Executive Summary

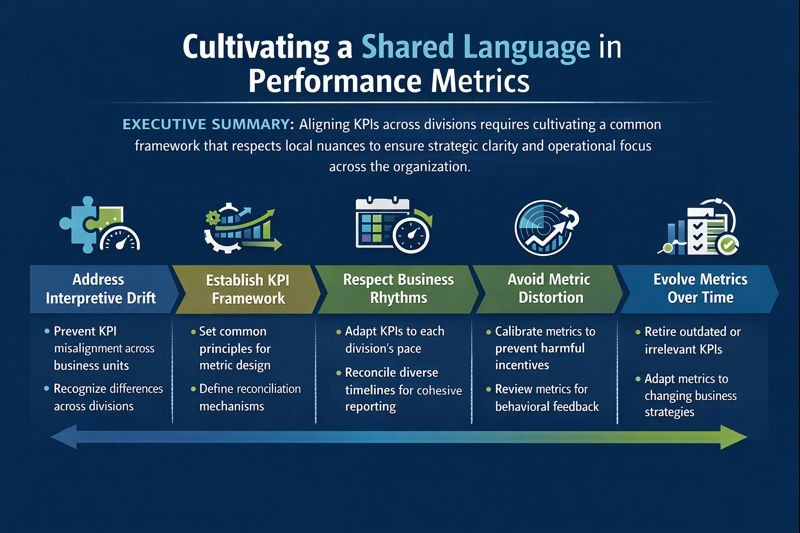

There is a seduction in numbers, especially in the corporate world. They promise clarity in complexity, accountability in ambition. Chief among these are KPIs, Key Performance Indicators, those neat acronyms etched into slide decks and dashboards. They are meant to guide, to align, to measure what matters. But across sprawling enterprises with multiple business units, KPIs rarely behave as their tidy moniker suggests. They stretch, splinter, and confuse more than they clarify. This interpretive drift is not simply a nuisance but a strategic liability. When performance metrics are misaligned across divisions, companies lose the ability to see themselves clearly. They misallocate resources, chase the wrong incentives, and conflate activity with impact. The solution is not standardization for its own sake but the cultivation of a shared language of performance, one that honors local nuance while preserving enterprise coherence.

The Challenge of Interpretive Drift

At the top of an organization, performance indicators glow with confidence: revenue growth, operating margin, return on capital. But as they cascade downward through regions, departments, and functions, they fracture into proxies, approximations, and interpretive adjustments.

Throughout thirty years leading finance organizations across SaaS, digital marketing, gaming, and logistics, I have witnessed how a financial target imposed centrally might mean one thing in a high-margin software division and something entirely different in a logistics unit where margins are thin. The indicator, constant in name, becomes variable in meaning.

At a gaming enterprise where I led global financial planning and controllership for a multi-studio operation, each studio operated with different business models. A single metric like “revenue per user” meant fundamentally different things across these divisions, requiring careful interpretation and context.

Honoring Local Logic While Preserving Coherence

Each division of a modern business functions within its own economic logic. A digital services unit prioritizes user engagement and monthly recurring revenue. A manufacturing plant must watch throughput. A retail arm lives by same-store sales.

The challenge becomes orchestration: to allow each unit its tailored indicators while ensuring those indicators harmonize with broader goals. This is not merely technical but cultural. The CFO and divisional heads must ask not just what to measure but why.

At organizations where I built enterprise KPI frameworks, we tracked bookings, utilization, annual recurring revenue, pipeline health, and retention. The key was establishing common principles for how metrics should be designed and governed across divisions.

