Executive Summary

There are few terms in a founder’s vocabulary more emotionally loaded than burn. It captures both aspiration and anxiety. It fuels the future, yet it signals the fuse. It is the byproduct of ambition, but also the boundary of survival. Everyone talks about managing burn, as if it were a bonfire one could neatly control with knobs and timers. But in practice, it is more like managing a fire in a forest. You do not extinguish it, you contain it, shape it, and guide it so that it clears the path forward without turning everything to ash. Throughout my twenty-five years leading finance across cybersecurity, SaaS, manufacturing, logistics, and gaming, I have learned that for finance leaders, burn is not just a number on the profit and loss statement. It is the translation of every strategic decision into time. And time is the most precious currency in early and growth-stage businesses. The art is not to avoid burn. The art is to burn wisely.

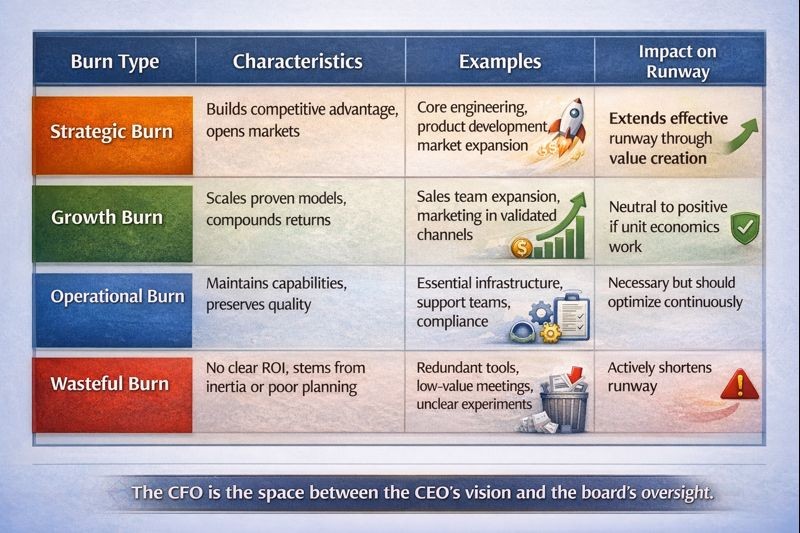

Productive Burn Versus Wasteful Burn

It starts by understanding that not all burn is created equal. There is productive burn, the kind that builds capabilities, opens markets, or accelerates learning curves. And there is wasteful burn, the kind that stems from unclear priorities, bloated processes, or uncalibrated bets. Productive burn generates options. Wasteful burn narrows them. And the difference between the two is rarely found in the aggregate. It lives in the details.

Burn Classification Framework

This is where the CFO must lead, not as the hall monitor of expenses but as the strategist of trade-offs. Cutting cost is not the same as extending runway. When I reduced monthly burn from $800,000 to $200,000 at an email marketing SaaS company, the key was distinguishing between costs that built value and costs that merely consumed cash. We eliminated redundant systems, consolidated vendors, and stopped low-performing marketing channels. But we protected core engineering capacity and customer success because those functions directly drove retention and expansion.

Spending Better, Not Just Less

The key is not to spend less. The key is to spend better. That requires understanding the marginal return of every dollar. Not just in theory, but in behavior. How does another hire in product affect velocity? What does an extra $100,000 in marketing really yield in qualified leads? Every burn decision is a capital allocation decision. And in high-burn environments, every allocation either compounds or corrodes your competitive position.

Great CFOs do not ask where can we cut. They ask what must we protect. Protect the engine, the differentiator, the thing that, if executed well, changes the game. That may be engineering, or brand, or customer success. It varies. But in every business, there is a core. Starving that to prolong the clock is like tightening your belt while running a marathon. You do not buy time. You buy collapse.

