Executive Summary

The Quote-to-Cash process functions as the organizational nervous system, transmitting either friction or flow throughout the enterprise. Drawing from three decades of global finance leadership, this analysis reframes QTC not as a linear pathway but as strategic infrastructure that shapes customer experience and reveals organizational maturity. Friction in QTC stems from misaligned time horizons: sales optimizes for quarterly results, finance for audit compliance, legal for risk mitigation. Without shared orchestration, these priorities create entropy that erodes trust. The solution requires systemic thinking, treating QTC as a learning system that interprets signals and adapts continuously. When designed with flow ownership, metadata intelligence, and cross-functional transparency, QTC becomes the front line of trust where brand promise meets operational integrity. This is where financial leadership transcends managing numbers to orchestrating systems that generate sustainable value.

From Quote to Cash: Reducing Friction in Customer Experience

Mapping the Terrain of Revenue Flow

Early in my career, invoices that refused to reconcile revealed deeper truth: misalignment between customer expectations and internal coordination. This experience across financial operations spanning Singapore to São Paulo, Stockholm to Sydney, shaped my understanding of Quote-to-Cash as organizational nervous system. Training in systems theory and information economics revealed one unifying challenge: aligning internal control with customer velocity.

The modern revenue process functions as multidimensional negotiation from commercial intent through retention, encompassing pricing, contracting, fulfillment, billing, and renewal. At each point, complexity accumulates. Legal clauses mutate, tax codes intrude, approval matrices thicken, and enterprise systems surface competing truths. Left unmanaged, complexity hardens into friction that silently kills growth.