The Multi-Division KPI Framework

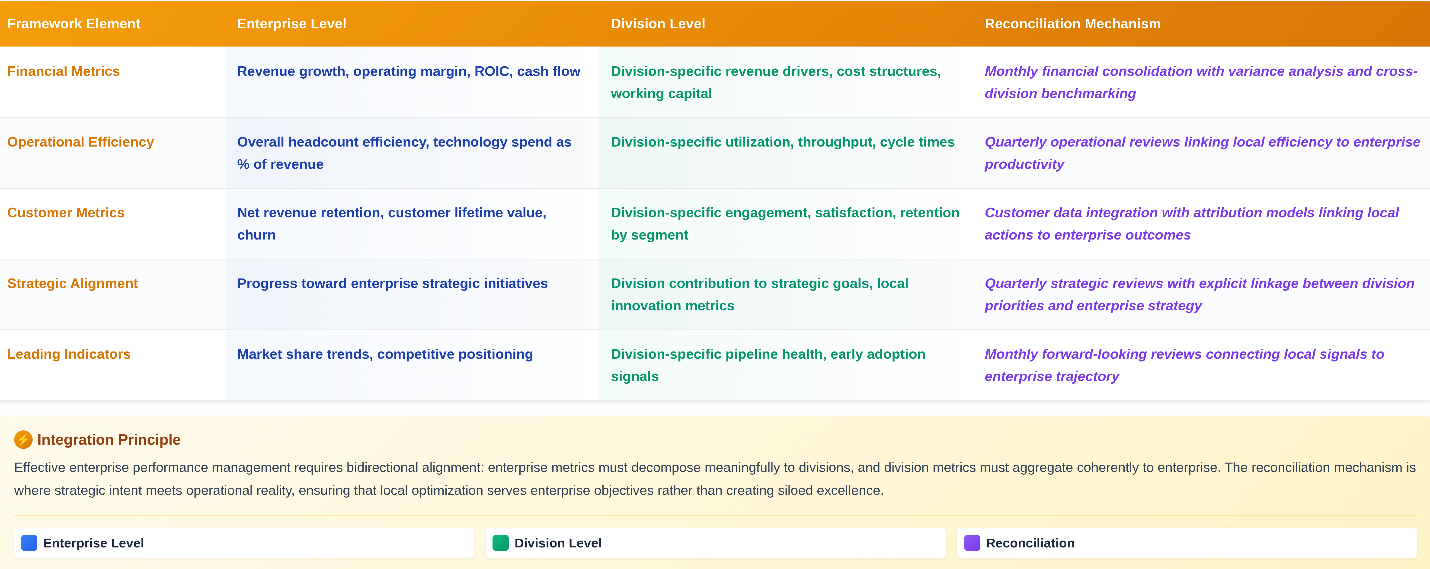

The following framework establishes how performance metrics can maintain coherence across diverse business units:

Respecting Different Rhythms

Different parts of an enterprise move to different clocks. A fast-scaling consumer app may evolve month by month. A regulated utility company may shift slowly, bound by infrastructure timelines. Yet the pressure to synchronize persists through quarterly reporting and annual budgeting.

The trick is not to force all divisions into a single rhythm but to reconcile those rhythms into a common score. When performance reviews respect the tempo of each business while tying outcomes to broader objectives, KPIs become not only functional but fair.

At a digital marketing organization that scaled from nine million to one hundred eighty million in revenue, we managed multiple client service divisions operating on different contract cycles and seasonal patterns. Rather than imposing uniform monthly targets, we designed rolling performance windows that captured each division’s natural rhythm while aggregating to consistent quarterly enterprise reporting.

Avoiding Metric-Driven Distortion

Even thoughtfully designed metric systems can produce distortion. People manage to what they are measured on. Sales teams rewarded purely on volume may sacrifice margin. Call centers judged by response time may prioritize speed over resolution.

The antidote is deliberate calibration. Metrics should be revisited not only for performance outcomes but for behavioral feedback. What happened is one question. Why it happened is another. And what the metric incentivized may be most important of all.

At one professional services organization where I reduced month-end close from seventeen days to under six days while increasing accuracy by twenty-eight percent, we discovered that aggressive close timelines initially incentivized premature accruals. We recalibrated by introducing quality gates alongside speed targets.

The Life Cycle of Metrics

KPIs, like business models, must evolve. A metric that once captured core value may become obsolete as markets shift and strategies pivot. Metrics have a life cycle. They must be reviewed, retired, replaced.

The most sophisticated enterprises design their performance systems not as monuments but as instruments: adaptive, responsive, and integrated with the learning rhythms of the business.

At a logistics organization managing one hundred twenty million in revenue, we retired legacy metrics around paper-based documentation when we digitized operations, replacing them with real-time tracking accuracy. The old metrics measured a process we no longer used. The new metrics captured what actually drove customer value.

Conclusion

To master performance indicators across divisional lines is an exercise in leadership, not just analysis. It demands that executives move beyond abstraction into conversation, asking not only what success looks like but how it is defined and how it evolves.

There will always be friction. Metrics will occasionally conflict. But when an organization commits to coherence, not uniformity but intelligibility, it transforms its performance system into a shared language. And in that shared language lies strategic clarity, operational focus, and organizational trust.

That is the real purpose of a performance indicator: not to reduce the business to numbers but to remind the numbers of their purpose. Not to chase alignment for its own sake but to use it to find out what really matters.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.