Executive Summary

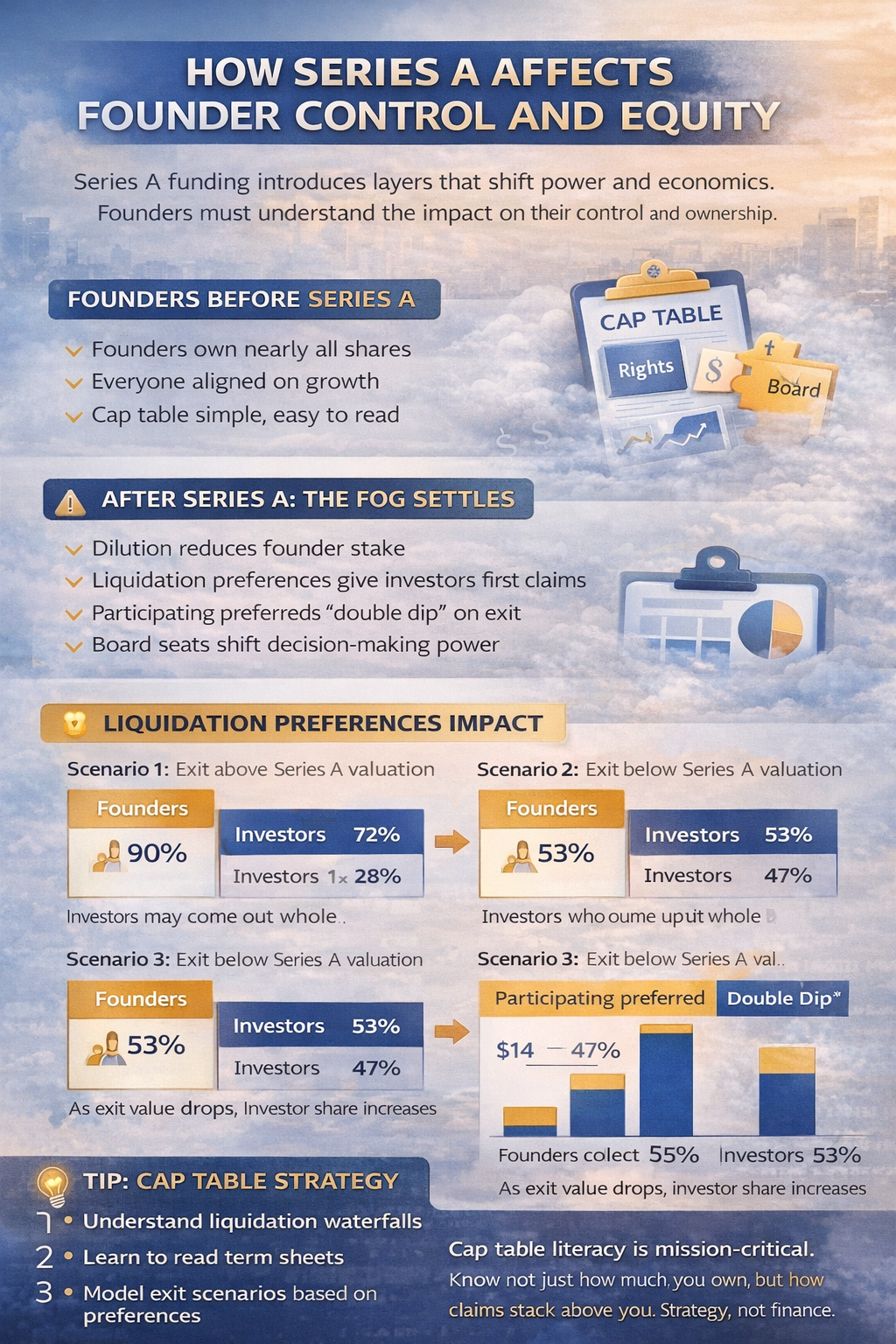

The excitement of closing a Series A round is palpable. But amid the celebration, something quieter happens. A fog settles over the cap table. Before Series A, the cap table is simple. Founders own nearly all the shares, and everyone is aligned. After Series A, investors want growth but also downside protection through rights, preferences, and board control. Liquidation preferences give investors their money back before anyone else gets paid. If the exit is below the Series A valuation, investors may come out whole while common shareholders take the loss. Then there is dilution, anti-dilution protection, participating preferred shares, board seats, protective provisions, and drag-along rights. Each layer changes how power is shared and where value flows. The fog becomes thickest when multiple rounds have occurred. Cap table literacy should be a core skill for any founder. Founders need to understand the mechanics themselves, how to read a term sheet, and how to model a liquidation waterfall. This is not finance for its own sake. It is strategy.

The Fog Settles: What Changes After Series A

Before Series A, the cap table is simple. Founders own nearly all the shares, early employees may have options, and an angel investor or two might hold small stakes. Everyone is aligned around survival and growth. The focus is on making something people want.

After Series A, the focus shifts. Investors want growth, but they also want to protect their downside through rights, preferences, and board control. The cap table becomes harder to read. This is not due to malice. It is due to mechanics. New money brings new rules.

Liquidation Preferences: The First Layer of Complexity

One of the first things founders miss is how preferences affect future payouts. When a Series A investor puts in money, they typically ask for preferred shares with liquidation preferences. This gives the investor their money back before anyone else gets paid, sometimes at one times the investment or more.

If the company sells for less than expected, the investor may still get their full money back while the founder gets little or nothing. A company can grow in revenue but decline in value. If the exit is below the Series A valuation, investors may come out whole while common shareholders take the loss. Founders often focus on percentage ownership and miss the stack of claims that stand above them.

