Executive Summary

Board effectiveness is a paradox. Taken for granted when performance sails, overlooked until failure arises. Leadership discussions focus on what management delivers but rarely on how the board governs itself. Yet the board’s function is foundational to enterprise resilience. Throughout my twenty-five years leading finance across cybersecurity, SaaS, manufacturing, logistics, and gaming, I have learned that when boards assess themselves with rigor, they model continuous improvement, restore strategic alignment, and demonstrate stewardship to stakeholders. When they do not, blind spots proliferate, conflicts fester unspoken, and strategic drift becomes inevitable. The logic is simple: if boards guide strategy, monitor risk, and shape culture, then they themselves must be subject to scrutiny. Directors evaluate management. Why should they not evaluate their own contribution? Yet too often, board evaluations are checklist exercises, outsourced and hurriedly filed. The result is blind faith in governance. Without honest feedback, boards drift into groupthink or token oversight. Suboptimal habits calcify. Decisions lose coherence across cycles.

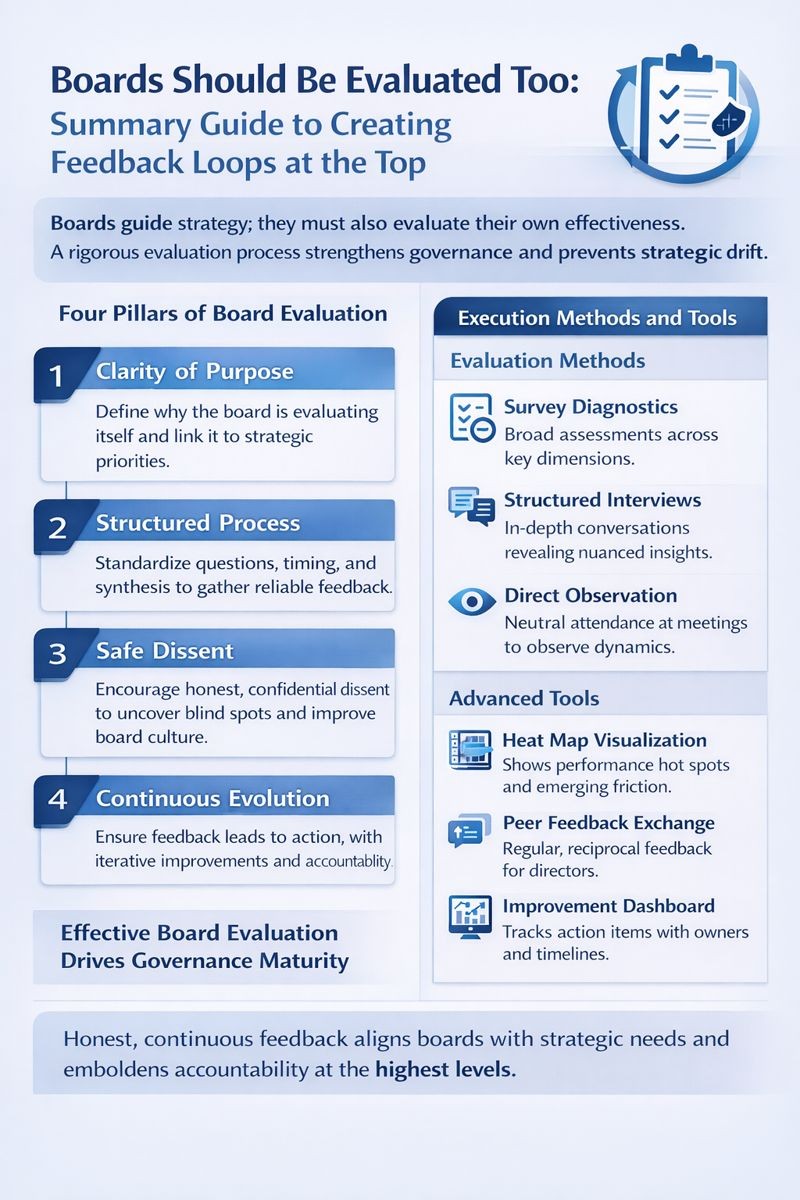

Four Interlocking Pillars of Board Evaluation

To respect the act of evaluation, boards must be intentional. The process must reflect seriousness. And it must be grounded in four interlocking pillars.

