Executive Summary

In the corporate arena where growth dazzles and valuations captivate, the CFO has often been cast as the financial steward, a pragmatic counterweight to the CEO’s boundless optimism. But in the modern enterprise where velocity is currency and complexity compounds like interest, that traditional framing is not just outdated, it is strategically insufficient. Throughout my twenty-five years leading finance across cybersecurity, SaaS, manufacturing, logistics, and gaming, I have learned that the CFO must now evolve into something far more vital: the architect of risk. This is not simply a semantic shift. It is a philosophical one. Being a risk architect means designing an organization where financial control is not a response to failure but a precondition to success.

The Fallacy of Control After Growth

Most organizations, especially those experiencing rapid growth, treat financial controls as retrospective necessities. They establish controls in response to failures: a missed forecast, a failed audit, a fraud incident, or a revenue restatement. Controls are viewed as a price of maturity, a toll one must pay to access public markets or institutional investors.

But this reactive approach is both costly and shortsighted. Restating financials can destroy credibility. Delayed audits can rattle investors. Revenue recognition errors can trigger regulatory scrutiny. More insidiously, lack of financial control creates internal noise: misaligned incentives, shadow systems, and fragile cash flow assumptions.

Proactive control design turns these risks into opportunities. A well-designed risk framework builds investor trust, supports scalability, and enhances decision velocity. Think of it as the difference between driving with a seatbelt already fastened and only reaching for it mid-collision.

Four Principles of Control Architecture

To design controls before they are needed, CFOs must adopt the mindset of an architect, not just building structures but designing for load, stress, and time. This requires embedding four key principles into the financial DNA of the organization:

Materiality-Driven Design:

Not all risks deserve equal attention. Controls should be prioritized based on materiality including financial, operational, and reputational. A $100 variance in travel and expense is not the same as a $1 million ARR recognition error. This ensures resources are deployed where exposure is real.

Preventive Over Detective:

Most audit trails are detective, exposing what went wrong. The risk architect prioritizes prevention. This means building systems that constrain behavior such as system-enforced approval thresholds rather than merely track it such as after-the-fact reconciliations.

Automation with Oversight:

Controls that rely on human vigilance are brittle. Automated controls including segregation of duties, programmatic validations, and anomaly detection scale with the business. But automation does not negate oversight. Exception reporting, audit logs, and regular review cycles ensure accountability.

Cultural Imprinting:

The most scalable controls are social, not just technical. When teams internalize financial discipline including submitting accurate forecasts, documenting spend rationale, and respecting budget guardrails, controls become self-enforcing. This requires storytelling, role modeling, and leadership alignment.

When I improved month-end close from 17 days to under six days at a cybersecurity firm, we built preventive controls into the process redesign. Rather than relying on post-close detective reconciliations, we implemented real-time validation rules in NetSuite that prevented journal entries with unbalanced debits and credits, enforced department code requirements, and flagged intercompany transactions missing reciprocal entries. These automated preventive controls reduced error rates by 73 percent and eliminated most reconciliation work that had previously extended the close cycle.

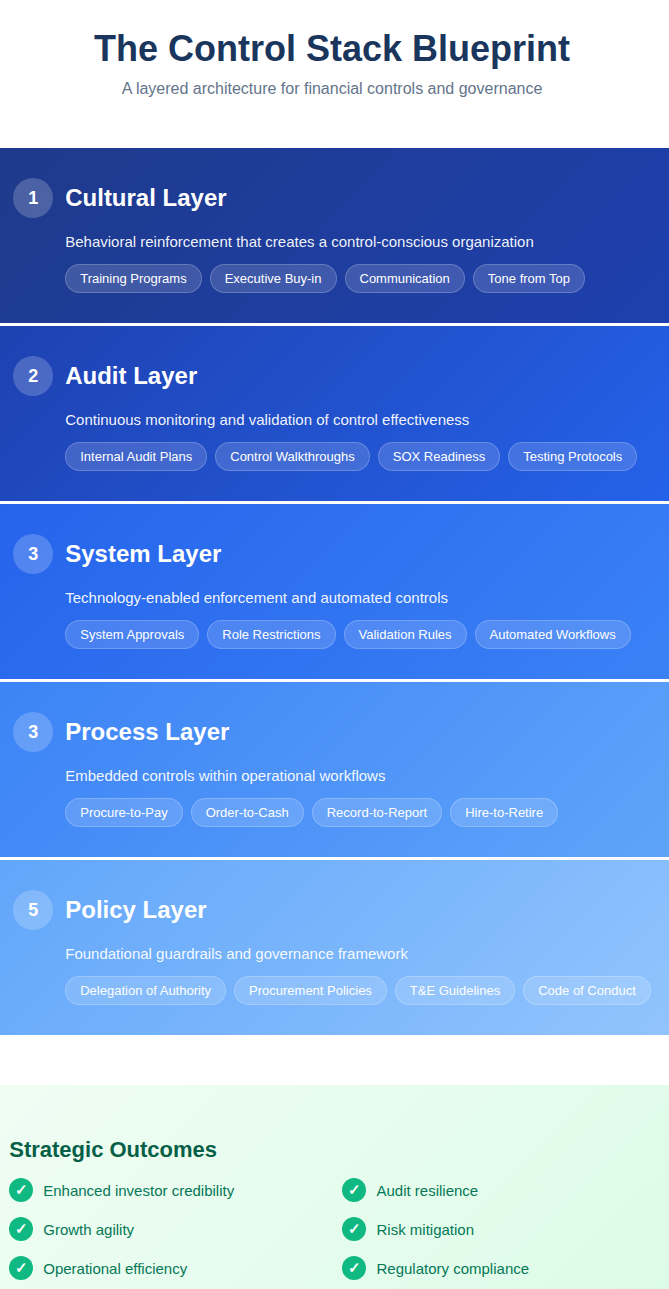

The Control Stack Blueprint

CFOs can adopt a control stack model, analogous to a technology stack, that layers control disciplines in a coherent architecture:

When Control Becomes Strategic

Controls are often perceived as constraints. But in high-performance organizations, they are catalysts. A strong control environment accelerates decision-making by reducing ambiguity and clarifying authority, enables delegation by ensuring governance scales with organizational complexity, builds investor confidence by signaling maturity and foresight, and supports strategic pivots by providing clean data and financial clarity.

When I built enterprise financial reporting frameworks for organizations preparing for growth funding or exit, we treated control architecture as strategic infrastructure. At one organization, implementing role-based access controls and automated approval workflows enabled us to decentralize budget authority to department heads while maintaining corporate oversight. This accelerated procurement decisions from an average of 12 days to three days while actually improving compliance rates from 82 percent to 97 percent.

Conclusion

In a world where markets reward velocity, the temptation is to defer control design until the brakes fail. But great CFOs do not merely prepare for audits. They design systems that make failure unlikely. They do not just prevent fraud. They make fraud hard to commit. They do not just manage risk. They shape it. The future of the CFO is not just fiduciary. It is architectural.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.