Executive Summary

The post-zero interest rate environment has fundamentally altered how we must approach capital allocation. Traditional methods rooted in static budgets, linear forecasting, and isolated project analysis no longer serve the dynamic, interconnected systems we operate today. Capital is no longer cheap, and its misapplication has become existentially costly. This paper argues for a paradigm shift from deterministic capital planning to complexity-based allocation, treating businesses not as machines to be optimized but as living systems that adapt, evolve, and respond to interdependencies.

Drawing on over twenty-five years of financial leadership across cybersecurity, SaaS, manufacturing, logistics, and digital marketing, I have witnessed firsthand how capital decisions ripple through organizations in ways that spreadsheets cannot predict. Whether standing up finance functions from scratch, managing multi-entity global operations, or leading companies through rapid scaling and capital raises exceeding $120 million, the lesson remains consistent: the order, timing, and systemic impact of capital deployment matter as much as the amounts themselves. Complexity-based capital planning does not abandon discipline. It upgrades it to reflect how business actually behaves, acknowledging feedback loops, emergence, and path dependence. For CFOs, this means speaking to boards in systems terms, building adaptive decision loops, and measuring leading indicators that signal system health before lagging metrics confirm decline. In volatile markets, this approach is not optional. It is the only path forward.

The Shift from Linear to Systemic Thinking

Traditional capital planning assumes that risk follows a bell curve and that systems behave proportionally to inputs. In volatile markets, these assumptions betray the complexity of the systems we operate. Throughout my career across cybersecurity, SaaS platforms, logistics, and gaming, capital decisions create cascading effects throughout organizations. Whether implementing NetSuite and OpenAir PSA systems or redesigning supply chain operations to reduce logistics costs by 22 percent, the insight remains constant: investments do not exist in isolation.

To thrive, CFOs must shift to complexity-based capital allocation, treating the business as a living, dynamic system rather than a machine to be tuned. Consider allocating $10 million across regional expansion, product development, and internal systems modernization. The classical approach analyzes projected returns and payback periods. But what if regional expansion stretches the engineering team already taxed with the product roadmap? What if internal systems fail to scale, creating onboarding bottlenecks? When I designed multi-entity global finance architecture spanning the United States, India, and Nepal, the challenge was understanding how investments in one geography would create demands on shared service teams and how revenue operations needed to scale before we could support complex enterprise contracts.

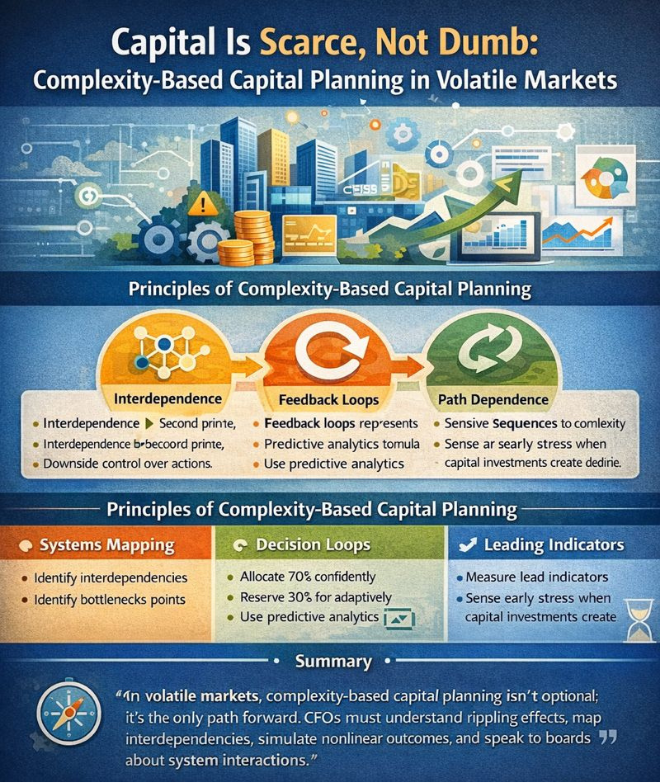

Complexity-based capital planning rests on three foundational principles. Interdependence means every allocation decision creates second-order effects. Adding sales representatives increases lead generation, which burdens support teams, which delays product feedback loops. At a digital marketing company where we scaled revenue from $9 million to $180 million, growth required careful sequencing of investments in client-facing reporting, ad operations infrastructure, and analytics platforms. Each wave of growth demanded that we strengthen underlying systems first.

Feedback loops represent the second principle. In healthy systems, outputs influence inputs. Investing in product user experience might lower support costs, improve net promoter scores, and increase referral traffic. When I rebuilt GAAP and IFRS financials for a high-growth SaaS company across the United States and European Union, we designed cohort analysis frameworks to understand how customer behavior would evolve. These feedback loops allowed us to model the long-term impact of pricing changes and customer success investments, preventing capital decisions made in a vacuum.

