Executive Summary

The audit committee sits at a unique intersection of financial integrity, regulatory expectation, and strategic exposure. It is often cast as the disciplinarian including keeper of checklists, gatekeeper of disclosures, and custodian of financial controls. But this perception, while historically grounded, is increasingly limiting. Throughout my twenty-five years leading finance across cybersecurity, SaaS, manufacturing, logistics, and gaming, I have learned that in high-performing organizations, the audit committee has transcended its stereotype. It no longer merely ensures compliance. It becomes a credibility platform. It signals rigor to investors, consistency to regulators, and truth to executives. In moments of crisis, transformation, or growth, this credibility becomes the strategic ballast boards depend on. Yet many boards underutilize the audit committee’s potential. They tolerate narrow scopes. They frame the committee’s mission around accounting integrity alone. They relegate it to retrospective reviews of controls without leveraging it for proactive risk assessment or forward-looking financial scrutiny. This is a missed opportunity that organizations can no longer afford.

Reframing the Audit Committee

Reframing begins with redefining success.

The audit committee’s purpose is not to catch mistakes after the fact. It is to provide assurance that:

- Financial results reflect operational truth

- Disclosures align with risk reality

- Internal controls support resilience, not just compliance

- Emerging risks surface before they become headlines

When assurance is viewed as strategic, the committee becomes indispensable to decision-making, not an obstacle to it.

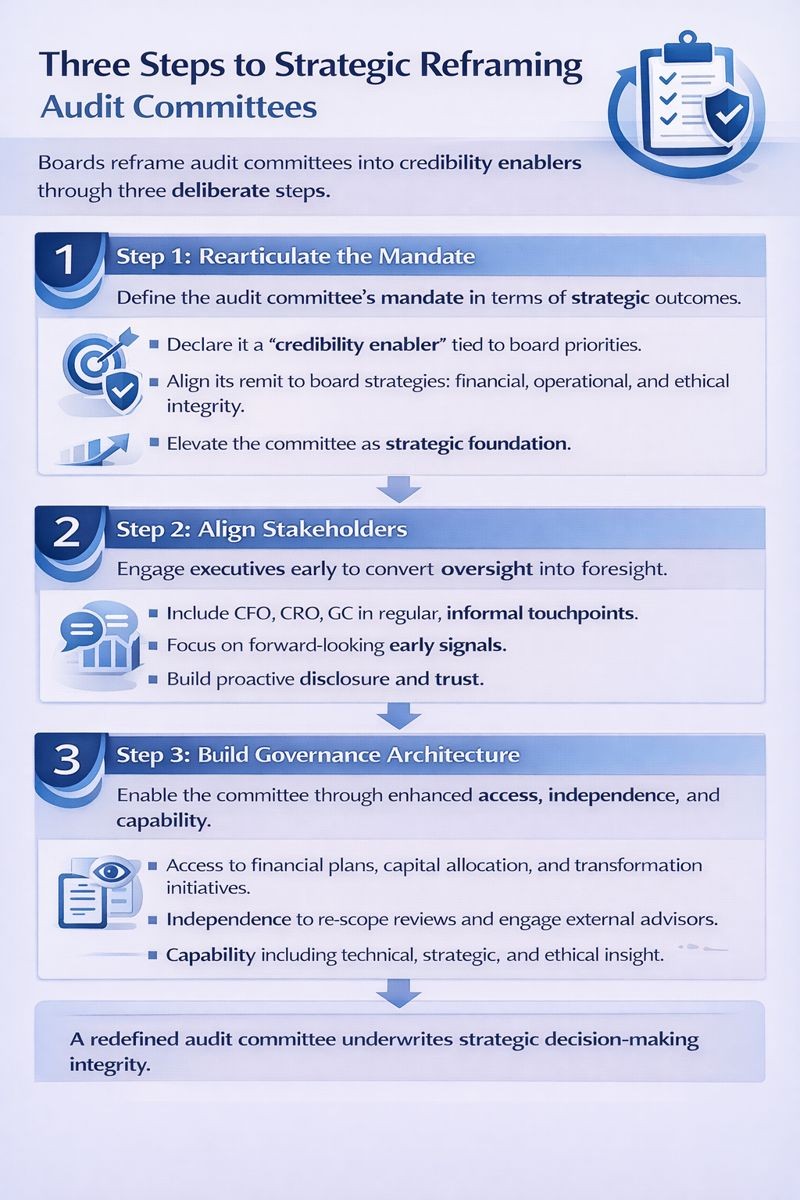

Three Steps to Strategic Reframing

Boards that re frame the audit committee take three deliberate steps.

