Executive Summary

In boardrooms across industries, a familiar question now emerges with increasing urgency: “Are we using AI?” It is often followed by a more uncertain one: “Should we worry about it?” As someone who has served CFO roles across verticals from SaaS and medical devices to freight logistics and nonprofit sectors, I have seen how board priorities evolve. What was once a curiosity about digital transformation has now become a matter of fiduciary oversight. Artificial Intelligence is no longer an R&D topic or a back-office efficiency play. It sits squarely within enterprise risk, strategic advantage, and regulatory exposure. AI is not simply a tool but a decision system. And like any system that influences financial outcomes, customer trust, and legal exposure, it demands structured oversight. Boards must now treat AI with the same discipline they apply to capital allocation, M&A diligence, and cybersecurity. This is not a technical responsibility but a governance imperative.

Why Boards Can No Longer Stay Silent on AI

The emergence of intelligent agents that perform financial forecasting, customer interaction, legal document review, and risk scoring creates operational leverage but also introduces systemic risk. AI models are dynamic, probabilistic, and adaptive. They may hallucinate. They may encode bias. Unlike human operators, they do not always explain their reasoning.

Throughout twenty-five years leading finance organizations across cybersecurity, SaaS, digital marketing, gaming, and logistics, I have witnessed technology transformations that fundamentally altered decision-making frameworks. At organizations where I implemented NetSuite and OpenAir PSA, automated revenue recognition and project accounting, the integration of intelligent systems required new governance protocols to ensure accuracy, auditability, and accountability.

In one company I advised, an AI-driven pricing assistant proposed a multi-tiered pricing change that, while mathematically sound, introduced legal risk due to regional price discrimination laws. No one had thought to vet the model through a legal lens. The output was live before risk was even considered. The lesson: AI can act faster than governance, unless governance is actively embedded.

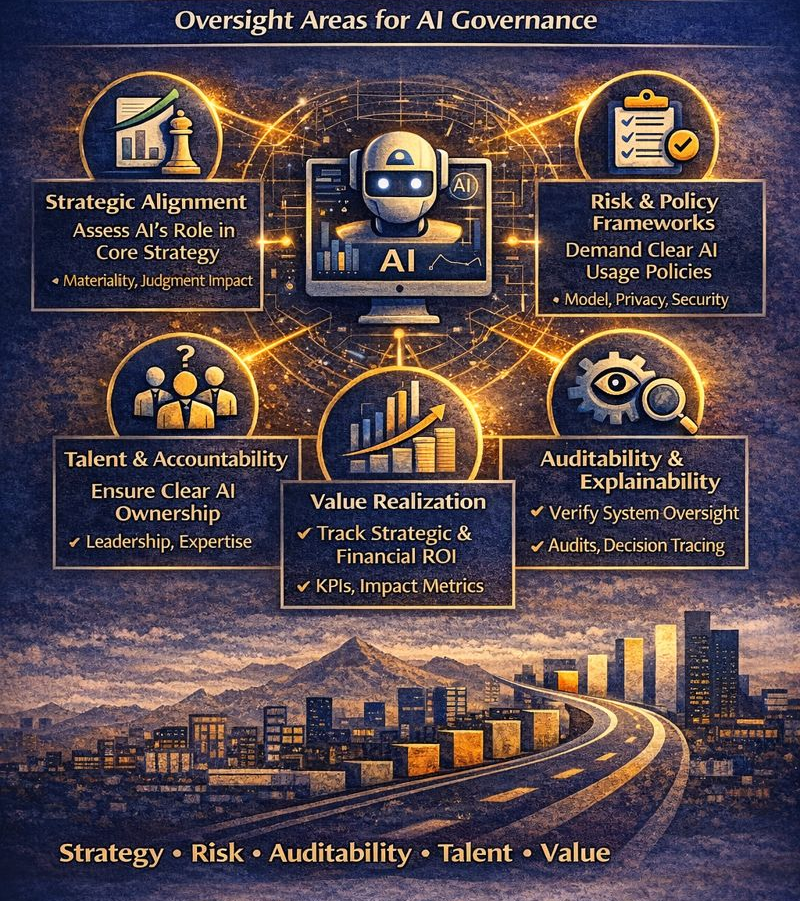

Five Areas Boards Must Now Monitor Closely

To govern AI effectively, boards must anchor their oversight in five key areas: strategy, risk, auditability, talent, and value realization.

1. Strategic Alignment: Is AI Central or Peripheral?

Boards must ask: what role does AI play in the company’s core value proposition? For example, a generative AI engine powering a legal search platform carries different exposure than an AI-enabled expense tool. One affects contract interpretation. The other optimizes coding. Both use AI, but only one touches critical judgment.

At organizations where I led board reporting, we developed AI Materiality Matrices mapping where AI touched customers, decisions, revenue, and risk.

2. Risk and Policy Frameworks: Is There a Playbook for AI Use?

Too many companies deploy AI without an explicit policy. Boards must demand one covering:

- Model selection criteria and acceptable use parameters

- Prohibited use cases and bias mitigation strategies

- Privacy protections and data governance standards

- Third-party dependency risks and vendor management

- Fallback protocols and incident response procedures

At one education nonprofit where I secured forty million in Series B funding, establishing clear technology governance policies proved essential for maintaining stakeholder trust. Boards should ask if the company has mapped its AI exposure to regulatory regimes including GDPR, CCPA, HIPAA, and emerging global AI laws.

3. Auditability and Explainability: Can the System Be Trusted?

Any AI system affecting customers, employees, or financial outcomes must be auditable. The company must maintain model logs, decision traces, override capabilities, and methods to explain why decisions were made.