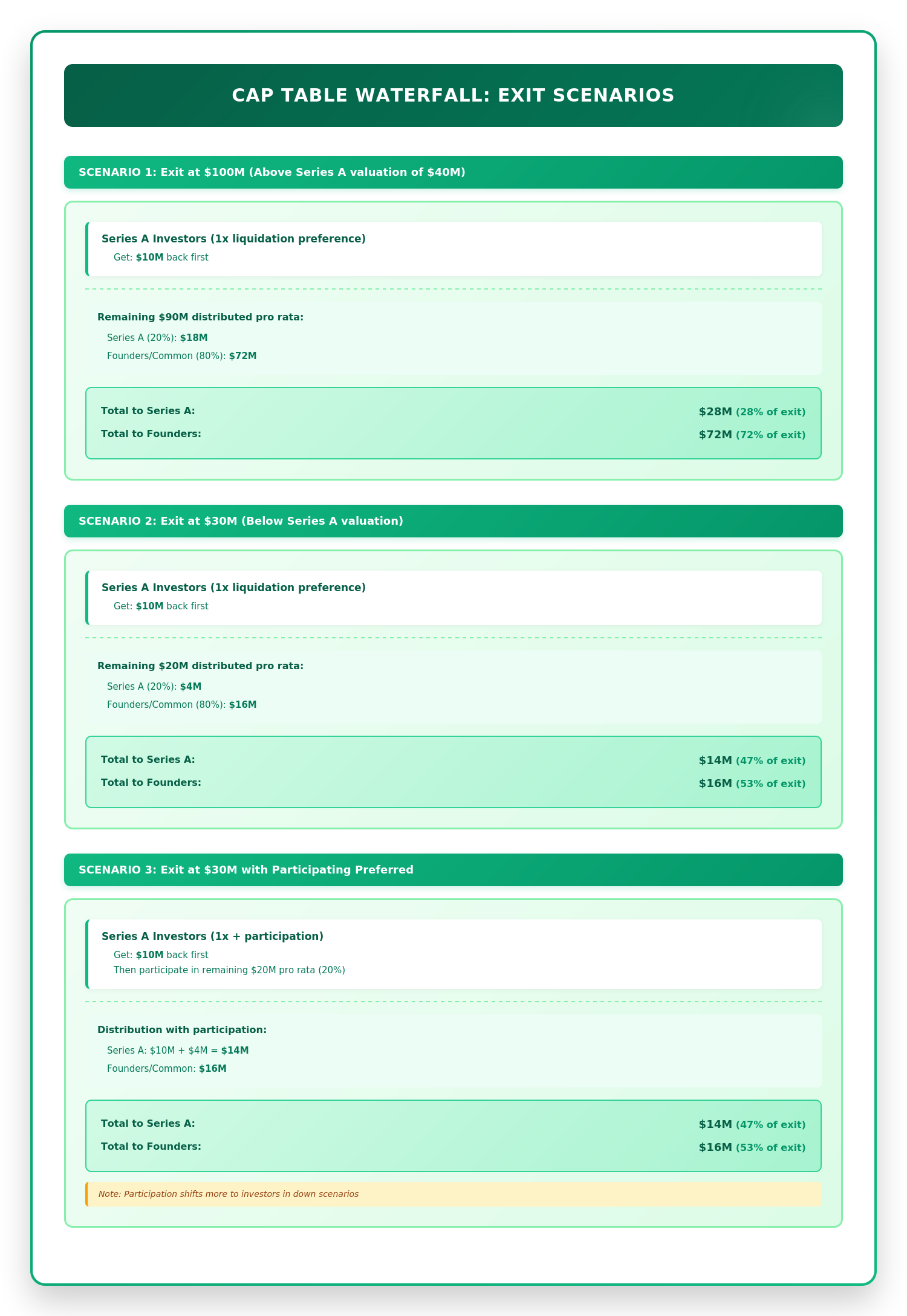

Cap Table Waterfall: How Claims Stack in Different Exit Scenarios

This diagram illustrates how liquidation preferences and participating preferred shares create a waterfall of claims that changes founder economics across different exit scenarios. In Scenario 1, with an exit above the Series A valuation, founders capture 72 percent of proceeds. In Scenario 2, with an exit below valuation, the liquidation preference protects investors, and founders drop to 53 percent despite owning 80 percent of the cap table on paper. Scenario 3 shows how participating preferred shifts even more value to investors through the double dip. The stack of claims matters more than percentage ownership.

Dilution and Anti-Dilution Protection

Founders expect to be diluted in a financing round. What they often miss is how future dilution combines with existing preferences to compound the problem. If the Series A investor has pro rata rights, they can maintain their ownership in future rounds. This means new money from others dilutes the founder, not the Series A investor.

Anti-dilution protection adds another layer. If the company raises money later at a lower valuation, the Series A investor may get more shares to compensate. The founder’s stake is reduced not just by the new money but by the adjustment of old money. Participating preferred shares allow the investor to get their money back and also participate in the remaining proceeds. This double dip shifts more value to investors, especially in smaller exits.

Control and Governance: The Shift in Decision-Making Power

Most Series A investors will request board seats and veto rights over key decisions including new fundraising rounds, hiring or firing executives, selling the company, and changing the business model. The founder may still be CEO, but they are no longer the sole decision maker. The board becomes a place where investors exert influence as fiduciaries to the company, not to the founder.

Protective provisions give investors the ability to block charter changes or major transactions. Drag-along rights force all shareholders to go along with a sale if certain conditions are met. Information rights require regular updates.

Employee option pools are often increased before a round closes, with the dilution hitting existing shareholders rather than new investors. Conversion rights allow investors to convert preferred shares into common shares when it benefits them, meaning the structure adapts based on outcomes.

The Path to Clarity

The fog becomes thickest when multiple rounds occur. Series B and C add more layers. The cap table becomes a stack of claims. Founders may own fifteen percent on paper, but economics and control may reflect much less.

Cap table literacy is a core skill. Founders need to understand how to read a term sheet and model a liquidation waterfall. This is strategy, not just finance.

Conclusion

The fog of war in the cap table is not inevitable. It is a sign that new forces are at play. Founders who want to lead must learn to see through it. They must understand not just how much they own but what their shares mean. They must know not just what decisions they make but which ones they no longer control.

This does not mean founders should avoid venture capital. It means they should engage with it fully informed. It is possible to raise capital and retain vision, to share control without losing direction. But it requires transparency, awareness, and constant recalibration. This is the path to being a stronger steward of both vision and value.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.