Executive Summary

There are few moments in a CFO’s calendar as consequential as preparing a memo or briefing for the board. It is not a mere update. It is a test of alignment, a presentation of stewardship, and a declaration of what lies ahead. In those few pages or that brief presentation, the board expects not just numbers but understanding, not just performance but direction, and not just statements of risk but interpretations of what those risks mean. A well-constructed board communication is not defensive, nor overly optimistic. It is clear-eyed, analytical, and above all, rooted in judgment. The role of the CFO in board communications is unique. It is to be the translator between operations and oversight, the link between the past and the possible. The CEO paints the vision, but it is the CFO who gives it weight, explaining how it will be funded, how it will return value, and what could go wrong along the way. Throughout my twenty-five years leading finance across cybersecurity, SaaS, manufacturing, logistics, and gaming, I have learned that this burden cannot be outsourced. It is part of the trust we inherit when the title changes to Chief Financial Officer.

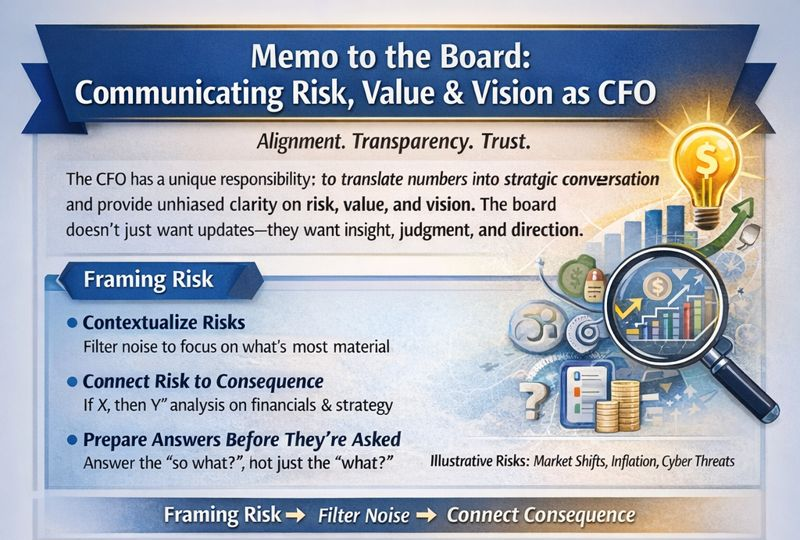

Framing Risk with Context and Consequence

In communicating with the board, the first and most critical task is to frame risk honestly. Boards are made of smart, experienced people, but they are not in the daily trenches. What they need is not a comprehensive listing of every exposure but a calibrated interpretation of the most material ones. This includes market volatility, supply chain pressures, competitive pricing trends, regulatory shifts, and internal risks ranging from systems to personnel to data integrity. But risk without context is noise. The CFO must connect risk to consequence.

What does it mean if inflation persists another two quarters? What happens if customer concentration worsens? What is the real impact of churn, not just on this quarter’s annual recurring revenue, but on long-term margin stability? These are the types of questions we must answer before they are asked. When I led board reporting at a gaming enterprise where I oversaw $100 million in acquisitions and post-merger integration, the board wanted to understand not just acquisition costs but integration risks, cultural alignment challenges, and the probability of achieving projected synergies under different scenarios.

A well-prepared CFO memo reads as if it were written by someone who already sat in the board’s seat and asked themselves what would I worry about if I were them. When I managed global finance for a $120 million logistics organization, board communications addressed not just revenue growth but supply chain concentration risk, the impact of fuel price volatility on margins, and the sensitivity of profitability to changes in customer mix. This contextual framing allowed the board to understand not just what was happening but what it meant for strategic decisions.

Communicating Value Creation

Equally vital is the communication of value. This is often the most underappreciated responsibility. It is easy to state revenue and gross margin. It is harder, but far more important, to explain how value is compounding beneath the surface. Perhaps it is through a refined customer cohort. Perhaps it is a strategic pricing model. Or maybe it is improved capital efficiency, demonstrated by growing output with flat spend. These subtleties of value creation often do not scream from the income statement. They have to be narrated.

When I rebuilt GAAP and IFRS financials for a high-growth SaaS company and designed cohort analysis frameworks, board communications evolved from simple revenue reporting to cohort-based value narratives. We showed how expansion revenue was growing faster than new business, how payback periods were compressing, and how customer lifetime value was increasing even as acquisition costs declined. The CFO does not embellish, but they must interpret. Numbers do not speak for themselves. And in the absence of interpretation, the board is left to draw its own conclusions, sometimes accurately, often not.

Clarity about what is being built, and why it matters, is essential. Especially in companies that are not yet profitable, or are investing heavily in future capabilities, the CFO must explain the logic of capital deployment. Why this path, at this time? Why now, and not later? Why this balance of burn and growth? When I secured $40 million in Series B funding and an $8 million credit line at a nonprofit organization, board communications addressed not just programmatic results but the capital efficiency of different program models, the return on investment of infrastructure buildout, and the timeline to self-sustainability.

