Executive Summary

Foreign exchange risk, or FX risk, is one of those financial topics that is both omnipresent and often underestimated. It sits quietly in the background of global commerce, invisible to most casual observers but profoundly influential in shaping corporate financial performance. Throughout my twenty-five years leading finance across cybersecurity, SaaS, manufacturing, logistics, and gaming, I have learned that for companies that operate across borders, FX risk is not just a technical concept for treasury to handle. It is a strategic factor that touches revenue, costs, margins, cash flow, and even stock price. The moment a company earns revenue in euros but reports in dollars, or buys raw materials in yen but sells in pounds, it is exposed. The movements of currencies are not just academic. They can be swift, sharp, and difficult to predict. A 5 percent drop in the euro against the dollar can wipe out millions in revenue when converted back to a U.S. company’s income statement. Despite its importance, many companies still treat FX risk as a back-office concern. This disconnect creates risk and missed opportunity. When managed proactively, FX strategy can be a source of competitive advantage.

Understanding the Three Types of FX Risk

Foreign exchange risk arises because companies deal in currencies other than their functional currency, which is typically the currency of the country where the company is headquartered or conducts most of its business. Companies experience FX risk in three distinct forms, each requiring different management approaches.

Transaction Exposure: The Most Immediate Risk

Transaction exposure arises from actual contractual cash flows, money that is owed or received in a foreign currency. Suppose a U.S.-based software company sells an enterprise license to a French customer for one million euros. The contract is signed and the invoice is issued in euros. However, payment is due in 90 days. In the meantime, the euro drops in value by 10 percent against the dollar. When the customer pays, the amount converted into dollars is only $900,000 instead of the expected $1 million. That is real, realized loss and an example of transaction exposure.

When I managed global finance for a $120 million logistics organization with operations spanning the United States, India, and Nepal, transaction exposure was constant. We invoiced international customers in their local currencies while reporting in U.S. dollars. A significant portion of our supplier payments were also in foreign currencies. Without systematic hedging of predictable cash flows, quarterly earnings could swing by several percentage points purely due to currency movements unrelated to operational performance.

Translation Exposure: The Accounting Illusion

Translation exposure arises not from cash flow but from accounting. Multinational companies consolidate foreign subsidiaries into a parent company’s financials. If a U.S. company owns a Brazilian subsidiary that reports in reais, the parent must translate those local financial statements into dollars. A currency swing does not change the reality in Brazil, local customers still paid and local suppliers still delivered, but it does affect how the subsidiary appears on the consolidated balance sheet and income statement.

Consider a concrete example. A U.S.-based company owns a French subsidiary that earned 10 million euros in revenue and 1 million euros in net income last year. The average exchange rate during the year was 1.20 dollars per euro, so the parent company reported $12 million in revenue and $1.2 million in net income from that subsidiary. This year, the French business performs exactly the same, 10 million euros in revenue and 1 million euros in income, but the euro weakens to 1.10 dollars per euro. The translated revenue drops to $11 million and net income appears as $1.1 million. On paper, it looks like a 9 percent revenue decline and a $100,000 drop in profit. But operationally, nothing changed.

Economic Exposure: Strategic and Long-Term

Economic exposure reflects the broader impact of exchange rate movements on a company’s market value, cost structure, and competitiveness. If a Japanese competitor benefits from a weaker yen, their prices become more attractive globally. Even if a U.S. firm hedges its near-term cash flows, its long-term position in the market could erode. Economic exposure is more difficult to quantify but no less important to manage.

Managing Transaction Exposure: Tools and Strategies

To manage transaction exposure effectively, companies need to adopt several foundational practices that begin with visibility and end with disciplined hedging execution.

Transaction Exposure Management Process

This flowchart illustrates the systematic five-step process for managing transaction exposure from identification through execution. Each step builds on the previous, ensuring comprehensive risk management aligned with business operations and accounting requirements.

