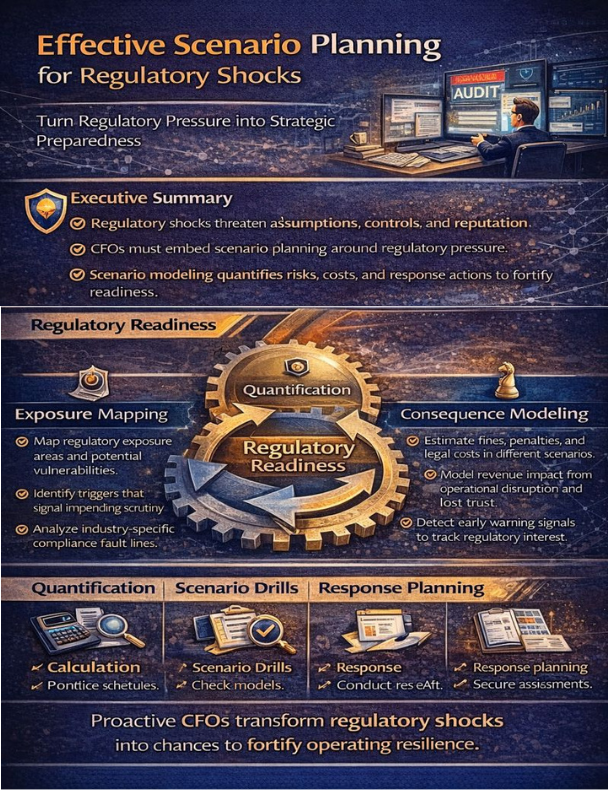

Executive Summary

When regulators appear at your doorstep, whether in the form of a surprise inquiry, a new mandate, or whispers of impending investigation, they do not come as friends. They arrive as forces that challenge assumptions, disrupt rhythms, and publicly illuminate vulnerabilities. At that moment, your organization stands at a crossroads: will it respond reactively, hoping that nothing critical emerges, or will it lean into the uncertainty, using scenario planning not just to defend but to fortify its operating model and reputation? Finance leaders must treat regulatory shocks as more than compliance exercises. They must treat them as strategic inflection points. Because regulatory scrutiny is not random. It often signals misaligned incentives, fragile controls, emerging material risks, or inconsistencies between narrative and record. Throughout my twenty-five years leading finance across cybersecurity, SaaS, manufacturing, logistics, and gaming, I have learned that scenario planning for regulatory events is not optional. It must be embedded actively, rigorously, continuously in finance leadership. This essay explores how to map exposure, quantify consequences, build organizational muscle, and transform regulatory preparedness from compliance burden into strategic capability.

Mapping Exposure and Regulatory Fault Lines

The process begins with a simple question that many leaders struggle to ask: if tomorrow we received a civil inquiry, a subpoena, or an audit notice, what would break first? The answer to that question is not only a test of systems. It is a test of organizational humility. Scenario planning of this kind starts with mapping exposure. Where does this company, and this industry, live in the regulatory spectrum? Are we in financial services, where oversight is perpetual and multi-jurisdictional? Or are we in consumer goods, where one deceptive ad claim can spark a national investigation? Each industry carries its own fault lines. A finance leader must be fluent in those fault lines and articulate them in business terms.

When I served as VP of Finance and Analytics at a cybersecurity and identity access management company, regulatory compliance was not peripheral. It was foundational. We operated in a sector where data privacy regulations including GDPR, CCPA, and sector-specific mandates intersected constantly. We mapped our regulatory exposure across geographic regions, customer segments, and data types. This mapping allowed us to identify where controls were strongest and where vulnerabilities existed. We discovered, for example, that our subprocessor agreements in certain jurisdictions lacked adequate data protection language. That gap, while not yet a violation, represented future regulatory risk that we immediately addressed.

But awareness alone is insufficient. Scenario planning requires structured imagination paired with operational calibration. For example, consider a scenario in which a regulator requests six months of transactional data around a particular product line. Do we have the data stored, accessible, and accurate? Can we produce reconciliations and narratives in days, not weeks? If not, the path forward is not only technical but strategic. We must build those capabilities proactively so that when the request arrives, we are not scrambling.

Quantifying Financial and Reputational Consequences

Scenario planning must consider financial and reputational consequences. A product recall, an anti-corruption investigation, or an earnings restatement, it is not enough to say we will hire a consultant. Finance leaders must build models that quantify the cost of legal fees, the impact on earnings per share, potential disgorgement, reputational drag, and even the cost of executive time diverted. Having these scenarios in hand transforms reactive statements into proactive roadmaps, showing investors, boards, and auditors that the company knows where its vulnerabilities lie.

