Executive Summary

One of the oldest maxims in business is this: capital is never free, and it is rarely patient. Especially in tight times, when markets wobble, interest rates bite, and cash burn becomes a four-letter word, every dollar spent carries weight and every dollar invested must sing. Capital expenditures, or CapEx, is where strategy meets commitment. You do not spend millions on infrastructure, systems, or equipment unless you believe in the long-term return. But in volatile or constrained markets, the margin for error shrinks. Throughout my twenty-five years leading finance across cybersecurity, SaaS, manufacturing, logistics, and gaming, I have learned that in difficult markets, CapEx discipline is not just a financial principle. It is a competitive advantage. For CFOs and operators alike, this moment demands a sharper pencil and a longer lens. Because operating expenses are the daily rent of doing business, variable, adjustable, and often reversible. But CapEx is different. When you commit to building a data center, purchasing equipment, or rolling out enterprise software, you place a bet. You lock in assumptions. You hard-code the future into today’s balance sheet.

CapEx Discipline in Constrained Markets

In strong markets, CapEx proposals are often justified by optimistic growth curves. In constrained markets, the question flips:

- What is essential?

- What is deferrable?

- What is simply hopeful?

Smart CapEx is not about spending less. It is about spending well—on infrastructure that creates resilience, efficiency, and leverage, not just additional capacity.

When I managed global finance for a $120 million logistics organization, we faced significant pressure to reduce costs amid market volatility. Rather than freezing all infrastructure investment, we prioritized CapEx ruthlessly based on payback and strategic alignment. We invested in route optimization technology and warehouse automation that reduced cost per unit by 22 percent while deferring non-critical facility upgrades.

The result was not austerity. It was advantage.

CapEx Prioritization Framework

This framework provides a systematic approach to evaluating capital expenditure requests during constrained periods. Each dimension includes evaluation criteria and decision thresholds that help CFOs separate essential investments from discretionary ones. The framework emphasizes payback timing, strategic alignment, and value creation across multiple functions.

| Evaluation Dimension | High Priority | Medium Priority | Low Priority / Defer |

| Strategic Alignment | Directly enables core strategy | Supports secondary objectives | Nice-to-have or speculative |

| Payback Period | <18 months | 18-36 months | >36 months |

| Cross-functional Value | Benefits 3+ functions | Benefits 1-2 functions | Single function only |

| Risk Profile | Modular, phased deployment | Some modularity possible | All-or-nothing commitment |

| Adoption Certainty | Clear user demand, proven need | Moderate adoption risk | Uncertain adoption or change management heavy |

| Alternative Options | No viable alternatives | Partial alternatives exist | Multiple alternatives available |

| Cash Flow Impact | Improves working capital or margin | Neutral cash flow impact | Delays cash generation |

