Executive Summary

An initial public offering is often described as a capital event. In reality, it is something far more consequential. It is a structural transformation. A company that was once accountable primarily to founders and private investors becomes accountable to markets, regulators, analysts, and an unforgiving public record.

In that transformation, no role carries greater responsibility than the Chief Financial Officer.

Over the past twenty five years leading finance organizations across cybersecurity, SaaS, manufacturing, logistics, and gaming, I have seen a consistent pattern. Companies that struggle after going public rarely fail because of market conditions. They struggle because the discipline required of a public company was never fully embedded before the listing.

Going public is not simply about meeting listing requirements. It is a test of whether the organization can operate with transparency, predictability, and credibility under continuous scrutiny. The CFO is the steward of that readiness. Not as a transactional executor, but as the architect of trust between the company and the capital markets.

What follows is not a procedural checklist. It is a practical framework for CFOs preparing their organizations, and themselves, for life as a public company.

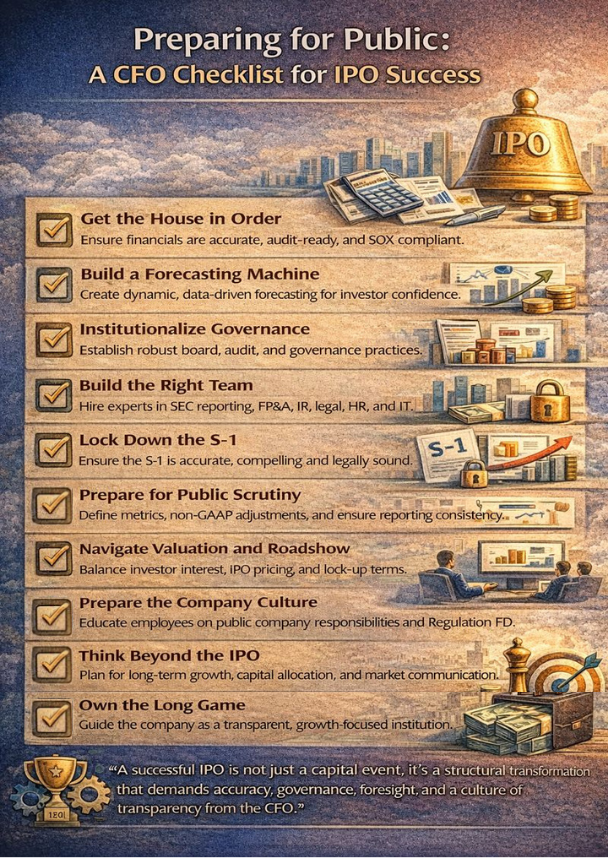

The IPO Readiness Checklist

1. Get the House in Order

First, the numbers must be pristine. If you are still closing the books 30 days after period-end, that will not fly. You need fast, accurate, auditable reporting because quarterly earnings wait for no one. Your general ledger must be clean. Your revenue recognition policies should be airtight, especially in SaaS or contract-heavy models. Controls must be documented and enforced. SOX compliance is not optional. It is mandatory.

This is not just about audit readiness. It is about operational maturity. If finance still runs on duct tape and Excel, you are not IPO-ready. When I improved month-end close from 17 days to under six days at a cybersecurity firm, we implemented automated variance analysis, exception reporting, and comprehensive audit trails. This level of operational discipline is table stakes for public companies. Upgrade the systems, tighten the reconciliations, and automate wherever you can. The SEC will not care how charming your narrative is if your numbers do not tie out.

2. Build a Forecasting Machine

Public investors care deeply about predictability. They want to know not only what happened but what is next and why. That means your forecasting needs to be dynamic, data-driven, and disciplined. Rolling forecasts are essential. So are scenario models. Can you confidently answer what happens to cash flow if sales slip 10 percent? What is the impact of a hiring freeze? How does seasonality affect gross margin?

When I rebuilt GAAP and IFRS financials for a high-growth SaaS company and designed cohort analysis frameworks, we developed scenario-based forecasting with explicit probability weights. We could model optimistic, baseline, and pessimistic scenarios with different revenue, margin, and cash flow implications. This capability became critical during investor diligence. The best CFOs treat forecasting as a strategic weapon. They model the business with precision. They pressure-test assumptions. And they never offer guidance they cannot stand behind. Because missing guidance as a public company is not just embarrassing. It is value-destructive.

3. Institutionalize Governance

As a private company, you may get away with informal board meetings and founder-led decisions. That ends here. You need a board with independent directors, proper committees including audit, compensation, and nominating, and real charters. Your audit committee needs to be chaired by someone with financial expertise because once you are public, the PCAOB does not grade on a curve.

