Executive Summary

When the world breaks, it does not send a calendar invite. It does not whisper warnings in the boardroom or give your spreadsheet the courtesy of a gentle correction. It shatters assumptions. Quietly, then all at once. The patterns stop behaving. Cash stops flowing like it used to. Models that seemed so carefully constructed begin to falter under the weight of newly introduced unknowns. And just like that, resilience stops being a corporate buzzword and becomes the difference between breathing and bleeding. Finance, by its nature, is a discipline of foresight. But the kind of foresight that matters most is not about predicting the exact timing of a downturn or the specific domino that will fall next. It is about preparing so thoroughly, so structurally, that when the domino tips, whether it is a pandemic, a war, a banking seizure, or a once-in-a-century interest rate shock, the organization does not collapse inwards. Instead, it absorbs the blow, rights its balance, and sometimes even finds the hidden path forward faster than its competitors. Throughout my twenty-five years leading finance across cybersecurity, SaaS, manufacturing, logistics, and gaming, I have learned that resilience is not built in a single quarter’s earnings. It is built quietly over years, in the choices most do not notice until the headlines arrive. The way working capital is managed when times are flush. The discipline to preserve liquidity even when capital is cheap and abundant. The wisdom to avoid excess leverage, even when equity markets are forgiving.

The Foundation of Resilience

The most important role of finance in a world prone to breaking is the preservation and allocation of optionality. Because when shocks arrive, the organizations that thrive are not the ones who predicted the weather. They are the ones who built arks. These arks take many forms including a conservative cash buffer that cushions a liquidity crunch, a modular cost structure that bends without snapping, a diversified revenue base that reduces dependency on any one industry or geography, and a technology stack that can shift operations remotely in hours instead of weeks. These are not theoretical constructs. They are real, pragmatic design decisions, and finance has its hand in each of them.

When I reduced monthly burn from $800,000 to $200,000 at an email marketing SaaS company, the key was not cutting to the bone but cutting to a sustainable level that preserved core capabilities while eliminating waste. That discipline created the optionality to survive a prolonged downturn without destroying the engine. It is fashionable to view CFOs as stewards of backward-looking data. But in moments of crisis, the CFO becomes the steward of time. Time is what cash buys. Time is what covenant flexibility protects. Time is what allows leadership to think strategically while others are panicking tactically.

The Resilience Framework

| Resilience Pillar | Key Elements | Financial Levers | Leading Indicators |

| Liquidity Preservation | Cash reserves, credit facilities, working capital optimization | Minimum cash thresholds, revolver capacity, AR/AP management | Days cash on hand, debt service coverage ratio, burn rate |

| Capital Structure Flexibility | Covenant-light debt, diversified funding sources, maturity laddering | Debt structure, equity access, capital allocation policy | Covenant headroom, maturity profile, cost of capital |

| Operational Modularity | Variable cost design, scalable infrastructure, process automation | Fixed vs variable cost mix, vendor contracts, technology stack | Operating leverage, capacity utilization, process cycle time |

| Revenue Diversification | Customer concentration limits, geographic spread, product mix | Customer dependency ratios, revenue segmentation, pricing power | Customer concentration index, retention rates, market exposure |

I have seen well-regarded companies with sterling brands buckle under pressure because they did not understand their true exposure. They thought resilience meant low cost. In fact, resilience often means redundancy, and redundancy looks like inefficiency until it becomes the only bridge across the chasm. They viewed debt covenants as legal formalities, not latent constraints. They operated with razor-thin margins and assumed scale would insulate them from volatility. But scale without flexibility is just inertia at a grander size.

Systemic Shocks and Internal Inconsistencies

What makes systemic shocks so uniquely destabilizing is not just the external pressure they exert but the internal inconsistencies they reveal. When stress enters the system, it does not test your strongest link. It seeks out the weakest. It exposes the assumptions you made in calm weather and punishes them in the storm. When I managed global finance for a $120 million logistics organization and overhauled freight, warehouse management, and last-mile logistics processes, we stress-tested each component under demand shock scenarios. We discovered that our warehouse capacity could handle 30 percent volume increases but our last-mile delivery network would collapse at 15 percent growth. That insight allowed us to invest preemptively in delivery capacity, creating resilience before it was needed.

