A CFO’s Blueprint for Risk, Speed, and Trust

In any well-functioning company, compliance is like the immune system. Done right, you barely notice it, but it protects you from risks that could otherwise bring the enterprise to its knees. Done poorly, it becomes overactive, attacking the very innovation and initiative it was meant to preserve. As companies scale and regulatory complexity grows, the temptation to layer rules atop rules becomes strong. But history has shown, again and again, that bureaucracy is no substitute for judgment. Throughout my twenty-five years leading finance across cybersecurity, SaaS, manufacturing, logistics, and gaming, I have learned that the challenge for modern finance and executive leaders is simple: how do we build a compliance function that defends the business without disabling it? The answer is with design, not reaction. A well-designed compliance organization does not exist to say no. It exists to ask better questions. It operates not as the hall monitor of the company but as a trusted advisor, close enough to the action to understand it and independent enough to safeguard it.

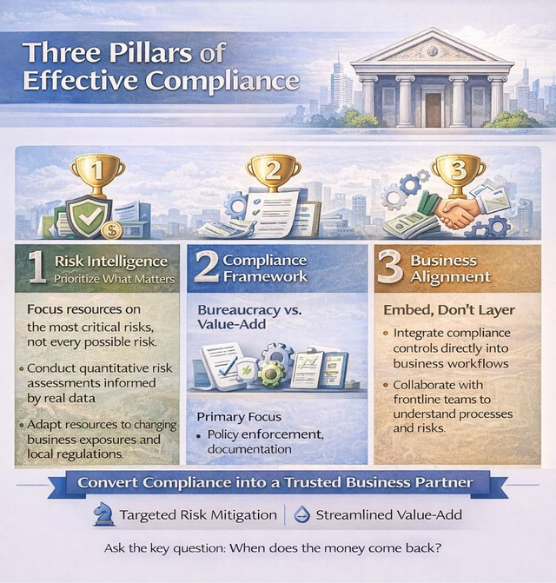

Three Pillars of Effective Compliance

1. Risk Intelligence: Prioritize What Matters

Risk intelligence means that the compliance function must begin with a clear-eyed view of the business model. Not all risks are created equal. A fintech startup handling customer funds faces different exposures than a SaaS platform selling marketing software. A multinational with operations in five continents faces compliance in tax, labor, sanctions, and anti-bribery regimes that a domestic player simply does not. Smart compliance teams do not try to boil the ocean. They map the risk landscape carefully, prioritize it ruthlessly, and allocate resources to the areas with the greatest downside, not the loudest internal voice.

This prioritization must be informed by real data. Leading companies invest in risk assessments that are both quantitative and dynamic. They ask not just what rules exist but how frequently they are breached, what the consequences are, and how well the company detects issues before they escalate.

When I designed multi-entity global finance architecture spanning the United States, India, and Nepal, compliance complexity multiplied across jurisdictions. Rather than implementing uniform controls everywhere, we conducted risk assessments to identify high-priority areas including transfer pricing, tax compliance, foreign exchange regulations, and labor law. This allowed us to focus resources on material risks while maintaining appropriate but proportionate controls for lower-risk areas.

2. Compliance Framework: Bureaucracy versus Value-Add

The fastest way to evaluate a compliance organization is not by how thick its policy binder is, but by what it optimizes for: documentation or outcomes.

| Dimension | Bureaucratic Compliance | Value-Add Compliance |

| Primary Focus | Policy enforcement, documentation | Risk prevention, business enablement |

| Approach | Reactive, crisis-driven | Proactive, risk-based |

| Integration | Layered on top of operations | Embedded in workflows |

| Communication | Legal language, mandates | Business context, practical risk translation |

| Controls | Complex, manual, detective | Simple, automated, preventive |

| Culture | Fear of mistakes, defensiveness | Transparency, speak-up encouraged |

| Measurement | Volume of policies, audit findings | Risk prevented, business velocity maintained |

| Reputation | Hall monitor, blocker | Trusted advisor, enabler |

Value-add compliance does not weaken standards. It strengthens outcomes. It reduces ambiguity. It makes the right behavior the easy behavior. And it protects the organization without turning it into a museum of approvals.

3. Business Alignment: Embed, Don’t Layer

Compliance must be embedded in the workflows of the business, not layered on top like an afterthought. This requires proximity. Compliance officers must understand how deals are structured, how procurement works, how customer onboarding flows, and where operational shortcuts are likely to occur. They must attend sales meetings, talk to engineers, and walk factory floors, not to police but to listen. When compliance understands the operating rhythms of the business, it can design controls that are both effective and unobtrusive.

Alignment also means speaking the language of business. Nothing builds credibility like being able to translate a regulatory requirement into a practical risk. The goal is not to hide the rules. It is to contextualize them, to show how smart compliance protects value, reputations, and long-term growth.

When I implemented NetSuite, Oracle Financials, and Intacct across multiple organizations, we built compliance controls directly into system workflows. Segregation of duties was enforced at the system level, not through manual oversight. Approval workflows were automated based on transaction type and amount. This embedded approach reduced control testing burden by approximately 60 percent while actually improving control effectiveness because the system enforced policies consistently.

Operational Simplicity: Design for Adoption

Complex controls do not inspire confidence. They inspire workarounds. The best compliance programs are simple by design. They focus on preventive measures over detective ones. They favor transparency over opacity. They use automation to reduce human error and friction. They measure their own effectiveness, not by how much paper they generate but by how much risk they prevent.

One powerful approach is to design compliance processes with the end-user in mind. If a policy requires an employee to fill out a six-tab spreadsheet and get three approvals to book a $2,000 event, that policy is destined to be ignored. Instead, smart companies build workflows into the systems employees already use including procurement platforms, HR portals, and CRM tools, so that compliance becomes part of the flow, not a disruption to it.

Just as important is clarity. Employees should not need a law degree to understand what is expected. Great compliance teams invest in training that is engaging, not punitive. They use plain language. They share real-world examples. And they make it clear that speaking up is not just tolerated. It is rewarded.

Compliance as Strategic Differentiator

There is also a strategic dimension here. In industries where trust is a competitive advantage including financial services, health tech, and logistics, a world-class compliance program is not a cost center. It is a differentiator. It reduces regulatory friction. It smooths due diligence in fundraising or mergers and acquisitions. It strengthens relationships with enterprise clients who value integrity as much as innovation.

My certifications as a CPA, CMA, and CIA emphasize governance, internal controls, and compliance. But what separates effective compliance organizations from bureaucratic ones is not credential depth. It is design philosophy. Compliance functions that prioritize risk intelligence, embed themselves in business workflows, and optimize for operational simplicity become trusted partners rather than obstacles. They enable the business to move faster because they provide confidence that it is moving on solid ground.

None of this means that compliance should be soft. It must be independent. It must be empowered. And it must be willing to escalate. But it can do so with judgment, empathy, and business fluency. The most effective compliance leaders are those who can walk into a boardroom, challenge a risky proposal, and still be invited to the next strategy session.

Conclusion

In the end, compliance is not about ticking boxes. It is about reinforcing values. It is about designing a system where doing the right thing is not only expected but enabled. And it is about remembering that the role of governance is not to slow the business down. It is to make sure it can go faster because it is doing so on solid ground. Companies that understand this build compliance organizations that are lean, respected, and indispensable. They turn what many view as overhead into an engine of durability.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.