Executive Summary

Business planning has always represented more than numerical prediction: it constitutes a ritual of coordination through which organizations impose architecture upon time and convert uncertainty into actionable conviction. Traditional forecasting, despite its flaws, provided stable epistemic narrative and moral framework for resource commitment. However, modern volatility and complexity have strained these deterministic systems beyond their design capacity. Artificial intelligence introduces unprecedented pattern detection capabilities, processing high-dimensional data to identify signals invisible to human analysis. Yet AI forecasts speak in correlations rather than causality, deliver probability distributions rather than definitive answers, and require human interpretation to convert mathematical output into strategic narrative. Success demands hybrid planning systems integrating three layers: predictive computation where machine learning generates time-series projections with confidence intervals, driver-based causality modeling where human planners assert economic logic and structural relationships, and strategic narrative encoding where leadership imprints forward-looking intent onto probabilistic frameworks. This transformation extends beyond technical implementation to cultural evolution, requiring organizations to abandon the fiction of certainty, embrace probabilistic thinking, and develop new rituals treating forecasts as fluid hypotheses continuously refined rather than static declarations. The CFO evolves from gatekeeper of compliance to architect of intelligent trust, stewarding not just forecast accuracy but institutional capacity for coordinated conviction under uncertainty.

The Forecast as Ritual: Why Planning Has Always Been More Than Numbers

To plan is to pretend. And yet in that pretense lies extraordinary expression of human intent: the attempt to coordinate action in a world whose future we do not control. A business plan, read plainly, is a forecasted income statement surrounded by operating assumptions. But to those who understand its deeper function, the plan represents far more: a gesture of collective alignment, a time-bound epistemic agreement that this is how the firm will behave if the world proceeds according to this imagined shape.

At the center lie the numbers, but also the theater of commitment they summon. The CFO does not forecast merely to estimate. She forecasts to declare directional truth, becoming in that moment a secular officiant, presiding over the conversion of stochastic possibility into behavioral resolve. That is the first thing AI cannot replicate: the spiritual function of the forecast.

The Moral Gravity of Traditional Planning

Business planning, even before computational models, was always a mix of epistemology, sociology, and psychology. Forecasts are not neutral projections but narratives of confidence and discipline, often written less to predict the future than to anchor the present. They provide the illusion of certainty not because certainty exists but because certainty is required for resource commitment. Headcount does not wait. Factories are not built on hedged possibilities. Strategy does not function on open-ended hypothesis.

Planning systems evolved not merely to model probable futures but to create emotional consensus around actionable futures. They allowed firms to commit, to enter the world with posture. As soon as a forecast became the basis for budget, hiring, investment, or public guidance, it ceased being a guess and became a moral boundary. To miss plan was not merely to be wrong but to fall short of declared intent.

The Strain of Modern Complexity

This system, for all its elegance, has long been straining under the weight of modern volatility. Supply chains no longer obey seasonal logic. Markets shift faster than budget cycles. Consumer demand, once explainable via lagged indicators, now responds to variables that feel almost quantum: social media virality, geopolitical tremors, climate anxieties, sentiment swings measured in real-time engagement.

In systems theory, a complex system is one in which the interaction between components generates emergent behavior. The whole is not the sum of the parts but something more intricate, more unpredictable, and less tractable to linear modeling. The modern enterprise is a complex adaptive system where inputs ripple, feedback loops abound, and second-order effects cascade. Traditional planning models, rooted in linear cause-and-effect mechanics, struggle to breathe in such ecosystems.

Yet organizations still need to plan. They need forecasts not because those forecasts will be right but because action requires a shape to lean into. The sales team needs a target. The marketing team needs a funnel. The investor community demands guidance. The organization needs a cognitive framework for action, even if that framework is an approximation.

The Machine’s Gaze: What AI Sees and What It Misses

There is a certain shimmer to the promise of artificial intelligence, a seduction that lies not just in its output but in the illusion that pattern equals truth. The machine’s vision is sharp, exquisitely tuned to signal, to noise, to repetition, but it lacks context and it lacks cause. In that, it sees everything and understands almost nothing.

The Paradox of AI Forecasting

AI operates not by understanding the world but by compressing experience into probabilistic logic. It looks not for why things happen but for how often patterns occur near one another, using this statistical closeness to estimate future proximity. This is not forecasting in the classical sense. It is data-driven inference, optimized through recursive learning, evaluated against historical closeness to truth.

And here lies the paradox: AI is at once better than us and less capable than us. It will outperform any human forecaster in detecting nonlinearities in revenue behavior, customer churn, anomaly detection in transactional flows, seasonality of demand, and micro-shifts in supply pricing. It ingests volumes of data the human brain cannot hold and cross-references patterns across domains we would never imagine were connected.

