A Capital Discipline for Volatile Markets

In finance, certain tools become so canonized that questioning them feels almost heretical. Net Present Value is one of those tools.

If you have sat through a CapEx review, a private equity pitch, or a corporate development meeting, you have likely seen an NPV model stretched across a dozen Excel tabs, complete with a discount rate that implies a level of precision bordering on fiction. There is nothing inherently wrong with NPV. When used properly, it is a rigorous method for valuing future cash flows and comparing long-term opportunities.

The problem is not the tool. It is the context in which it is often used.

Over twenty-five years leading finance across cybersecurity, SaaS, manufacturing, logistics, and gaming, I have seen NPV deployed less as a decision aid and more as a justification device—especially when timelines are long, assumptions are optimistic, and capital discipline is under pressure. In volatile markets, rising rate environments, or periods of strategic uncertainty, the comfort NPV provides can begin to look less like a map and more like a mirage.

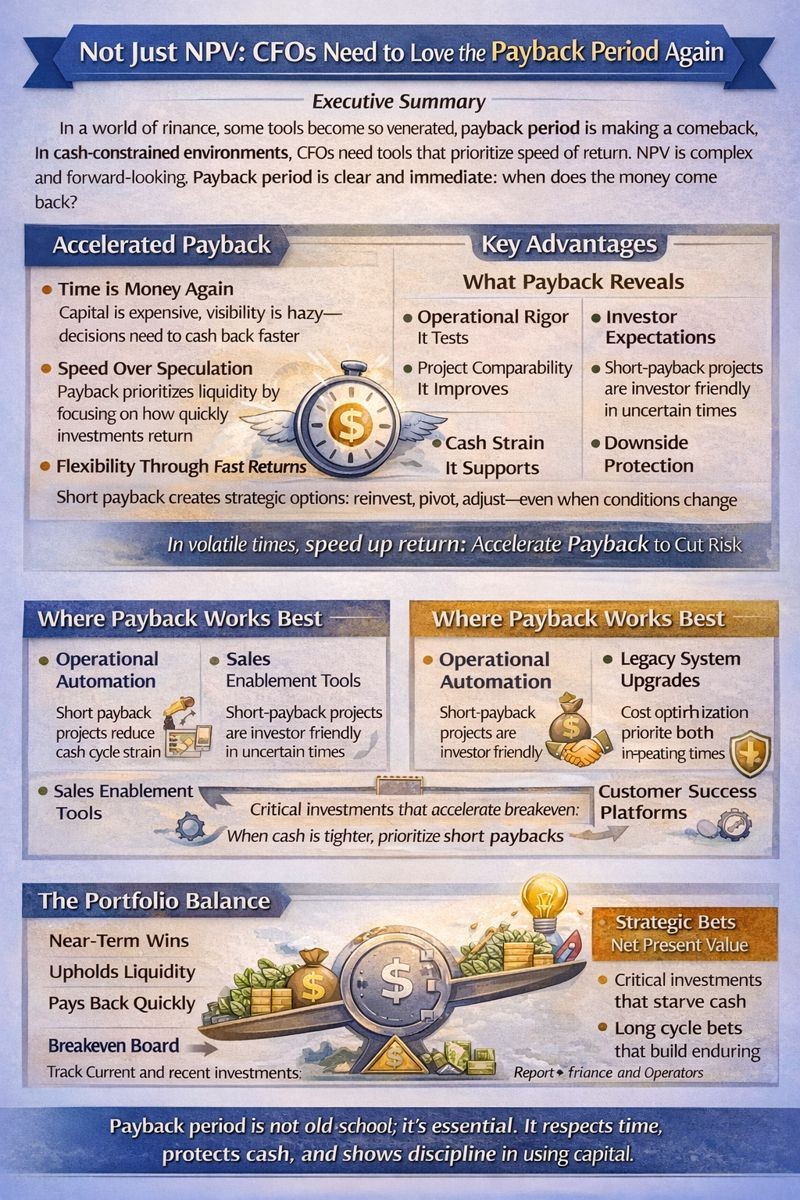

Which brings us to NPV’s unfashionable cousin: the payback period.

It is not mathematically elegant. It will not impress an MBA classroom. But in times of uncertainty and capital scarcity, it may be the most honest question a CFO can ask:

When does the money come back?

Why Payback Period Matters Now

In a zero-interest rate environment, with stable markets and predictable consumer behavior, it made perfect sense to focus on maximizing long-term value. Projects with five to seven year horizons looked viable. Risk premiums were thin. Capital was patient. But the world has changed. Capital is expensive. Demand is volatile. Cash flow forecasting is more art than science. And boards are asking finance teams not just what is the internal rate of return but how long will we be exposed.

That is where the payback period shines. It introduces a temporal discipline to investment decisions. It prioritizes speed of return, not just magnitude. And it provides a practical lens through which to compare initiatives when uncertainty clouds the out-years of any forecast. It does not mean you abandon long-term thinking. It means you temper it with a dose of liquidity awareness.