When I managed global finance for a $120 million logistics organization, we faced potential regulatory scrutiny around customs compliance and transportation safety standards. We modeled the financial impact of various enforcement scenarios including fines, operational shutdowns, increased insurance premiums, and customer contract penalties. These models revealed that the cost of enhancing compliance infrastructure upfront was one-tenth the cost of a single major violation. That analysis justified immediate investment in compliance systems and training, transforming regulatory risk from abstract threat to concrete business decision.

A powerful element of scenario planning is trigger calibration. What early warning signals indicate the initiation or escalation of regulatory interest? Was it a whistleblower? An entry in the risk register? A sudden change in transaction volume in a particular region? A social media spotlight on a customer issue? By building diagnostic triggers and monitoring them, you can detect risk before the regulator does. That is not speculative. That is disciplined contingency planning.

Building Organizational Muscle Through Practice

Equally important is the organizational muscle built when scenario planning becomes habitual. When finance leaders embed mock regulatory drills into quarterly forecasts, compliance is not an afterthought. It is a partner in storytelling. And when controls are tested routinely, not just at audit time, the company gains confidence in its readiness. The fear of regulator fatigue fades when regulatory readiness is integrated into regular rhythms.

When I improved month-end close from 17 days to under six days at a cybersecurity firm, we incorporated regulatory readiness checks into the close process. We validated that revenue recognition matched contract terms, that customer data handling complied with privacy commitments, and that financial disclosures aligned with SEC guidance. This continuous validation meant that when we received SEC comment letters, we could respond within days with comprehensive documentation rather than scrambling for weeks to reconstruct the basis for our accounting positions.

But scenario planning cannot be technical-only. Regulatory risk touches people including frontline managers, compliance teams, legal, human resources, and even information technology. A robust planning process weaves these stakeholders together. It creates cross-functional playbooks including who responds to subpoenas, who owns media narrative, who manages internal communications, and who updates the board. These playbooks must be practiced, not documented and shelved. An organization that has run its scenario once is already ahead when it matters.

Scenario planning can also reveal control gaps. Consider revenue recognition issues, something many finance teams manage tightly. But what if contracts do not match standard operating procedures? Or if special pricing was approved verbally? A regulatory scenario could show that even small deviations, unchecked, become systemic red flags that require restatement. The power of scenario modeling is that it moves finance from defensive posture to strategic leadership, surfacing precision where ambiguity once reigned.

When I rebuilt GAAP and IFRS financials for a high-growth SaaS company and designed cohort analysis frameworks, we conducted a comprehensive review of revenue recognition practices across all contract types. We discovered inconsistencies in how professional services were recognized versus subscription revenue, and how multi-year contracts with variable pricing were being handled. These findings, surfaced through scenario analysis of potential audit inquiries, allowed us to remediate before they became material weaknesses. We strengthened controls, documented policies, and trained the revenue operations team on proper recognition triggers.

Informing Capital Strategy and M&A Due Diligence

Following each scenario drill, the finance team must transition into action. It is not merely about closing gaps. It is about communicating them. Boards, investors, and audit committees appreciate transparency when it comes with a plan. When you can say here are the twelve areas we discovered, here is timeline to remediation, and here is how we tested them, you not only reduce risk, you increase credibility. You turn crisis into currency.

In addition, scenario planning should actively inform capital strategy. When regulatory scenarios expose potential liabilities, they also impact valuation and covenants. A resilient CFO weaves scenario models into financing conversations, ensuring lender relationships are informed, not surprised. And when mergers and acquisitions is on the table, acquirers will scrutinize the depth of the target’s regulatory resilience. That is because one poorly-managed investigation can destroy synergies and earnings.

When I led board reporting at a gaming enterprise where I oversaw $100 million in acquisitions and post-merger integration, regulatory due diligence was as rigorous as financial due diligence. We modeled regulatory exposure for each acquisition target and built remediation costs into valuation models. In one case, we discovered that a target company had inconsistent practices around player data retention across different jurisdictions. The cost to remediate was $2 million. We adjusted the purchase price accordingly and required remediation completion before closing. That disciplined approach protected shareholder value and prevented post-acquisition surprises.