Why Friction Persists and Why It Matters

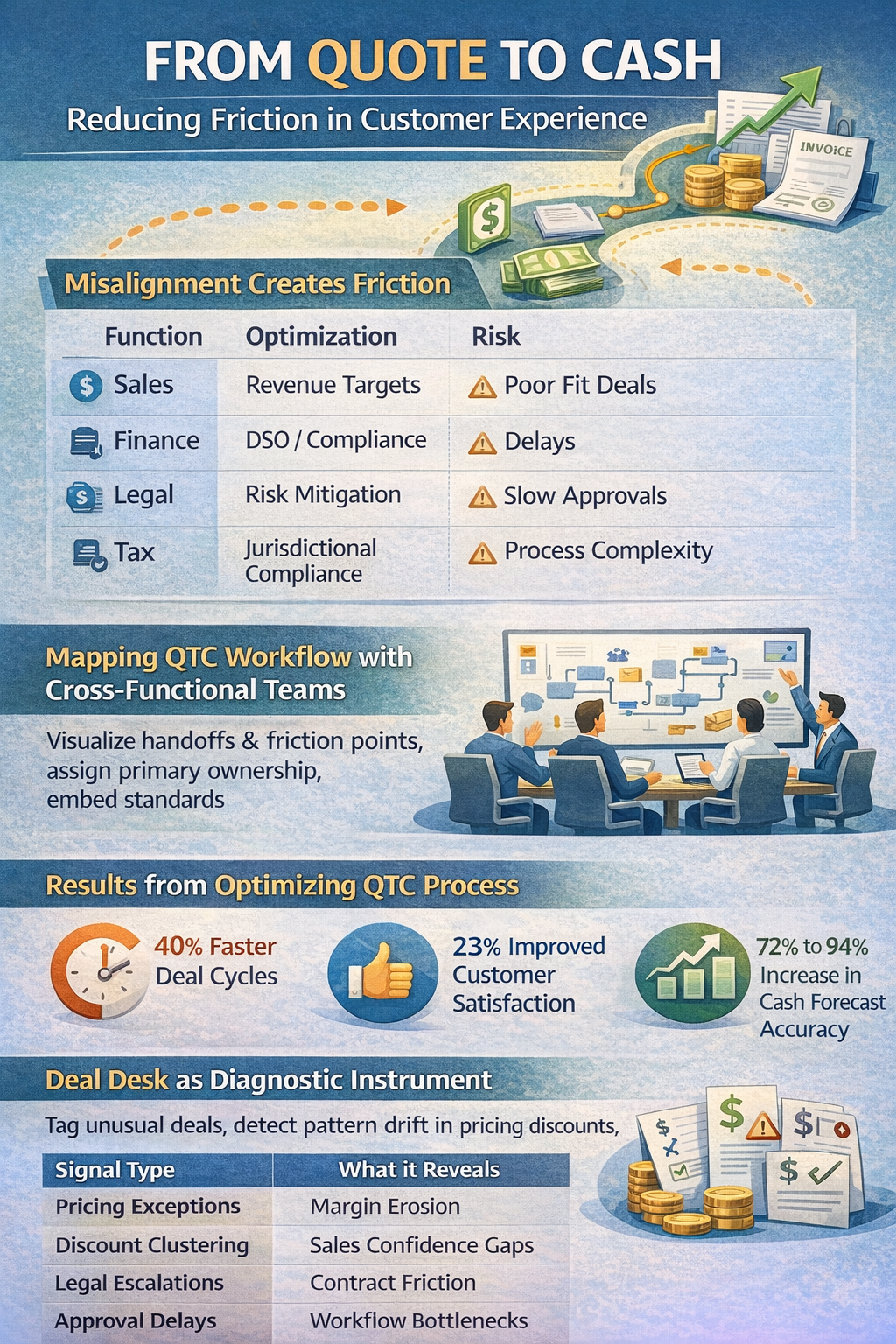

Friction in QTC rarely results from incompetence but from mismatched time horizons across functions:

| Function | Primary Optimization | Time Horizon | Risk if Unchecked |

| Sales | Revenue targets | Quarterly | Unsustainable discounting, poor fit deals |

| Finance | Audit compliance, DSO | Annual cycles | Delays, excessive controls |

| Legal | Risk mitigation | Contract lifetime | Over-engineered terms, slow approvals |

| Tax | Jurisdictional compliance | Regulatory cycles | Process complexity, geographic friction |

None of these priorities are incorrect. However, absent a shared design language and orchestrated rhythm, these optimizations pull in different directions. The result is a process that satisfies no one and frustrates everyone.

In one transformation, elapsed time from quote acceptance to invoice issuance averaged eighteen days from lack of orchestration, not individual failures. Legal re-reviewed approved terms. Sales used disconnected templates. Billing waited for metadata that never arrived structured.

Collaborative mapping with cross-functional teams charted actual workflow, revealing two dozen handoffs, shadow systems, and absent feedback mechanisms. We rebuilt around flow ownership, assigning primary owners for each journey segment responsible for velocity and integrity. We introduced metadata standards, eliminated redundant checkpoints, and embedded conditional logic into configure-price-quote systems. Quarterly reviews examined exceptions, measured throughput, and adjusted logic.

Results across three dimensions:

- Velocity: Deal cycles reduced 40 percent (eighteen to eleven days)

- Quality: Customer satisfaction improved 23 percentage points

- Predictability: Cash forecasting accuracy increased from 72 to 94 percent

Systemic Thinking, Not Procedural Tweaks

Many executives approach QTC like plumbing: tighten valves, add automation, hope pressure equalizes. Real leverage lies in how systems learn from behavior.

Bundled service-plus-software deals exhibited higher billing disputes. Rather than tweaking billing logic, we looked upstream. Tagging SKUs with metadata and running regression analysis revealed mismatched service timelines and revenue recognition assumptions. The issue originated in sales packaging and legal translation. We redesigned bundling guidelines and embedded cross-functional reviews for hybrid deals.

Every QTC data point functions as a signal. Systems must hear signals and translate them into adaptive learning, treating operations as dynamic cognition, not static compliance.

