Executive Summary

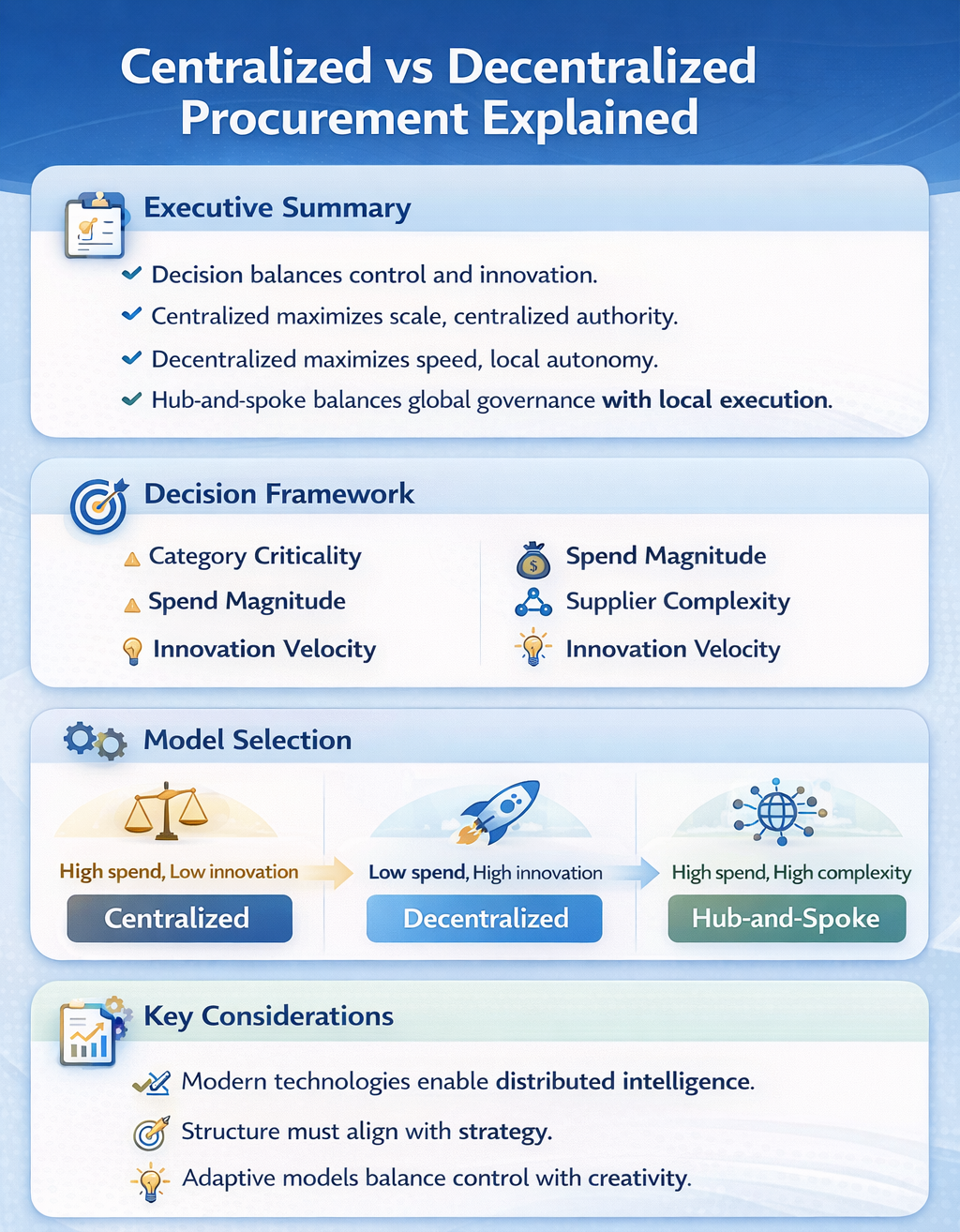

The question of whether to centralize or decentralize procurement is not merely administrative but a declaration of philosophy. It determines how an enterprise balances control with innovation and encodes its strategic DNA. Having led transformations across industries, the same tension reemerges: companies want to unlock global buying power yet local teams resist slow central controls, prizing freedom to move fast and innovate with regional suppliers. The hub-and-spoke model provides core governance at the center while regional spokes execute with tailored autonomy, achieving leverage without rigidity. The decision matrix includes category criticality, spend magnitude, supplier complexity, and innovation velocity. For high spend and low innovation categories, centralization yields better outcomes. For low spend but high innovation, decentralization is superior. Modern technologies including real-time analytics and AI are reshaping procurement into distributed intelligence with unified governance. Structure must follow strategy, reflecting the company’s competitive advantage.