The Evolution of Regulatory Complexity

One of the most dangerous assumptions that finance leaders make is that if they have been in compliance in the past, they are inherently safe from future regulatory disruption. But regulation is not static. It evolves. Rules tighten, expectations rise, enforcement cycles intensify, and the perimeter of what is considered material expands year by year. If the finance function assumes that last year’s controls are sufficient for this year’s complexity, it is not just complacent. It is negligent.

Consider how global data privacy laws have shifted. A decade ago, the focus was limited largely to HIPAA and PCI compliance for health or payment data. Today, with the emergence of GDPR in Europe, CPRA in California, and a slew of other regional data mandates, the burden has extended deep into areas like marketing automation, cross-border transfers, and consent architecture. A CFO who does not have line of sight into how customer data is handled, contractually and operationally, could face millions in penalties, not to mention brand damage that far outweighs the fine.

This is where scenario planning transforms into a competitive advantage. It allows finance to front-run the consequences before the spotlight ever hits. If we know a data request could be coming from a regulator, we can already model how long it would take to retrieve the data, validate its lineage, confirm its completeness, and interpret its business context. More than that, we can estimate the financial impact including legal spend, insurance deductibles, downtime, and possible reputational discount on valuation. These are numbers boards understand. They allow finance to lead the conversation with fact, not speculation.

Scenario planning also inoculates the organization against the sudden vacuum that forms when a regulatory issue moves from dormant to active. That vacuum, created by fear, ambiguity, and internal misalignment, often does more damage than the regulatory inquiry itself. Employees start whispering. Business units stall. Legal departments scramble to control messaging. Leadership loses internal coherence. But if finance has modeled the playbook, has rehearsed the sequence, and can initiate with confidence, it immediately becomes a source of stability. When people know who is doing what, when, and why, the business regains focus faster.

Cross-Border Regulatory Coherence

Another element that deserves emphasis is the CFO’s responsibility in cross-border regulatory coherence. In multinational operations, differing jurisdictions often have conflicting rules, overlapping mandates, and inconsistent enforcement. What passes in one country may be viewed as a violation in another. A finance leader who operates globally must model these conflicts in advance. What happens if an international subsidiary faces local tax scrutiny just as the parent company is preparing for an SEC filing? What if one country demands data the company is restricted from sharing due to another country’s privacy laws?

When I designed multi-entity global finance architecture spanning the United States, India, and Nepal, we mapped regulatory requirements for each jurisdiction. We identified where tax treaties provided relief, where transfer pricing required additional documentation, where local employment laws imposed constraints on restructuring, and where data residency requirements affected system architecture. This mapping allowed us to design business processes that satisfied multiple regulatory regimes simultaneously rather than creating conflicts that would require expensive remediation later.

This is where finance must collaborate closely with legal, compliance, and operational leadership to create a regulatory map, one that outlines exposure, priority, and interdependency across geographies. It is not about predicting the exact moment of a knock at the door. It is about being the only executive in the room who can answer if the knock comes from London or São Paulo or Washington, are we prepared differently and why. And yet, too often, finance teams rely solely on external auditors or legal counsel to manage this risk. While these partners are critical, they are not inside the operating model. They do not understand the cadence of decisions, the nuances of revenue timing, or the subtleties of compensation structures. The CFO does. That is why it is dangerous to fully outsource regulatory response planning.

Building Cultural Dividends and Reputation Capital

Even in the more routine regulatory interactions including periodic audits, SEC comment letters, and state compliance reviews, the same principle holds. Scenario planning gives you a muscle memory that shortens response time, minimizes over-disclosure, and frames conversations through a lens of competency. It turns every interaction into an opportunity to demonstrate mastery rather than scramble to mitigate risk.

There is also a cultural dividend to this discipline. When finance models regulatory scenarios and treats them with the same seriousness as capital allocation or pricing elasticity, it sends a powerful internal message. It says compliance is not someone else’s job. It is embedded in how we create and protect value. That mindset shifts behavior long before rules are broken. It creates accountability at the edges, where most violations originate, not from malice but from misunderstanding.

When I implemented NetSuite and OpenAir PSA systems to automate revenue recognition and project accounting, we built regulatory compliance checks directly into the workflows. Revenue could not be recognized until contract terms were validated against recognition criteria. Invoices could not be issued until delivery milestones were confirmed. These embedded controls meant that compliance was not a separate review step but an integrated part of doing business. That cultural shift reduced errors, accelerated close times, and increased audit confidence.

