Executive Summary

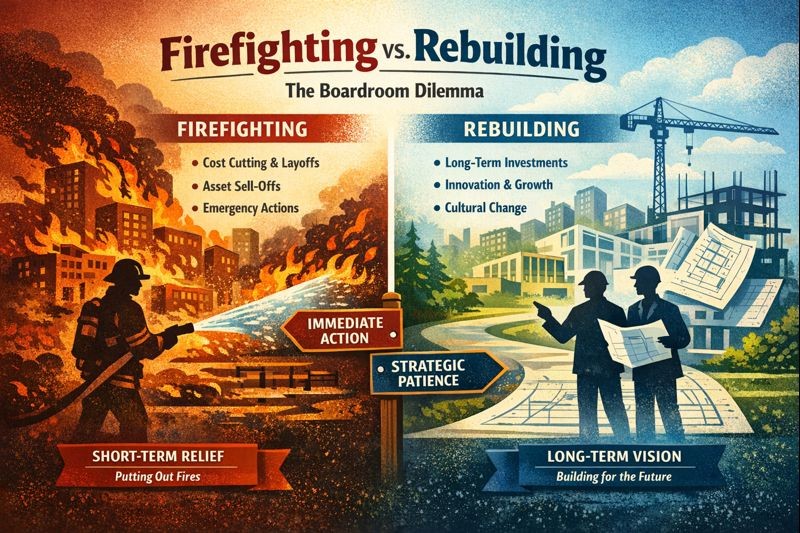

Few moments are as pivotal as when a company confronts its own fragility. Whether prompted by economic downturn, mismanagement, or technological obsolescence, the board inevitably finds itself at a strategic fork: should it embrace aggressive firefighting through cost-cutting, asset spin-offs, and emergency directives, or pursue the longer view of rebuilding through reinvesting in competencies, attracting long-term capital, and reshaping culture? The metaphor of firefighting is emotionally appealing, conjuring heroism and urgency, but boards cannot fight fires indefinitely. At some point, water gives way to blueprints and triage gives way to reconstruction. Yet boards, structurally risk-averse and oriented toward quarterly accountability, often conflate action with effectiveness. In times of crisis, doing something now can feel more comforting than waiting to do something better later. This decision is existential, speaking to the very identity of the company and its leadership. The question of firefighting versus rebuilding is ultimately one of timing and temperament: timing because crisis urgency compresses decision windows, and temperament because boards composed of financiers, technologists, or founders bring inherently different reflexes. Cost-cutting creates the illusion of control without addressing root causes and can destroy the very assets that make recovery possible. Rebuilding requires different courage, asking boards to tolerate ambiguity, invest in long-term capabilities even as short-term metrics falter, and think like architects rather than emergency responders.

The Boardroom Dilemma: Action vs. Architecture

In the annals of corporate decision-making, few moments are as pivotal as when a company confronts its own fragility. Whether prompted by an economic downturn, a black swan event, mismanagement, or technological obsolescence, the board of directors inevitably finds itself standing at a strategic fork. Should the board throw its weight behind aggressive firefighting, triaging the most immediate threats, cutting costs, spinning off assets, and issuing emergency directives? Or should it embrace the longer view of rebuilding, reinvesting in competencies, attracting long-term capital, reshaping culture, and allowing time for durable reform?

Having managed finance operations, strategic planning, and organizational transformations across companies scaling from $9M to $180M in revenue while navigating market volatility, leadership transitions, and strategic pivots, I have witnessed how the metaphor of firefighting is emotionally appealing, conjuring heroism, urgency, and a kind of sacrificial leadership. But as any seasoned fire chief will attest, you cannot fight fires indefinitely. At some point, water gives way to blueprints and triage gives way to reconstruction. Yet boards, which are structurally risk-averse and oriented toward quarterly accountability, often conflate action with effectiveness. In times of crisis, doing something now can feel more comforting than waiting to do something better later.

This decision is not just tactical; it is existential. It speaks to the very identity of the company and its leadership. Is this an enterprise built for survival, or one designed for renewal? The question is ultimately one of timing and temperament. Timing, because the urgency of a crisis can compress decision windows and distort prioritization. Temperament, because boards composed of financiers, technologists, or founders may bring inherently different reflexes to the table.