The Deal Desk as the Tuning Fork of Revenue

Deal desks are often mistaken for bureaucratic overhead. However, in well-designed revenue systems, they serve as diagnostic instruments detecting pattern drift in pricing, discounts, legal clauses, and product-market fit before data makes issues visible.

Deal Desk as Diagnostic Instrument

| Signal Type | What It Reveals | Response |

| Pricing exceptions | Margin erosion, competitive pressure | Pricing redesign |

| Discount clustering | Sales confidence gaps | Training, positioning refinement |

| Legal escalations | Contract friction, compliance gaps | Template revision |

| Approval delays | Workflow bottlenecks | Process simplification |

In one global rollout, we empowered deal desks to tag exceptions with reason codes feeding executive dashboards. When European legal escalations spiked around indemnity language, we rewrote templates rather than escalating deals. Escalation volume fell and close rates rose within weeks. Deal desks positioned as signal interpreters enable agility without sacrificing governance.

Quote-to-Cash as Customer Experience Infrastructure

Customer experience is often siloed as post-sale function. However, QTC shapes earliest impressions where brand promise meets operational integrity. Late quotes, lengthy approvals, or mismatched billing create dissonance regardless of product quality.

QTC must reinforce positioning. Quote templates extend brand identity. Contract language matches trust tone. Onboarding feels like purchase continuation, not reset.

When customers accepted quotes, we engineered three immediate responses:

- Onboarding activation: Workflows triggered within minutes

- Context preservation: Success plans pre-populated with terms and objectives

- Transparency provision: Live status dashboards showing fulfillment progress

Billing reflected precise contract language and structure, eliminating interpretation needs. In competitive markets, detail becomes differentiation. Frictionless QTC reduces days sales outstanding while improving retention and building trust that compounds faster than bookings.

Building for Velocity, Trust, and Retention

Time Ownership as a Core Principle

In every QTC transformation, who owns time? Sales owns forecasts, finance owns revenue recognition, legal owns liability clauses. Yet elapsed time lacks clear accountability. Time defines whether customers feel served or stalled.

We measured elapsed time at each handoff: contract to signature, invoice to payment, quote to onboarding. Time became tangible organizational intent metric. This reframing changed behavior. Legal benchmarked response times. Sales learned when to nudge versus escalate. Billing flagged incomplete contracts upstream. The organization operated as if customer time was more valuable than internal convenience.

Reducing Days Sales Outstanding as Strategic Imperative

Global DSO reports resembled geopolitical risk maps: some countries averaged twenty days, others ninety. DSO reflects payee clarity and consistency, not just payer behavior.

We standardized QTC-to-invoice pathways. Fourteen percent of EMEA invoices contained contractual errors between sales promises and billing records. In Latin America, missing invoice fields created government buyer rejections. Each friction point risked relationships.

Playbooks aligned contract design with billing data capture. Pre-billing validation caught errors before delivery. Weekly exception dashboards drove improvement. DSO declined, disputes fell, satisfaction increased, and cash forecasting accuracy improved from 72 to 94 percent. Reducing DSO is systemic work harmonizing expectations with execution, aligning revenue recognition with value realization.

Churn Prevention Begins at Contract Creation

Most retention strategies commence after implementation. Mine begins at the quote. Contract structure and clarity signal, before the first payment, whether customers will renew. Misaligned incentives, ambiguous timelines, and unnecessary complexity create relationship debt that compounds monthly. This debt hides until renewal conversations begin.

Auditing churned customers over twelve months, we traced sixty-two percent of terminations to original quote or contract issues. Misunderstood terms. Undefined service level agreements. Optional services listed as entitlements. Sales closed deals but embedded confusion that metastasized into disillusionment.

We introduced a quote reviewer role in revenue operations. Their mandate was alignment verification: ensuring contract statements, customer beliefs, and delivery team plans were congruent. This was not a delay-inducing checkpoint but an essential alignment step ensuring transparent value pathways. Retention starts with clarity. QTC, executed with precision, becomes the first churn reduction lever through proactive structural transparency, not reactive support.