When I managed global finance for a $120 million logistics organization and overhauled freight, warehouse management, and last-mile logistics processes, we faced pressure to reduce costs during market volatility. Rather than uniform cuts, we analyzed which processes created competitive advantage. Our route optimization algorithms and customer service responsiveness were differentiators. We protected investment in those areas while aggressively cutting administrative overhead and redundant middle management.

Runway as Dynamic Strategy

One of the smartest moves a CFO can make is to reframe burn in terms of runway-per-strategy. You do not just have 18 months of runway. You have 18 months of runway at your current burn rate pursuing your current strategy. If you pivot, pause, or accelerate, that runway changes. What this means is that burn is dynamic. It is not a fixed fuse. It is a lever. Managed properly, it can be lengthened, compressed, or repurposed to fit new conditions.

This is especially critical in volatile markets, when access to capital fluctuates and valuations compress. In these moments, extending runway is not just prudent. It is existential. But again, the goal is not austerity. The goal is optionality. A company with 12 months of cash but six months of high confidence progress is in a better place than a company with 24 months of cash but no strategic clarity. Burn is not the enemy. Blind burn is.

Forecasting with Buffers and Branches

Most burn problems are not actually spending problems. They are forecasting problems. Teams overestimate the speed of revenue, underestimate the cost of scaling, and fail to model downside scenarios. They assume the next fundraise will happen on time, at a premium. They build for the best case, hedge with slogans, and hope that execution fills in the gaps. Hope is not a strategy. Real runway management includes buffers, probabilities, and stress tests. It does not forecast linearly. It models in branches.

When I rebuilt GAAP and IFRS financials for a high-growth SaaS company and designed cohort analysis frameworks, we moved from single-point revenue forecasts to scenario-based planning with explicit probability weights. We modeled optimistic, baseline, and pessimistic scenarios with different burn implications for each. This allowed us to identify trigger points where we would need to adjust spending levels based on actual performance, creating decision gates rather than hoping for the best.

And behind every model lies behavior. A forecast is only as good as the operating discipline that underpins it. Are teams tracking performance against plan, or just rolling forward old assumptions? Are there mechanisms to shut down underperforming bets, or do projects linger out of inertia? Finance leaders must design for accountability. That means clear metrics, but also cultural reinforcement. Burn management is not just a spreadsheet. It is a mindset.

Time Horizons and Committed Capital

It also helps to understand burn across time horizons. Short-term burn is what you see in monthly cash flow statements. Medium-term burn is what shows up in trailing twelve-month trends. But long-term burn is embedded in decisions that do not hit the books until months or quarters later. Hiring a new team, signing a three-year lease, committing to a multi-year vendor, these are burn decisions in disguise. The best CFOs account for this by tracking not just GAAP spend but burn-committed capital. They manage not just today’s fire but tomorrow’s terrain.

When I secured $40 million in Series B funding and an $8 million credit line at a nonprofit organization, we structured our burn plan with explicit phase gates. Certain hires and infrastructure investments were contingent on hitting milestone metrics. This created natural checkpoints where we could adjust burn based on actual progress rather than commitment to a static plan made months earlier.

The Storytelling Dimension

There is also a storytelling dimension to burn. Boards and investors do not just want lower burn. They want to understand burn rationale. Why now? What are we buying with it? When will it return? What is the sensitivity? The CFO’s role is to make that story legible, to tie spend to outcomes and outcomes to valuation. The more transparent and disciplined the narrative, the more support you will find, even in tough times.

Lastly, we must recognize that burn is not just about cash. It is about energy. Teams working in high-burn environments often run at unsustainable paces. When finance leaders show clarity in capital management, they create psychological runway too. Teams feel grounded. They understand the levers. They focus on progress, not panic. And in that clarity, they execute better.

Conclusion

To burn wisely is not to become conservative. It is to become deliberate. It is to say we will spend where it matters, we will stop what does not, and we will stay in control even when the world changes. Great companies do not burn less. They burn smarter. And that is the difference between lasting twelve months and building something that lasts a generation.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.