At a digital marketing organization that scaled from nine million to one hundred eighty million in revenue, we discovered an AI recommendation engine optimizing for click-throughs at user experience expense. There was no audit trail. We had to retrain the system.

Boards must ask: What mechanisms exist for AI explainability? Can humans override AI decisions? Can the company reproduce results under scrutiny?

4. Talent and Accountability: Who Owns AI in the Organization?

AI systems need stewardship. Boards must ensure there is a clearly identified AI governance leader, ideally reporting to the CEO, CFO, or Chief Risk Officer.

At a gaming enterprise where I led global controllership and internal controls, establishing clear ownership for technology systems proved essential for risk management. The question: who is on point if the model goes wrong?

5. Value Realization: Is AI Delivering Strategic or Financial ROI?

Boards must differentiate between AI as novelty and AI as leverage. Ask what is being improved: Are decisions faster? Is forecast accuracy better?

At organizations where I built enterprise KPI frameworks, we tracked AI system performance with the same rigor as any major capital investment. Boards should expect AI ROI tracked with quantified impact, timelines, and cost-benefit ratios.

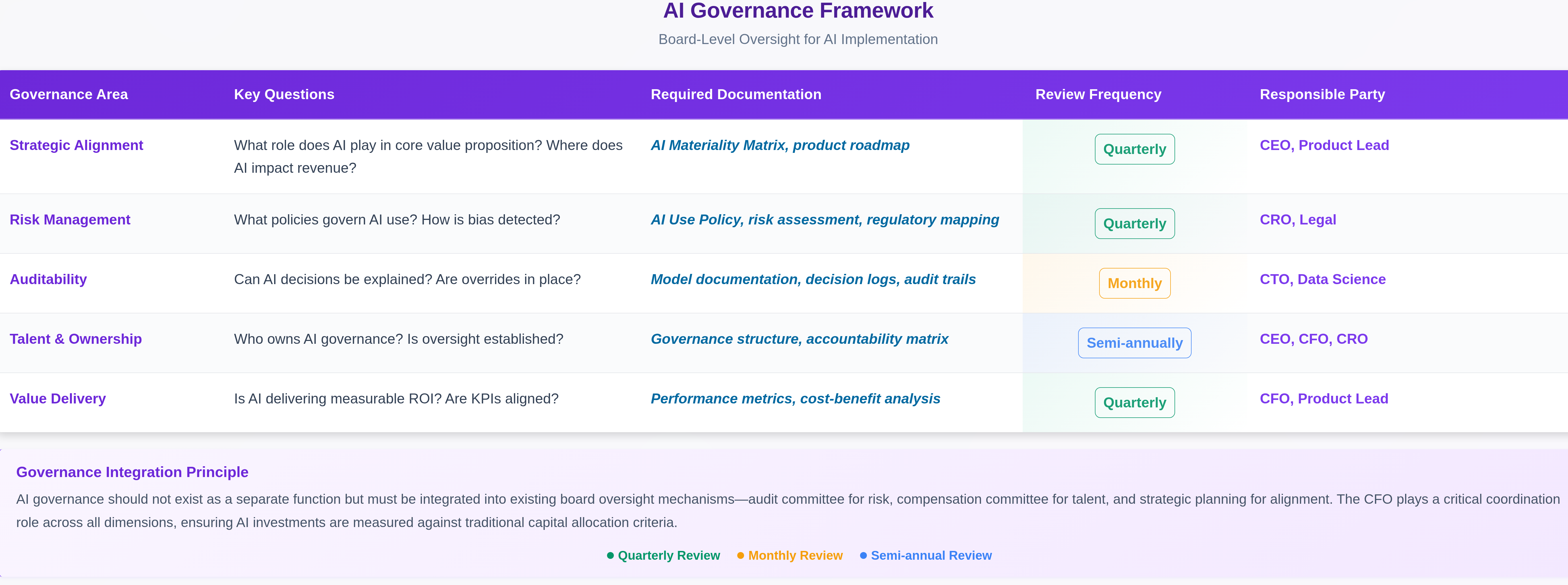

AI Governance Framework for Boards

The following framework provides a systematic approach to AI oversight:

AI-Specific Questions Boards Should Be Asking Now

To operationalize AI governance, boards should incorporate these questions into regular reviews:

- What AI models are deployed, and where do they impact customers or financial outcomes?

- What unique data trains these models, and how is that data protected?

- How do we handle AI errors, technically and reputationally?

- What oversight mechanisms govern AI updates, model drift, and retraining?

- What happens if the vendor hosting our AI goes offline or changes terms?

- Are we prepared to explain and defend AI-driven decisions in legal or regulatory contexts?

- Do we have a clear strategy for integrating AI into our product roadmap and operations?

Embedding AI Governance into the Board Agenda

Just as cybersecurity now appears as a recurring board topic, so too must AI governance. Every audit committee, risk committee, and technology subcommittee must include AI oversight in their charters.

Board members need not become machine learning experts but must become literate in how AI systems work, what failure modes exist, and how trust is preserved. A quarterly AI Risk Dashboard summarizing model usage, error rates, regulatory alerts, investment ROI, and vendor dependencies provides a good starting point.

At organizations where I led FP&A and board reporting, establishing regular review cadences for emerging technology risks enabled proactive governance.

Conclusion

The AI wave will not wait for slow governance. Regulations are coming. Customers are watching. Investors are asking. Boards that fail to engage will find themselves reactive at best.

AI changes how decisions are made, who makes them, and how they scale. That is governance territory. It cannot be delegated away. The best boards treat AI governance as competitive advantage. They ask sharp questions, demand evidence, and support leadership with clarity.

AI is not just a risk but an amplifier. With thoughtful oversight, it amplifies value, resilience, and strategy. Without it, it amplifies blind spots. The future of governance is algorithmic, and it is here.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.