Executive Summary

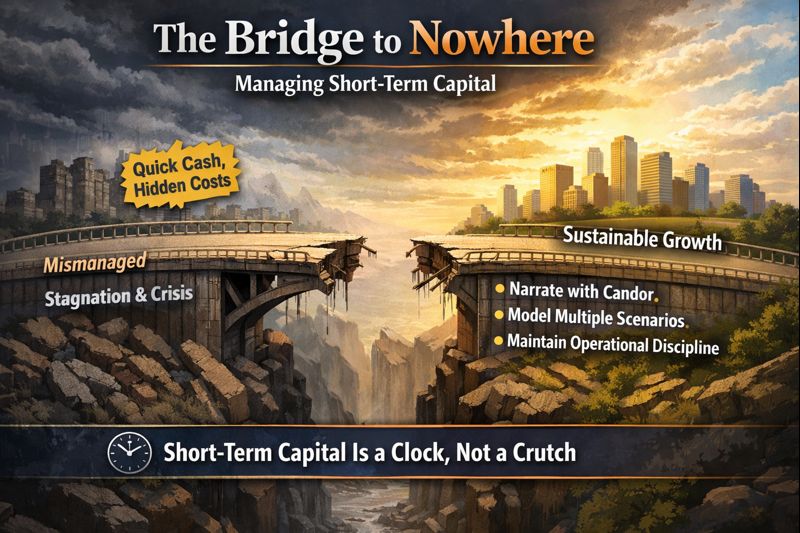

Short-term capital represents one of the most deceptive instruments in corporate finance, arriving quickly with seemingly soft terms but carrying hidden costs that extend far beyond dilution and covenants. For CFOs navigating bridge rounds, the fundamental challenge is not securing the capital but managing the expectations, narratives, and operational discipline that determine whether such financing provides genuine strategic optionality or merely defers an inevitable crisis. The seduction of bridge financing lies in its apparent ability to solve immediate pressures around payroll, runway, and vendor obligations, yet capital is never neutral. It comes with unspoken expectations and compressed timelines that demand measurable progress toward the next funding milestone. Successful navigation of short-term capital requires three critical disciplines: narrating the raise with candor as a strategic tool rather than a victory, modeling multiple exit scenarios including flat or down rounds, and maintaining operational urgency rather than allowing temporary relief to reset discipline. The CFO must treat the bridge period as a clock with a six to twelve month half-life, ensuring that every initiative directly moves metrics relevant to the next raise while simultaneously planning the infrastructure needed if that raise succeeds. Ultimately, how a CFO wields short-term capital determines whether it bridges to sustainable growth or merely leads to the same side of the river.

Short-term capital whispers promises it rarely keeps. It arrives quickly at terms that seem deceptively soft, dressed in urgency as a bridge intended to buy time. For CFOs who misunderstand its nature, this capital does not bridge to scale or certainty. It bridges to nowhere. Having navigated capital raises totaling over $120M across venture-backed SaaS companies, education nonprofits, and digital platforms, I have witnessed how short-term financing can either provide strategic breathing room or become a trap undermining value creation.

The seduction is real. A short-term raise appears to solve immediate pressures of payroll, runway extension, and vendor obligations. But capital is never neutral. It comes with covenants, with dilution even if deferred, and most dangerously, with expectations often unspoken but firmly assumed. The first misstep is narrative. CFOs too often allow short-term capital to become the headline rather than the footnote, presenting the raise as momentum when it is actually a lifeline. When I secured $40M in Series B funding and an $8M credit line for an education organization, the discipline came from framing each capital instrument clearly: what gap it closed, what milestone it enabled, what risk was addressed.

Managing expectations begins by narrating the raise correctly. Not as victory, but as tool. The CFO must frame it with candor: What gap is being closed? What milestone does this buy time to reach? What risk is being priced in? This clarity stabilizes teams and aligns the board. In driving company scale from $9M to $180M revenue while securing $36.5M in growth capital, the lesson was clear: investors respect transparency about why capital is needed far more than optimistic narratives unsupported by reality.

Short-term capital has a half-life of six to twelve months. The CFO must treat that time as both privilege and constraint. It is a clock, not a runway extension. Milestones linked to the next round must be attainable, measurable, and credible. Teams too often overpromise, assuming the bridge will lead to higher valuations. But if the next raise narrative is not demonstrably stronger, the bridge becomes a trap. Strong CFOs model multiple exit paths, building scenarios for revenue underperformance and flat or down rounds. When I reduced monthly burn from $800K to $200K for a SaaS company, scenario planning proved essential to maintaining optionality.

Communication with existing investors tests trust during bridge rounds. They are being asked for more capital without proportional progress. The CFO must earn this through stewardship: clear use of proceeds, crisp operating plans, transparent KPIs. Covenants and triggers require deep understanding. Many short-term notes include ratchets or liquidation preferences that distort the next round. The CFO must model cap table outcomes at flat or down rounds, preparing leadership for hard decisions.

Internally, teams must remain grounded. Bridge capital cannot reset urgency; it must reinforce it. Operational focus must narrow, discretionary spend must contract, and only initiatives moving metrics for the next raise survive. This is design, not austerity. A CFO navigating short-term raises must control morale, projecting confidence without delusion. Transparency without alarmism becomes the balance.

Finally, the CFO must plan for success. If the next round goes well, what structure will support the scale that follows? Capital is only as useful as the infrastructure it enables. The bridge is not the business model; it is the brief pause in which to prove one.

Conclusion

Capital is indifferent, but how a CFO wields it determines outcomes. Short-term capital requires clarity, design, and operational exactness. A bridge, poorly architected, leads only to the same side of the river, and in capital markets, standing still is not an option.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.