Sales Enablement as System Integrity

Empowering sales teams relates to system architecture, not motivation. Confident representatives trust that sent quotes honor embedded promises. They know approval workflows are rational, pricing guardrails are market-based, and legal reviews will not arbitrarily dismantle momentum.

Working with Chief Revenue Officers, we embedded confidence structurally. Deal desks operated with published service level agreements. Approval rules were codified into configure-price-quote systems. Sales autonomy existed within pre-approved pricing thresholds varying by region and vertical. We made complexity navigable, not eliminated.

This approach paid dividends in velocity and trust. Sales teams viewed finance and legal as collaborators, not adversaries. They operated with transparent data rather than backchannels. They closed faster because we removed doubt. Sales enablement is a promise kept across integrated systems, the cultural thread connecting forecasting, fulfillment, and financial planning.

Marketing as the First Step in Quote Accuracy

Quote-to-Cash discussions often overlook marketing’s foundational role. Customer expectations form long before quotes issue. When marketing communicates value without operational qualification, and sales cannot fulfill promises with available systems and terms, the disconnect signals operational misalignment.

I have collaborated with marketing leadership ensuring QTC closes loops with initiating messaging. If campaigns emphasize flexibility, contracts must allow it. If go-to-market motions promote instant onboarding, billing systems cannot delay activation with compliance friction.

We integrated marketing into quarterly QTC reviews. They observed quote failures, learned how brand promises translated into commercial reality, and adjusted campaigns accordingly. The result was accurate marketing grounded in operational truth. We observed measurable declines in quote revisions and corresponding rises in first-time-right contracts. When QTC becomes integral to brand experience, customers feel like stakeholders in systems designed to deliver promises, not handoffs between disconnected departments. This shift from message to mechanism is where revenue operations becomes customer experience.

