Executive Summary

Growth stagnation represents one of the most challenging inflection points in a company’s lifecycle. Unlike dramatic market crashes or sudden competitive disruptions, growth stalls often emerge gradually through subtle shifts in market dynamics, operational friction, or strategic misalignment. Drawing from extensive experience advising leadership teams across financial services, technology, and healthcare sectors, this article examines the critical distinction between strategic and operational failures that underlie growth plateaus. The diagnostic process requires disciplined inquiry, emotional intelligence, and the courage to confront uncomfortable truths about both market fit and execution capabilities. Successful recovery demands not just identifying root causes but also sequencing interventions appropriately, whether that means rebuilding operational foundations before pursuing new strategic initiatives or pivoting core value propositions when market assumptions prove flawed. The companies that emerge stronger from growth stalls share common characteristics: they create space for honest assessment, they resist the impulse toward premature action, and they rebuild with deliberate intent rather than reactive urgency. This exploration offers practical frameworks for diagnosing growth stagnation and charting pathways toward sustainable, resilient expansion that positions organizations for long-term competitive advantage.

Recognizing the Warning Signs

Growth stagnation rarely announces itself with dramatic fanfare. Instead, it arrives as a collection of quiet signals that leadership teams often rationalize or dismiss. A quarterly revenue target is met, but only narrowly. Product lines that previously delivered consistent growth begin to plateau. Team dynamics shift from confident enthusiasm to cautious hesitation. The challenge lies in recognizing these patterns early enough to intervene effectively before they cascade into more serious organizational problems.

These early indicators deserve serious attention because by the time growth problems appear definitively in financial dashboards, valuable time and momentum have already been lost. Leadership teams must develop the discipline to distinguish between normal business fluctuations and genuine stagnation signals. This requires creating mechanisms for honest internal assessment that cut through the natural organizational tendency toward optimism and status quo preservation.

My experience with a digital services firm that had just crossed the hundred million dollar revenue threshold illustrates this pattern perfectly. Their client backlog appeared healthy and leadership remained optimistic about future prospects, yet talent turnover accelerated and delivery teams reported rising internal tensions. The disconnect between surface-level metrics and underlying organizational health became increasingly apparent. Within two quarters, sales figures dropped sharply and urgent calls for intervention began. The lesson proved clear: the most dangerous growth stalls are those that develop gradually, eroding organizational capability and market position before leadership recognizes the severity of the challenge.