Board Communication Framework

| Element | What to Communicate | How to Frame It |

| Risk | Material exposures with probability and impact | Connect risk to consequence, not just identification |

| Value | How value compounds beneath surface metrics | Show cohort dynamics, capital efficiency, strategic progress |

| Vision | Where we’re going and capital required | Pair ambition with assumptions, contingencies, thresholds |

| Performance | Results relative to plan with variance drivers | Explain what happened, why it happened, what we’re doing next |

| Scenarios | Range of outcomes with triggers and responses | Think in decision trees, not just point estimates |

Pairing Vision with Structure

Boards want to hear vision, but they want to hear it in numbers. The CFO plays the role of rational optimist, pairing ambition with structure. It is perfectly acceptable to talk about bold plans, as long as those plans come with assumptions, contingencies, and thresholds. We are entering three new markets is a CEO’s statement. Here is the capital structure required, the internal rate of return sensitivity based on customer acquisition costs, and the downside scenario where we pull back is the CFO’s layer. This is not about caution. It is about control.

When I built enterprise KPI frameworks using MicroStrategy, Domo, and Power BI tracking bookings, utilization, backlog, annual recurring revenue, pipeline health, customer margin, and retention, board materials evolved from static reports to dynamic dashboards that allowed scenario exploration. We could show the board not just current performance but how key metrics would evolve under different growth, pricing, and market assumptions. This transparency built confidence that leadership understood both the upside and the risks.

Building Trust Through Transparency

There is also nuance in timing and tone. Boards do not want to be surprised. They want to be informed. A CFO who only delivers good news builds a fragile relationship. One tough quarter can undermine years of credibility if the prior communications were overly polished or light on contingency planning. Conversely, a CFO who signals potential issues early and frames them as manageable builds confidence. Trust is not built when things go right. It is built when things go sideways and your assessments prove reliable.

Part of communicating risk and value is acknowledging uncertainty. A mature CFO does not posture as a fortune-teller. Instead, they show the board how the team is thinking probabilistically. What are the scenarios? What are the probabilities we assign to them? What are our prepared responses in each case? This is what separates tactical finance from strategic finance: the ability to think in decision trees, not just variance reports.

When I improved month-end close from 17 days to under six days at a cybersecurity firm, the value to the board was not just faster reporting but earlier warning signals. We could identify trends and issues while there was still time to respond. Board communications shifted from retrospective analysis to forward-looking guidance based on real-time data. This style of communication must also be reflected in the board materials. Not just reams of spreadsheets, but synthesized insights. Not overly designed slides, but clean, logical flows. The best CFO decks are not the most colorful. They are the most usable.

Earning Influence Through Credibility

Boards are not asking us to be perfect. But they are asking us to be accountable. That means being able to say this was our plan, here is where we missed, here is what we have learned, here is how we have adapted. If you cannot close that loop, your board will lose confidence, not just in your plan, but in your leadership. The CFO is not just managing cash. They are managing credibility. And credibility compounds.

A CFO who demonstrates command of the numbers, alignment with the CEO, and fluency in risk can become a true partner to the board, not just a presenter. Over time, the CFO becomes a source of insight on matters well beyond finance, on talent allocation, strategic bets, capital markets timing, even competitive positioning. But that influence must be earned. It is not granted with the title. It is earned with every meeting, every memo, and every response to a difficult question.

Great CFOs do not dodge questions. They reframe them. If a board member asks about the slowdown in sales, do not deflect to seasonality. Lean into the question. Explain the funnel dynamics, the sales velocity, and the adjustments being made. When asked about a high churn rate, do not hide behind averages. Show the outliers, the root causes, and the plan to improve retention. Transparency is not weakness. It is a display of strength, of intellectual honesty and operational control.

At the most strategic level, the CFO is the board’s window into how the company sees the world. What are the assumptions baked into next year’s plan? How are we pricing geopolitical risk? What are we assuming about rates, currency, or commodity inputs? Are we seeing early indicators of a capital cycle shift? My certifications as a CPA, CMA, and CIA reflect a commitment to governance and fiduciary responsibility. But what creates board confidence is not credentials alone. It is the consistent demonstration of judgment, transparency, and accountability in every communication.

Conclusion

Vision is not about dreaming. It is about synthesizing where the business is, where the market is going, and how the company intends to navigate that journey. It is the job of the CFO to make that vision legible, to put numbers to it, to define the shape of success, and to highlight the conditions that must hold for the vision to become reality. Communicating risk, value, and vision is not a quarterly task. It is a mindset. One that views the board not as an audience but as a partner. One that treats every question as an opportunity to build understanding. And one that recognizes that the most valuable thing a CFO can deliver is not certainty, but clarity. Because in the end, it is clarity that enables action. And action, measured, informed, and timely, is the only path to value creation that stands the test of both the market and the moment.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.