There is one more lens through which a CFO must examine regulatory preparedness, and that is reputation capital. While financial statements quantify performance, and scenario planning quantifies risk, reputation capital reflects how much credibility the market gives you, especially under scrutiny. In the moments following a regulatory announcement, the world does not wait for details. It reacts to posture. Does the company look prepared? Is leadership coherent and aligned? Is the CFO confident but not evasive, humble but not panicked?

The regulator’s knock, whether public or behind closed doors, is never just a test of compliance. It is a test of culture. A test of whether integrity has been designed into the operating model, not just declared in the code of ethics. When finance leads scenario planning, it becomes the internal compass pointing toward that design. Because it is not enough to comply. We must be seen as trustworthy. And trust is not claimed. It is observed, especially under stress.

From a board perspective, scenario planning for regulatory risk also serves as a critical fiduciary tool. Directors increasingly ask how prepared are we for compliance events. The CFO who can point to living documents, current playbooks, and regularly refreshed assumptions transforms that conversation from theoretical to strategic. It turns risk oversight from checkbox to value-add. My certifications as a CPA, CMA, and CIA reflect a commitment to governance, controls, and risk management. These credentials provide frameworks, but what creates resilience is the daily practice of scenario planning, testing assumptions, and building response capabilities.

When I secured $40 million in Series B funding and an $8 million credit line at a nonprofit organization, investors scrutinized our regulatory compliance posture as rigorously as our financial projections. We demonstrated that we had mapped regulatory exposure across program areas, built compliance monitoring into operations, and conducted regular scenario drills. That preparedness gave investors confidence that regulatory risk would not derail programmatic impact or financial performance.

Enabling Strategic Agility and Building the Capability

It is worth noting too that regulatory scenario planning is not merely about financial survival. It is about enabling agility in strategy. When you know where your potential regulatory constraints lie, you can move more decisively in adjacent areas. If, for example, you have modeled what happens if a regional compliance issue freezes operations, you can build parallel routes, partnerships, or product variants. That foresight gives you room to adapt. It builds strategic degrees of freedom, and in modern business, degrees of freedom are the most undervalued form of capital.

Some will argue that overplanning for rare regulatory shocks is inefficient. That the time spent running scenarios could be better used closing books faster or reducing selling, general, and administrative expenses. But that view is dangerously narrow. Because one material event can undo years of careful performance. And in the real world, no line item in a budget is as expensive as a consent decree, a restatement, or a loss of public trust. Scenario planning is not overhead. It is the insurance policy that pays for itself in leadership credibility.

For those starting this journey, do not try to boil the ocean. Begin with one scenario, one risk that sits uncomfortably at the edge of your current processes. Model it. Identify data needs. Draft a response plan. Run a table-top exercise with legal and compliance. Capture lessons. Refine. Then move to the next. Over time, you will not only build resilience, you will also build speed. And speed is everything when the regulator’s clock starts ticking.

When I built enterprise KPI frameworks using MicroStrategy, Domo, and Power BI tracking bookings, utilization, backlog, annual recurring revenue, pipeline health, customer margin, and retention, we added regulatory compliance metrics. We tracked the percentage of contracts reviewed by legal, the average time to complete compliance audits, the number of open control findings, and the speed of regulatory response. These metrics made regulatory readiness visible and measurable, transforming it from abstract commitment to operational discipline.

The truth is this: regulators will always come. Whether it is through routine channels, public pressure, whistleblower tips, or global coordination, scrutiny is not a possibility. It is an inevitability. The only question is whether you will meet it with uncertainty or readiness. The companies that endure, and the finance leaders who thrive within them, are those who refuse to be surprised twice. They learn, they practice, they embed. And when the knock comes, they do not panic. They open the door, hand over the plan and lead.

Conclusion

Scenario planning is not just a finance discipline. It is leadership in its highest form. The CFO who treats regulatory risk as a strategic inflection point rather than a compliance burden transforms their organization’s relationship with oversight. They build systems that detect risk early, respond quickly, and communicate credibly. They create cultures where compliance is embedded in operations rather than bolted on through audits. They turn potential crises into demonstrations of organizational maturity. This work is not glamorous. It does not generate headlines in boom times. But when the regulatory environment tightens, when enforcement intensifies, when scrutiny focuses, the companies that invested in scenario planning will stand apart. Not because they avoided regulatory attention but because they were prepared to meet it with competence, transparency, and strategic clarity. And that preparation, built quietly over time through rigorous scenario planning, becomes the ultimate competitive advantage when it matters most.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.