Executive Summary

In margin management, few adversaries are as insidious as sudden cost shocks. Inflation, foreign exchange volatility, and quantum shifts in input pricing can dismantle even the most elegant P&Ls. For CFOs, the challenge is not to predict shocks with precision but to embed guardrails allowing organizations to respond without panic. Pricing protection mechanisms including CPI-linked adjustments, FX pass-throughs, and cost reset triggers form a second defense when market dynamics veer off-course. Companies cannot rely on hope as hedging strategy but need intelligent design where contracts evolve with the economy. Pricing is not static but a dynamic function of inputs, market forces, and negotiated boundaries. The era of fixed-price dogma is giving way to intelligent equilibrium where price reflects both value and volatility. Embedding pricing protection requires balance: too aggressive erodes client trust, too passive endangers profitability.

The Strategic Case for Pricing Protection

In margin management, few adversaries are as insidious as sudden cost shocks. Inflation, foreign exchange volatility, and quantum shifts in input pricing can dismantle P&Ls. Having managed financial planning, pricing strategy, and margin protection while navigating currency volatility in global operations, I have witnessed how the challenge is embedding guardrails that allow response without panic.

Pricing protection mechanisms serve as instruments of economic rationality. These contractual clauses form a second defense when market dynamics veer off-course. At a time when geopolitical volatility, supply chain fragility, and monetary policy divergence co-exist, companies need intelligent design where contracts evolve with the economy.

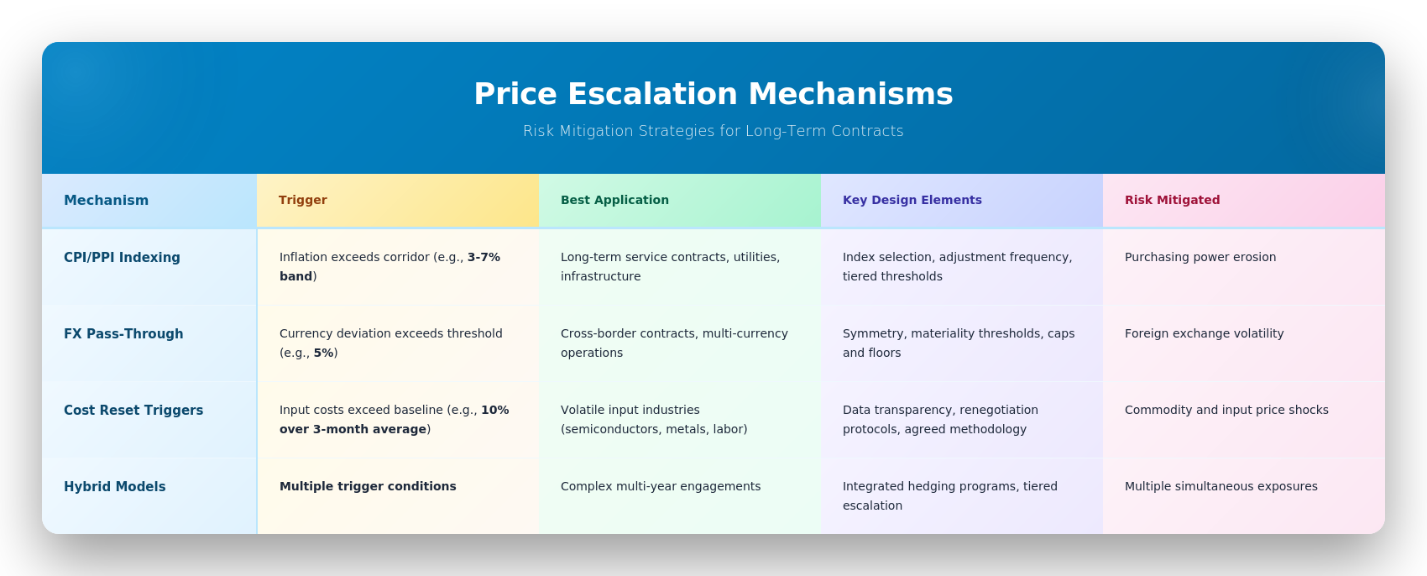

Pricing Protection Mechanisms Comparison

Inflation Indexing: Beyond One-Size-Fits-All

Inflation indexing, structured around CPI or PPI, has long been used in infrastructure contracts but remains underutilized in commercial agreements. If purchasing power changes, contract value must adjust. However, a one-size-fits-all CPI metric often fails to reflect sectoral dynamics. A logistics firm should peg pricing to a fuel-adjusted index, while a software consultancy might use wage-indexed adjustments. The choice must mirror cost structure, otherwise it introduces basis risk.

