Executive Summary

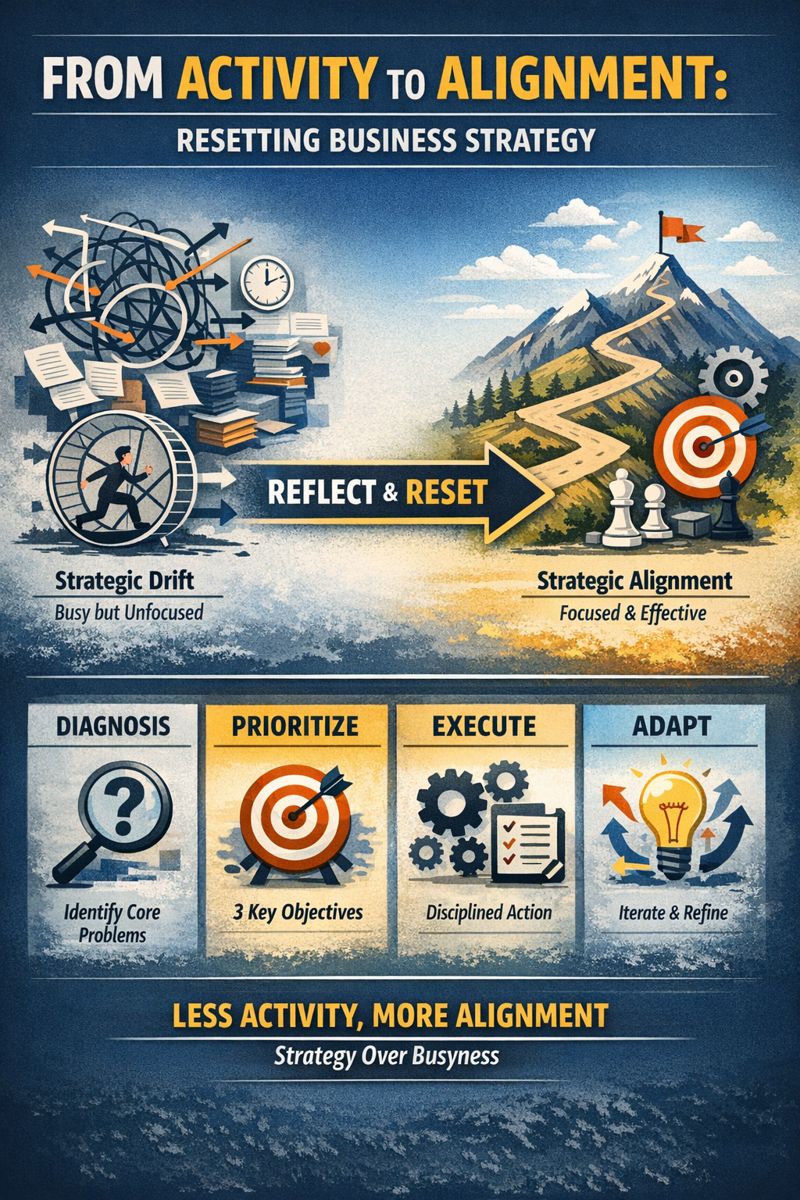

Strategic drift remains one of the most insidious challenges facing troubled organizations. When companies stumble, the instinctive response is often to accelerate activity rather than pause for reflection. More initiatives are launched, more metrics are tracked, and more teams are assembled, yet the underlying trajectory continues to decline. This creates an environment where activity masquerades as progress, and the organization becomes increasingly busy while decreasing coherent. The core problem is not insufficient effort but rather the misallocation of scarce resources toward initiatives that may be energetic yet fundamentally irrelevant to the organization’s central challenges. Recovery demands a fundamentally different approach: strategic subtraction rather than expansion, precision rather than proliferation, and the courage to choose fewer battles with greater focus. Successful turnarounds begin not with ambitious growth agendas but with clear diagnosis, ruthless prioritization, and the discipline to stop doing things that no longer serve the organization’s path to recovery. This demands leadership that recognizes progress as the product of alignment rather than the sum of activity.

The Illusion of Motion: Why Activity Becomes the Enemy of Progress

The corporate world harbors few fallacies more persistent than the belief that activity serves as proxy for progress. When organizations enter distress, the instinct to act intensifies. Projects multiply, meetings proliferate, and dashboards appear with increasing frequency. Yet beneath this surge of motion lies strategic drift rather than direction.

