Executive Summary

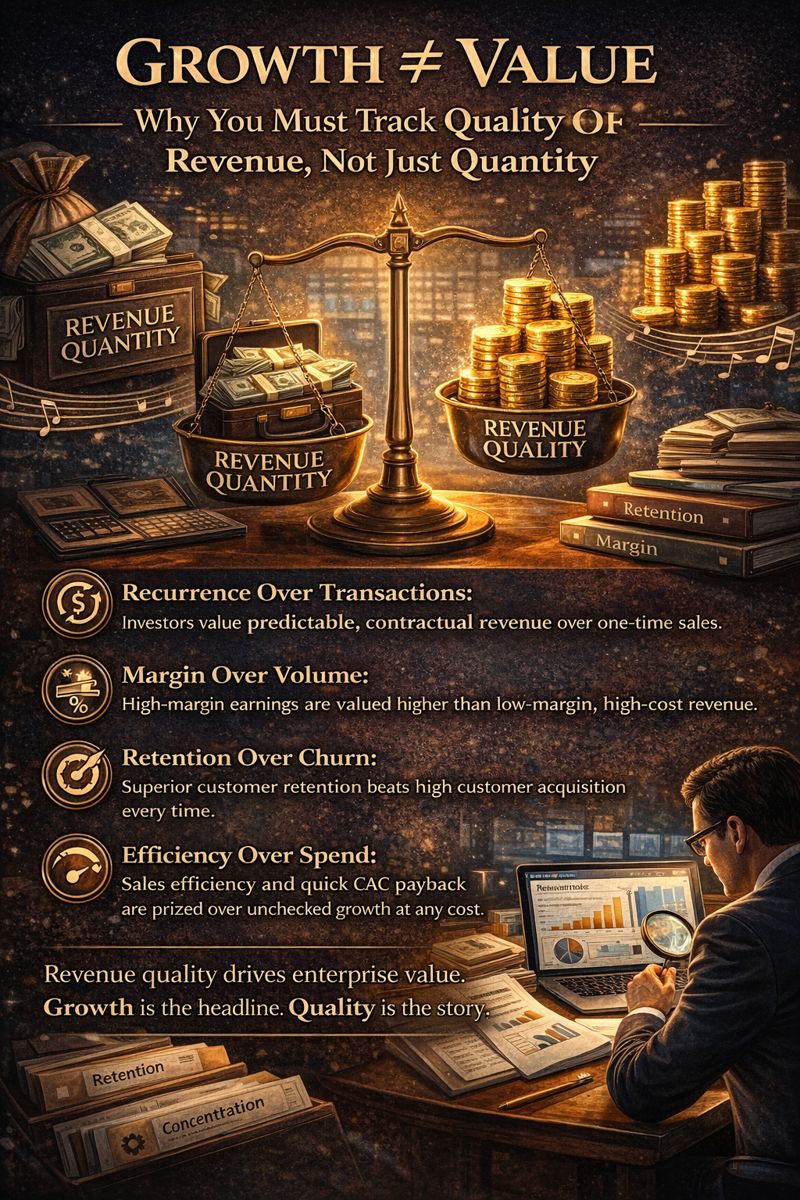

In the early innings of any growth story, there is an intoxicating simplicity: revenue is going up, and that must be good. But beneath that velocity lies a critical distinction that separates durable enterprises from ephemeral ones: the quality of revenue. Quantity may tell you how fast you are growing. Quality tells you whether that growth is worth anything. Revenue makes no distinction between high-margin and low-margin dollars, between recurring and transactional sales, or between sticky and churn-prone customers. In the post-zero interest rate environment, investors are no longer infatuated with growth for growth’s sake. The premium now lies with predictability, profitability, and capital efficiency.

The Mirage of Topline Metrics

Revenue paints a single number where nuance is everything. Companies with identical top-line growth can have radically different enterprise values. One grows by selling one-time services to price-sensitive customers. The other grows by expanding wallet share in long-term contracts. Both are growing, but only one is compounding.