Step 1: Rearticulate the Mandate

First, they rearticulate the mandate, not in legal terms but in strategic outcomes. They declare the audit committee as a credibility enabler. They align its remit to board priorities: this committee ensures the financial, operational, and ethical integrity that underwrites every strategic decision we make. This repositioning elevates the committee. It clarifies its role as a foundation, not a filter.

When I led board reporting at a gaming enterprise where I oversaw $100 million in acquisitions and post-merger integration, we established formal audit committee processes that extended beyond compliance. The audit committee charter explicitly defined dual roles: financial control assurance and strategic risk surfacing. Rather than reviewing only historical financial statements, the committee examined integration risk patterns, cross-border regulatory exposure, and post-acquisition control harmonization. This mandate elevated the committee from compliance reviewer to strategic partner in capital allocation decisions.

Step 2: Align Stakeholders

Audit committees fail when they are feared or ignored.

They succeed when they are engaged early.

CFOs, Chief Risk Officers, General Counsel, and Internal Audit leaders must see the committee as a thought partner. That requires proactive disclosure, not reactive defense. It requires informal touchpoints, not theatrical meetings.

One global financial services firm instituted quarterly pre-meetings between the audit chair, CFO, CRO, and General Counsel. These conversations focused on early signals, not finalized issues. By the time matters reached the formal agenda, discussions were substantive and aligned. That committee later helped the company avoid regulatory escalation by identifying reputational risk patterns early.

Trust converted oversight into foresight.

Step 3: Build Governance Architecture

The third step is governance architecture. Audit committees need access, independence, and capability.

Access: Full visibility into financial planning, capital allocation decisions, and major transformation initiatives.

Independence: Authority to question, re-scope reviews, and engage external advisors without constraint.

Capability: Both technical literacy and judgment fluency, directors who can parse complexity, not just check controls.

How the Audit Committee Evolves in Practice

| Traditional Role | Strategic Role | Key Shift | Impact |

| Retrospective control review | Proactive risk assessment | From audit findings to emerging risk signals | Early intervention before exposure becomes liability |

| Compliance gatekeeper | Credibility platform | From checklist verification to assurance provider | Investor confidence, regulatory trust |

| Isolated financial oversight | Integrated strategic partner | From committee silo to cross-functional connector | M&A insight, transformation oversight, ESG alignment |

| Management watchdog | Thought partner | From adversarial scrutiny to collaborative engagement | CFO/CRO proactive disclosure, early escalation |

| Audit findings focus | Forward-looking foresight | From historical misses to future blind spots | Strategic resilience, adaptive risk management |

