Executive Summary

If you had asked a CFO twenty years ago what they believed about the relationship between their customers and their company’s finances, you would have heard words like invoices, collections, payment terms, maybe credit risk. Their world was a clear boundary, finance was internal, customers were external, and the primary bridge between the two was the accounts receivable line on the balance sheet. Fast-forward to today, and that boundary is dissolving. We now live in a world where finance is not just something you do to support the business. It is something you embed into the business. And it changes not just how CFOs operate but how they compete. Throughout my twenty-five years leading finance across cybersecurity, SaaS, manufacturing, logistics, and gaming, I have learned that what embedded finance really represents is a philosophical inversion. It makes finance a first-class citizen in the product experience, not a downstream process. For the CFO, this is not just a technical upgrade. It is a strategic shift. Because now, finance becomes part of the customer value proposition. And that changes everything.

From Boundary to Integration

At its most basic level, embedded finance refers to integrating financial services such as payments, lending, insurance, and banking directly into non-financial customer journeys. But to view it as just a set of integrations is to miss the forest for the trees. For the CFO, this shift changes how you structure teams and design systems, how you forecast cash, model risk, and even shape product roadmaps.

Let us consider the traditional e-commerce model. A customer selects a product, checks out, and is routed through a payment processor. The CFO is concerned with gateway fees, chargebacks, and net settlement. All of this happens after the transaction. In the embedded model, that same retailer might offer buy-now-pay-later financing at the point of sale, under its own brand, but powered by a third party. The difference? That financing offer is now part of the product. It influences conversion. It affects average order value. It touches loyalty. And it puts the CFO right in the middle of customer experience design.

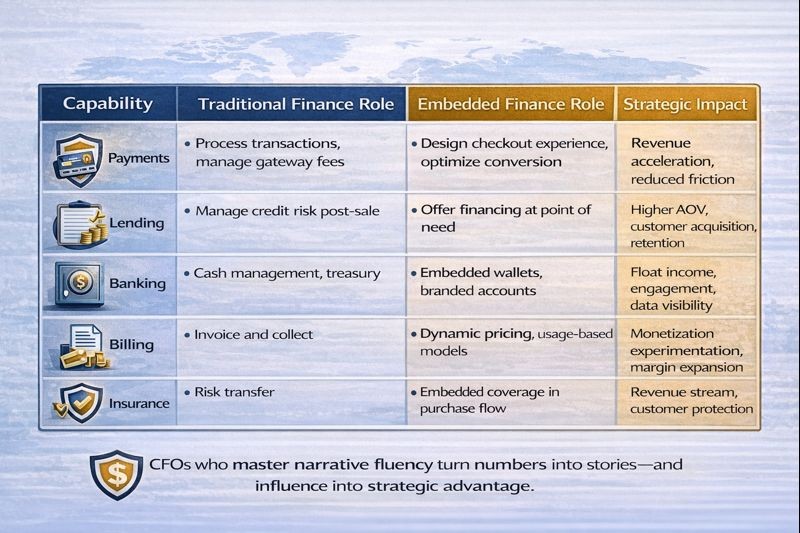

Embedded Finance Capabilities and CFO Impact

In SaaS, the effect is even more profound. A company that embeds real-time billing, usage-based pricing, or tiered subscription logic is not just automating revenue operations. It is designing the revenue model itself, and often doing so dynamically. The CFO who understands how embedded finance tools can enable experimentation at the edge, A/B testing price tiers, automating credits, bundling features with flexible billing, holds a new kind of power. They are not just counting dollars. They are architecting monetization.

When I rebuilt GAAP and IFRS financials for a high-growth SaaS company and designed cohort analysis frameworks, we explored embedded billing capabilities that would allow dynamic pricing based on customer usage patterns. This required finance to work closely with product and engineering to ensure that usage metering, billing logic, and revenue recognition remained synchronized in real time. The embedded approach allowed us to test new pricing models without rebuilding systems each time.

Real-Time Visibility and Control

One of the most important shifts is how embedded finance improves visibility. Traditionally, finance operated in rear-view mode. Transactions would flow through operations, sit in clearing, then finally settle into the ledger. But with embedded finance, every transaction becomes a data point in real time. Embedded payments allow the CFO to see cash positioning across channels instantly. Embedded lending enables dynamic risk pricing. Embedded cards let companies offer branded spending accounts to users or employees with limits, approvals, and cashback logic built in.