One of the most profound challenges that systemic shocks impose on finance leaders is the simultaneous requirement to make decisions under heightened uncertainty and diminished visibility. Forecasting becomes fragile. Historic benchmarks lose their predictive power. Markets react irrationally, suppliers become erratic, and customers change behavior at speeds that no model can accommodate. But here is where a resilient finance leader separates from a reactive one: rather than chase precision in a world that no longer offers it, the resilient CFO pivots to flexibility.

To lead effectively through a systemic shock, a CFO must embrace a principle that often goes ignored in times of plenty: velocity is not the enemy of accuracy. It is its companion. When the world is in motion, decisions delayed are often more dangerous than decisions made with imperfect data. You may not know what the next quarter’s revenue will be, but you can estimate cash burn under a range of scenarios. You may not predict customer behavior precisely, but you can model stress on working capital based on analogs from previous downturns. Actionable range-based planning becomes your edge.

When I rebuilt GAAP and IFRS financials for a high-growth SaaS company and designed cohort analysis frameworks, we moved from single-point forecasts to scenario-based planning. We modeled revenue under optimistic, baseline, and pessimistic scenarios with explicit trigger points for each. When the pandemic hit and usage patterns shifted dramatically, we already had playbooks ready. We did not waste weeks debating what to do. We executed against pre-approved scenarios.

Capital Deployment and Discipline

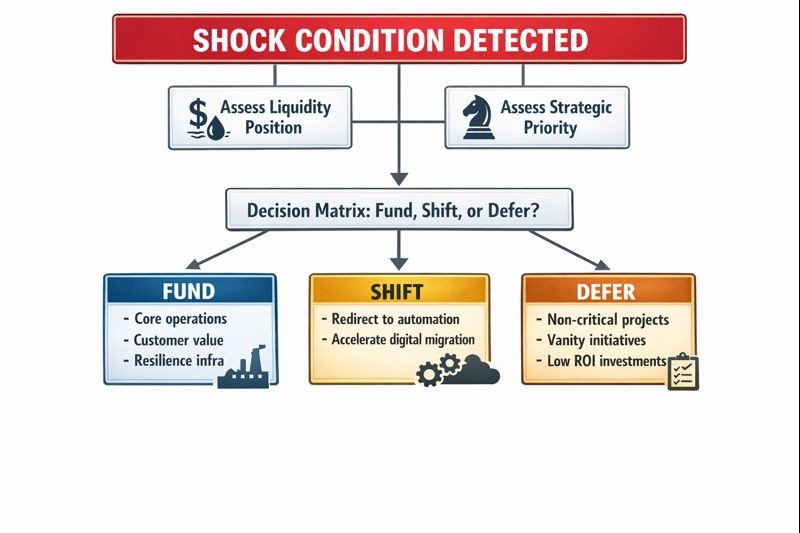

A great many companies make the mistake of seeing systemic shocks as a time for freeze, the so-called pause button mentality. They stop hiring, halt capital projects, delay product launches, and focus exclusively on defense. But the opportunity cost of inaction during a disruption is often larger than the cost of a wrong move. This is particularly true in competitive markets where nimble players gain share simply by continuing to serve while others retreat. That is why CFOs must go beyond the role of resource gatekeeper. They must become clarity engines.

Take, for example, the nature of capital expenditures. In a traditional downturn, the reflex is to slash capital expenditures. But in a systemic shock, the smarter move may be to shift capital expenditures rather than eliminate them. Reinvest in automation that reduces fixed labor over time. Accelerate cloud migrations that improve operational continuity. Fund data infrastructure that enhances real-time forecasting. These are not acts of indulgence. They are bets on resilience.

