Executive Summary

There was a time when capital was a growth strategy. Cash was cheap, investors were patient, and the mandate was expansion. Every new market, new hire, new tool felt like acceleration. The CFO’s job was to fuel the fire without losing the map. But that era has ended. Throughout my twenty-five years leading finance across cybersecurity, SaaS, manufacturing, logistics, and gaming, I have learned that in its place is a different economy, one defined not by abundance but by friction. Today capital is costly. Time, talent, and investor goodwill are constrained. And the CFO is no longer the funder of dreams. They are the architect of discipline.

From Abundance to Discipline

Doing more with less is not about austerity. It is about design. It begins with reframing. Scarcity is not a penalty. It is a forcing function. It demands prioritization. It clarifies what matters. Companies that cling to the memory of capital abundance try to stretch. They make small bets everywhere. They hedge. They hope. But hope is not a lever. Focus is.

A CFO who understands this begins by asking: what drives value? Not noise. Not vanity. Not motion. Value. Which products have margin? Which customers retain? Which channels convert predictably? Which hires accelerate output? The answers to these questions become the strategy.

Once value is clear, the rest is tradeoffs. CFOs must move from cost-cutting to capital shaping. This means not trimming budgets blindly but reallocating with intention:

- Killing pet projects

- Delaying nice-to-haves

- Accelerating what compounds

Capital, when scarce, must not be spread. It must be stacked.

When I managed global finance for a $120 million logistics organization during an economic downturn, we faced 18 percent revenue decline while maintaining profitability targets. Rather than across-the-board cuts, we conducted zero-based budget reviews identifying value drivers. We eliminated underperforming route networks, consolidated warehouse operations in overlapping markets, and accelerated investment in technology automation for high-volume corridors. This surgical reallocation reduced operating costs by 22 percent while maintaining service levels in strategic segments, enabling return to growth within two quarters with structurally improved margins.

Building Capital Efficiency Structure

Capital Efficiency Operating Model

Capital efficiency is not a mindset. It is a system. It begins with belief but it survives through structure. The CFO who commits to doing more with less must build mechanisms that translate constraint into action.

