Executive Summary

In the life of every growing business, a pivotal question arises with unrelenting clarity: how do we fund what comes next? That question may be phrased as should we borrow or should we sell equity or should we do a mix. But the real issue behind those questions is strategic and existential. It demands a serious examination of purpose, time horizon, risk appetite, control, and financial discipline. And it starts by recognizing that capital is never neutral. It shapes how a company grows, evolves, and ultimately succeeds. Throughout my twenty-five years leading finance across cybersecurity, SaaS, manufacturing, logistics, and gaming, I have learned that at the heart of this issue is a trade-off between ownership and obligation. Issuing equity allows you to buy flexibility with dilution. Borrowing imposes discipline and fixed obligations. Hybrids attempt to blend the best of both worlds but often combine complexity, uncertainty, and expectations that may not align with the business plan. The CFO’s responsibility is to understand how each instrument shapes incentives, stress-tests resilience, and enables strategic optionality.

Part I: Understanding the Capital Instruments

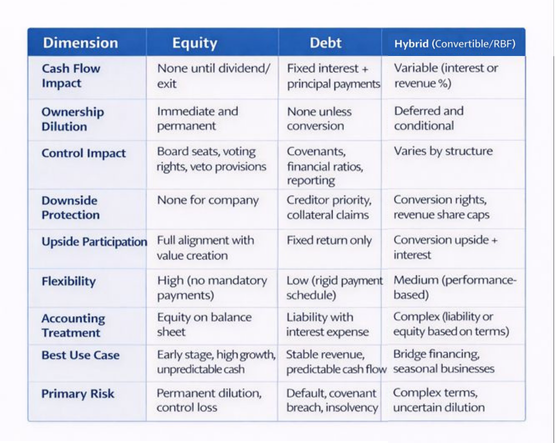

Equity: Growth Capital with Dilution Cost

Equity is the quintessential growth capital. There is no mandatory repayment, no periodic interest, and no balance sheet liability. Instead, investors accept diluted ownership for upside participation. For early-stage businesses, raising equity is usually the simplest path. It enables experimentation, hiring, and capacity-building without the immediate pressure of revenue or cash flow.

But equity has hidden costs. Each round sacrifices control. Investors may impose covenants, board seats, veto rights, or liquidation preferences. As the rounds progress, the risk of founder dilution becomes existential. Most importantly, equity financing raises expectations for growth, scale, and exit. Missing targets is not just a slide to adjust. It is a potential market reset and morale challenge.

When I secured $40 million in Series B funding and an $8 million credit line at a nonprofit organization, we modeled dilution scenarios extensively. We analyzed how different valuation levels and option pool sizes would affect founder, employee, and investor ownership at various exit values. This transparency allowed the board to make informed decisions about timing, valuation expectations, and the trade-offs between dilution today and optionality tomorrow.

Capital Instrument Comparison Framework

Debt: Leverage with Discipline

Debt is the tool of leverage. It binds the business to future performance through scheduled interest and principal payments. Unlike equity, it does not dilute ownership, and when used judiciously, it imposes operational rigor, encouraging discipline, cash discipline, and prioritization. Debt can be particularly effective in stable, revenue-generating companies, perhaps a mature SaaS operator, a manufacturing leader, or a consumer business with deep brand loyalty. The leverage multiplier amplifies return on equity. But it equally amplifies risk in downturns, when covenants are tested, cash flow tightens, and markets wobble.

Misjudged debt can precipitate near-death experiences. Default triggers may be as simple as missing a covenant, but the resulting credit events can snowball: covenant waivers, rising rates, forced renegotiations, or even insolvency. Borrow too little and you limit growth. Borrow too much and you lose optionality and potentially ownership if equity is issued to support debt covenants.

Hybrid Instruments: Balancing Flexibility and Complexity

Between equity and debt lies the twilight of hybrid instruments: convertible notes, SAFEs, revenue-based loans, warrant-linked debt. These structures attempt to balance the flexibility of equity and the discipline of debt. For example, a convertible note may start as a debt obligation but convert into equity at a future financing event. Revenue-based financing ties repayments to top-line performance, aligning capital costs with business cycle.

Hybrids can be powerful when used strategically. They solve specific needs including bridge financing before a round, early funding for pre-revenue businesses, or liquidity instruments for seasonal operations. But they bring complexity: uncertain future dilution, unpredictable interest curves, and accounting intricacies. Poorly structured hybrids may obscure leverage, compress reporting clarity, or incentivize misaligned behaviors in the leadership team.

Part II: Execution and Term Sheet Mechanics

The most elegant theory of capital structure means little if execution falters. Capital is not a spreadsheet decision. It is a relationship, a negotiation, and often a bet on the future. It lives in term sheets, side letters, covenants, and scenarios.