A Personal Lesson in Rebuilding

To illuminate this tension, let me offer a brief episode. Several years ago, following a leadership change that rendered my role redundant, I found myself unemployed. I accepted a position at a smaller company with a title many peers would have considered a step down. To some, this seemed like defeat; to me, it was deliberate rebuilding. The role gave me access to emerging technologies and analytics tools I had never mastered hands-on. More importantly, it allowed me to reframe my identity not just as a senior executive but as a lifelong learner.

That decision proved catalytic. Within two years, I was leading initiatives that would reinvigorate the business. By choosing to rebuild rather than firefight my career, I invested in capability rather than optics, and the dividends were exponential. This is the thinking boards must encourage when companies face adversity. The quiet work of laying new foundations often secures the long-term future.

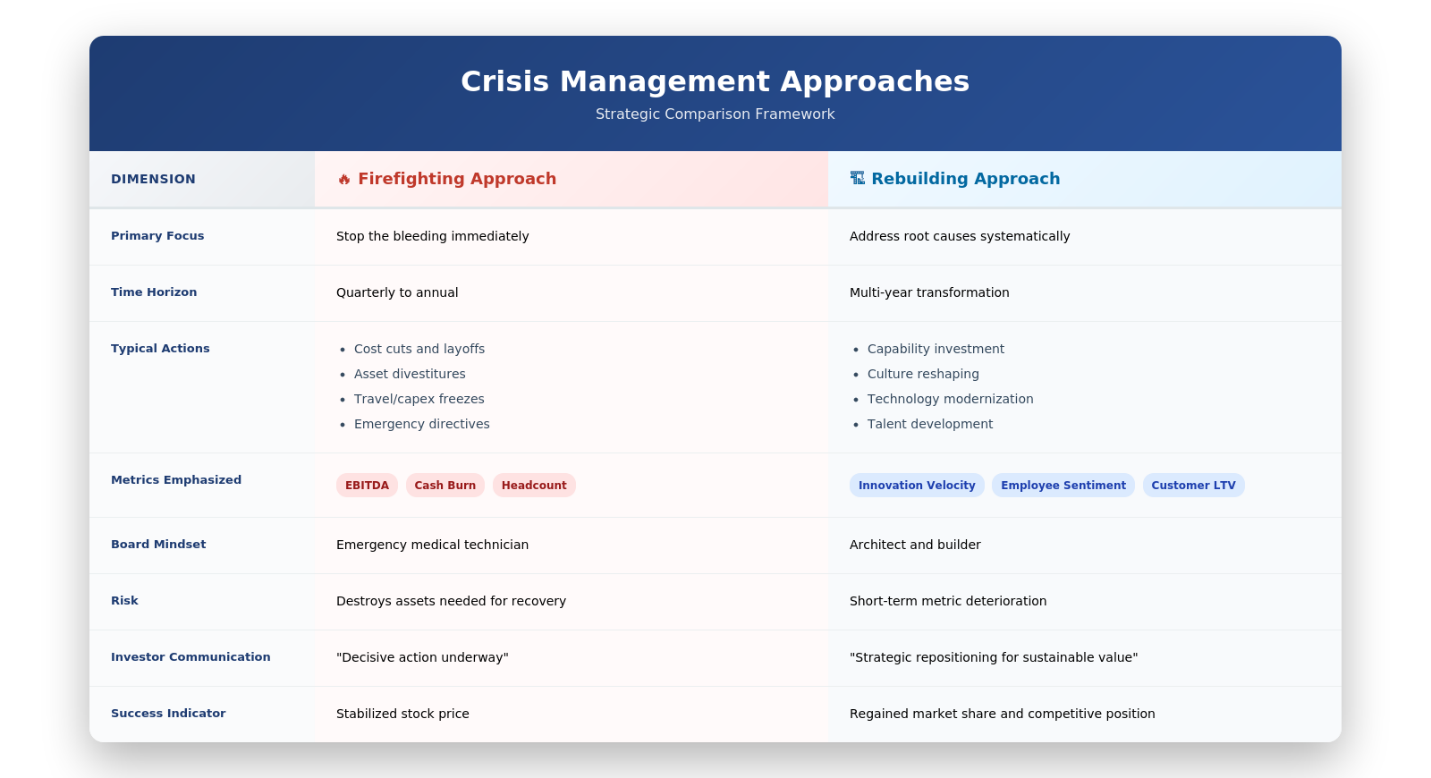

Firefighting vs. Rebuilding: Strategic Framework

The Urgency Trap: When Firefighting Becomes a Mirage

In boardrooms, time and again, the same pattern emerges. Revenues slip. Margins compress. Key talent exits. Activist investors circle. The board convenes, and the dominant question becomes: what can we do now to stop the bleeding? Cost-cutting is the most common response. It is immediate, quantifiable, and symbolically satisfying. Layoffs, divestitures, travel bans, and capital expenditure freezes become the order of the day. A kind of scorched-earth approach takes hold, designed to reassure markets that decisive action is underway.