When I rebuilt GAAP and IFRS financials for a high-growth SaaS company and designed cohort analysis frameworks, FX exposure management became critical as we expanded internationally. We established clear policies on contract currency decisions, implemented forward contracts for predictable receivables above $100,000, and built dashboards tracking exposure by currency and timing. This reduced earnings volatility from FX by approximately 40 percent.

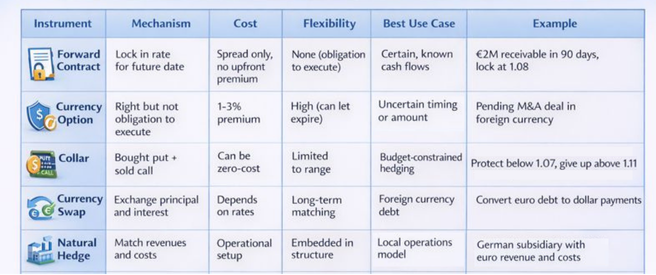

Hedging Instruments Detailed Comparison

Translation Exposure: Managing the Narrative

Translation exposure is difficult to hedge directly because the cash flows are not real in the sense of crossing borders. They are accounting constructs. Most companies do not hedge translation exposure because doing so would require expensive and potentially speculative hedges that do not actually offset real risk. Instead, the most effective strategy is to manage the narrative and design reporting thoughtfully.

Translation Exposure Management Strategies

- Report in Constant Currency: Companies can show as reported and constant currency performance side by side. Constant currency reporting holds exchange rates fixed and isolates operational performance. It allows analysts and investors to understand what part of revenue growth came from real business activity versus FX movement.

- Disaggregate by Geography and Currency: Providing a breakdown of revenue and margin by region or major currency helps readers contextualize FX impact. If 40 percent of revenue is in euros and the euro drops 5 percent, the math becomes transparent.

- Use Natural Hedging: While you cannot hedge accounting entries, you can align costs and revenues in the same currency to reduce net exposure. If a French subsidiary earns in euros and pays in euros, its local margins are protected even if translation varies.

- Build Awareness into Planning and Communication: CFOs should proactively communicate expected FX impact during earnings calls, board updates, and budget reviews. By setting expectations and explaining mechanics, they reduce surprises and build credibility.

- Adjust Performance Targets: If bonus plans, KPIs, or debt covenants are based on reported results, consider adjusting for FX. Many companies use constant currency targets for internal compensation to ensure managers are not penalized or rewarded for factors outside their control.

Real-World Impact Scenarios

Foreign exchange volatility is real and it shows up in ways both subtle and dramatic. Understanding common scenarios helps CFOs prepare appropriate responses.

Scenario 1: Revenue Shortfall from Currency Weakness

A mid-sized SaaS company headquartered in San Francisco has 30 percent of its customer base in the Eurozone and bills those customers in euros. In Q1, the euro to dollar rate averages 1.15. The company invoices 10 million euros, which converts to $11.5 million in revenue. In Q2, everything seems normal operationally but the average exchange rate drops to 1.05. The same 10 million euros now translates to only $10.5 million, a full $1 million revenue shortfall purely from currency. No performance issues. No operational missteps. Just FX.

Scenario 2: Double-Edged Margin Compression

A U.S.-based industrial parts company sources raw materials from suppliers in China and sells finished products in Latin America. The Chinese yuan strengthens 8 percent against the dollar while several Latin American currencies weaken by 10 to 15 percent against the dollar. Costs go up. Revenue shrinks. And margins compress from both ends. Even if volumes stay flat, the company sees its EBITDA decline significantly.

Scenario 3: M&A Deal Price Volatility

A U.S. firm attempting to acquire a British tech company faces a situation where the deal is priced in pounds. Just before closing, the pound strengthens 6 percent relative to the dollar. The deal becomes significantly more expensive in dollar terms. The buyer either accepts a higher cost or tries to renegotiate. In volatile FX environments, many M&A deals now include currency collars, clauses that allow price adjustments if exchange rates move beyond a preset band.