The Architecture of Control and Creativity

The question of whether to centralize or decentralize procurement is not merely administrative. It is a declaration of philosophy. It determines how an enterprise balances control with innovation, how it arbitrates between efficiency and responsiveness.

Having led transformations across industries and continents while straddling finance, operations, and systems, the same tension reemerges. A company operating across continents wants to unlock global buying power. Yet local teams resist slow central controls, prizing freedom to move fast and source locally. The benefits of scale cannot be realized without alignment, but alignment threatens creativity.

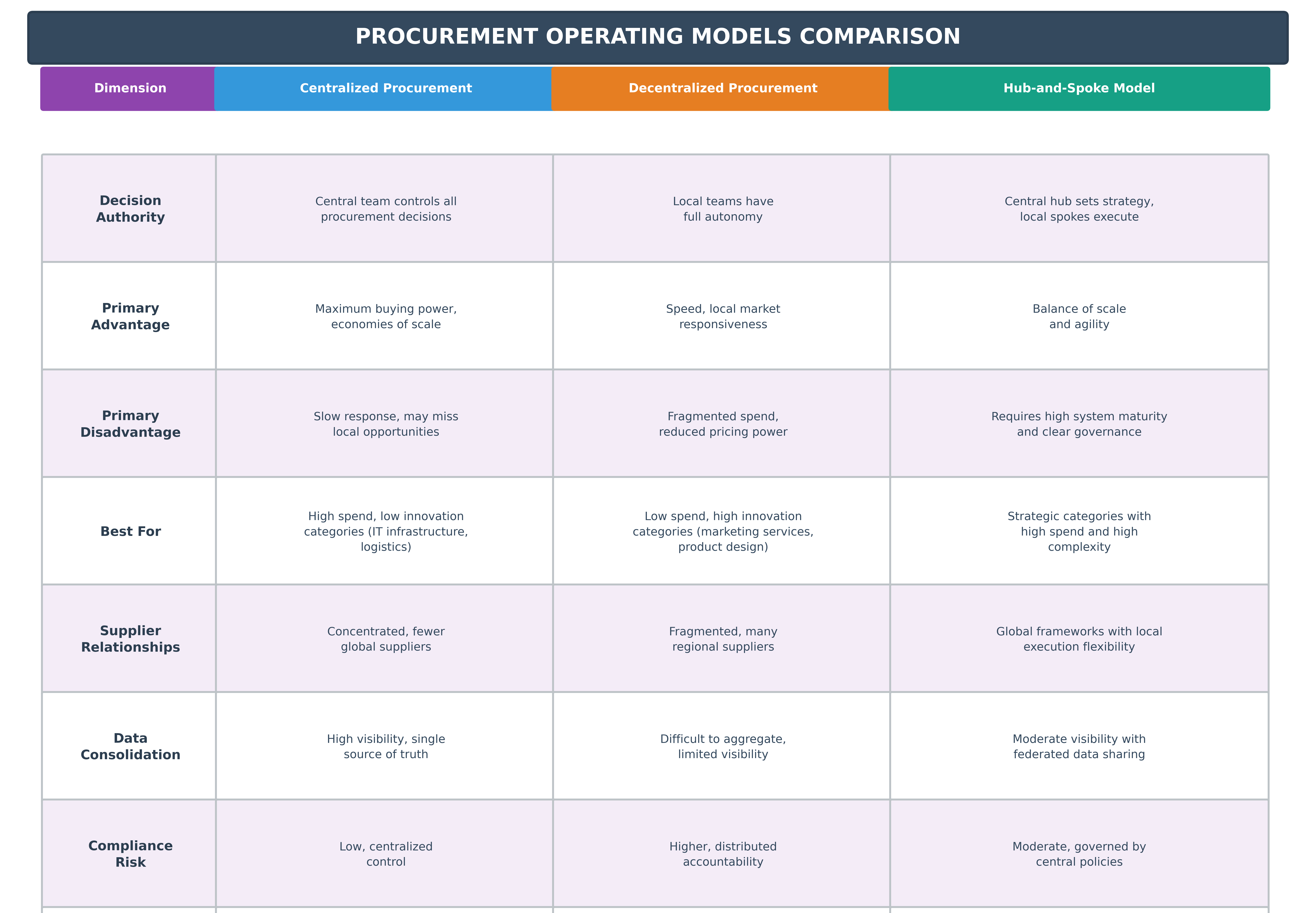

Centralized vs. Decentralized vs. Hub-and-Spoke: Structural Comparison

The Hub-and-Spoke Model

The hub-and-spoke model provides core governance, analytics, supplier contracts, and policy at the center while regional spokes execute with tailored autonomy. The idea is achieving leverage without rigidity, consistency without stagnation.

Procter & Gamble with operations in over 70 countries employs a centralized procurement hub setting global strategy and compliance architecture. Regional business units retain flexibility in executing day-to-day procurement, allowing agility in markets with fluctuating regulations. Global scale enables favorable pricing and uniform quality standards while local empowerment ensures relevance.

Unilever operates under connected autonomy, aligning global category strategies at the center but enabling regional customization. The central team may negotiate with packaging suppliers globally, but local units select delivery schedules or configurations based on regional customer behavior and environmental mandates.

But the hub-and-spoke model demands high maturity in systems integration, clear rules of engagement, and trust. Without these, the model becomes bureaucratic. Local teams may feel disempowered. Decision latency can increase. Innovation can be stifled by slow approvals.

Decentralized Models

Decentralized procurement models are seen in companies diversified by design or born of acquisitions. Berkshire Hathaway with over 60 wholly owned businesses ranging from insurance to railroads runs procurement autonomously in each company. This radical decentralization works because businesses are varied and leadership philosophy is clear. The result is speed, ownership, and deep contextual knowledge.

Johnson & Johnson’s history was shaped by a decentralized model underpinned by the famous Credo. Business units operated with high autonomy. Procurement decisions reflected unique needs of each product line and region, empowering local managers to respond quickly to regulatory changes or supply disruptions.