This paradox becomes acute in struggling firms, where relentless doing evolves into institutional self-defense. Leaders facing pressure from boards and investors rush to demonstrate urgency. Operating teams devise initiatives maintaining only tenuous connections to fundamental challenges. The result is an enterprise growing increasingly busy while becoming decreasingly coherent. Productivity declines even as effort increases.

The problem originates not from deficient motivation. Most employees in troubled organizations work harder rather than less. The central issue lies in systematic misallocation of scarce resources toward initiatives demonstrating energy yet lacking relevance. In an environment where strategic advantage depends as much on what an organization stops doing as on what it pursues, this confusion becomes genuine liability.

Organizations entering underperformance typically fall into a familiar cycle. New initiatives receive announcement with fanfare. Teams assemble, objectives crystallize, and progress tracking begins. Within months, these initiatives lose momentum as leadership attention shifts. The cycle perpetuates itself, becoming a substitute for clarity.

Much of this behavior stems from cognitive biases rooted in survival instincts. When conditions become hostile, motion feels safer than reflection. Yet the greater the uncertainty, the more critical it becomes to pause, diagnose with precision, and choose with care. The prevailing impulse in many companies drives toward acceleration: launching additional products, pursuing new markets, restructuring teams. Through these actions, organizations create the appearance of control while drifting further from stability.

The proliferation of key performance indicators has exacerbated this drift. Modern enterprises track hundreds of indicators spanning customer engagement, website analytics, and internal response times. While some provide utility, many generate digital noise. The fundamental danger lies in mistaking measurement for meaning. In distressed organizations, teams highlight improvements in peripheral metrics even as core indicators including revenue, margin, and retention continue deteriorating.

Throughout twenty-five years leading finance organizations across cybersecurity, SaaS, digital marketing, gaming, logistics, and manufacturing, I have witnessed this pattern repeatedly. At one professional services organization, I inherited a finance function managing seventeen disparate initiatives simultaneously. Teams tracked hundreds of metrics, yet none could articulate how their work connected to customer acquisition cost reduction or margin improvement. Our first action was not to launch new programs but to eliminate thirteen initiatives entirely. We redirected those resources toward building an enterprise KPI framework centered on bookings, utilization, backlog, annual recurring revenue, pipeline health, customer margin, and retention. This shift from metric proliferation to metric precision improved our month-end close from seventeen days to under six days while increasing forecast accuracy by twenty-eight percent.

The structure of large organizations reinforces these tendencies. Middle management, caught between strategic ambiguity at senior levels and performance anxiety from below, often becomes the engine of misguided activity. Absent clear direction from above, individual departments create their own. Human resources launches culture initiatives. Marketing revisits brand positioning. Operations introduces new tracking systems. Each effort may possess merit in isolation, yet collectively they fragment organizational focus.

Strategy, once a term denoting choice and trade-offs, has devolved into a synonym for aspiration. Companies declare commitment to customer centricity, digital transformation, or innovation without specifying what activities they will discontinue. This creates an environment where every initiative can claim strategic importance, yet none are truly strategic.

Some organizations recognize this reality and embrace strategic subtraction. Rather than pursue endless arrays of pilots and speculative bets, they stop. They close underperforming divisions, shelve promising but distracting innovations, and focus relentlessly on repairing foundational capabilities. This approach reflects not austerity but coherence.

At a logistics and wholesale organization managing global operations, we faced margin pressures. Rather than launching new product lines or geographic expansions, we undertook comprehensive analysis of freight, warehouse management, and last-mile logistics operations. Through disciplined focus on these core processes, we reduced logistics cost per unit by twenty-two percent. This attention to operational excellence generated greater shareholder value than any diversification strategy could have achieved.

Stopping requires as much courage as starting. It means informing teams that their work, however well-intentioned, no longer aligns with organizational priorities. It means confronting sunk costs and political capital invested in favored projects. Most critically, it means resisting pressure to do something when the wiser path involves doing less but better.

Strategic Reset Framework

If the first casualty of corporate distress is profitability, the second is clarity. Organizations under pressure lose direction, replacing it with improvisation. What these organizations require is not additional activity but greater restraint. Strategy represents a discipline of exclusion.

Resetting direction begins with fundamental mindset change. Most turnaround efforts fail not from lack of power but from lack of focus. The central task involves reducing noise, restoring focus, and reclaiming control over time, capital, and talent allocation.