Two Fundamental Types of Failure

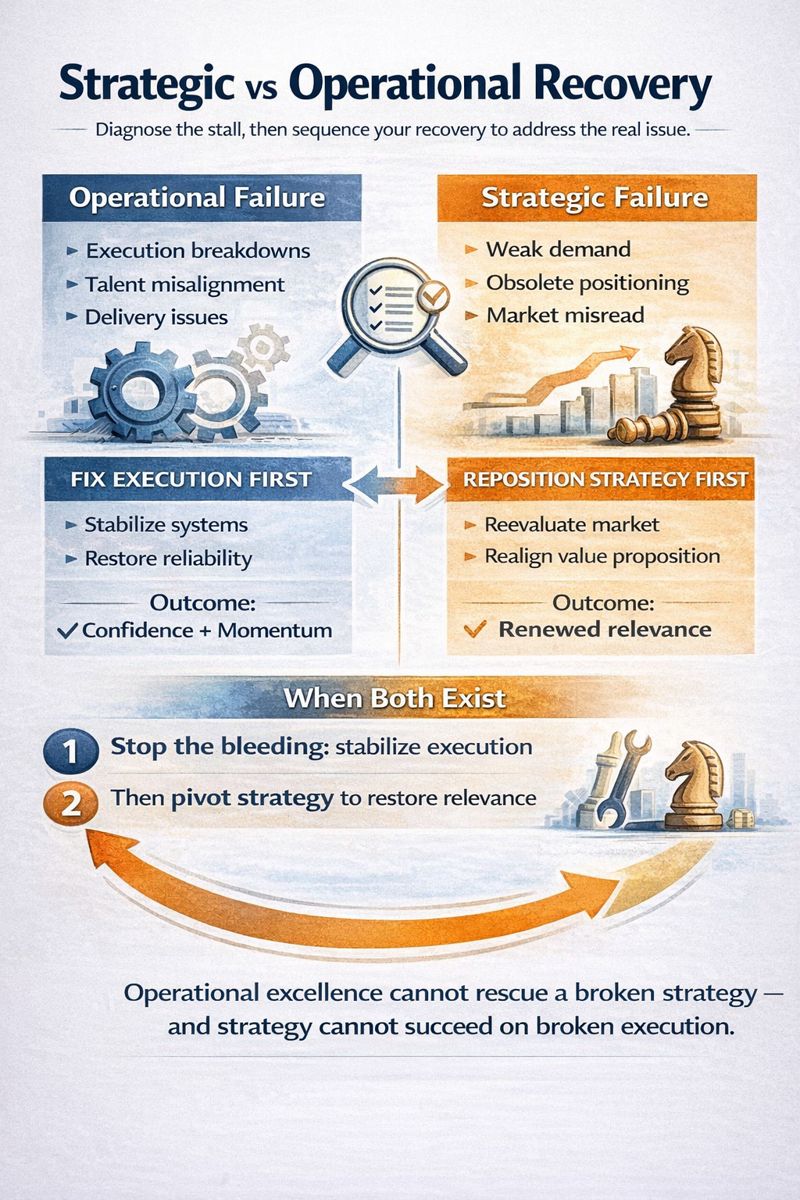

Understanding growth stagnation requires distinguishing between two fundamentally different types of organizational failure. Strategic failures occur when a company’s value proposition no longer aligns with market needs and preferences. The organization may execute flawlessly, but it executes against the wrong objectives. The product or service offering has become disconnected from what customers actually value. Market dynamics have shifted in ways that render previous positioning obsolete or irrelevant.

Operational failures involve sound strategic direction undermined by broken systems, inefficient processes, or misaligned talent. The destination remains correct, but the vehicle cannot reach it. Think of it as having an accurate map but a malfunctioning engine. Execution breakdowns prevent the organization from delivering on its strategic promise, regardless of how sound that promise might be.

This distinction matters immensely because the interventions required for each type of failure differ substantially. Too often, organizations confuse the two, leading to wasted resources and delayed recovery. Leadership teams rewrite strategic roadmaps when the actual problem involves execution drag. Alternatively, companies invest heavily in efficiency improvements while their core value proposition becomes increasingly obsolete. Both responses waste resources and delay necessary corrective action.

| Failure Type | Core Issue | Primary Symptoms | Intervention Focus |

| Strategic | Value proposition misalignment | Market share erosion, declining conversion rates, customer indifference | Market research, repositioning, value proposition redesign |

| Operational | Execution breakdown | Delivery delays, quality issues, rising costs, talent churn | Process improvement, system upgrades, capability building |

| Hybrid | Both strategic and operational gaps | Multiple concurrent symptoms across market and operations | Staged approach: stabilize operations first, then address strategy |

The Diagnostic Process

Effective diagnosis of growth stagnation mirrors the approach of skilled physicians: ask precise questions, separate symptoms from root causes, and validate conclusions through multiple data sources. This process begins by identifying the exact moment when growth momentum shifted. Was the change sudden, triggered by an external market shock such as new competitive entry or regulatory change? Or did it develop gradually, like sand slipping through fingers, with barely perceptible decline accumulating over quarters? The answer shapes subsequent investigation and determines the urgency and scope of response required.

From there, leadership teams must generate and categorize hypotheses about potential causes. What factors could explain the observed patterns? These hypotheses should be sorted into strategic and operational categories, creating structure for the analytical process. This categorization proves powerful because it transforms conversations from blame-oriented finger-pointing into clear, action-oriented inquiry. It allows different functional leaders to contribute expertise without defensive posturing.

The diagnostic framework should address several critical questions:

- When precisely did growth momentum begin to decline, and what internal or external events coincided with that timing?

- Are customer acquisition costs rising, conversion rates falling, or customer lifetime value declining, and which metric shows the most significant deterioration?

- Have competitive dynamics shifted through new entrants, pricing pressure, or changing customer preferences?

- Are delivery timelines slipping, quality metrics declining, or operational costs rising faster than revenue?

- Is talent retention becoming problematic, and if so, in which functions or roles specifically?

Working with a financial services organization that had invested heavily in marketing despite slowing growth demonstrated the value of structured diagnosis. Leadership insisted they were doing everything right, pointing to increased advertising spend and expanded sales territories. Yet closer examination revealed that their digital onboarding process created significant customer friction. Abandonment rates had soared to nearly forty percent. The strategy itself remained sound and the market opportunity continued to exist, but operational execution had broken down at a critical customer touchpoint.