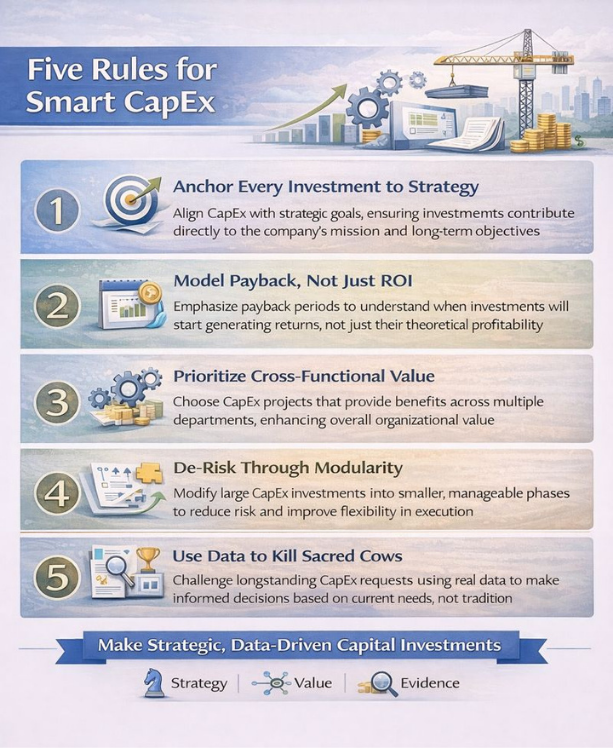

Five Rules for Smart CapEx

1. Anchor Every Investment to Strategy

If your strategy is to move upmarket, does this CapEx help you deliver enterprise-grade service? If your strategy is margin expansion, does it lower unit cost or improve gross margin? Too often, teams pitch CapEx initiatives in isolation. Capital budgeting must sit inside strategic context, not parallel to it. Every CapEx line item should pass a first-principles test. If you did not already own it, would you buy it now?

2. Model Payback, Not Just ROI

ROI calculations are notoriously pliable. With the right assumptions, any CapEx can look like a winner. But what separates sound investments from hopeful ones is payback timing. A 40 percent internal rate of return on a five-year payback might look great in Excel. But in tight times, cash flow timing matters more than theoretical returns. Smart CFOs ask when will this investment start paying for itself and what are the leading indicators that show we are on track. The faster the payback, the more flexible the business remains.

When I reduced monthly burn from $800,000 to $200,000 at an email marketing SaaS company, we evaluated all pending CapEx requests using payback analysis. Infrastructure investments with payback periods under 12 months were approved. Those with longer horizons were deferred or restructured into smaller pilots.

3. Prioritize Cross-Functional Value

The best CapEx delivers value to more than one team. A warehouse upgrade might reduce logistics costs and improve customer experience. A software platform might streamline finance workflows and unlock sales reporting. In lean environments, prioritize investments that break silos and compound utility. If only one department is cheering, it might not be time to spend.

4. De-Risk Through Modularity

One of the reasons CapEx is scary in downturns is its lumpiness. A $5 million commitment feels immovable. But smart infrastructure bets can often be modularized. Instead of one big spend, structure investments in phases with defined gates. Want to automate your manufacturing line? Start with one cell. Want to deploy a new ERP? Roll it out in one region. Use the results of each phase to decide whether to accelerate or pause. This options-based approach to CapEx mirrors the way investors think about risk.

5. Use Data to Kill Sacred Cows

Some CapEx requests survive only because they have been repeated for years. But in tight times, the burden of proof flips. The assumption is no longer why not. It is why now. Bring data to the conversation. What is the utilization rate? What is the actual downtime cost? What alternatives exist including cloud, outsourcing, or partnerships? The best finance leaders are unafraid to challenge tradition with facts. They do not just protect the bottom line. They protect future flexibility.

Digital Infrastructure: The Modern CapEx Frontier

Today, one of the most underappreciated areas of CapEx is digital infrastructure. For decades, CapEx meant factories, trucks, or buildings. But increasingly, the real enablers of scale and efficiency are in data, software, and automation. Consider a data warehouse that centralizes customer and operational data for better forecasting, a pricing engine that allows for dynamic margin-optimized quoting, a compliance automation platform that reduces audit costs and risks, or a low-code workflow engine that cuts process time in half across functions.

When I built enterprise KPI frameworks using MicroStrategy, Domo, and Power BI tracking bookings, utilization, backlog, annual recurring revenue, pipeline health, customer margin, and retention, this was CapEx in digital infrastructure. The platforms required upfront investment but enabled real-time decision-making that compounded value across the organization. The key is to treat digital CapEx with the same rigor: assess payback, define metrics, phase deployment, and review adoption. A shiny platform that no one uses is just expense with a longer tail.

Conclusion

CapEx, like most things in business, is a reflection of discipline. It is easy to spend when capital is cheap and growth is automatic. It is harder to invest wisely when both are constrained. But that is exactly when your choices matter most. Smart CapEx is the ultimate test of confidence, not in forecasts but in the future. If you are going to spend capital, make sure it moves the needle, make sure it buys not just assets but agility, and make sure it is tied to the business you are building, not the one you built yesterday. And if you get it right, tight times will not shrink your advantage. They will magnify it.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.