Executive Summary

In theory, the value of an asset is the present value of its future cash flows, discounted appropriately for risk and time. That elegant framework starts to fray when it meets the real world, especially when that world becomes unknowable. In practice, the CFO lives in a marketplace that is often anything but rational or clear. We do not get clean future cash flows. We get fog. We get variables that shift without notice, models that bend under pressure, and signals that distort when you need them most. Yet we must decide. Whether valuing a startup in an uncertain macroeconomic environment, a piece of intellectual property with no obvious comparable, or a business line exposed to regulatory flux, the decision cannot be deferred. Capital must be allocated. Balance sheets must be signed. Investors must be told what something is worth, even if no one truly knows. Traditional models including discounted cash flow, comparables, and precedent transactions are helpful scaffolding. But they are useful only when you remember they are not the building. In times of clarity, precision is an advantage. In times of fog, judgment is the premium. Throughout my twenty-five years leading finance across cybersecurity, SaaS, manufacturing, logistics, and gaming, I have learned that the greatest mistake in an unknowable market is to insist on false certainty. When the data does not sing, do not hum the melody you wish were there. Instead, learn to hear the silence and value accordingly.

Pricing Uncertainty Versus Unknowability

The first principle is to acknowledge the fog. Many boards and executives try to force visibility through brute force including more modeling, more forecasting, more confidence intervals. But uncertainty is not a variable. It is a condition. It cannot be eliminated. It must be priced. To price uncertainty, map what you do not know. Then separate the unknowable from the merely uncertain. If you are evaluating a startup entering an untested vertical, you may not know adoption curves. That is uncertainty. But if the total market itself is undefined or the regulatory pathway is ambiguous, that is unknowability. Treat these categories differently. Uncertainty can be hedged, offset, or diversified. Unknowability cannot. It must be contained through optionality or bounded through minimum viable commitments.

Second, resist the urge to overvalue precision. In unknowable environments, the goal is not to be precise but to be approximately right. That means developing valuation ranges and using scenarios, not single-point estimates. Throughout my work overseeing $100 million in acquisitions and post-merger integration at a gaming enterprise, the deals that succeeded were those where we framed valuation as a range of outcomes tied to specific conditions rather than a single confident number. Ask not what is this worth but under what conditions is this worth more than we are paying and under what conditions does this deal expose us to ruin. If the downside cannot be absorbed, the asset is not underpriced. It is radioactive.

First Principles and Strategic Optionality

Third, return to first principles. When you cannot model cash flows directly, identify what must be true for value to exist. Ask what real-world behaviors or structural dynamics would support this valuation and how long can we afford to be wrong before that optionality decays. These are not spreadsheet questions. They are capital allocation questions. When I secured over $120 million in capital raises across multiple companies, the investors who moved forward were those who could articulate the minimum conditions required for value creation rather than those who presented elaborate scenarios divorced from reality.

Fourth, incorporate behavioral dynamics into valuation. In uncertain markets, perception becomes a multiplier. A company might be worth five times revenue on paper but trade at fifteen times if it is perceived as category defining. That delta is not just hype. It is pricing power, recruiting leverage, and capital access. The wise CFO knows that narrative is a valuation input, not a rounding error. But also knows that when perception detaches from fundamentals, the reversion can be cruel. Value the narrative. Then value the fragility of the narrative.

Fifth, value the optionalities embedded in the asset. Unknowable markets often create hidden value in the form of strategic options. Can the business pivot? Can its technology serve adjacent markets? Can a distribution channel be monetized in a different form? When I managed global finance and supply chain analytics for a $120 million logistics organization, we faced valuation decisions about geographic expansion. The value was not in the immediate market opportunity but in the optionality to serve adjacent verticals using the same infrastructure. A company that loses its primary market but has built flexible infrastructure may have more value than one that dominates a single niche but has no ability to adapt.