Equity Term Sheet Negotiation Axes

When raising a priced equity round, the negotiation typically revolves around three key axes:

Valuation: Sets the price per share and thereby the dilution. A higher valuation may come at the cost of more aggressive control terms.

Control: Determines board composition, voting rights, protective provisions, and approval thresholds. A founder-friendly board may require accepting more dilution.

Preference: Dictates the downside protection for investors including liquidation preferences, participation rights, anti-dilution clauses, and seniority in waterfall events.

Each of these terms interacts with the others. The job of the CFO is not just to get the highest valuation. It is to protect the company’s flexibility and integrity over time. Consider the implications of a 1x non-participating liquidation preference versus a participating preferred with no cap. In a sale scenario, the latter structure can significantly depress the common shareholders’ upside. Similarly, full-ratchet anti-dilution clauses, still seen in distressed rounds, can poison future fundraising and limit management equity pool refreshes.

Smart CFOs model scenarios under flat, up, and down exits to understand who gets what under every potential outcome. Great CFOs go further. They help the board and founders understand the psychology these terms create in future negotiations.

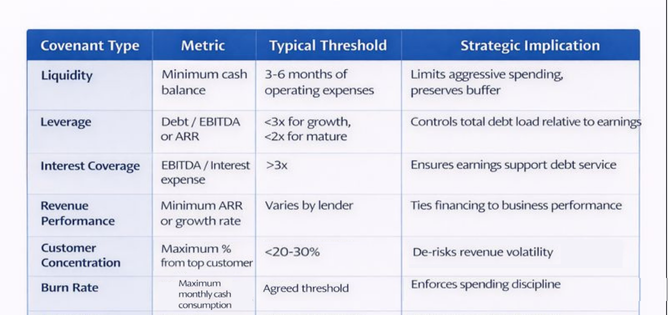

Debt Covenant Framework

Moving to debt, execution requires a different rhythm and language. Debt negotiations are not anchored in stories and growth vision. They are grounded in numbers, covenants, and downside risk. Lenders think about stability, predictability, and legal recourse. When a SaaS company seeks debt, the lender will want to understand historical revenue, customer concentration, gross margin, cash burn, and churn.

A typical term loan will involve covenants, financial ratios the company must maintain. Violating these covenants triggers a default, which could allow the lender to call the loan, increase interest rates, or impose operational restrictions. The danger is not just legal. It is reputational. A covenant breach during a growth stage can scare future investors, affect credit ratings, and trigger clawbacks on executive bonuses.

When I managed global finance for a $120 million logistics organization, we maintained both equity and debt in our capital structure. The debt facility required quarterly covenant reporting including minimum liquidity thresholds and maximum leverage ratios. We built covenant monitoring dashboards that projected compliance under various scenarios, allowing us to proactively engage lenders before any potential issues and maintain strong banking relationships.

Hybrid Instrument Considerations

Convertible notes and SAFEs are the most common hybrid instruments, particularly at early stages. Their appeal lies in simplicity: they defer valuation to a future round, saving time and negotiation. But they are not costless. Uncapped SAFEs can lead to unexpected dilution. Convertible notes with high interest accruals may become large claims on equity during conversion. Worse, if multiple hybrid instruments are issued over time with varying terms, they can stack into a complex, layered capital structure that confuses new investors and delays closings.

Other hybrid solutions include revenue-based financing, preferred equity with warrant coverage, and structured equity products from growth funds or private equity. Each tool brings its own implications. Revenue-based financing aligns repayment with performance but can become expensive if the top line accelerates. Structured equity may reduce dilution but often carries performance triggers or synthetic interest.

Part III: Capital Strategy Through the Business Lifecycle

Every business moves through cycles, from startup scrappiness to scale-up velocity, from maturity to market-facing inflection. The capital structure that works at one stage can become an anchor at the next. And unlike products, which can be pivoted, or people, who can be trained, a capital stack, once baked into legal agreements and ownership structures, becomes hard to unwind.

Capital Stack Evolution by Stage

This flowchart illustrates how capital stack composition evolves as a company matures. Each stage has distinct capital needs, risk profiles, and optimal instrument mixes. The transition points between stages are critical decision moments for CFOs.

Early Stage: Simplicity and Validation

In the seed and Series A phases, equity is typically the dominant funding source. The business is still proving product-market fit, revenue is sparse or nonexistent, and debt markets are mostly closed. Founders raise equity not just for capital but for belief from angels, accelerators, and early venture funds. At this stage, simplicity matters more than price. Cap tables must be clean. Terms should be straightforward. Governance rights should reflect belief, not control.