But such firefighting tactics, while necessary at times, can become a mirage. They create the illusion of control without addressing the root cause of decline. Worse, they can destroy the very assets including intellectual capital, customer goodwill, and innovation pipelines that make recovery possible. Contrast this with rebuilding, which requires a different kind of courage. Rebuilding asks boards to tolerate ambiguity, to invest in long-term capabilities even as short-term metrics falter. It demands patience in a world addicted to quarterly guidance. It requires boards to think like architects, not EMTs.

The Case for Strategic Patience

Consider the case of a mid-sized tech firm that had long relied on a legacy software platform. As competitors moved to cloud-based subscription models, the firm stayed anchored in its traditional licensing framework. When revenues began to slip, the board responded with forceful austerity, cutting R&D, freezing hiring, and reducing sales incentives. The stock stabilized, but customer churn worsened.

It took a new board member with a background in digital transformation to pivot the conversation toward rebuilding. Her proposal was radical: sunset the legacy platform, migrate to SaaS, and absorb the pain of a 12-month earnings dip. The initial reaction was fear of analyst downgrades, of losing loyal customers, of appearing weak. But the board ultimately endorsed the plan. Two years later, not only had the firm regained market share, but it had also established a new revenue base with far higher predictability. The lesson was clear: firefighting had bought time, but rebuilding had bought the future.

Designing Boards for Renewal

If boards are to choose rebuilding over firefighting at the right moments, they must themselves be designed for resilience:

Composition and Cognitive Diversity: A board made up solely of financiers may lack the range required to assess complex situations. Diversity of experience across industries and disciplines enhances capacity to entertain unconventional ideas and mitigates groupthink. Bringing in members with expertise in transformation and customer experience can materially change outlook.

Incentives Aligned to Long-Termism: Too often, board compensation is tied to short-term metrics. Boards must design incentive schemes that reward strategic investment and capability-building. One manufacturing firm linked compensation to talent development and sustainability goals, allowing directors to support automation retraining despite short-term financial hits.

Information Flow Beyond Dashboards: Boards frequently suffer from data overload but insight scarcity. To rebuild, boards must insist on richer reporting: employee sentiment, customer feedback, innovation velocity. When I implemented KPI tracking systems while improving forecasting accuracy by 28 percent, the revelation was not just better numbers but better questions, creating visibility into leading indicators rather than lagging metrics alone.

Culture That Embraces Ambiguity: Rebuilding is messy and iterative. Boards that succeed normalize ambiguity and destigmatize failure, moving from punitive oversight toward partnership. Amazon’s board tolerates experimentation, launching and sunsetting initiatives because it understands that long-term value requires calculated risk-taking.

The Narrative Imperative

In times of crisis, narratives matter. Stakeholders want to know not just what the company is doing but why. Boards must craft a coherent story that explains the pivot from firefighting to rebuilding. This narrative must be consistent across investor calls, employee town halls, and customer interactions. A clear narrative can buy the most precious commodity in a downturn: time. When stakeholders understand that today’s pain is an investment in tomorrow, they stay engaged and supportive.

Conclusion

The choice between firefighting and rebuilding is not binary. Companies often need both. But sequence and emphasis matter. Firefighting can buy time, but rebuilding defines destiny. Boards must develop the discipline to know when the fire is out and when it is time to pick up the blueprints. They must summon the humility to admit when triage is no longer enough and the vision to lead a company into its next incarnation. In my own journey, the decision to rebuild was not resignation but an assertion of long-term intent. Companies deserve the same grace: the chance to stumble, to reimagine, and ultimately to rise. The board’s role is not merely to preserve enterprise value but to create conditions under which future value can emerge. That requires not just vigilance but vision, not just courage in the fire but conviction in the rebuilding.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.