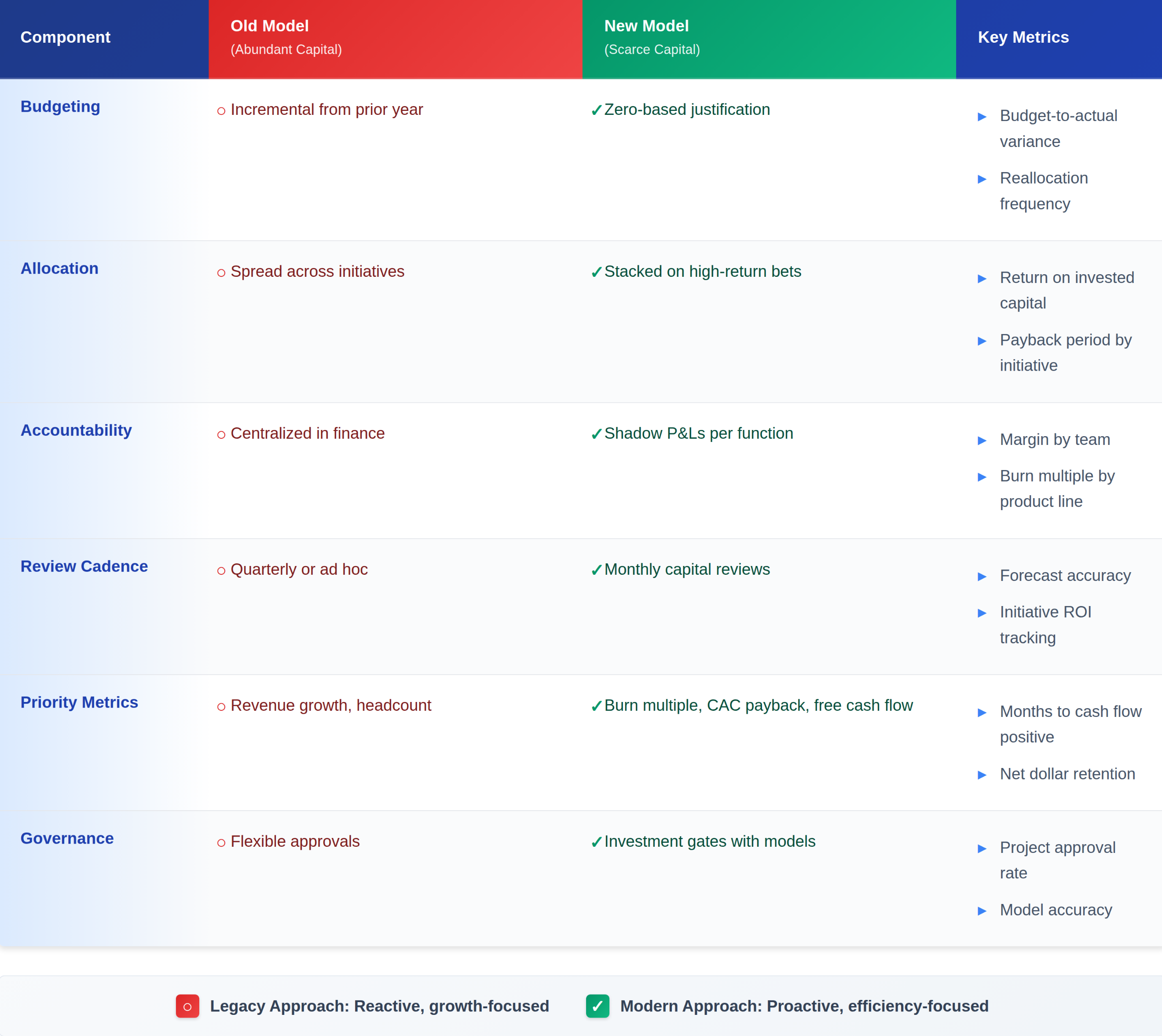

Core Structural Elements of Capital Discipline

Zero-Based Budgeting in a High-Cost Capital Environment

Instead of starting from last year’s budget, every line item must be justified from zero. This forces rigor. It challenges assumptions. It reveals inertia. A CFO who builds zero-based budgets does not just cut. They reallocate. They fund what works. They defund what flatters.

Capital Allocation Modeling:

The CFO must rank initiatives not by enthusiasm but by return. Product investments, go-to-market experiments, and geographic expansions each must carry an expected yield. Not in vague total addressable market upside but in tangible, trackable output. Capital allocation scorecards are built. Projects are mapped against cost, timing, and return. Tradeoffs become visible.

Shadow P&Ls and Functional Accountability

For each function, each team, even major projects. Not to punish but to educate. What is the effective margin of that sales pod? What is the burn multiple of that new product line? What is the cash conversion cycle of customer support? These shadow P&Ls bring accountability. They turn each function into a financial citizen.

Operating Cadence as Culture

Monthly capital reviews, quarterly investment retrospectives, and forecast variance reviews. These meetings are not just rituals. They are how a capital-efficient culture sustains. Without rhythm, even the best metrics get buried. With rhythm, they become habits.

Redefined Metrics for Capital Efficiency

In a capital-efficient company, the metrics shift fundamentally:

- Burn multiple watched more than top-line growth

- Net dollar retention matters more than logo count

- CAC payback becomes non-negotiable

- Free cash flow becomes the north star

Each of these metrics tells a different story: one of resilience.

When I improved month-end close from 17 days to under six days at a cybersecurity firm, we simultaneously implemented weekly cash flow forecasting and monthly burn multiple tracking. This enabled leadership to identify efficiency opportunities in real time rather than retrospectively. We caught a 35 percent increase in customer acquisition cost within one month, immediately adjusted marketing spend allocation, and prevented $400,000 in inefficient spend over the subsequent quarter.

Governance and Culture

But metrics alone are not enough. Structures must extend to governance. Investment gates must be defined:

- No project over a certain threshold moves forward without a financial model

- No hire is approved without justification

- No vendor contract is renewed without performance review

These are not bottlenecks. They are architecture.

This governance must scale. As teams grow, so does complexity. The CFO must decentralize accountability. Functional leaders need mini-CFO mindsets. They must own their budgets. Defend their asks. Know their numbers. The finance team must train, not just tally. The operating model becomes a culture.

My certifications as a CPA, CMA, and CIA provide technical foundation for financial systems and operational efficiency. But what separates companies that thrive under capital constraint from those that fracture is not accounting discipline alone. It is the architecture to translate scarcity into focus, the systems to make tradeoffs visible and defensible, and the governance to ensure every dollar has a measurable return that compounds rather than dissipates.

Conclusion

Resilience is the output. Not just of capital preservation but of confidence. Investors see it. Boards feel it. Teams trust it. A business with efficient capital structure does not just last longer. It grows cleaner. It pivots faster. It earns better terms. In this era where capital costs more, the advantage goes not to the boldest but to the best prepared. And the best prepared have structure.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.