Growth Stage: Blending and Optimizing

As the company matures into a post-Series A or Series B stage, the conversation shifts from validation to acceleration. Revenue exists, product is stable, and the focus turns to scaling go-to-market, customer success, and platform development. Here, capital needs often spike, and companies begin to consider blending equity with other instruments. Venture debt becomes viable. Revenue-based financing appears on the radar. Founders become sensitive to dilution, and rightfully so.

This is a pivotal moment, the first major opportunity to diversify the capital base. If structured wisely, the addition of debt or hybrids can increase runway, reduce dilution, and enforce discipline. But it must be aligned with forecast precision. Taking on debt before churn is under control, or before unit economics are predictable, can backfire.

When I rebuilt GAAP and IFRS financials for a high-growth SaaS company and designed cohort analysis frameworks, we reached the stage where venture debt became viable. We modeled how a $5 million venture debt facility with warrants would compare to raising additional equity. The debt extended our runway by 9 months at a lower dilution cost, but required maintaining minimum cash balances and ARR growth targets. The financial modeling clarity allowed leadership to make an informed decision about capital structure optimization.

Mature Stage: Sophistication and Flexibility

As the company enters the growth stage, Series C and beyond, capital stack strategy becomes even more nuanced. The company is likely at $10 to $50 million in annual recurring revenue, with multiple product lines, a larger team, and perhaps international exposure. Growth capital needs remain high, but the cost of capital becomes more differentiated. At this point, private equity growth funds may enter the picture, offering structured equity or minority investments.

Here, hybrid instruments become more sophisticated: preferred equity with participation caps, warrants embedded in debt facilities, delayed convertibles with step-up terms. Each of these adds complexity but also flexibility. The challenge is to balance optionality with clarity. A CFO who layers in three overlapping instruments with conflicting triggers may inadvertently create blocking rights, preference overhangs, or equity dilution surprises.

Pre-Exit: Cleanup and Alignment

Eventually, the company approaches an inflection point including IPO, strategic acquisition, or large-scale secondary. At this stage, the capital stack becomes not just a financing strategy but a story. Investors will want to see a clean, understandable equity structure. Buyers will scrutinize preferences, redemption rights, and change-of-control clauses. Lenders will evaluate debt service capacity, covenant flexibility, and risk reserves.

A messy stack can derail deals. Worse, it can spook potential acquirers who fear post-close surprises. The best CFOs prepare for this well in advance. They rationalize the cap table, convert outstanding notes, clean up old preferences, and consolidate warrants. They proactively align stakeholders including founders, early investors, and employees around exit mechanics and liquidity priorities.

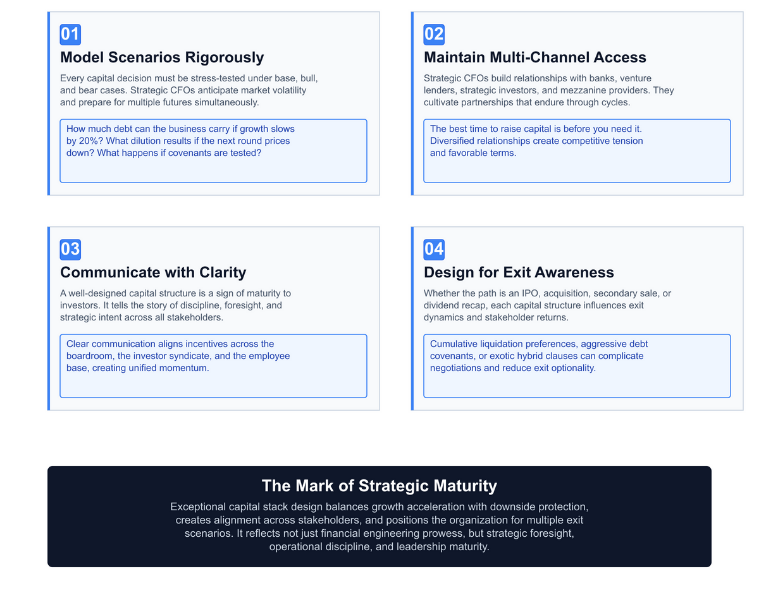

Strategic Principles for Capital Stack Design

My certifications as a CPA, CMA, and CIA provide the technical foundation for evaluating capital structures, understanding accounting implications, and assessing risk. But what separates strategic capital stack design from opportunistic fundraising is the ability to see capital not as a commodity but as architecture. Each layer, each term, each clause is a brick in the foundation of sustainable value creation.

Conclusion

Capital is not a commodity. It is a signal. A company’s capital stack reflects its values, its vision, and its ability to navigate uncertainty. A sloppy, bloated stack signals confusion, short-termism, or desperation. A disciplined, tailored stack signals control, resilience, and strategy. The best CFOs do not view capital stack decisions as transactional. They view them as architectural. And when done right, that foundation supports not only the next round but the next chapter.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.