Redesigning Committee Operations

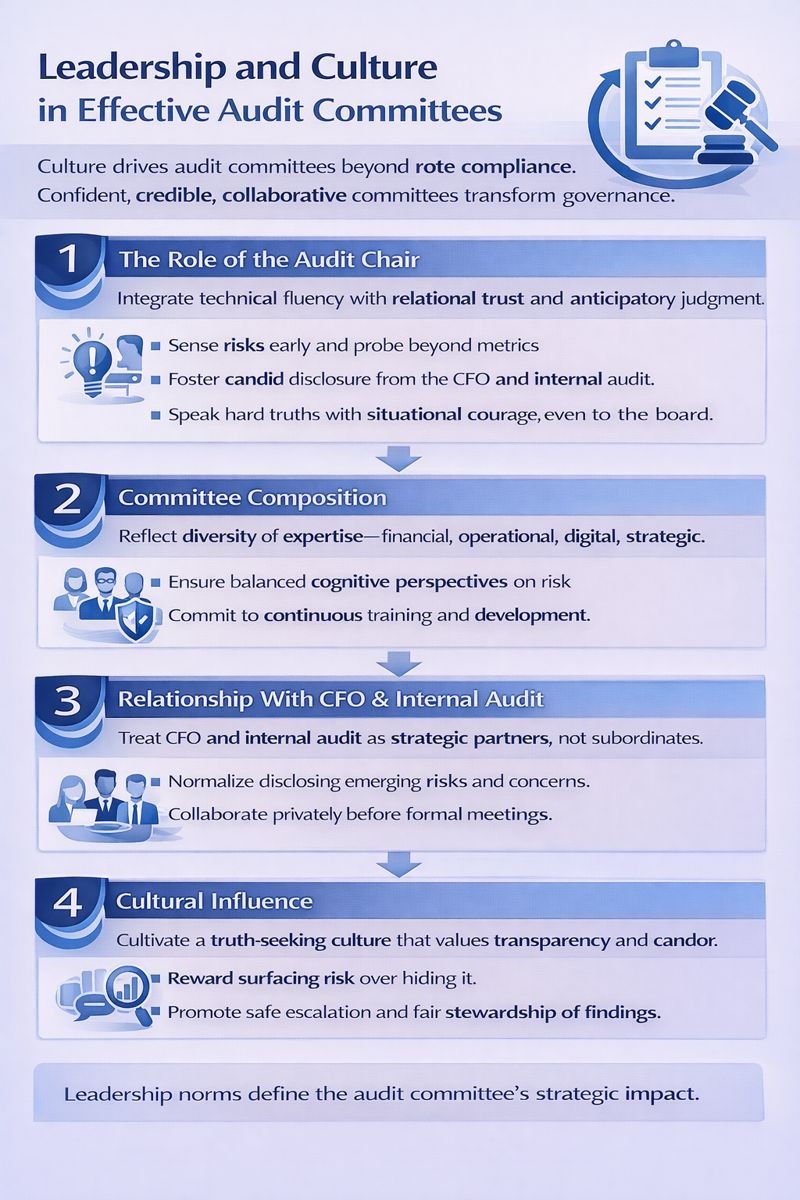

Architecture is not enough. Boards must also examine why audit committees are often miscast. The reasons are cultural. In many organizations, the committee inherits a reactive tone including waiting for auditors, questioning for compliance, and deferring to management. Its rhythm is dictated by reporting cycles, not strategic developments. Its agenda is shaped by checklist, not insight. To break this mold, boards must redesign how the committee operates.

Agenda Architecture

Start with agenda architecture. Strong committees reverse the order of discussion. They begin with emerging risk, not audit findings. They dedicate time to foresight including what is coming, not just what is behind. They integrate external signals including industry shifts, regulatory pressure, and investor concerns into every meeting. And they regularly ask: what is the risk we are not yet monitoring?

Consider a global logistics company that made this shift. The audit committee began each quarter with a strategic signal scan. Directors reviewed not just internal controls but macro indicators: commodity price shifts, sovereign risk indexes, ESG regulatory developments. One cycle revealed data localization laws emerging in several markets. That early insight led to a risk review which exposed data practices misaligned with pending regulation. Mitigation began preemptively. Months later, as competitors scrambled to comply, this company was already aligned. The audit committee had surfaced risk, not retroactively but before exposure turned to liability.

When I managed global finance for a $120 million logistics organization, the audit committee adopted forward-looking risk scanning. Rather than reviewing only past-quarter variances, we established quarterly strategic exposure reviews examining geopolitical risks to supply chains, fuel price volatility scenarios, and emerging labor regulations. When port labor disruptions threatened operations, the audit committee had already mapped contingency protocols and financial stress scenarios, enabling rapid board response without crisis escalation.

Meeting Rhythms and Deep Dives

Strong committees also redesign meeting rhythms. They reduce page volume. They increase synthesis. They use dashboards, not decks. They set aside time for unstructured dialogue. And they host regular deep dives into emerging themes: cyber-readiness, fraud modeling, whistleblower trends, and geopolitical overlays. These sessions are not academic. They inform board decisions, shift management priorities, and reshape enterprise assumptions.