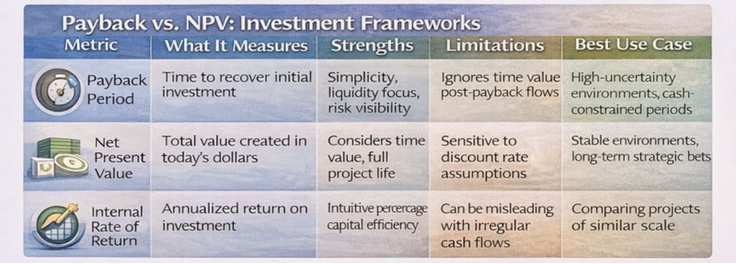

Investment Evaluation Framework Comparison

When I reduced monthly burn from $800,000 to $200,000 at an email marketing SaaS company, we evaluated all pending investments using payback analysis. Infrastructure investments with payback periods under 12 months were approved. Those with longer horizons were deferred or restructured into smaller pilots. This discipline allowed us to maintain strategic momentum while protecting cash reserves during a difficult market environment.

Payback as a Tool for Discipline in Downturns

In leaner cycles, cash is king again. That means your first obligation is to protect the balance sheet, not with austerity but with clarity. And clarity starts with knowing how quickly your capital commitments return to the bank. A project that pays back in 12 months is fundamentally different than one that promises 35 percent IRR over five years but only turns positive in year four. That distinction matters when you are funding out of operating cash, not cheap debt or flush equity rounds.

Here is the deeper insight: a short payback period is not just financially safer. It creates strategic options. Once an investment pays itself back, the capital becomes flexible again. You can reallocate, reinvest, or pivot. But if you are locked into a long-dated payback, your options narrow. And in business, options are often more valuable than projections.

When I managed global finance for a $120 million logistics organization, we invested in route optimization technology and warehouse automation. Both projects had payback periods under 18 months. This allowed us to demonstrate value quickly, build organizational confidence in technology investments, and reinvest savings into additional improvements. The 22 percent reduction in logistics cost per unit was achieved through this disciplined approach to capital deployment.

What Payback Reveals That NPV Often Hides

In the real world of fast-moving markets and resource constraints, the payback period has distinct advantages. It enforces operational rigor. You cannot assume hockey-stick curves in year five and call it value. You need to show returns quickly. It improves project comparability. When CapEx and growth initiatives compete for cash, the payback period helps identify which bets return liquidity fastest.

It supports working capital management. Projects with shorter payback windows often reduce strain on cash cycles, something NPV rarely accounts for. It aligns with investor expectations. Public markets and private equity both increasingly value capital velocity, how fast you turn investments into outcomes. It mitigates downside risk. If a market turns or the business pivots, short-payback projects carry less regret.

When I built enterprise KPI frameworks using MicroStrategy, Domo, and Power BI tracking bookings, utilization, backlog, annual recurring revenue, pipeline health, customer margin, and retention, the platform investment had a clear 14-month payback based on eliminated manual reporting time and improved decision velocity. This measurable return timeline made the investment defensible even during capital-constrained periods.

Where Payback Applies Best

Not every initiative should be judged primarily on payback. But the metric is particularly powerful for:

- Operational automation (RPA, warehouse robotics)

- Cloud migrations and legacy system modernization

- Sales enablement tools with measurable conversion lift

- Productivity investments that reduce cost-to-serve

- Customer success platforms that lower churn

These initiatives typically allow credible monthly or quarterly impact measurement. That makes payback not just a finance metric, but a shared language between finance and operators.

The Breakeven Board: A CFO Habit Worth Relearning

One of the smartest habits from great CFOs is maintaining a breakeven board. It is a rolling view of current and recent investments sorted by amount spent, payback target, actual payback achieved, variance in timing or dollars, and lessons learned. This habit creates accountability. People know the business is watching not just ROI but how fast returns materialize. It drives learning. Over time, you build a library of actuals, not assumptions. That makes the next forecast sharper.

Portfolio Balance

If you over-index on payback, you risk starving long-term bets. Innovation, brand development, and platform plays often require multi-year horizons. But the solution is not to ignore payback. It is to understand the portfolio mix. A healthy capital allocation model has room for both short-cycle wins that maintain liquidity and show impact, and long-cycle bets that build enduring value. The discipline is in knowing which is which and how many long bets your balance sheet can support.

Conclusion

In every market cycle, tools rise and fall in favor. But the fundamentals never change. Businesses exist to turn capital into value. And the sooner that capital returns, the stronger your ability to reallocate, adapt, and grow. In tight markets, the payback period is not old-school. It is essential. It keeps the company honest. It tells you who is really adding value. And it builds a financial culture that respects time, not just theory. So let the NPV models run their course. But when you are signing that approval form, ask the question: when does the money come back? Because until it does, it is not a return. It is a bet.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.