These capabilities have real profit and loss consequences. They reduce leakage. They shorten cash cycles. They automate compliance. And they give the CFO an always-on window into the engine of the business, not just as a report but as a real-time control panel. And let us be clear: this is not a playground for startups only. Enterprises are embedding finance too. Airlines embedding travel insurance. Logistics companies embedding fuel card programs. B2B marketplaces offering net terms and receivables financing. Each of these is not just a product feature. It is a financial channel. It generates revenue, deepens data, and creates financial leverage.

When I managed global finance for a $120 million logistics organization, we explored embedded fuel card programs for our driver network. This would have allowed us to capture transaction data in real time, optimize fuel purchasing, and potentially earn interchange revenue. The embedded approach transformed what was traditionally an expense category into a potential profit center while improving driver experience.

New Complexity and Governance

But embedded finance also brings new complexity. With every added capability, be it lending, payments, or card issuance, comes operational nuance. There are compliance risks, reconciliation headaches, and data security requirements. Regulators want to know who is underwriting, who is holding funds, and who is responsible when something fails. The CFO must be able to speak not just in debits and credits but in regulatory frameworks, API throughput, and partner liability structures.

That is why leading CFOs are hiring differently. They are building finance teams with product managers. They are embedding data analysts who understand revenue attribution. They are partnering with engineering to shape event-driven systems that stream usage data directly into billing logic. The function is moving from close-and-report to sense-and-respond.

And this is changing how success is measured. In the traditional model, the CFO might be judged on margin, EBITDA, and working capital. All still essential. But in an embedded world, they are also measured on monetization efficiency, platform conversion, and partner economics. How many users adopted the embedded wallet? What is the drop-off rate on real-time financing offers? How does embedded checkout affect customer acquisition cost payback? These are not marketing metrics. They are financial architecture metrics.

When I built enterprise KPI frameworks using MicroStrategy, Domo, and Power BI tracking bookings, utilization, backlog, annual recurring revenue, pipeline health, customer margin, and retention, we would have needed to add embedded finance metrics including payment conversion rates, financing attachment rates, and embedded product revenue contribution. These metrics bridge product analytics and financial performance.

Strategic Positioning and Product Convergence

This shift is forcing CFOs to get closer to product strategy. Because in many cases, the fastest path to growth is no longer just adding sales representatives or spending on ads. It is turning the product itself into a channel of financial value. It is enabling embedded wallets so users spend more. It is offering cash advances that keep sellers engaged. It is integrating with supplier payment rails to extract better working capital terms.

The lines between product and finance are blurring. And the companies who get this right are not just optimizing operations. They are redefining their business models. Consider how Shopify offers embedded capital, payments, and banking services to its merchants. This is not just convenience. It is a revenue stream. It is also a retention strategy. And it is powered by finance.

CFOs must now ask new questions: Should we build or partner for financial infrastructure? How do we price risk in embedded lending? What margin profiles do we expect from these new products? What are the downstream accounting implications? What disclosures are required? These are no longer fringe topics. They sit at the center of strategy. And the capital markets are watching. Investors have begun to see embedded finance as a signal of platform maturity. Companies that own their financial stack or partner smartly for it earn better valuations because they control more of the margin and own more of the customer experience.

But there is a caution here too. Embedded finance creates complexity fast. APIs multiply. Vendor relationships deepen. Financial flows become opaque. Without discipline, what begins as innovation can become chaos. This is where the CFO’s core strength, control, must evolve. Not as gatekeeping but as orchestration. The best CFOs will build embedded finance governance models. They will define roles, vet fintech partners, establish data integrity pipelines, and align incentives across operations, legal, and product.

Conclusion

This is the CFO’s new mandate. Not just to close the books or protect the cash, but to design the financial fabric of the business. To turn finance from back-office to platform. To turn transactions into insight, payments into products, and risk into revenue. To lead, not react, as the ground shifts. In an embedded world, finance is no longer a function. It is a layer. And the CFO is no longer a steward of past performance. They are the architect of financial systems that serve the present and shape the future. And in that role, the only thing more dangerous than being too late is thinking it is someone else’s job.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.