What Black Swan Events Expose About Governance, Judgment, and Trust

Black swans arrive unannounced and demand judgment under chaos. Whether a geopolitical shock, a pandemic, a cyber breach, or regulatory meltdown, they test not only strategy but integrity. In those moments, board performance peaks or collapses. The markers are clear: resilience, clarity, alignment, and courage. Throughout my twenty-five years leading finance across cybersecurity, SaaS, manufacturing, logistics, and gaming, I have learned that those qualities are not accidental. Boards that navigate black swans with integrity do so because they have built the muscle long before crisis arrives. Great boards begin by anticipating adversity, not to forecast the unpredictable but to build preparedness. They cultivate scenario fluency, stress-test their operating assumptions, and embed crisis readiness into governance. When black swans hit, they do not scramble. They respond.

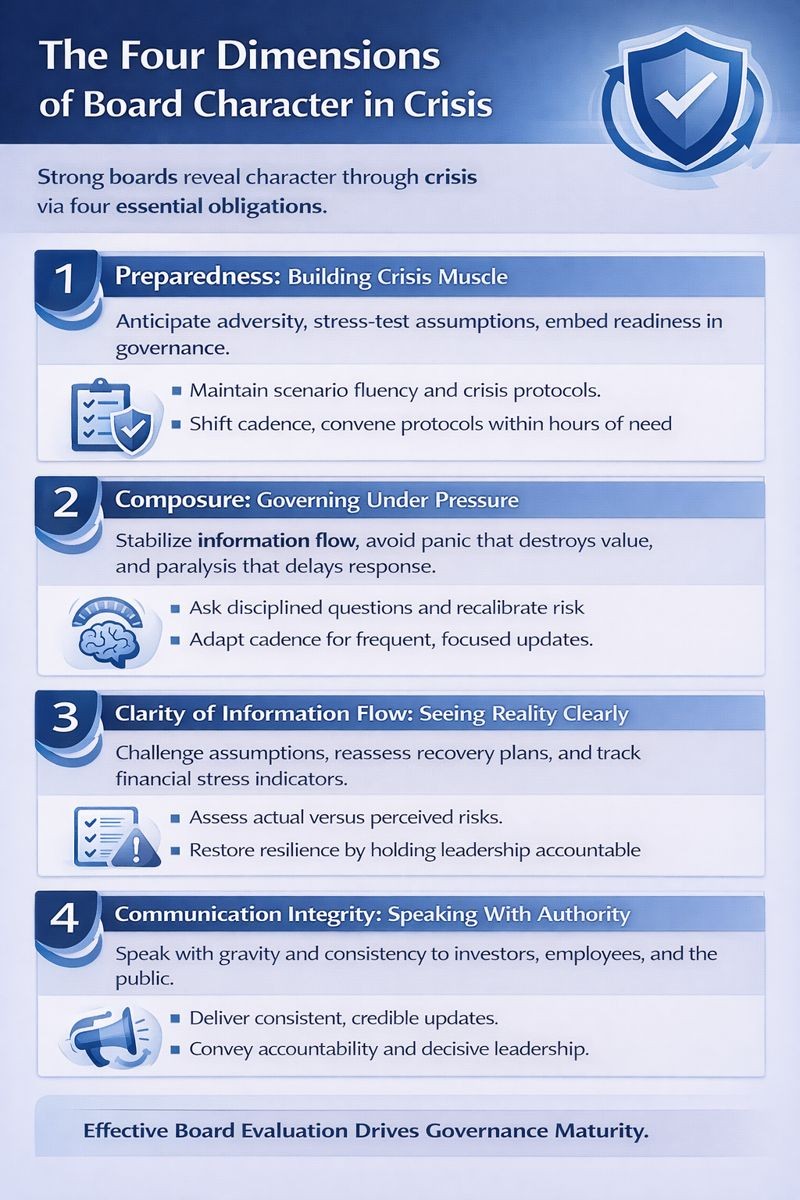

The Four Dimensions of Board Character in Crisis

Strong boards reveal character during crisis through four tangible obligations: preparedness, composure, clarity of information flow, and communication integrity.

1. Preparedness: Building Crisis Muscle Before It Is Needed

Great boards anticipate adversity not to forecast the unpredictable but to build preparedness. They cultivate scenario fluency, stress-test their operating assumptions, and embed crisis readiness into governance. When black swans hit, they do not scramble. They respond. Within hours, they can shift cadence, convene leadership, and establish protocols. Their preparedness reflects an understanding: character is not revealed in calm, it is proven in crisis.

When I managed global finance for a $120 million logistics organization, we maintained crisis response protocols for supply chain disruption scenarios including port closures, carrier bankruptcy, fuel price shocks, and labor strikes. These protocols defined escalation thresholds, decision authority, communication cadence, and financial stress indicators. When a major carrier went bankrupt unexpectedly, we activated the protocol within four hours. The board received daily updates with liquidity position, alternative carrier costs, customer impact assessment, and mitigation actions. This preparedness prevented panic and enabled focused response.