Indexing must be tiered and time-bound. A well-designed model ties adjustments to corridors, say a 3 to 7 percent inflation band, beyond which price resets trigger. This preserves stability in low-volatility regimes while protecting margins in turbulent ones, signaling that pricing is rational and rules-based, not opportunistic.

Foreign Exchange Clauses: Asymmetry and Sophistication

FX clauses must address exposure asymmetry. The typical pass-through model allows pricing to adjust when currency deviations exceed thresholds. But nuance matters: should the adjustment be symmetrical? Should it apply to all currencies or only material exposures? The most successful FX clauses use thresholds and collars. If currency fluctuation exceeds 5 percent, proportionate adjustment triggers. But caps and floors ensure minor fluctuations are absorbed as normal business risk. Sophisticated models integrate FX hedging programs with pricing clauses, pegging contractual rates to hedge rates rather than spot market.

Cost Reset Triggers: Structured Renegotiation

Cost reset triggers allow contracts to be reopened if cost line items exceed pre-agreed thresholds. For example, if core input cost increases more than 10 percent over a trailing three-month average, both parties revisit pricing terms. The mechanism is not automatic escalation but structured renegotiation, ensuring viability without forcing unilateral decisions. Implementation demands data transparency. Both parties must agree on data sources, update frequency, and calculation methodology. The CFO’s role is diplomatic, crafting language that protects economic interest while preserving relational trust.

Operationalizing Pricing Resilience: Essential Practices

Pricing is not static but a dynamic function of inputs, market forces, and negotiated boundaries. Finance leaders must operate with both defensive and offensive tools, foreseeing shocks rather than predicting them. Embedding pricing protection requires balance. Here are essential practices:

Create a Pricing Charter: Develop a document outlining how inflation, FX, and cost shocks will be treated across contract types. This ensures consistency across sales, legal, and delivery units, avoiding ad hocism. When shared selectively with customers, it becomes a transparency tool.

Build Simulation Models: Using historical volatility data and forward scenarios, construct pricing stress tests. What happens to margin if FX moves by 8 percent? What if labor costs rise by 6 percent? Embedding these scenarios into contract design sets thresholds reflecting foresight, allowing commercial creativity like multi-year deals with fixed rates initially and banded CPI adjustments later.

Invest in Deal Analytics: Every contract is a bet on future cost behavior. Patterns emerge over time: certain industries show stronger FX sensitivity, others exhibit wage inflation cyclicality. Mining deal data refines pricing clauses and segments clients by volatility exposure, transforming contract design from art to applied science.

Design Enforcement Protocols: Unused clauses become obsolete. Random enforcement undermines credibility. CFOs must design escalation protocols: what process triggers when CPI clauses breach? Who reviews FX deviations? What governance decides cost reset activation? These mechanics should be embedded into commercial operating models.

Offer Customer Optionality: Customers prize stability and resist opaque models. Offer opt-in features: fixed-price with tighter timelines or variable price with inflation indexing. This empowers explicit trade-offs and introduces optionality into pricing.

Think Systemically: Pricing is part of a larger feedback loop involving procurement, supply chain, treasury, and delivery. FX exposure changes influence hedge ratios, affecting cash flow forecasts. Inflation clauses may require wage adjustments or vendor renegotiations. Pricing protection must be viewed through a systems lens as a capability, not just a clause.

Conclusion

At the heart of all pricing discussions lies the question of fairness, not just what is legally permissible but what is economically just. The best pricing models do not exploit volatility; they accommodate it. They recognize that markets move, costs rise, and currencies swing. But rather than letting these forces dictate profitability, CFOs can harness them into structured, symmetrical frameworks. They can turn randomness into resilience. In a world where volatility is no longer episodic but endemic, pricing protection is not optional. It is the scaffolding that holds profitability in place when the winds shift. Done right, it is not just a hedge against uncertainty but a manifestation of strategic intent. And in that, it speaks not just to numbers but to the very nature of how value is created, shared, and sustained.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.