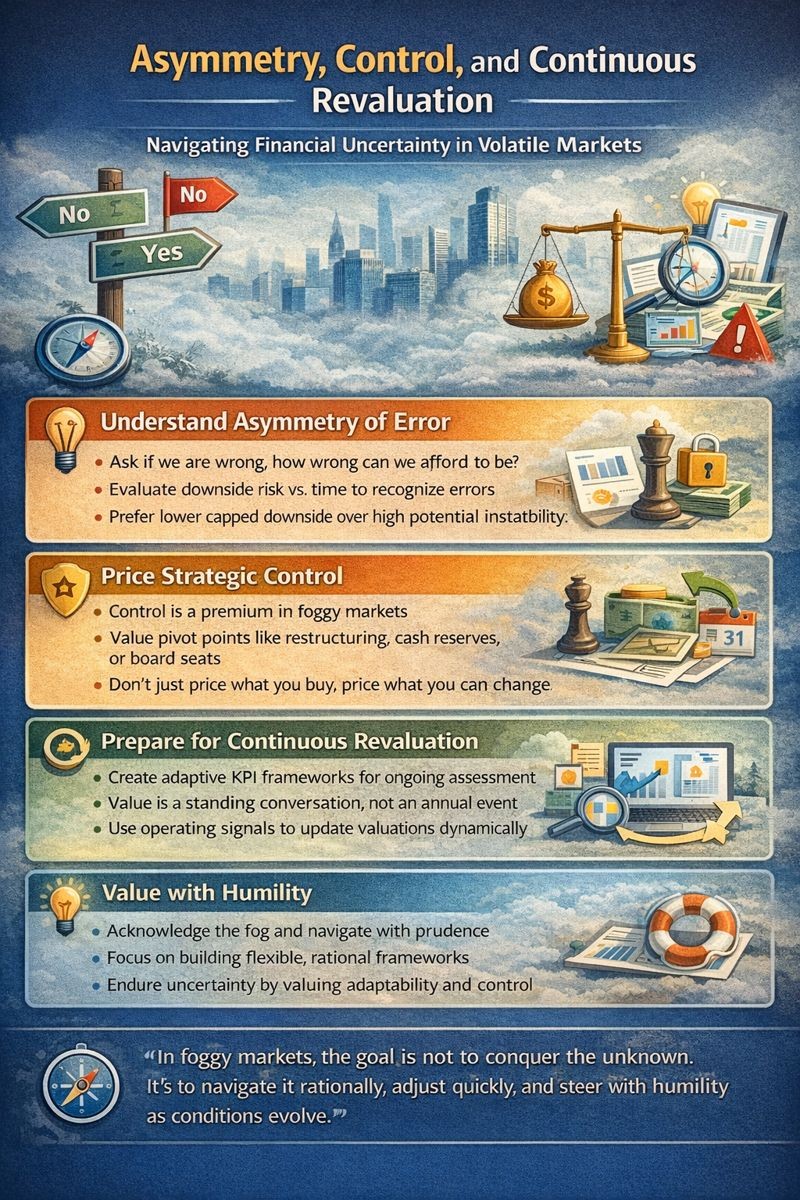

Asymmetry, Control, and Continuous Revaluation

Sixth, be honest about your exposure to being wrong. In unknowable markets, the asymmetry of error matters more than the central estimate. A deal that is slightly overpriced but has capped downside might be wiser than a seemingly underpriced asset with structural fragility. Ask if we are wrong, how wrong can we afford to be, what is our time to recognize the error, and how fast can we adjust. When I led finance across multiple M&A transactions, some of the best decisions were the ones where we said no, not because the asset was bad but because the fog was too thick, the optionality too low, and the exposure too great.

Seventh, price strategic control. In foggy markets, control becomes more valuable, not less. The ability to pivot, restructure, or hold cash becomes a premium. Do not just price what you are buying. Price what you can change about what you are buying. That is where value is created when markets shift.

Eighth, prepare to revalue continuously. In stable markets, valuation can be an annual event. In volatile or unknowable conditions, valuation is a standing conversation. When I built enterprise KPI frameworks using MicroStrategy, Domo, and Power BI tracking bookings, utilization, backlog, annual recurring revenue, pipeline health, customer margin, and retention, the purpose was not just reporting but creating feedback loops that allowed us to update valuations based on operating signals rather than static assumptions.

Finally, value with humility. The fog is not something to conquer. It is something to navigate. The role of the CFO in such times is not to find the perfect price. It is to build the framework for rational decisions amid imperfect information. That is not weakness. That is stewardship. The market does not reward those who guess right. It rewards those who endure when others guess wrong.

Conclusion

Pricing assets in unknowable markets is not a science. It is not even an art. It is a discipline built on curiosity, skepticism, adaptability, and above all, a refusal to be seduced by the illusion of certainty. Throughout my career, from standing up finance functions in emerging industries to implementing enterprise systems that transform operations, the breakthrough moments came not from brilliant analysis but from quiet confidence that the structure of decisions gave us time to learn, room to adjust, and protection from downside. Valuing the fog means knowing that not all darkness is the same. Some is temporary. Some is structural. Some can be navigated. Some must be avoided. The task of the CFO is to see clearly when the world does not and to act wisely when others flinch. The next time you are asked to price an asset that lives in the fog, do not bring only your model. Bring your judgment. Bring your clarity. And above all, bring your humility. Because in unknowable markets, those are the only tools that matter.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.