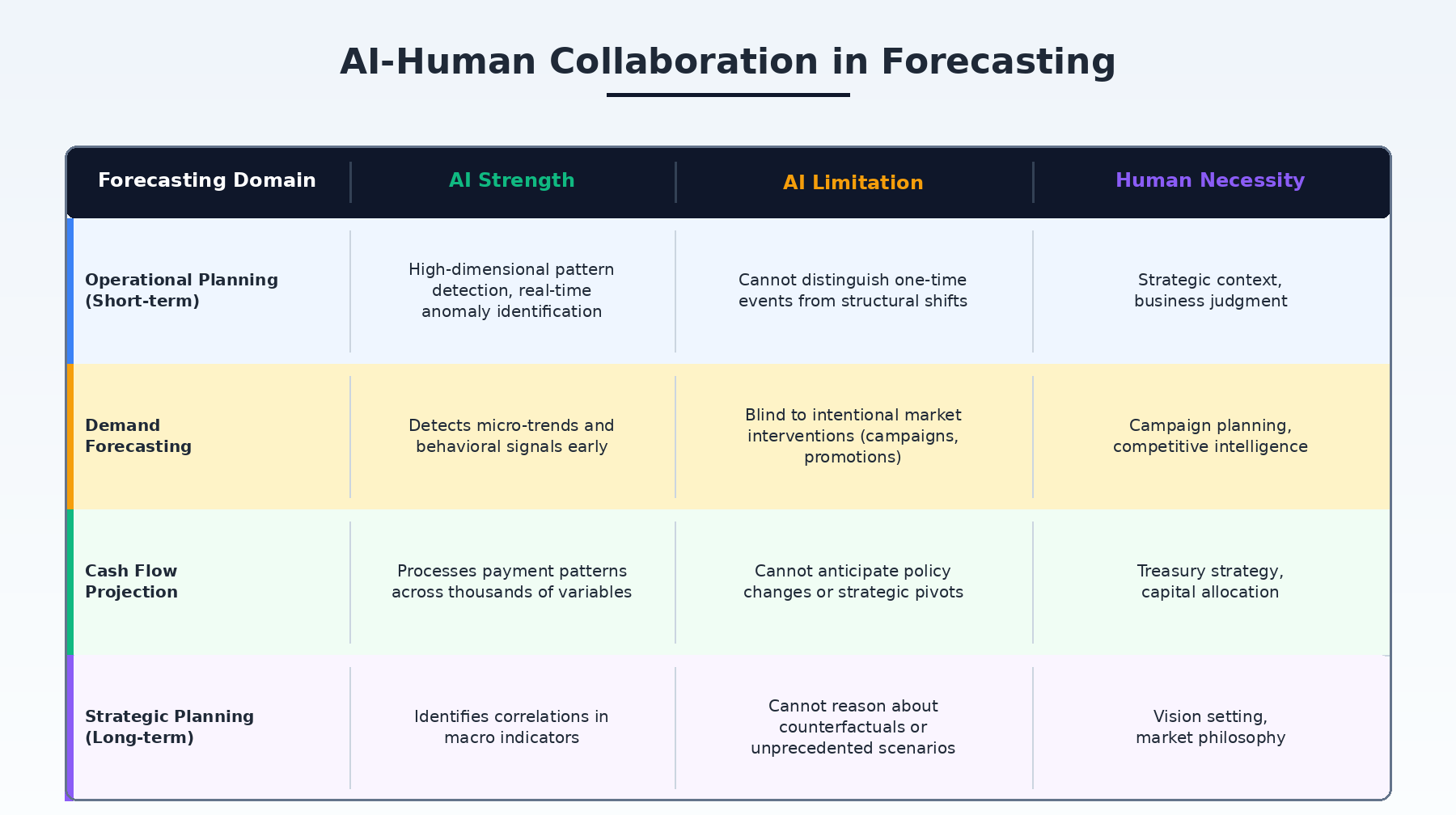

Where AI Excels and Where It Fails

AI excels at detecting signal amidst chaos using methods like gradient boosting, random forests, and neural embeddings. It pulls meaning from high-dimensional data with breathtaking efficiency. In operational forecasting where near-term precision is paramount, AI thrives. Inventory demand planning, cash collection forecasting, unit economic modeling can all benefit immensely. These are domains of short feedback loops, consistent structure, and high data quality.

But venture too far from those stable grounds, and the foundation cracks. In domains of strategic planning including long-horizon forecast modeling, market entry timing, and capital allocation, the machine becomes increasingly uncertain. Not because it lacks data but because it lacks philosophy. It cannot reason about counterfactuals. It cannot hold ambiguity. It cannot say we have never seen this before and so we must think differently. It can only say this looks familiar and thus I will treat it as precedent.