Pillar 1: Clarity of Purpose

The first pillar is clarity of purpose. The board must define why it is evaluating itself. Is the goal improved meeting quality? Stronger strategic alignment? Committee effectiveness? Director fit? Clarity ensures that evaluation is not ceremonial but purposeful. A board scrutinizing strategic foresight ensures its evaluation design focuses on future-readiness, not simply governance hygiene.

Boards often neglect this step. They ask generic questions including was the board effective without linking them to future imperatives. A powerful evaluation begins with a framing on what excellence will look like next year: deeper risk scan, sharper focus on enterprise transformation, faster decision-making, higher-quality debate.

When I led board reporting at a gaming enterprise where I oversaw $100 million in acquisitions and post-merger integration, we conducted annual board effectiveness assessments tied to specific strategic priorities. Rather than generic effectiveness questions, we evaluated board performance against integration oversight objectives: Did we provide appropriate challenge during diligence? Did we monitor cultural integration metrics effectively? Did we escalate concerns at appropriate thresholds? This purpose-driven evaluation revealed gaps in our technical diligence process and led to engaging external advisors for future transactions.

Pillar 2: Structured Process

The second pillar is a structured process. Leaving feedback ad hoc is no feedback at all. Boards need standardization: consistent questions, reliable formats, regular timing. This does not mean mechanical surveys but disciplined collection and synthesis. A typical process starts with director surveys with anonymous rating across key axes, one-on-one interviews with the chair or external facilitator, committee assessments, and peer feedback.

The process must ensure confidentiality. Honest feedback is earned, not demanded. The venue may vary including external consultant or trusted lead director, but directors must feel safe. The board decides collectively whether the report is discussed with management and how anonymity is preserved. Too often, evaluations become exercises in self-justification rather than deep insight.

Board Evaluation Process Framework

| Phase | Method | Key Questions | Output | Timeline |

| 1. Purpose Setting | Board discussion | What are our strategic priorities for next year? Where do we need to improve? | Evaluation objectives aligned to strategy | Q4 board meeting |

| 2. Data Collection | Anonymous surveys, 1-on-1 interviews | Meeting effectiveness, strategic alignment, committee performance, director contribution | Raw feedback data | 3-4 weeks |

| 3. Synthesis | Thematic analysis, heat mapping | What patterns emerge? Where are critical gaps? What tensions exist? | Synthesized findings report | 2 weeks |

| 4. Dialogue | Executive session discussion | What do we agree needs improvement? What actions will we take? | Action plan with owners and timelines | Next board meeting |

| 5. Implementation | Committee work, policy updates | Are changes being implemented? What resistance exists? | Documented progress | Ongoing |

| 6. Review | Follow-up assessment | Did our actions improve effectiveness? What remains unresolved? | Updated evaluation for next cycle | Next annual cycle |

Pillar 3: Safe Dissent

The third pillar is safe dissent. Effective board evaluation surfaces discomfort without retribution. Boards must invite dissent at every level of process design and review. They must ask: who held silence when they should have spoken? Who deferred too easily? Did any committee avoid airing sensitive issues? The evaluation must probe not just what happened but what did not happen: absent voices, avoided topics, stifled debate.

Safe dissent extends to culture. Evaluations should explore whether the board welcomes challenge or whether directors self-censor. They should examine the degree of psychological safety in executive session. The role of the chair is material here: do directors feel they can question even the CEO without retribution? Without trust, evaluation remains superficial.

Pillar 4: Continuous Evolution

The fourth pillar is continuous evolution. Feedback without action is misconduct disguised as process. Boards must close the loop. Evaluations should lead to action plans including committee recalibration, meeting rhythm adjustments, policy enhancements, and skills refreshment. And they must be revisited. No board says action taken. They say is it working? Board self-assessment is seasonal, not episodic.

Boards that institutionalize evaluation show evidence of improvement over time: tighter agendas, faster decisions, more strategic leadership transitions, healthier board-management relationships. They publicly signal accountability and internalize improvement. They powerfully demonstrate that the top can get better too.

Execution Methods and Tools

Evaluation is not just an event. It is a mechanism. Boards that embed evaluation into governance operations develop the strategic maturity to adapt in the face of complexity. Execution starts with fit-for-purpose frameworks tailored to board structure, ownership type, and performance context.

Context-Specific Evaluation Design

- High-Growth Board: Must evaluate agility and strategic sparring. Framework includes: how effectively does the board challenge founder assumptions without eroding trust? Are we allocating sufficient time to growth versus governance? Is the composition diverse enough to support future phases?

