Executive Summary

At the center of every enduring business, beyond the product and the pitch deck, the metrics and the markets, lies a relationship that defines the tempo, tone, and trajectory of the enterprise. It is the relationship between the CEO and the CFO. It is, at once, the axis of decision-making and the ballast of judgment. There was a time when the CFO was the foil to the CEO’s ambition, the sharp pencil in the corner, tasked with keeping the exuberance of strategy in check with the cold steel of numbers. The CEO dreamed, the CFO discounted. The CEO expanded, the CFO conserved. But today’s environment, defined by volatility, velocity, and vanishing moats, demands more. Throughout my twenty-five years leading finance across cybersecurity, SaaS, manufacturing, logistics, and gaming, I have learned that in today’s company, the CFO cannot simply be a sparring partner. They must become a strategic twin.

From Sparring Partner to Strategic Twin

This transformation is foundational. A sparring partner pushes back, keeps balance, and ensures the fight is clean. A strategic twin shares vision, challenges assumptions with context, and helps co-create the path forward. It is not about losing independence. It is about gaining relevance. The CFO remains the guardian of discipline, but they also become the architect of acceleration. The tension becomes productive, not punitive.

This new dynamic begins with trust, not blind trust, but earned alignment. The CEO must trust that the CFO understands more than the numbers, that they grasp the customer, the product, the competitive landscape, and the psychology of the team. The CFO must trust that the CEO wants not just compliance but clarity. When this trust is present, conversations shift. No longer are they binary debates over spend or save, risk or reward. They become joint exercises in scenario planning, trade-off design, and capital stewardship.

When I secured $40 million in Series B funding and an $8 million credit line at a nonprofit organization, the CEO and I operated as strategic twins. We co-created the capital strategy, jointly modeled growth scenarios, and presented a unified narrative to investors. That alignment created confidence, lowered the cost of capital, and accelerated decision-making. Great CEOs know how to sell the dream. Great CFOs must know how to operationalize it. But in the best companies, those roles start to blur.

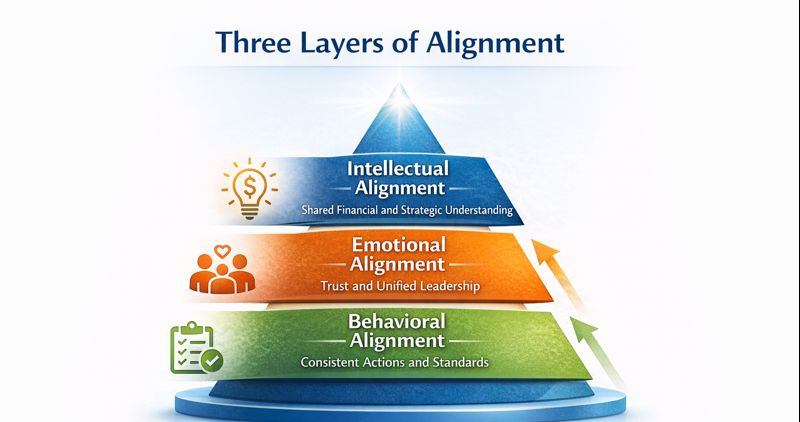

Three Layers of Alignment

Intellectual Alignment

The first layer is intellectual alignment, a shared view of how the business creates value. This means both leaders must be fluent in the key drivers including customer acquisition cost, lifetime value, burn multiple, capital efficiency, and market adoption curves, not in isolation but in synthesis. The CEO might feel them in the market. The CFO models them in Excel. But until those perspectives are merged, decisions will lack coherence.

When I rebuilt GAAP and IFRS financials for a high-growth SaaS company and designed cohort analysis frameworks, the CEO and I developed a shared language around customer economics. We both understood expansion velocity, payback periods, and cohort behavior. That intellectual alignment meant we could move from data to decision faster than competitors.

Emotional Alignment

The second layer is emotional alignment. It shows up in moments of pressure including missed quarters, failed launches, and investor churn. When the room tenses, the strategic twin does not retreat to their corner. They close ranks. They interpret data together, they model options together, and most importantly, they show up to the boardroom together. Unity at the top is not about always agreeing. It is about always owning the decision.

When I managed global finance for a $120 million logistics organization, we faced unexpected cost inflation that threatened margins. The CEO and I jointly owned the narrative to the board, presented mitigation options we had co-developed, and implemented solutions together. That emotional alignment preserved board confidence and organizational morale.

Behavioural Alignment

The third layer is behavioral alignment. Do the CEO and CFO reinforce the same standards across the organization? Does the CEO champion a culture of accountability and transparency, or undercut it with shortcuts? Does the CFO support innovation by enabling calculated risk, or block it with bureaucracy? In companies where the relationship works, there is a rhythm, a shared tempo of meetings, decision gates, post-mortems, and planning cycles that elevates the organization.

When I improved month-end close from 17 days to under six days at a cybersecurity firm, the CEO championed the initiative as strategic, not just operational. That behavioral alignment from the top signaled to the organization that financial discipline enabled strategic speed, not constrained it.

Capital Allocation and Board Impact

This relationship redefines how capital is allocated. In traditional models, finance approves and strategy proposes. But in modern companies, the CFO co-authors capital deployment. They help identify not just where to invest but how to measure return over time. They create dashboards that go beyond accounting to include strategic signals including customer adoption curves, retention by cohort, and contribution margin by segment.

When I built enterprise KPI frameworks using MicroStrategy, Domo, and Power BI tracking bookings, utilization, backlog, annual recurring revenue, pipeline health, customer margin, and retention, the CEO and I used these frameworks jointly for capital allocation decisions. We were both looking at the same data with the same interpretation framework. That eliminated the finance-versus-strategy dynamic that plagues many organizations.

The benefit extends to the boardroom. When the CEO and CFO are aligned, the board sees coherence. When they are not, every question becomes a wedge. When I led board reporting at a gaming enterprise where I oversaw $100 million in acquisitions and post-merger integration, the CEO and I presented as a unified team. The CEO spoke to strategic rationale, I spoke to financial implications, and together we created a complete picture that enabled faster board decisions.

Setting the Organizational Tone

The CEO-CFO partnership also models the tone for the entire organization. If finance is seen as a brake pedal, other functions will withhold data and treat budget season like a siege. But when the CFO is viewed as a partner in execution, finance becomes a trusted advisor. This shift does not happen through slogans. It happens through behavior. Through the CFO showing up in product meetings, go-to-market sessions, and talent reviews, not to audit but to contribute.

Of course, there will always be tension. That is healthy. A CEO’s optimism must be grounded. A CFO’s caution must be challenged. The friction is not the problem. It is the lubricant. But only when it is done with mutual respect, aligned incentives, and a shared belief that the job is not to win the argument but to win the war. My certifications as a CPA, CMA, and CIA provide the technical foundation for credibility. But what makes the CEO-CFO relationship work is not credentials. It is the consistent demonstration of partnership, alignment, and shared commitment to building something that lasts.

Conclusion

In the end, the CEO-CFO relationship is less a hierarchy than a polarity. It is not about dominance or deference. It is about duality. The CEO is the forward thrust. The CFO is the stabilizer. The CEO is vision. The CFO is velocity. One without the other produces a company that is either chaotic or inert. Together, they produce companies that move with speed and confidence, even in ambiguity. It is fashionable to say that the CFO is now a co-pilot. But that metaphor still implies someone else is flying the plane. The better metaphor is co-architect. Two leaders, drawing from different disciplines, building a structure meant to last. And that is the essence of strategy, not just a plan for growth, but a design for resilience. Built not by one mind, but by two.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.