Decentralization thrives in complex, diverse portfolios where speed and local context are more valuable than scale. It works when trust is institutionalized and local leaders have capability to manage spend responsibly. But suppliers are fragmented, pricing power is diluted, data is harder to consolidate, and compliance risk increases.

Structure Follows Purpose

In Search of Excellence by Tom Peters and Robert Waterman identified bias for action, closeness to the customer, and autonomy as core traits of excellence. The most enduring lesson is that structure follows purpose. Great companies made architecture a function of strategic intent. If innovation and speed were paramount, autonomy was granted. If consistency and efficiency were vital, centralization prevailed.

The most effective organizations treat procurement structure as a portfolio decision, not a binary one. They identify categories where global leverage matters such as IT infrastructure and centralize accordingly. Simultaneously, they localize categories where regional expertise drives value. This hybrid architecture becomes a force multiplier, enabling the enterprise to buy like a conglomerate and move like a startup.

The Decision Matrix for Procurement Structure

The decision matrix I often use includes four variables:

- Category Criticality: How essential is this category to business operations and competitive advantage?

- Spend Magnitude: What is the total addressable spend in this category across the enterprise?

- Supplier Complexity: How specialized are the suppliers, and how difficult is it to switch or consolidate?

- Innovation Velocity: How quickly does this category evolve, and how important is local customization?

For categories with high spend and low innovation, such as travel or office supplies, centralization typically yields better outcomes. For categories with low spend but high innovation, such as marketing services or product design, decentralization is usually superior. For strategic categories that are both high spend and high complexity, such as logistics or raw materials, a hub-and-spoke model allows for tight coordination with adaptive execution.

Procurement structure, in other words, must be mapped to business complexity and strategic value. There is no universal answer. The right model is the one that aligns incentives, accelerates decision-making, and amplifies enterprise capability. It is not static. As the business evolves, so must the architecture. A company expanding globally may initially benefit from decentralization but find that centralization becomes necessary as complexity and scale increase. Conversely, a firm that starts with rigid central control may need to loosen the reins to remain innovative in fast-changing markets.

