Executive Summary

The best kind of money is the kind you already earned and just forgot to claim. There is a strange kind of tension in the world of tax incentives: the Research and Development tax credit is one of the most generous rewards governments offer to businesses, and yet it remains one of the most underutilized and misunderstood. It is like a savings bond that has been sitting in your desk drawer for years, collecting value, but never getting cashed. Companies either leave it unclaimed, claim it incorrectly, or worse, rush into it recklessly and trigger audits that cost more than the benefit. Throughout my twenty-five years leading finance across cybersecurity, SaaS, manufacturing, logistics, and gaming, I have learned that the R&D credit is not just for labs, scientists, or people in white coats mixing chemicals. It is for manufacturers building prototypes, for software developers debugging code, for engineers iterating on designs. And yes, for startups and mid-market firms pushing the edge of product, process, or platform. If you are solving technical challenges with uncertainty in outcome and applying a process of experimentation, there is a good chance you qualify. But like all things in finance, the devil sits patiently in the details.

Understanding the R and D Tax Credit: Incentive and Scrutiny

The Research and Development tax credit exists at the intersection of opportunity and oversight. It provides dollar for dollar reductions in federal and often state tax liability, but it also attracts regulatory attention.

If a company becomes overly aggressive, it invites scrutiny from tax authorities. If it becomes overly conservative, it leaves legitimate value unclaimed. The correct approach is not avoidance, but disciplined pursuit supported by defensible methodology, documentation, and governance.

In the United States, the R and D tax credit, formally codified as the Credit for Increasing Research Activities under Section 41 of the Internal Revenue Code, was made permanent in 2015. It may offset income tax for profitable companies and payroll taxes for qualifying startups. Many states provide additional credits layered on top of the federal incentive.

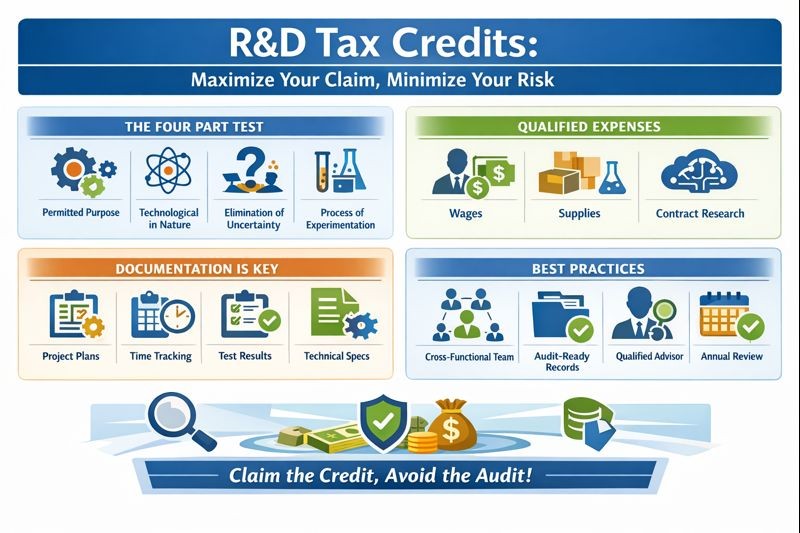

The economic impact can be meaningful. Qualified expenses may generate credits ranging from approximately six percent to fourteen percent, depending on methodology and facts. These expenses generally fall into four categories: wages, supplies, contract research, and certain cloud computing costs related to development and testing.

What Costs Actually Qualify

| Cost Category | What Qualifies | What Does Not Qualify | Documentation Required |

| Wages | Direct R&D labor, supervision, direct support | General management, sales, administrative staff | Timesheets, project allocation, role descriptions |

| Supplies | Materials consumed in R&D process, prototypes | Capital equipment, general office supplies | Purchase orders, project assignment records |

| Contract Research | 65% of third-party qualified research costs | Non-technical outsourcing, offshore development (certain cases) | Contracts, invoices, scope of work descriptions |

| Cloud Computing | Development and test environments | Production infrastructure, general IT | Usage logs, project attribution |

A frequent error among finance leaders is treating the credit as a purely tax driven exercise. In practice, it is an operating discipline challenge. The real question is whether the organization can credibly link spending to qualifying technical activities and demonstrate that linkage under review.

The Four Part Test: Where Most Companies Struggle

To qualify, research activities must satisfy what is commonly known as the Four Part Test.

Permitted Purpose

The activity must aim to create or improve a business component such as a product, process, technique, formula, or software that has functional value to the business.

Technological in Nature

The activity must rely on principles of physical or biological science, engineering, or computer science. Activities grounded in social sciences, management theory, or market research do not qualify.

Elimination of Uncertainty

At the outset, there must be uncertainty regarding capability, method, or design. The outcome cannot be known in advance.

Process of Experimentation

The activity must involve a systematic evaluation of alternatives through modeling, simulation, testing, or trial and error.

A common misconception is that only groundbreaking inventions qualify. The credit does not require novelty at the industry level. It requires technical problem solving where the outcome is uncertain.