Where Audit Committees Create Strategic Value

Financial oversight is only the starting point for the audit committee. To evolve into a strategic force, its insights must flow into the organization’s decision arteries including capital deployment, transformation efforts, risk frameworks, and ESG integration.

M&A and Capital Allocation

Decisions that carry financial or risk implications must be routed through the audit committee for targeted review. For example, mergers and acquisitions due diligence often includes legal, strategy, and finance committee reviews. Yet the audit committee can elevate the analysis by focusing on integration risks: systems alignment, financial control gaps, accounting harmonization, post-close governance, and contingent liabilities. When the committee examines these angles early, it surfaces risks before headlines. It injects accountability into execution plans, not after disclosure is required.

A logistics board once included the audit committee in its cross-border acquisition team. The committee reviewed workstream heat maps, liability buffers, and integration metrics. They flagged counterparty concentration and currency mismatch risks before the deal was signed. The mergers and acquisitions and board approvals came with disclaimers, not delays. When integration hiccups surfaced, the board acted quickly, not with surprise but with preparation.

Transformation Oversight

Major transformation programs including ERP implementations, digital migrations, and supply-chain redesign are fertile grounds for audit insight. These initiatives pose execution risk, cost overruns, complexity, and financial opacity. Rather than schedule these under optional updates, leading boards assign the audit committee a role in transformation oversight. They examine budgets, vendor selection, control design, and contingency planning. This creates early accountability and reduces downstream missteps.

One global consumer brand invited audit committee members into its ERP steering group. The committee’s input on reconciliation processes and cut-over readiness led to building in dual-controls and phased deployment, avoiding a costly go-live failure that occurred in a peer company.

When I improved month-end close from 17 days to under six days at a cybersecurity firm, the audit committee played an active oversight role. They reviewed process redesign plans, validated control framework changes, and monitored implementation milestones. Their involvement ensured that speed improvements did not compromise control integrity. The committee’s pre-approval of the transformation approach provided board confidence and enabled aggressive timeline commitments.

Risk Management Convergence

Risk management is another domain for interoperability. Audit committees often oversee risk frameworks alongside board risk committees. When audit identifies emerging risk signals including fraud openings, whistleblower trends, and cyber anomalies, these insights must converge with enterprise risk dashboards and strategic risk appetite discussions. Interlinking audit committees and risk oversight becomes necessary.

A financial institution endorsed this practice. When internal audit reported anomalous trading patterns, the audit chair joined the next risk committee meeting. Together, they recommended stronger guardrails and revised capital buffers. Their joint letter to the board escalated both financial and regulatory exposure. The board was informed before a headline broke.

ESG Governance Partnership

Audit committees can also partner on ESG governance. Environmental, social, and governance risk impacts financial statements from provisions to contingent liabilities to supply chain exposure. Audit committee-led collaboration with ESG committees ensures that sustainability ambitions are grounded in sound control frameworks and disclosure integrity. It adds credibility to claims.

A materials company faced carbon regulation uncertainty. The audit committee reviewed measurement methodologies, third-party assurance, and alignment with accounting provisions. Their involvement ensured that ESG narratives did not inadvertently misstate liabilities. When the board certified ESG performance, investors had context and trust.

Leadership and Culture

Governance is not mechanical. Even the most well-structured audit committee can underperform if human dynamics are misaligned. Trust, courage, curiosity, and judgment are the invisible threads that determine whether a committee is feared, ignored, or respected. The audit committee’s strategic potential is activated not by design alone but by behavior. And at the center of that behavior is leadership.

Conclusion

The audit committee is not just a compliance tool. It is a cultural force. It shows the enterprise what kind of truth the board expects. What kind of risk posture it respects. What kind of financial integrity it requires. In doing so, it anchors governance. It earns trust. It becomes a cornerstone, not of fear but of credibility. That is the opportunity. That is the responsibility. That is the transformation.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.