The best procurement leaders understand this dynamism. They do not worship at the altar of one structure. Instead, they design adaptive models with governance built for change. They invest in systems that provide transparency regardless of who holds the decision rights. They empower local teams with clear boundaries and escalate only what truly requires alignment. They avoid the trap of centralizing for the sake of politics or decentralizing to avoid accountability.

Technology as the Great Enabler

The decision to centralize or decentralize no longer hinges solely on structure but depends on availability of intelligence across that structure. Modern technologies including real-time analytics, cloud-based ERP platforms, and AI-driven insights are reshaping procurement. What was once a dichotomy is now evolving into distributed intelligence with unified governance. Boundaries are no longer defined by geography but by data flow and decision clarity.

Even decentralized teams can act with centralized wisdom. A procurement manager in Brazil can access global supplier performance metrics. A category lead in Tokyo can tap into compliance protocols crafted in Zurich. The connective tissue is the tech stack.

Embedded analytics and AI in procurement tools score supplier risk in real time, flag policy deviations, and offer predictive insights. An AI engine can analyze thousands of past supplier contracts and identify clauses most associated with disputes. This intelligence allows decentralized users to act with centralized foresight. Decision rights remain local, but decision quality is elevated.

This federated procurement model relies heavily on technology but succeeds only with intentional governance. Clear rules must exist for what decisions are global, which are local, and how exceptions are handled. Threshold-based approvals, policy-driven supplier onboarding, and centralized contract templates anchor the system while local teams retain freedom to execute within guardrails.

Peters and Waterman emphasized simultaneous loose-tight properties as a hallmark of great companies. Organizations that are tightly held on values and goals but loosely held on methods and tactics. Applied to procurement, this means defining enterprise-wide principles around risk tolerance and ethical standards while allowing business units to interpret these principles based on local needs. The result is coherence without conformity.

In leading financial transformations, I have seen this play out. At one organization, we implemented a centralized contract management platform ensuring all agreements were digitally stored and compliant with standard terms. But we did not force every negotiation through the central team. Regional managers had authority to negotiate deals within pre-approved frameworks. This retained agility while strengthening visibility and governance.

Structure Must Follow Strategy

Technological progress has made some centralization redundant. We no longer need to collocate people to ensure visibility. Dashboards provide transparency. Audit trails replace approval chains. Workflows support conditional autonomy. Excessive centralization today can signal poor systems maturity. When the architecture is strong, authority can be delegated with confidence.

Yet a fully decentralized model without strong data infrastructure invites fragmentation. Without a single source of truth for supplier performance and contract compliance, the organization becomes blind. This is why decentralized organizations still invest in procurement centers of excellence. These hubs do not control day-to-day buying but build the tools, insights, and policies that empower others to buy better.

Amazon allows business units significant autonomy but operates with obsessive measurement and transparency. Procurement is data-driven, not command-driven. Apple centralizes core supplier negotiations but allows regional teams flexibility in supplier qualification and logistics execution. Both models work because they are designed for their respective strategies and powered by their systems.

Structure must follow strategy. Procurement should reflect the company’s competitive advantage. A firm competing on cost leadership will likely benefit from centralized procurement maximizing volume leverage. A company focused on customer intimacy or innovation needs procurement structures that are responsive and locally tuned. The procurement function must mirror the value proposition of the business.

When procurement structure, technology, and strategy align, the impact is exponential. A centralized contract platform reduces compliance costs. An AI-powered risk engine prevents disruptions. Federated teams respond faster. Executive dashboards reveal trends before they become problems. Together, these elements allow procurement to influence not just costs but revenue, risk, reputation, and resilience.

Conclusion

From a CFO’s perspective, this is transformative. It reframes procurement from budgetary gatekeeper to strategic enabler, allowing finance to forecast with greater confidence and partner with procurement in shaping supplier ecosystems that align with enterprise risk and ESG objectives.

Excellence is not an act of structure but of alignment. The most enduring companies do not pick centralization or decentralization as ideology. They pick the model that fits their mission, their markets, and their moment. They stay close to their customers, empower their people, and use data as intelligence.

Procurement, at its best, becomes an exemplar of this philosophy. It is where strategy meets execution. Where global leverage meets local creativity. Where systems and people work in concert. And where structure becomes not a constraint but a catalyst for better decisions. The procurement function that understands this becomes not just a cost center but an architect of competitive advantage, creating value through intelligent design that balances scale with speed, control with creativity, and governance with entrepreneurial spirit.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.