The CFO is expected to be deeply engaged with the board. That means briefing directors on financial performance, managing audit relationships, and preparing for earnings calls. When I led board reporting at a gaming enterprise where I oversaw $100 million in acquisitions and post-merger integration, we established formal audit committee processes, quarterly compliance reviews, and structured board reporting calendars. Governance is not a box to check. It is the foundation of trust with the Street.

4. Build the Right Team

An IPO stretches every part of the finance function. You need accounting professionals who can handle SEC reporting, financial planning and analysis leaders who understand market dynamics, and an investor relations lead who can navigate earnings scripts and investor Q&A. But you also need strength beyond finance. Legal needs to understand public disclosures. HR must prep for equity plan revisions and executive compensation scrutiny. IT must be SOX-ready. Communications must be prepared for media attention. The CFO becomes a conductor, ensuring every function plays in harmony.

When I built enterprise KPI frameworks using MicroStrategy, Domo, and Power BI tracking bookings, utilization, backlog, annual recurring revenue, pipeline health, customer margin, and retention, we prepared finance teams to explain these metrics to public market investors. Each metric required clear definitions, consistent calculation methodologies, and defensible reconciliations to GAAP measures.

5. Lock Down the S-1

The S-1 is your company’s first impression to the world. It is a legal document but also a narrative. The numbers must be accurate, yes, but the story must resonate. What problem do you solve? How big is your market? What is your moat? What risks are you candid about? The CFO works hand-in-glove with counsel, auditors, and bankers to ensure the S-1 is not just compliant but compelling.

Every line in the management discussion and analysis matters. Every risk factor must be real. This is not the place to spin. It is the place to anchor credibility. And remember: once you say it in the S-1, you own it forever. The SEC reads every word. So will investors. So will your competitors. Say what you mean and mean what you say.

6. Prepare for Public Scrutiny

Once public, your metrics are everyone’s business. That means you must define them before the IPO. What does ARR mean in your business? How do you calculate net retention? What adjustments do you make to EBITDA? Your non-GAAP reconciliations must be defensible. Your KPIs must be consistent. The CFO sets this discipline. Earnings calls are not improv sessions. Each metric must be explainable, repeatable, and tied to strategy. The Street does not like surprises. They respect transparency, consistency, and competence. That is the CFO’s job.

7. Navigate Valuation and Roadshow

Working with your investment bankers, you will land on a price range. But price is not the only goal. You want the right investors, long-term holders, not just day-one flippers. The roadshow is your chance to pitch not just the stock but the story. The CFO becomes a central voice here. You must be able to articulate the business model, defend the numbers, and answer sharp questions with grace. What drives gross margin expansion? How defensible is your customer acquisition cost? When do you turn profitable? You are not just selling equity. You are selling confidence.

And do not forget secondary liquidity. Founders, early employees, and investors will want to understand when and how they can sell. Lockups must be negotiated carefully. Too much liquidity too soon can crash the stock. Too little can create resentment. The CFO must balance this act with diplomacy and data.

8. Prepare the Company Culture

Going public affects how people work. Suddenly, information becomes material. Disclosures must be tightly controlled. Teams must be trained on Regulation FD. Watercooler conversations can become liabilities. The company must mature but not ossify. The CFO, often in partnership with the CEO, helps set the tone. Transparency with employees is vital, but so is discretion. You must educate without creating fear. You must prepare without paralyzing. And most importantly, you must maintain the soul of the company while introducing the rigor of the public markets.

9. Think Beyond the IPO

The IPO is not the finish line. It is the starting gate. Once public, you will be judged every quarter. Can you hit your numbers? Can you tell your story? Can you manage expectations? The CFO becomes a marathoner. Investor relations, capital markets, earnings preparation, investor outreach, these all become part of your rhythm. Liquidity brings options but also pressure. Will you use the cash for acquisitions? Buybacks? Research and development acceleration? The market will demand clarity. And the CFO will be the one they ask.

10. Own the Long Game

In the end, going public is about building a durable institution. One that can access capital, attract talent, and stand the test of scrutiny. The CFO must operate not just as a financial steward but as a strategic architect. Do you have the capital structure to support growth? Are your incentives aligned with long-term value creation? Can you guide the company through market cycles, activist investors, and regulatory shifts?

My certifications as a CPA, CMA, and CIA emphasize the technical rigor required for public company finance. But what separates successful public company CFOs is not just technical competence. It is the ability to balance transparency with strategy, to manage expectations with integrity, and to build trust with the capital markets while maintaining focus on long-term value creation.

Conclusion

Going public is a transformation that tests every dimension of the CFO’s capabilities. It requires operational excellence, strategic thinking, governance discipline, and communication mastery. The companies that succeed are those where the CFO treats IPO readiness not as a checklist to complete but as a culture to build, one that values transparency, rewards predictability, and demonstrates the maturity the public markets demand.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.