We rebuilt the backend systems, fixed the customer flow to reduce friction points, and reskilled frontline teams on the new processes. Growth returned not because strategic direction changed but because we honored the existing direction by fixing execution. The intervention required less than six months and cost a fraction of what had been spent on ineffective marketing campaigns. This experience reinforced a fundamental principle: accurate diagnosis prevents wasted intervention.

Learning to Listen

Diagnostic accuracy depends heavily on organizational listening capability. Teams consist of people who bring pride, political considerations, and fear to their work. Product leaders may hesitate to acknowledge market misfit because it implies their previous decisions were flawed. Operations heads may defend processes even when evidence suggests they no longer serve their purpose, because admitting operational failure feels like personal failure. Real diagnosis therefore requires not just analytical rigor but also emotional intelligence and trust-building.

My practice insists on validation from multiple sources. Internal perspectives matter, but they must be balanced with input from customers, partners, and vendors. Silent signals between meetings often prove as informative as explicit statements. The conversation that happens in the hallway after the formal meeting ends frequently contains more truth than what was said in the conference room. Reading the room becomes as important as reading the data.

A fintech client developed excellent technology for simplifying credit risk assessment for small businesses. The model should have scaled rapidly based on market size and competitive positioning, yet growth stalled after initial customer acquisition. Various theories circulated internally about customer acquisition costs, macroeconomic pressures, and competitive dynamics. Marketing blamed sales execution. Sales blamed product features. Product pointed to market conditions. However, one frustrated customer provided the insight that unlocked the truth: the product was excellent but did not solve the problem customers actually needed addressed.

They required financial guidance and cash flow forecasting, not just better risk scoring. The technology was sophisticated and the execution was solid, but it addressed a problem customers found less pressing than the company assumed. A comprehensive listening tour through sales calls, customer interviews, and support transcripts confirmed this pattern across the customer base. Adjusting the value proposition and rebuilding parts of the customer experience to incorporate financial planning tools transformed stagnation into accelerating growth. The lesson was humbling but clear: assumptions about customer needs must be continuously validated, not simply asserted.

Strategic Vs Operational Recovery

Once diagnosis clarifies the nature of the stall, recovery pathways diverge based on whether the fundamental issue is strategic or operational. If operational factors drive the stagnation through delivery issues, talent misalignment, or system breakdowns, then fixing the organizational machine takes priority. Building new strategic initiatives on top of a wobbly operational foundation simply multiplies problems. Restoring capability and reliability allows teams to experience progress and rebuild confidence before undertaking more ambitious strategic shifts.

Conversely, when diagnosis reveals strategic failure through market misunderstanding, flawed positioning, or obsolete offerings, operational efficiency provides little help. No amount of process improvement rescues a value proposition that markets no longer value. In these situations, the painful work of strategic repositioning must come first, even if it means acknowledging that previous strategic choices were incorrect. This requires leadership courage because it involves admitting error at the highest organizational levels.

Sometimes, as my experience across multiple sectors confirms, both strategic and operational issues contribute to growth stagnation simultaneously. In these complex situations, effective leaders stage their recovery carefully. They begin by addressing the most urgent operational issues that bleed momentum and credibility. These quick wins demonstrate that leadership understands the problems and can execute solutions. Only after stabilizing execution do they undertake the more complex and time-consuming work of strategic repositioning.

A global consumer brand illustrates this challenge vividly. They had embraced digital channels early, invested substantially in omnichannel capabilities, and executed multiple rebranding initiatives with considerable fanfare. Marketing campaigns won industry awards. The executive team spoke at conferences about their digital transformation. Yet new product lines failed to resonate and market share eroded steadily. Leadership doubled down on execution through product launches, loyalty programs, and regional marketing campaigns, but decline continued quarter after quarter.

Deeper investigation revealed that the strategy itself had become fundamentally flawed. The company had misunderstood their target customers in profound ways. The insights driving their roadmap had become outdated as demographic preferences shifted. Their flagship products no longer fit into the lives of the younger demographic they pursued. Premium positioning alienated price-sensitive segments while failing to deliver sufficient differentiation for true luxury buyers. Sophisticated execution could not overcome strategic misalignment. We returned to foundational customer research through immersions, usage studies, and cultural mapping. The resulting strategic pivot from premium to accessible positioning and from style-focused to substance-focused messaging restored both growth and cultural relevance within eighteen months.