The Problem of Opacity

Many AI models, especially deep neural networks, are functionally black boxes. They deliver forecasts with confidence scores but not explanations. For a CFO tasked with defending every assumption, explaining every variance, and justifying every pivot, this is intolerable. A forecast that cannot be interrogated is a forecast that cannot be trusted.

When an AI model forecasts a seventeen percent drop in renewal rates, the board will ask: Why? Is it pricing? Product? Macroeconomic softness? Competitive pressure? And if the answer is the model detected a shift in latent customer cluster, the room will fall into polite silence and quiet disbelief. The model may be right. But its truth must be convertible into human narrative.

Designing the Hybrid Planning Model

A planning system is not merely a mechanism for forecasting but a language the enterprise uses to make commitments under uncertainty. To alter the planning system is not to upgrade a workflow but to reshape the very logic of how the firm imagines the future. The CFO must design a model that does not discard the moral architecture of classical forecasting but augments it with the pattern-detection intelligence of machines.

The Three-Layer Architecture

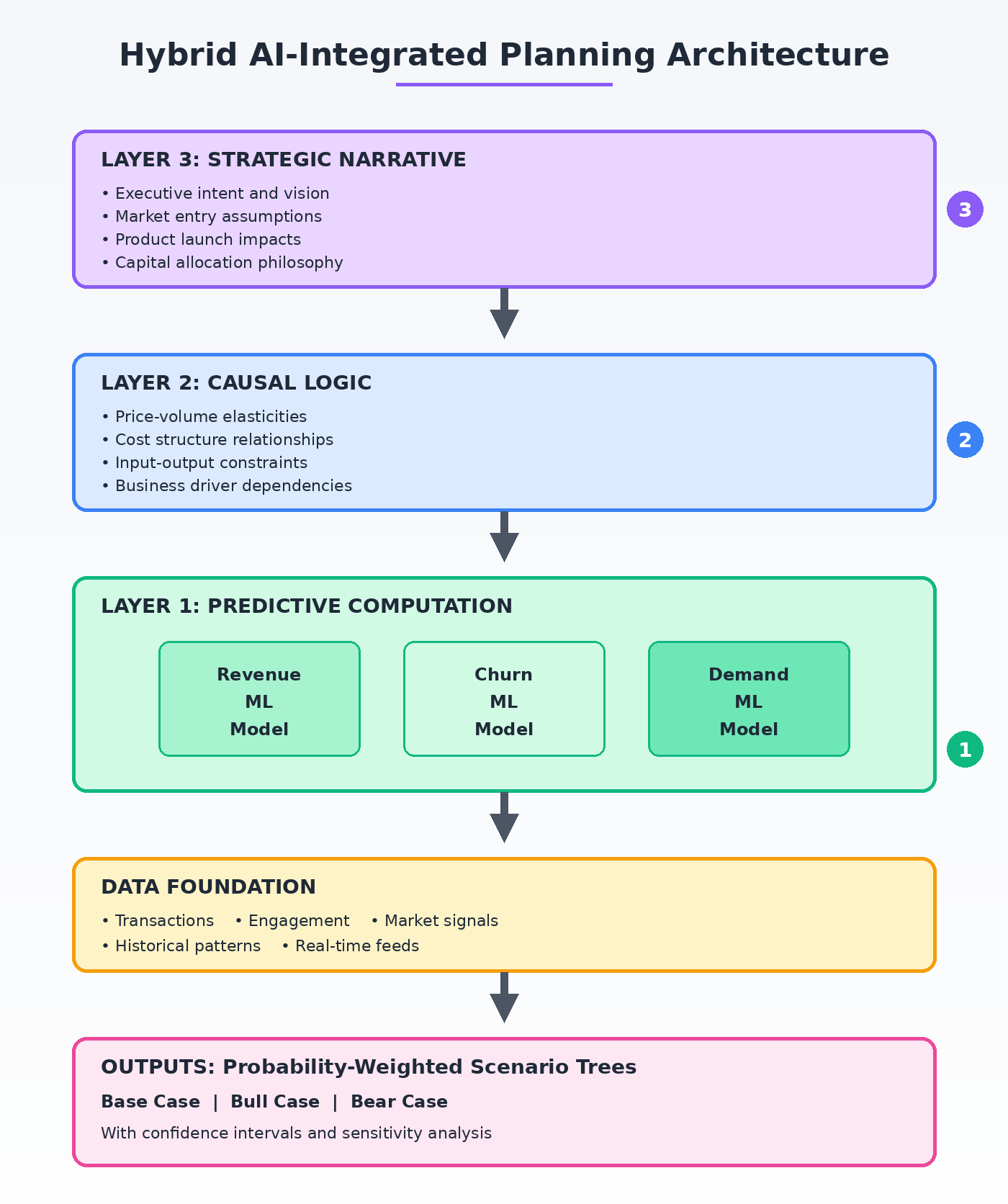

The hybrid model divides forecasting into three interwoven layers:

Layer 1: Predictive Computation Machine learning models ingest historical and real-time data including transactions, sales velocity, digital engagement, and macroeconomic indicators to generate time-series projections with confidence intervals. These models can run daily or even hourly, offering micro-adjustments that traditional systems could never deliver.