Scenario 4: Debt Covenant Impact

A European company has dollar-denominated debt. If the euro weakens, its dollar liability increases in local terms. That can skew leverage ratios and trip covenants even if operational cash flow is strong. Suddenly, a stable company finds itself renegotiating with lenders because of FX effects.

Building a Comprehensive FX Risk Management Framework

The cornerstone of any FX risk management program is governance. This begins with ownership. Who is responsible for FX risk? In most companies, it falls under the CFO with execution led by the Treasury function. But FX affects more than just Treasury. Sales, procurement, legal, and even IT influence the shape of FX exposure through contract terms, vendor agreements, and system capabilities.

FX Risk Management Framework Components

- Exposure Mapping: Create a currency risk inventory, an end-to-end review of all cash flows, contracts, and balances that involve foreign currencies. This includes revenue, payables, intercompany loans, royalties, dividends, tax payments, and capital expenditure commitments. Modern FX exposure mapping often leverages ERP systems and treasury workstations.

- When I implemented NetSuite, Oracle Financials, and Intacct across multiple organizations, FX exposure tracking was a critical configuration requirement. We established standardized currency tagging, built automated exposure reports by entity and currency, and integrated these with cash flow forecasting systems. This provided real-time visibility that enabled proactive hedging decisions.

- Hedging Policy Definition: The control document that specifies what to hedge, how much to hedge, when to hedge, which instruments to use, who can execute, how to account, and how to report. This policy should be approved by senior management and reviewed annually. For public companies, the Audit Committee often plays an oversight role.

- Execution Infrastructure: Bank relationships with at least two to three counterparties to ensure pricing transparency and reduce concentration risk. Pricing and execution tools ranging from manual processes for small volumes to automated platforms like Bloomberg or Kyriba for larger programs. Trade confirmation and settlement procedures with standardized workflows. Hedge documentation especially if applying hedge accounting with formal documentation at inception and supporting effectiveness testing.

- Analytics and Scenario Planning: Value-at-risk metrics showing how much FX movements could affect earnings or cash flow. Sensitivity tables quantifying impact of specific currency moves on key financial metrics. Stress testing simulating extreme market conditions and quantifying impact on financials. Backtesting comparing hedge program performance against unhedged baseline to validate policy effectiveness.

- Reporting and Communication: Develop an FX dashboard shared monthly or quarterly with senior leadership showing open exposures by currency and timing, hedge positions and instruments, profit and loss impact of hedging versus unhedged FX, forecast accuracy of exposures, and material movements and macro trends.

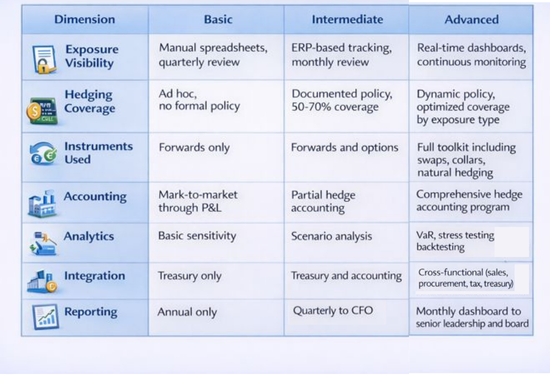

FX Program Maturity Assessment

My certifications as a CPA, CMA, and CIA emphasize the governance, controls, and risk management discipline required for FX programs. But what separates mature finance organizations is treating FX not as a back-office function but as strategic infrastructure that enables growth, protects margins, and builds investor confidence through transparent communication.

Conclusion

Foreign exchange risk is not just about loss avoidance. Managed well, it can improve forecast accuracy, support pricing decisions, and increase investor confidence. It can protect margin, enable growth, and reduce operational noise. But that only happens with structure. CFOs who build an FX framework based on visibility, discipline, and communication create not only resilience, they build trust. When currency becomes a tailwind, they harness it. When it becomes a headwind, they already have a plan. The companies that succeed do not treat FX as a quarterly nuisance. They treat it as a strategic input, baked into planning, contracts, and capital allocation.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.