The Human Dimension of Recovery

Recovery from growth stagnation tests more than analytical capabilities and strategic acumen. It tests leadership character and organizational resilience in fundamental ways. Teams entering recovery often feel battle-weary, with fragile confidence and uneven energy across different functions. People question whether leadership truly understands what went wrong. They wonder whether proposed solutions will actually work or represent just another false start. This environment does not respond well to sweeping pronouncements or overwhelming action plans that promise transformation without acknowledging past failures.

Instead, it requires thoughtful sequencing, precise interventions, and clear communication that builds credibility through demonstrated competence rather than rhetorical flourish. The most effective turnarounds begin with specific, tangible improvements rather than grand visions. A critical process gets simplified, reducing cycle time by measurable amounts. A customer journey is redesigned, improving conversion rates in ways that sales teams can see immediately. A leadership bottleneck is removed, accelerating decision-making that had been frustrating teams for months.

These early actions matter not just for their operational impact but for what they signal to the organization: leadership sees clearly now and is rebuilding with genuine intent rather than desperate improvisation. Each small victory rebuilds trust and creates momentum for larger changes that follow. This staged approach prevents the cynicism that develops when organizations announce major transformation programs that fail to deliver tangible results.

My experience in corporate restructuring, developed through work ranging from troubled asset management to strategic business turnarounds, reinforces the importance of this measured approach. Professional certifications including the Chartered Financial Analyst designation provide analytical frameworks for assessing organizational health and designing recovery strategies, but successful recovery ultimately depends on reading organizational dynamics accurately and pacing change appropriately. The technical skills matter, but the emotional intelligence to navigate organizational politics and rebuild confidence matters equally.

Communication and Culture

Once recovery gains momentum, communication becomes central to sustaining progress and preventing backsliding. Internal and external stakeholders need confidence that the organization understands what happened and has charted a credible path forward. Many leaders stumble here by over-indexing on inspirational slogans or speaking in vague abstractions about vision and values. Teams have heard enough about aspirations. What they actually need is candor, context, and coherence.

This is not the moment for poetic inspiration. It is the moment for precise information that demonstrates mastery of detail and commitment to execution. Effective leaders explain what changed in market conditions or organizational capabilities, demonstrate how learning occurred through specific examples, and outline the trade-offs inherent in chosen paths with honesty about what will be gained and what will be sacrificed. Rather than selling hope alone, they sell the plan that makes hope reasonable and achievable.

One of the most powerful statements a leader can make after growth stagnation is direct acknowledgment: we made decisions based on beliefs that proved incorrect, we now understand differently based on specific evidence, and here is precisely how our actions will change going forward. This combination of humility and resolve rebuilds cultures more effectively than a thousand offsite meetings or motivational speeches that ignore past failures. It creates psychological safety for others to acknowledge their own mistakes and learn from them.

One CEO I worked with during organizational recovery maintained a simple but powerful practice that transformed team dynamics. Every Friday, he called three people from different teams and organizational levels to thank them specifically for something they accomplished that week. He did not lecture them about strategy or vision. He did not use the call to gather information or assign new tasks. He simply showed them they were seen and valued as individuals contributing to collective success. This practice, maintained consistently over eighteen months, changed organizational culture profoundly by creating hundreds of personal connections between leadership and frontline teams.

Finding New Edges

Recovery from growth stagnation does not always mean returning to previous approaches or trying to recapture past glory. Often, it requires moving toward organizational edges where future customers, emerging channels, and untapped capabilities reside. The fastest path to renewed growth may lie in spaces the organization previously overlooked or dismissed as peripheral to core business. This requires willingness to challenge assumptions about where value creation opportunities exist.

A technology client faced severe stagnation after scaling too quickly in their core market, overwhelming operational capabilities and diluting product quality. Rather than intensifying efforts in spaces that had stopped working, we explored adjacent verticals that remained underserved but showed strong growth potential and better aligned with organizational capabilities. The healthcare technology sector, which they had previously considered too regulated and complex, actually offered opportunities for their core competencies in data integration and user experience design.

The pivot was quiet and disciplined, lacking the drama of major announcements. We tested hypotheses with small pilots, iterated based on customer feedback, and listened carefully to what early adopters told us about unmet needs. Within eighteen months, their fastest-growing segment was one they had not seriously considered before the stall occurred. Revenue from healthcare clients grew from zero to thirty percent of total revenue, and margins were significantly higher than in their original market due to less intense competition.