Layer 2: Driver-Based Causality Modeling Human planners assert logic into the system through elasticities, price-volume relationships, input-output constraints, and margin stack dynamics. In this layer, we specify why things should move together, not just how they have moved historically. This preserves economic coherence and tells the model which signals matter, which do not, and which are linked versus orthogonal.

Layer 3: Strategic Narrative Encoding The CFO injects intent by adjusting growth assumptions based on new product launches, limiting spend projections in advance of cost discipline initiatives, or modeling alternate realities for capital market stress. This layer is where human leadership imprints its forward-looking posture onto a probabilistic chassis. Without this layer, the model is reactive, never aspirational.

Practical Implementation Example

Consider a CFO overseeing a consumer subscription business. Traditional planning would forecast churn using historical rates adjusted for seasonality and recent trend. But the hybrid model does more:

- The AI component ingests behavioral data including login frequency, feature usage, and payment anomalies, detecting rising churn risk among a customer segment not yet showing cancellation

- The causal layer understands that churn increases when NPS drops below thirty and product uptime falls below ninety-eight percent, incorporating these constraints to limit false positives

- The narrative layer knows that a new loyalty program launches next quarter and adjusts forward churn projections downward to reflect anticipated retention gains

The result is a forecast that sees earlier, reasons better, and aligns with what the firm actually plans to do. This is not magic but forecasting as system architecture.

Cultural Transformation: Forecasting as Organizational Covenant

Every organization is a story it tells itself about how the future unfolds. When that grammar changes, when the forecast becomes probabilistic rather than deterministic, adaptive rather than fixed, AI-augmented rather than manager-authored, the entire culture of planning must be rewritten.

Abandoning the Fiction of Certainty

This rewriting begins with a painful confession: that certainty has always been a comforting fiction. For decades, we built annual plans that read as declarations, projecting revenue to the thousandth dollar as if rounding error were moral failure. But those numbers were never truths. They were rituals of unity saying we agree to act as if this were knowable.

AI breaks that paradigm open, revealing how little we knew and how much we can now detect. But it offers no comfort. Its predictions are fluid, its assumptions hard to trace, its output probabilistic. It returns not one forecast but a distribution of futures, forcing the enterprise to confront a truth long hidden: we are making bets, not marching certainties.

New Planning Rituals

The culture must shift in language and emotional contract:

The Evolved CFO Role

The CFO becomes curator of expectation entropy, managing not just accuracy but belief coherence. She must speak fluently to board members who still crave certainty, to managers who seek guidance, and to data scientists who traffic in probabilistic nuance. She must translate signal into story, risk into action, and algorithmic suggestion into institutional conviction.

This demands new capabilities:

- Stewarding forecast credibility under evolving complexity

- Managing distributions of futures while acting with clarity in the present

- Building institutional capacity for intelligent doubt

- Treating forecast governance as deliberate interpretation discipline

Conclusion

Reimagining business planning through AI integration represents not merely technological upgrade but fundamental reconception of how organizations convert uncertainty into actionable conviction. The hybrid model succeeds not by replacing human judgment with machine precision but by creating architecture where both operate in complementary concert. AI provides pattern detection at scales and speeds beyond human capability, surfacing early signals and cross-referencing dimensions we would never connect. Human judgment provides causal reasoning, strategic context, and narrative coherence that converts correlation into actionable truth. The cultural transformation proves as critical as technical implementation: organizations must abandon the comforting fiction of deterministic certainty, embrace probabilistic thinking as maturity rather than weakness, and develop planning rituals treating forecasts as continuously refined hypotheses rather than static declarations. The CFO’s role evolves from defending single-point estimates to stewarding institutional capacity for coordinated conviction under uncertainty, designing systems where machine inference and human intent sharpen each other. In this new covenant, forecasting becomes not the art of being correct but the discipline of remaining adaptively aligned to emergent reality while maintaining strategic coherence. AI will not replace the CFO but will demand more from her: the wisdom to interpret machine outputs through strategic lens, the courage to update priors when signals demand it, and the leadership to guide organizations through probability fields toward futures worth pursuing.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.