value creation.

Dynamic Commercial Architecture

Critically, the commercial architecture of procurement must include mechanisms for renegotiation. Price caps, reopener clauses, commodity indexation, and service level penalties all serve to balance fairness with discipline. I have worked with vendors to co-develop pricing bands based on utilization or performance, a structure that preserves flexibility while anchoring risk. The best contracts are not those that win at the point of signature but those that remain valid under stress.

During my time negotiating master service agreements and managing vendor relationships across global operations, I learned that contract flexibility determines long-term value. Markets change. Business requirements evolve. Vendor capabilities shift. Contracts must accommodate these realities through mechanisms that allow adjustment without requiring full renegotiation. Well-structured contracts include escalation clauses tied to objective indices, volume discounts that adjust automatically based on actual usage, and performance metrics that trigger pricing adjustments.

My experience across sectors from manufacturing to professional services to technology taught me that different industries require different contract structures. Manufacturing contracts may include raw material cost pass-throughs. Professional services contracts may include utilization-based pricing. Technology contracts may include subscription tiers with volume discounts. The key is aligning contract structure with value drivers and risk factors specific to the category and relationship.

Conclusion: Procurement as Strategic Engine

Ultimately, the journey from cost center to value center is not a project. It is a philosophical shift. Procurement is not a lever to be pulled. It is a lens through which business resilience, supplier collaboration, and economic foresight are jointly advanced. As the landscape shifts toward more agile value chains, more fragmented supplier bases, and more regulated compliance obligations, procurement must also evolve to anticipate complexity. That requires investing in negotiation analytics, generative artificial intelligence for clause benchmarking, and integration with environmental and social governance compliance modules. But more fundamentally, it means treating procurement strategy as a board-level discipline, one with material impact on margin, risk, and brand reputation.

Having built finance organizations across multiple sectors and stages, from startups to growth companies to established enterprises, I have learned that the functions that create disproportionate value are those that connect strategy to execution. Procurement sits at this intersection. It translates business requirements into vendor relationships. It converts market intelligence into cost advantages. It transforms risk management into supplier resilience. When empowered with the right mandate, capabilities, and integration, procurement becomes not just a cost management function but a competitive advantage engine.

The time has come to rewrite the procurement charter, not as a compliance checklist but as a commercial engine. It is not enough to track spend. We must track the velocity of value. The CFOs who lead this transformation will deliver outcomes that extend far beyond cost savings: resilient supply chains, innovative supplier partnerships, optimized working capital, and strategic flexibility that becomes competitive moat. Based on my experience, the organizations that treat procurement strategically will outperform those that treat it tactically. The choice is clear, and the opportunity is now.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.