When I implemented NetSuite and OpenAir PSA systems to automate revenue recognition and project accounting with 28 percent improvement in accuracy, the timing was during market uncertainty. Many questioned whether we should delay. But automation created capacity that allowed us to scale without proportional headcount increases. That decision paid compound returns over years. But capital deployment alone is not the hallmark of resilience. Just as important is capital discipline. Shocks have a way of making companies panic-buy solutions. They throw money at consultants, redundant tools, and contingency suppliers in the name of stability. But money does not create clarity.

Capital Allocation Decision Framework

Debt Structure and Adaptive Capital

Another underrated lever of resilience is debt structure. Too many CFOs focus on cost of debt in the abstract, optimizing basis points without considering scenario durability. When the world breaks, debt becomes less about cost and more about constraint. Fixed amortization schedules, tight maintenance covenants, inflexible maturity profiles, these become chains around the neck of a stressed enterprise. The resilient CFO does not just look for cheaper capital. They look for adaptive capital. Revolvers with flexible drawdown schedules. Covenant-lite structures with step-ups instead of cliffs. Contingent funding based on revenue triggers.

When I secured $40 million in Series B funding and an $8 million credit line at a nonprofit organization, we negotiated covenant structures that provided breathing room during program scaling. Rather than fixed quarterly EBITDA targets, we agreed to trailing twelve-month revenue growth thresholds with seasonal adjustments. This flexibility proved critical when donor patterns shifted unexpectedly. Similarly, CFOs must begin treating supplier and customer relationships not as transactional line items but as embedded extensions of the company’s risk posture. In a systemic shock, concentration becomes risk.

At a digital marketing company where we scaled revenue from $9 million to $180 million, we tracked customer concentration religiously. No single client represented more than 8 percent of revenue. When we lost our third-largest customer during market turbulence, the impact was manageable. Had we allowed concentration to drift to 15 or 20 percent, that loss would have been catastrophic. Resilient finance teams regularly review their revenue and procurement dependencies. They model the cost of losing a top client, not just in margin terms but in cash flow timing.

Internal Cohesion and Transparency

Just as important is how the finance team manages internal cohesion under pressure. Shocks do not just strain the balance sheet. They strain people. Employees fear for their jobs. Leaders hunker down into silos. Communication becomes guarded. That is why the resilient CFO must become a beacon of transparency. Even when the news is bad, the clarity of the message can be stabilizing. Here is what we know. Here is what we are doing. Here is what we are watching. That rhythm becomes a source of calm.

When I improved month-end close from 17 days to under six days at a cybersecurity firm, part of that acceleration came from automation. But equally important was communication cadence. We established daily cash position updates, weekly forecast reviews, and transparent variance explanations. When market conditions deteriorated, this cadence intensified but the structure remained familiar. Teams knew what to expect and when. That predictability in process created stability amid market chaos.

All of this comes together in one simple, powerful truth: the role of finance during systemic shocks is not just to manage risk but to orchestrate resilience. That resilience must be financial, operational, strategic, and cultural, all in unison. And it must be continuous. Because the shocks never really stop. They just change shape.

Post-Shock Reimagination

In the aftermath of any systemic shock, there is an almost gravitational pull to return to business as usual. Management teams, investors, employees, they all want to believe that stability is restored, that the system has rebalanced, that uncertainty is behind us. But this is where the most important work of a resilient CFO begins. Not in the storm, but in the silence that follows it. Because the silence is deceptive. Markets recover, sentiment rebounds, and forward guidance creeps back into the conversation. But beneath the surface, the memory of the shock persists.

And so the resilient CFO must ask the questions no one else dares to. Not how do we get back to where we were but should we. This is the crux of long-term value creation. It is not found in the quarter after a recovery. It is found in the discipline to reexamine, restructure, and reprice every element of the operating model. What are we carrying that no longer serves us? What assumptions have expired? Which cost centers proved brittle under pressure? Which customer relationships held and why?

When I led board reporting at a gaming enterprise where I oversaw $100 million in acquisitions and post-merger integration, we conducted post-acquisition reviews not just on financial performance but on organizational resilience. Which acquired capabilities proved durable under integration stress? Which systems created friction? These insights informed not just integration but future acquisition criteria. Resilience, at its highest form, becomes a design principle. It shapes product strategy, go-to-market models, investment decisions, even corporate culture.