Throughout twenty-five years leading finance organizations across SaaS, digital marketing, gaming, and logistics, I have witnessed boards celebrate revenue growth while ignoring quality signals. At one SaaS organization, customer cohort analysis revealed recently acquired customers were churning at three times the historical rate. The issue was not pricing but sales targeting.

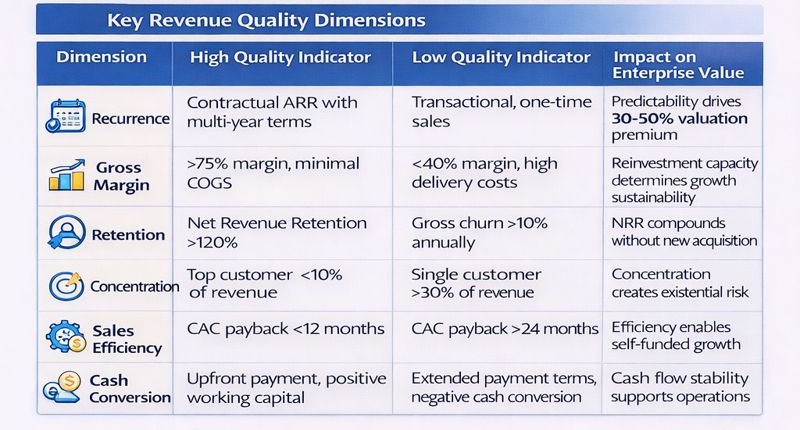

What Defines Revenue Quality

Revenue quality is a multidimensional framework examining where revenue comes from, how likely it is to recur, how expensive it is to earn, and how much value it generates downstream.

The Revenue Illusion in SaaS and Beyond

SaaS companies often boast recurring revenue, but not all ARR is created equal:

- Company A: Fifty million in ARR with ninety percent gross margins, less than one percent churn, and one hundred thirty percent NRR

- Company B: Fifty million in ARR with sixty-five percent gross margins, ten percent churn, and ninety percent NRR

Company A is a compounding machine. Company B runs on a treadmill. Yet without a revenue quality lens, they look identical.

The same logic applies outside SaaS. In e-commerce, repeat purchase rate matters more than gross merchandise value. In services, utilization and client tenure matter more than billable hours.

At a digital marketing organization that scaled from nine million to one hundred eighty million in revenue, revenue quality metrics proved more predictive of capital access terms than absolute growth rates. Investors rewarded efficient customer acquisition with favorable valuations.

Why Finance Must Lead This Conversation

CFOs are uniquely positioned to champion revenue quality. Unlike Sales, which focuses on hitting quota, Finance has the mandate and data to measure economic durability.

This requires building dashboards that track:

- CAC by segment: Understanding which customer types generate profitable returns

- NRR by cohort: Measuring expansion potential within existing base

- Margin by product line: Identifying which offerings drive profitability

- Payback by channel: Optimizing go-to-market efficiency

- Churn-adjusted growth: Separating net new from replacement revenue

At organizations where I led FP&A and board reporting, embedding these metrics into compensation structures proved essential. What gets measured gets managed.

At one education nonprofit where I secured forty million in Series B funding, demonstrating revenue quality through donor retention rates and recurring commitment percentages proved as important as total fundraising amounts.

The Perils of Ignoring Quality

When revenue quality is ignored, companies make dangerous bets:

- They overhire for unsustainable growth trajectories

- They raise capital based on inflated run rates that mask churn

- They enter new markets with weak unit economics

- They build product for acquisition, not retention

These bets work in bull markets. They collapse in contraction. High-quality revenue enables better forecasting, lower cost of capital, higher enterprise value multiples, and stronger resilience in downturns.

At a gaming enterprise where I led global financial planning, tracking revenue quality metrics including lifetime value by game title and player retention curves enabled confident multi-year investment decisions in franchise development.

Conclusion

In financial markets, valuation is about discounted future cash flows. The inputs to that equation must be accurate, reliable, and repeatable. Growth alone does not meet that bar. Quality does. As easy capital recedes, companies left standing will not be those that grew fastest but those that grew smartest. Growth is the headline. Revenue quality is the story.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.