Sound strategy represents a series of choices. The most fundamental involves deciding what not to pursue. Strategic planning sessions often produce extensive goal lists, each with metrics and timelines. Yet these represent aspirations rather than strategies. Without coherent business theory explaining why it wins and how it sustains advantage, no initiative set will generate more than episodic improvements.

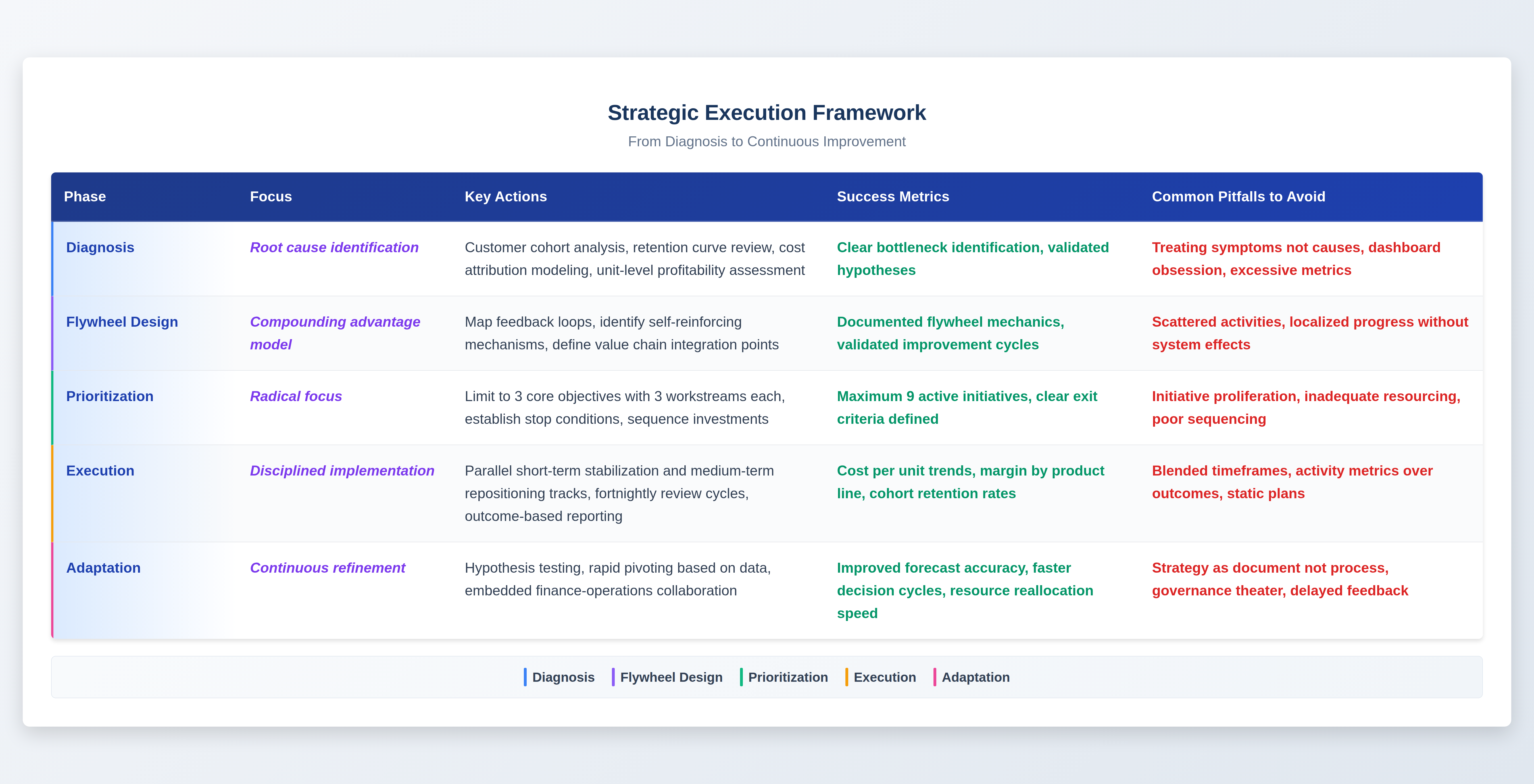

The table below outlines a practical framework for strategic reset based on twenty-five years of finance leadership across diverse industries:

The most effective resets begin with diagnosis, not forecasting. They ask: Where does the real profitability bottleneck exist? Which customer segment has eroded most sharply? Which cost center grows fastest relative to revenue? These questions demand return to primary data including customer cohorts, retention curves, cost attribution models, and unit-level profitability.