2. Composure: Governing Under Pressure Without Losing Judgment

In the early phase of crisis, boards must stabilize information flow before they attempt to stabilize outcomes.

They ask disciplined questions:

- What do we know for certain?

- What is still unknown?

- Where are our blind spots?

- Who has command authority?

Meeting cadence shifts. Updates become shorter and more frequent. War-room structures emerge across finance, operations, legal, communications, and risk.

But composure is not passivity. Boards must actively test assumptions, weigh trade-offs, and recalibrate risk tolerance. They must avoid two common failure modes: panic that destroys value and paralysis that delays response.

Strong boards create space for rapid action while preserving the ability to change course as facts evolve.

3. Clarity of Information Flow: Seeing Reality Without Being Drowned by It

During the stabilization phase, the board shifts to oversight. They evaluate recovery plans, revisit risk appetite, and assess flows through financial stress trackers. They interrogate assumptions. They challenge continuity biases: do we assume recovery will be symmetrical? Do we underestimate tail risks? They restore resilience by holding leadership accountable for both execution and adaptation.

4. Communication Integrity: Speaking With Authority, Not Noise

Character shows in communication. Boards must communicate with consistency and integrity to investors, employees, regulators, and the public. They do not hide. They do not evade. They speak with gravity and clarity. They model accountability. They amplify action, not blame. And they do so from the highest level, signaling that the response has both mind and mandate.

Crisis Operating Model

Crisis transforms decision-making. It compresses timelines, multiplies uncertainties, and magnifies consequences. Boards that succeed do not improvise in this state. They operate from frameworks that scale judgment and concentrate authority where needed. The crisis operating model consists of four elements: activation triggers, authority maps, response cadence, and escalation logic.

- Activation Triggers: Boards predefine which scenarios activate crisis governance including data breaches, liquidity breaches, regulatory inquiries, or supply chain collapse.

- Authority Maps: These clarify what powers shift to executive command, what remains under board oversight, and what roles are reassigned or concentrated. This avoids duplication and delay.

- Response Cadence: The board, often through the chair or lead director, receives rolling updates and participates in review cycles. But they do not disrupt command. They reinforce it.

- Escalation Logic: Not every development requires full board review. But critical thresholds do. Boards define these thresholds in advance: a customer outage over 24 hours, a regulatory breach, a financial forecast deviation above 15 percent, a whistleblower escalation.

One technology board facing a massive platform breach activated its crisis operating model within two hours. The chair, audit chair, and CEO formed a crisis triad. Legal and risk leads reported hourly. A designated board liaison coordinated updates. The model was rehearsed months earlier. Its activation required no debate. The board focused not on discovery but on strategic response including reputation containment, stakeholder messaging, and remediation financing.

War-Room Architecture and Tracking Systems

Strong boards ensure that crisis response is not fragmented across silos. They request that management forms an integrated command center, cross-functional, staffed with decision-makers, and operating on live data. Within the war-room model, boards insist on tracking systems. Dashboards provide visibility on liquidity, supply chain friction, customer sentiment, employee availability, legal exposure, and regulatory developments.

These dashboards often include red-yellow-green alert systems with commentary from each functional lead. Boards monitor not only the metrics but the rate of change. What changed since yesterday? What surprised the team? What trend is emerging? What threshold may be breached?

When I improved month-end close from 17 days to under six days at a cybersecurity firm, we built real-time financial dashboards that became the template for crisis monitoring. The board could see cash position, accounts receivable aging, vendor payment status, and burn rate updated daily. This infrastructure proved critical during a subsequent product recall when the board needed immediate visibility into financial impact and liquidity runway.

Communication and Recovery

Crisis also tests communication. Boards that succeed establish a messaging cell, often a combination of CEO, communications lead, and general counsel. The chair is kept briefed and, in major situations, may co-sign messages to investors or employees. Strong boards establish pre-approved language banks for various stakeholders. They do not write scripts but they define tone.

The board’s role evolves as crisis shifts into recovery. High-integrity boards initiate after-action reviews, not as blame sessions but learning cycles. They convene all board members, executive leads, and crisis stakeholders. They ask three questions: what did we do well? What did we miss? What must we never forget? The output becomes an institutional memory asset, feeding new protocols, dashboard enhancements, and cultural codification.

My certifications as a CPA, CMA, and CIA emphasize risk management, internal controls, and crisis preparedness. But what separates boards that navigate crises effectively from those that collapse is not technical expertise. It is the discipline to build preparedness before crisis arrives, the composure to maintain strategic focus under pressure, the clarity to ensure information flows without overwhelming decision-makers, and the integrity to communicate with consistency to all stakeholders.

Conclusion

This is the lesson: crisis does not just test resilience. It reveals truth. The truth about a board’s preparedness. Its culture. Its posture. And its ability to lead when leadership is the only thing that matters. Crisis cannot be avoided. But leadership failure during crisis can. For boards, the only way to meet a black swan is with built muscle, strategic, structural, and ethical. That is how strong boards navigate what others do not survive. And that is the real test of governance.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.