Institutionalizing Learning

The best CFOs I have known are not defined by the crises they endured. They are defined by how they transformed after them. How they rethought capital structure to bake in strategic flexibility. How they redefined productivity metrics to reflect not just efficiency but agility. How they collaborated with the CEO to reshape investor messaging to emphasize long-term durability rather than near-term acceleration. And perhaps most importantly, how they institutionalized learning, so that the muscle memory of one shock became embedded protection against the next.

When I built enterprise KPI frameworks using MicroStrategy, Domo, and Power BI tracking bookings, utilization, backlog, annual recurring revenue, pipeline health, customer margin, and retention, we added resilience indicators. We tracked not just revenue growth but revenue stability. Not just gross margin but gross margin volatility. Not just cash flow but cash flow predictability. These resilience metrics informed capital allocation decisions and strategic planning. This work is quiet. It does not make headlines. But it builds a company that lasts.

A company that does not flinch at volatility. A company that knows where it bends and where it breaks, and fortifies accordingly. A company that can respond to the next global supply chain failure, or geopolitical flashpoint, or regulatory upheaval, not with panic but with preparedness. And that, in the end, is what shareholders pay for. Not just earnings but endurance. Not just growth but growth that can survive the cycle.

The Evolution of the CFO Role

We live in an age of acceleration. Markets move faster, shocks hit harder, and information cycles compress decision-making into tighter windows. In such an age, the CFO must evolve. No longer is it enough to be the historian of the enterprise. You must be its translator, its radar, and its compass. You must take the noise of volatility and turn it into a signal of where to go next. You must hold the dual obligation of preserving liquidity and enabling velocity. You must know when to spend and when to sit, when to signal caution and when to bet big.

This is not a role for the faint of heart. It requires rigor, yes, but also imagination. Discipline, yes, but also daring. It requires the humility to admit what you do not know and the courage to act anyway. It requires seeing resilience not as a moat but as a bridge: something that allows the company to cross from risk to opportunity faster than its rivals. And it requires one final thing: patience. Because resilience does not pay off every quarter. It does not always show up in the metrics. Sometimes it feels invisible.

My certifications as a CPA, CMA, and CIA reflect a commitment to controls, governance, and risk management. But these credentials are only frameworks. What creates resilience is the daily practice of applying these principles with context, judgment, and adaptability. It is asking not just is this compliant but is this resilient. Not just does this maximize efficiency but does this preserve optionality. Not just will this satisfy quarterly earnings but will this position us to survive and thrive through the next cycle.

When I designed multi-entity global finance architecture spanning the United States, India, and Nepal, resilience was built into the foundation. Each entity could operate semi-autonomously if connectivity failed. Cash could be managed locally while maintaining consolidated visibility. Systems were designed with redundancy. This architecture proved its value multiple times, from regional banking disruptions to pandemic-driven travel restrictions. The investment in resilience architecture paid for itself many times over.

Conclusion

When the world breaks, as it will again, the companies that endure will not be those with the biggest headlines or the flashiest roadmaps. They will be the ones that prepared quietly, executed relentlessly, and built their house not for the best of times but for all times. So let the others chase growth at any cost. Let them optimize for optics. Let them model the future as if it were a continuation of the past. Meanwhile, you, the resilient CFO, will build for what matters most. Not the illusion of stability but the truth of strength.

Because when the world breaks, your job is not just to hold the line. It is to ensure that when the dust settles, your company stands taller than before. Resilience is not found in avoiding shocks. It is found in how you respond to them, learn from them, and emerge stronger. It is the compound interest of discipline. It is the architecture of adaptability. It is the difference between companies that survive and companies that thrive. And it begins and ends with finance. Not because finance controls everything but because finance sees everything. And in that visibility lies the power to build organizations that bend but do not break, that absorb shocks but do not shatter, that emerge from crisis not diminished but transformed. This is the mandate of the modern CFO. This is the art and science of financial resilience.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.