When I managed global finance for a one hundred twenty million dollar logistics organization, we successfully claimed credits for route optimization algorithms, warehouse automation development, and last mile delivery process improvements. These efforts involved structured testing of alternatives, performance measurement under varying conditions, and iterative refinement. The resulting credits generated cash flow that was reinvested into further operational improvement.

Documentation: The Critical Success Factor

Now comes the hard part: documentation. The IRS does not deny credits because companies are not innovative. It denies them because they cannot prove they were. In an audit, what matters is not what your team remembers. It is what is written down. You need contemporaneous records: project plans, engineering specs, emails, timesheets, test results, and technical diagrams.

Think of it this way. If your tax return says you spent $1.5 million on qualified R&D but your internal documentation can only substantiate $400,000, you are exposed. Worse, if the IRS finds your claim to be negligent or without reasonable basis, they can assess penalties in addition to disallowing the credit.

Essential Documentation Requirements

| Document Type | Purpose | Best Practice | Red Flag to Avoid |

| Project Plans | Establish technical objectives and uncertainty | Document at project initiation with clear technical goals | Retroactive documentation created for audit |

| Time Tracking | Allocate personnel costs to qualified activities | Weekly or daily timesheets with project codes | Estimated percentages without supporting detail |

| Technical Specifications | Show iterative improvement and experimentation | Version control showing evolution of design | Single final spec without interim iterations |

| Test Results | Demonstrate systematic experimentation | Logs of tests performed, results, decisions made | Undocumented testing or verbal recollections |

| Email/Communications | Provide contemporaneous evidence of R&D intent | Natural business communications referencing technical challenges | Artificially created “audit trail” emails |

| Contractor Agreements | Support third-party R&D expense claims | Detailed SOWs specifying technical deliverables | Vague agreements without technical detail |

Many organizations engage specialized advisory firms. While these firms can provide expertise, they do not remove accountability from finance leadership. The chief financial officer must ensure consistency year over year, methodological rigor, and rapid document production capability.

A practical benchmark is whether the organization can produce project level evidence within thirty days of request.

When I implemented NetSuite, Oracle Financials, and Intacct across multiple organizations, we configured project tracking modules to capture qualifying activity in real time. Engineering time allocation, sprint documentation, specification versioning, and contractor tagging were embedded into daily workflows. This eliminated year end reconstruction and ensured audit readiness by design.

Special Provisions for Startups: Payroll Tax Offset

Since 2016, qualifying small businesses with less than five million dollars in gross receipts and fewer than five years of operations may apply the credit against payroll taxes. This allows benefit realization before profitability.

Eligible companies may offset up to two hundred fifty thousand dollars per year, subject to statutory limits. This requires coordination between tax advisors and payroll processors and proper filing with payroll tax forms.

This opportunity is frequently overlooked because early stage companies assume credits require taxable income.

The CFO Implementation Framework: Treat the Credit as an Asset

Concern about audits should not prevent legitimate claims. Tax authorities expect qualifying businesses to utilize the incentive. However, misuse invites enforcement.

The disciplined approach balances conservatism in ambiguous areas with confidence where qualification is clear.

Ten Step Implementation Framework

R&D Credit Program Implementation Checklist

| Step | Action | Owner | Frequency |

| 1. Leadership | Appoint finance/ops liaison | CFO | Annual |

| 2. Eligibility | Use IRS Four-Part Test to identify projects | Program Lead | Quarterly |

| 3. Expenses | Track wages, supplies, contracts, cloud | Finance/Engineering | Ongoing |

| 4. Tracking | Maintain live log of projects and technical tests | Program Lead | Real-time |

| 5. Filing Method | Use ASC unless detailed base period available | Tax Advisor | Annual |

| 6. Startups | Consider payroll offset if under $5M revenue | CFO/Tax Advisor | Annual |

| 7. Advisor | Vet for audit experience and engineering fluency | CFO | As needed |

| 8. Documentation | Build quarterly documentation review cadence | Program Lead | Quarterly |

| 9. Filing | Attach Form 6765 and supporting documentation | Tax Advisor | Annual |

| 10. Governance | Review program and embed in finance operations | CFO | Annual |

My certifications as a CPA, CMA, and CIA emphasize tax compliance, internal controls, and audit readiness. However, what differentiates successful R and D credit programs from problematic ones is operational discipline. Capturing qualifying activity as it occurs, documenting it contemporaneously, and defending it credibly separates value creation from exposure.

Conclusion

The R&D tax credit can be a powerful source of cash and earnings lift. It applies to more companies than you think, not just tech giants or biotech labs. The key to using it well is documentation, discipline, and defensibility. Do not chase maximum credit. Chase maximum justified credit. Run it like a CFO: clear policy, coordinated teams, and audit readiness. Remember: in the world of tax, not claiming is expensive. But claiming without diligence is reckless. The smart CFO does not guess, does not gamble, and never leaves money on the table when it is legally theirs.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.