This pattern reflects broader lessons about organizational adaptation and the importance of maintaining peripheral vision even during periods of growth. Sometimes growth does not come from reigniting old fires but from lighting new ones in different locations that offer better fuel and less resistance. My background in business development and market expansion, developed through work across financial services, technology, and healthcare sectors, confirms that recovery often requires looking beyond traditional boundaries toward opportunities that existing organizational frameworks may have overlooked or actively avoided.

Board Dynamics During Recovery

No recovery succeeds without board alignment, yet boards can become either assets or obstacles during periods of organizational stress and uncertainty. Some boards push for faster results regardless of underlying reality, creating pressure for premature action that undermines careful diagnosis and staged recovery. Others second-guess management decisions in ways that undermine confidence and coherence, creating paralysis through endless debate. The most effective boards become genuine partners in recovery by clarifying their own role rather than attempting to manage operations or substitute their judgment for management expertise.

Strong boards during recovery periods ask sharper questions that expose assumptions and challenge conventional thinking, protect long-term investments from short-term pressures that would sacrifice sustainable recovery for quarterly optics, and help leadership teams distinguish signal from noise in the flood of data and opinions that characterize stagnation periods. They understand that not every quarter needs to demonstrate growth when the organization is rebuilding foundations for future success. They know the difference between necessary slowness that serves clarity and problematic drift that indicates confusion or lack of direction.

When working with boards during recovery phases, I emphasize the importance of distinguishing between noise and narrative. Punishing slowness when it serves necessary clarity and thorough diagnosis proves counterproductive and encourages premature action. Demanding visible change when alignment is still forming around root causes creates additional confusion and false starts. Recovery is not about optics or public relations gestures. It is about rebuilding truthfully and sustainably in ways that address fundamental issues rather than cosmetic symptoms.

Emerging Stronger

Eventually, when diagnosis proves accurate and recovery is executed with discipline and patience, organizational tides turn in measurable and sustainable ways. Financial metrics begin improving consistently rather than sporadically. Team confidence returns as people see that their efforts produce tangible results. Customer feedback becomes more positive as operational improvements enhance experience. Market perception shifts as the organization demonstrates renewed competence and relevance.

However, the growth that follows stagnation differs fundamentally from the growth that preceded it. Initially, it may be slower and more deliberate as the organization prioritizes sustainability over velocity. But it proves deeper, more resilient, and more honest in confronting challenges rather than papering over them. Organizations that have experienced and overcome growth stagnation stop chasing every opportunity that appears attractive on surface. They build with greater intention, applying clearer criteria for resource allocation and strategic focus.

They respect execution more seriously, understanding that brilliant strategy means nothing without operational capability to deliver. They question strategy more rigorously, refusing to accept plans based on wishful thinking or outdated assumptions. They abandon illusions of permanent advantage or inevitable success, recognizing that competitive position must be earned continuously through superior value creation. This kind of growth does not just heal an organization. It matures it into something more capable and resilient than what existed before the stall.

Companies that have known failure and recovered lead differently than those that have experienced only success. They listen more carefully to dissenting voices and uncomfortable truths. They balance metrics with morale, understanding that organizational health requires both. They understand that strategy matters but timing matters equally, and that patience often proves more valuable than speed. They recognize that sometimes the bravest decision is to stop, assess honestly, and change direction rather than persisting with approaches that no longer work.

There is a particular grace in organizations that have confronted their limitations honestly and emerged stronger from that confrontation. They carry wisdom that cannot be taught through case studies or consulting frameworks, only earned through direct experience of failure and the hard work of recovery. This wisdom shapes decision-making, strengthens resilience, and positions them to navigate future uncertainties with greater confidence and capability than competitors who have never been tested by serious adversity.

Conclusion

Growth stagnation represents not an ending but a revealing pause that can illuminate the path toward a stronger, more resilient future if leadership responds with clarity and discipline. Success requires listening closely to what the stall reveals about strategic assumptions and operational realities, moving wisely through staged interventions that address root causes rather than superficial symptoms, and rebuilding patiently with disciplined execution that prioritizes sustainable capability over quick wins. At the heart of every successful turnaround lies not elegant models or sophisticated market analysis but a group of people who choose, despite evidence of past failure, to believe that better outcomes remain possible through honest assessment and committed action. That belief, when rooted in clear-eyed diagnosis and expressed through purposeful, sequenced interventions, transforms stagnation from a crisis into a foundation for renewed growth. The companies that emerge from these challenges carry hard-won wisdom that shapes their decision-making, strengthens their resilience, and positions them to navigate future uncertainties with confidence and capability that only adversity can forge.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.