- Crisis-Management Board: Requires feedback lens tuned to risk vigilance, decision intensity, and leadership integrity. Evaluations measure response cadence, signal clarity, and ethical grounding. Questions include: Did we escalate fast enough? Were dissenting views heard? Did we shield management from undue pressure?

- Owner-Led Board: Must evaluate role clarity and voice discipline. Framework examines dominance patterns, boundary respect, and strategic delegation to ensure the board does not overstep into operational zones.

When I improved month-end close from 17 days to under six days at a cybersecurity firm, the board evaluation process helped surface that directors lacked sufficient understanding of operational finance processes to provide effective oversight. This led to quarterly operational deep-dives where finance leadership presented process workflows, control frameworks, and improvement initiatives. Board members gained literacy that enabled more effective strategic guidance and appropriate challenge.

Three Evaluation Methods

- Survey Diagnostics: Provide breadth across standard dimensions including meeting effectiveness, strategic alignment, committee performance, director contribution, and chair leadership. Quantitative ratings enable year-over-year trending and benchmarking.

- Structured Interviews: Provide depth through open-ended exploration of board dynamics, decision quality, and cultural patterns. Conducted by chair, lead independent director, or external facilitator. Reveal nuances that surveys miss.

- Direct Observation: Provides behavioral evidence through ethnographic sit-ins where neutral observers attend meetings to document participation patterns, tone of debate, framing of dissent, and power asymmetries.

High-performing boards triangulate all three methods to gain comprehensive insight.

Advanced Tools

- Heat Map Visualization: After data collection, responses are synthesized into thematic clusters: board dynamics, strategic alignment, committee effectiveness, chair leadership. Each theme is scored and color-coded including red for critical gap, amber for emerging friction, green for strong coherence. The visual form helps focus dialogue.

- Peer Feedback Exchange: Directors reflect annually on one behavior to amplify and one to evolve. These reflections are exchanged voluntarily in small peer groups or synthesized anonymously by the chair. Over time, language softens, trust rises, and feedback becomes a shared asset.

- Improvement Dashboard: Tracks action items from evaluation with owners, timelines, and status. Reviewed at every board meeting to maintain momentum and signal seriousness about continuous improvement.

From Feedback to Action

The final step is action. Evaluation becomes effective only when follow-through is visible. Strong boards create an improvement plan that is simple, time-bound, and transparent. If feedback reveals meeting inefficiency, agendas are adjusted. If it signals skill gaps, recruitment begins. If it highlights governance erosion, charters are redrafted. Updates are shared with the full board. The next evaluation cycle includes a review of actions taken.

In some cases, outcomes are dramatic. Following three cycles of underperformance and persistent feedback gaps, one global technology board initiated a full composition refresh. Three directors rotated out. A new strategy committee was formed. Evaluation insights were embedded into onboarding. Culture reset. Performance recovered. The board did not dissolve under critique. It evolved.

Contrast this with a healthcare board that conducted perfunctory evaluation. Directors rated themselves highly. Results were sanitized. No actions followed. A year later, a strategic misstep occurred, an unvetted acquisition that burned capital. Post-mortem revealed that critical questions were never asked. The evaluation had ignored dissent. Silence cost them oversight.

My certifications as a CPA, CMA, and CIA emphasize governance frameworks and continuous improvement methodologies. But what separates effective board evaluation from ceremonial exercise is not process sophistication. It is the courage to surface uncomfortable truths, the discipline to act on findings, and the humility to acknowledge that even the most experienced directors have blind spots that require external perspective and structured feedback to address.

Conclusion

This is the final truth of board evaluation: when ignored, it costs. When done with courage, it compounds. It creates smarter decisions. It invites better talent. It strengthens governance posture. And it tells the entire enterprise that accountability does not end at the top. It begins there. Boards should be evaluated because boards are human systems. And all systems drift without feedback. Evaluation is not judgment. It is alignment. It is performance oxygen. It is the difference between believing you are effective and knowing it. Great boards welcome evaluation not as a verdict but as a mirror. And they use that mirror not for vanity but for velocity.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta is a seasoned finance executive with over 25 years of leadership experience across SaaS, cybersecurity, logistics, and digital marketing industries. He has served as CFO and VP of Finance in both public and private companies, leading $120M+ in fundraising and $150M+ in M&A transactions while driving predictive analytics and ERP transformations. Known for blending strategic foresight with operational discipline, he builds high-performing global finance organizations that enable scalable growth and data-driven decision-making.

AI-assisted insights, supplemented by 25 years of finance leadership experience.