Unifying Global QTC as a Network of Learning Nodes

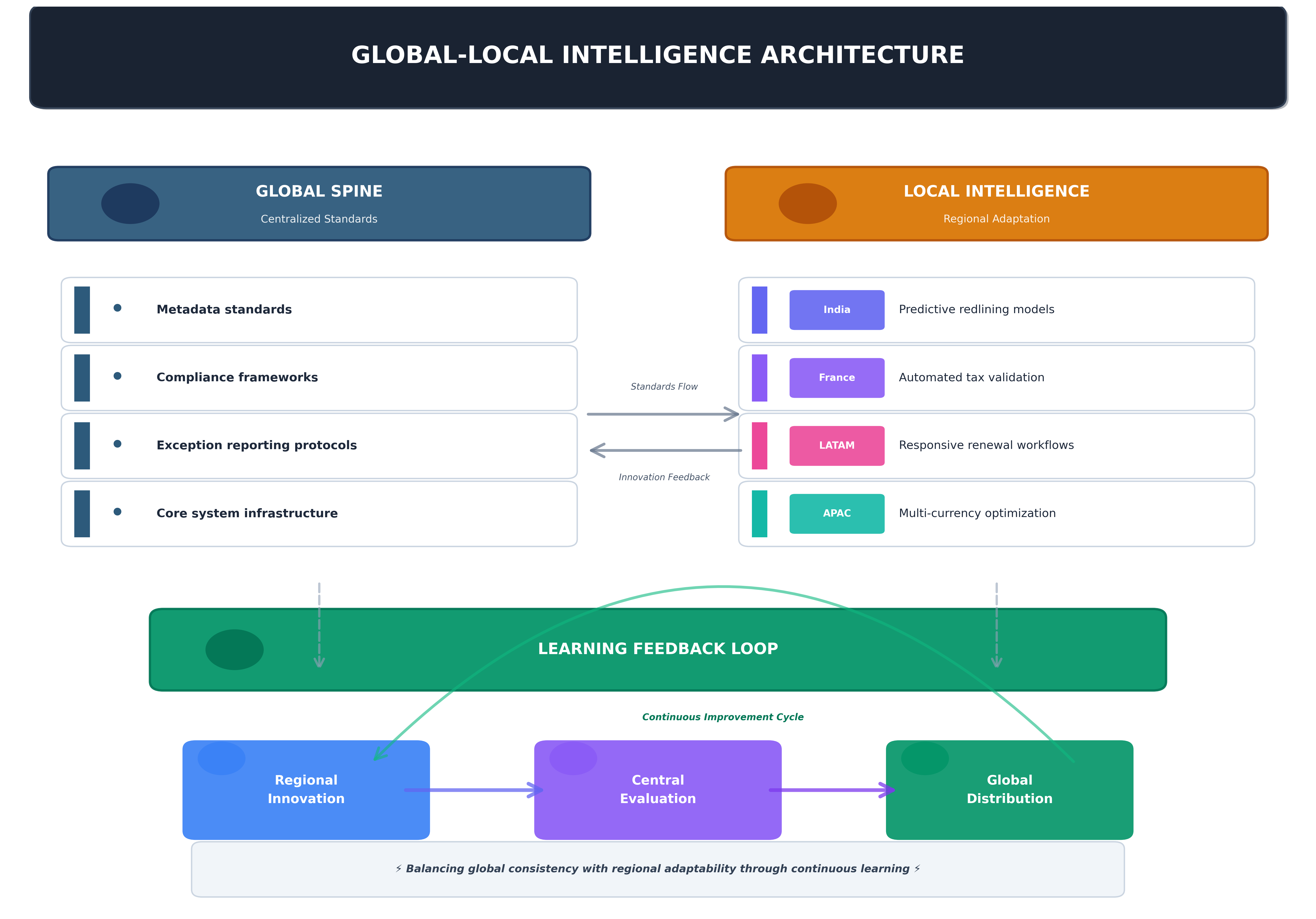

Scaling QTC across continents requires transposition, not translation. Essential legal clauses in one jurisdiction prove irrelevant in another. German VAT regulations mean nothing in Mexico. Managing global operations taught me to architect federated systems: global operational spines with local intelligence.

The Federated QTC Architecture

Subsidiaries operated under shared principles but maintained flexibility for local market conditions. This balanced centralized control with contextual responsiveness. We created adaptable templates modifiable within defined boundaries rather than imposing headquarters workflows on global operations.

Regional operations surfaced portable insights. Innovations became global playbook components through earned credibility, not mandates. QTC at scale becomes a learning node network where improvements must transfer across geographies. As CFO, I ensured financial systems functioned as translators and distributors of organizational learning, not merely transaction repositories.

Conclusion: Flow as the Metric of Maturity

After three decades building financial systems, watching companies scale across geographies, and observing revenue patterns rise and fall, I have come to value one metric above all others: flow. Not merely revenue flow, but information flow, decision flow, and trust flow. Quote-to-Cash, when executed with precision and strategic intent, becomes the embodiment of that flow. It does not simply support the business but reveals how well the business understands itself. The Chief Financial Officer reduces days sales outstanding not by tightening collections policies but by designing clarity into contract structures from the beginning. The Chief Revenue Officer empowers sales representatives not by offering larger quota incentives but by removing ambiguity from approval processes. The Head of Sales and Marketing aligns campaign messaging to global customer personas by participating directly in the operational truth of fulfillment capabilities. In the end, customers do not experience process documentation. They experience either friction or flow. They experience confidence or confusion. They choose to renew contracts, or not, based fundamentally on how well we honor that experience throughout their entire journey with our organization. Quote-to-Cash is not a back office function relegated to operational teams but the front line of institutional trust. The companies that master this discipline do not simply grow their top line. They compound their competitive advantage through superior customer experience, predictable cash flow, and organizational learning that continuously refines the mechanism connecting promise to delivery. This is the essence of financial leadership in the modern enterprise: not managing numbers, but orchestrating the systems that generate sustainable value.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.