The objective involves addressing causes, not symptoms. Many turnaround plans fail through misdiagnosis. Revenue declines receive treatment through sales incentives when the real problem involves product obsolescence. Margin compression receives attention through pricing initiatives when the true issue lies in supply-chain volatility or fixed cost overhang.

At one SaaS organization operating across US and EU entities, cohort analysis tracking new customer behavior revealed recently acquired customers were churning at three times the historical rate. The issue was not pricing or service delivery. The problem originated in sales targeting and qualification criteria. Corrective shifts in lead qualification did more to restore profitability than any broad operational overhaul could have achieved.

Once clear diagnosis emerges, the next task involves rebuilding a model of compounding advantage. Most successful organizations operate some flywheel version: a core feedback loop where improvements in one domain feed performance in others. Struggling organizations often lack such mechanisms. Their activities remain scattered. Progress stays localized. Proper strategic reset involves identifying where such a flywheel can exist. For software firms, it may lie in customer success driving retention, which reduces acquisition pressure and improves margin. For retailers, it may stem from improved merchandising accuracy reducing markdowns and boosting profitability.

Priorities must crystallize, yet these must remain few. In organizations under stress, narrowing focus itself generates stability. A practical rule: three core objectives, each broken into no more than three workstreams. This constraint is not a planning gimmick. It represents a forcing function designed to compel genuine trade-offs. If more than nine initiatives operate simultaneously, the organization likely diffuses attention unproductively.

Each workstream must receive complete resourcing and attachment to measurable outcomes. Resource allocation represents the point where strategy meets reality. Many plans fail not because underlying ideas prove wrong but because the organization funds them halfway by assigning junior staff, denying capital, or underinvesting in enabling systems. Prioritization without adequate resourcing represents performance theater.

Timing matters profoundly. In turnaround conditions, sequencing can determine success or failure. Infrastructure must precede scale. Data hygiene must precede automation. Hiring must follow rather than lead process reform. Without correct sequencing, initiatives collapse under their own ambition.

At one digital marketing organization, we established an effective planning horizon consisting of two parallel tracks: short-term stabilization targeting six months and medium-term repositioning spanning twelve to eighteen months. These tracks operated in parallel yet remained separately managed. The mistake many organizations make involves blending these timeframes, thereby compromising both stabilization and repositioning efforts.

Strategic plans must include stop conditions: explicit criteria for abandoning or pivoting initiatives. These represent essential safeguards against inertia. Turnarounds without built-in exit mechanisms typically recreate the conditions they seek to escape.

Feedback loops prove essential to adaptation. Too many organizations treat strategy as a document rather than a process. They craft detailed plans, present them to stakeholders, then file them away until the next planning cycle. More effective models treat plans as hypotheses. Each initiative represents an experiment. Each output must receive testing against defined benchmarks. Progress reporting relies not on anecdotes or volume metrics but on outcome indicators: cost per unit, margin by product line, customer retention by cohort.

Digital tools enable this real-time visibility. Yet tools alone prove insufficient. Governance must evolve. Fortnightly rhythms of review, recalibration, and resource reallocation ensure strategy remains alive rather than static. In organizations that recover successfully, the strategic function becomes operationally embedded. Finance and operations sit alongside product and customer success functions. The language shifts from strategy as inspiration to strategy as iteration.

These practices of focus, sequencing, and feedback constitute the ingredients of coherence. Coherence represents what struggling organizations most often lack. By reducing surface-level activity and increasing strategic precision, companies move from noise to navigation. The gains from this approach prove cumulative. Small improvements compound. Customer pain points receive attention. Profitability returns. Morale stabilizes. The organization regains not only performance but purpose.

Conclusion

Organizations that recover do so not by attempting to excel at everything but by excelling at fewer things with greater intensity and precision. Throughout my career leading finance transformations across industries from gaming to SaaS, from logistics to cybersecurity, the pattern remains consistent. Recovery begins when leadership gains the courage to eliminate rather than accumulate, to focus rather than diffuse, and to measure outcomes rather than activity. The discipline to prune, to say no, to choose fewer battles represents the defining difference between organizations that recover and those that continue their decline. In the final analysis, progress does not represent the sum of activity but the product of alignment. And alignment begins with the humility to ask whether what is being done truly helps or merely hides the fact that the organization has lost its way.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.