Path dependence is the third principle. Where you are now is a function of past decisions, and where you end up depends on the order in which you deploy capital. When managing global finance for a $120 million logistics organization, we overhauled freight, warehouse management, and last-mile logistics processes. The decision to invest in warehouse management systems before expanding our e-commerce channel proved critical. Had we reversed that order, we would have lacked operational capacity to fulfill increased demand. The sequence of capital deployment created a foundation for sustainable growth.

Complexity theory also teaches us about emergence, where the behavior of the whole system cannot be predicted by analyzing the parts. Capital planning should shift from annual static budgeting to dynamic, adaptive decision making. At a nonprofit where I served as CFO, we secured $40 million in Series B funding. We implemented quarterly capital allocation reviews that allowed us to redirect funding based on emerging opportunities and system constraints.

Complexity-based capital planning in practice begins with systems mapping. Identify where capital touches not just expenses but outcomes. Map interactions between departments. In implementing ERP systems such as NetSuite, Oracle Financials, and Intacct, I learned that technology alone does not solve the problem. You must first understand the system, where data originates, how processes interact, and where bottlenecks exist.

Build decision loops into your capital plan. Allocate 70 percent of your capital with confidence and hold back 30 percent for adaptive deployment. This requires discipline and courage. Use predictive analytics to simulate nonlinear outcomes. Throughout my career, I have used tools ranging from SQL and R to MicroStrategy, Power BI, and Adaptive Insights to understand the range of possible outcomes and leverage points where small investments create disproportionate returns.

Measure leading indicators, not just lagging ones. Traditional metrics like revenue per head or customer lifetime value trail reality by quarters. At a cybersecurity firm, we built an enterprise KPI framework tracking bookings, utilization, backlog, annual recurring revenue, pipeline health, customer margin, and retention. These metrics gave us early warning signals when capital investments were creating unintended stress.

Speak to the board in systems terms. Instead of saying, “We are investing $5 million in go-to-market acceleration,” say, “This investment increases lead generation by 40 percent, which will stress onboarding and customer success by 20 percent, and without $750,000 in system automation, we will create negative customer impact by Q3.” Over my career leading board reporting at multiple companies, including a gaming enterprise where I oversaw $100 million in acquisitions, the most effective boards engaged with systemic thinking, exploring how investments would interact.

Some may argue this approach is too complex or speculative. But consider the alternative: static planning, overfunded initiatives with hidden interdependencies, and delayed recognition of system-level breakdowns. The product launch that overwhelmed the support team, the market expansion that outpaced hiring, the acquisition that created cultural drift. These were capital allocation failures born from linear thinking in a nonlinear world.

Complexity-based capital planning does not mean abandoning structure. It means upgrading structure to reflect how business actually behaves. It requires a finance team fluent in both numbers and narrative, in spreadsheets and systems. What creates effective capital planning is the willingness to look beyond the numbers and see the system. Capital is no longer cheap, but it is not dumb either. It is a reflection of judgment, feedback, and adaptability. The companies that win will not just outspend or out-hire. They will out-learn.

Closing Summary

In the post-zero interest rate economy, capital allocation has become the strategic edge that separates resilient organizations from those that struggle. Traditional methods rooted in static budgets, linear forecasting, and isolated project analysis are no longer adequate. They assume a world of proportional cause and effect, where risk follows predictable patterns and systems respond mechanically to inputs. That world no longer exists, if it ever did.

Complexity-based capital planning offers a better way forward. It begins with the recognition that businesses are dynamic systems characterized by interdependence, feedback loops, and path dependence. Capital decisions create ripple effects that cascade through the organization in ways that cannot be fully captured in spreadsheets. The order and timing of investments matter as much as the amounts. Small changes in sequence can produce dramatically different outcomes.

The practical implications are clear. CFOs must shift from annual static budgeting to adaptive decision making, building flexibility into capital plans and reserving capacity for opportunistic deployment. They must use systems mapping to understand how investments interact, predictive analytics to simulate nonlinear outcomes, and leading indicators to sense when the system is under stress before lagging metrics confirm decline. Most importantly, they must speak to boards in systems terms, articulating not just what they plan to spend, but how those expenditures will interact with the rest of the business and what signals will indicate success or failure.

This shift requires courage and discipline. It means saying no to attractive projects that would strain the system. It means being willing to kill initiatives that are not working, even if they enjoy strong advocacy. And it means accepting that capital planning is not about predicting the future with precision, but about building the organizational capacity to adapt faster than the environment changes.

Throughout my career, from standing up finance functions in emerging industries like cannabis manufacturing to leading global finance operations for logistics and gaming enterprises, from implementing ERP systems that automate revenue recognition to securing over $120 million in capital raises, the lesson has remained consistent: the companies that thrive are those that treat capital as a signal, not a commodity. They test their assumptions rigorously, learn from feedback quickly, and adapt their plans based on what the system tells them.

In a world where volatility is permanent and certainty is a luxury, planning capital with complexity in mind is no longer optional. It is the only way forward. The CFOs who embrace this reality, who upgrade their planning processes to reflect how business actually behaves, will not simply manage risk. They will create resilience. They will not just allocate resources. They will architect systems that scale, compound, and endure. And in doing so, they will redefine what it means to be a steward of capital in the modern economy.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.